Flexible Office Market Size, Share, Trends Analysis, 2032

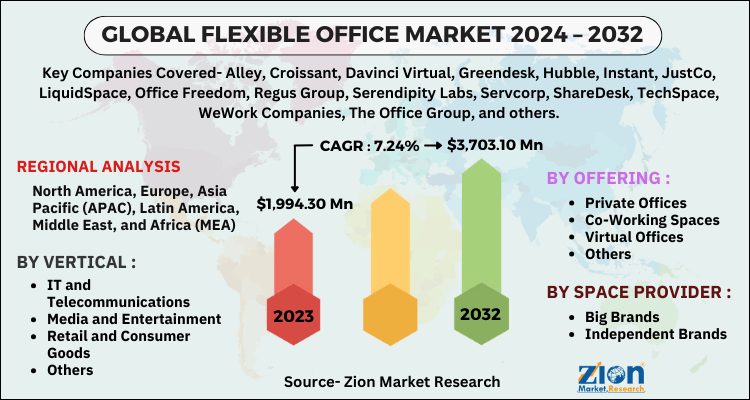

Flexible Office Market By Offering (Private Offices, Co-Working Spaces, Virtual Offices, And Others), By Space Provider (Big Brands And Independent Brands), By Vertical (IT & Telecommunications, Media & Entertainment, Retail & Consumer Goods, And Others), and Region: Global Industry Perspective, Comprehensive Analysis, And Forecast, 2024 - 2032

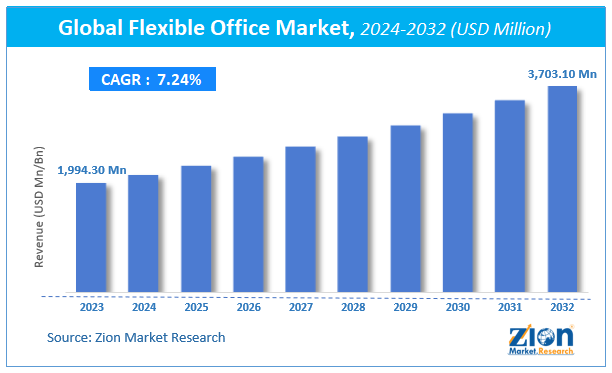

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,994.30 Million | USD 3,703.10 Million | 7.24% | 2023 |

Flexible Office Industry Perspective

The global flexible office market size was worth around USD 1,994.30 million in 2023 and is predicted to grow to around USD 3,703.10 million by 2032 with a compound annual growth rate (CAGR) of roughly 7.24% between 2024 and 2032.

The report covers a forecast and an analysis of the flexible office market on a global and regional level. The study provides historical data from 208 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Million). The study includes the drivers and restraints of the flexible office market along with their impact on demand over the forecast period. Additionally, the report includes the study of opportunities available in the flexible office market on a global level.

To give the users a comprehensive view of the flexible office market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides a company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

Flexible Office Market: Overview

Flexible workspace, also known as shared flexispace or office space, is an alternative solution to traditional offices, which makes the possibility to implement versatile space solutions affordable for companies. These types of office spaces come with basic equipment like desks, phone lines, chairs, etc., which allows employees to work normally from home or telecommute to have a physical office for a few hours on a weekly or monthly basis. Unlike traditional offices, the allocation of space in flexible workspaces is not fixed, thus businesses can maximize their time-efficient solutions and cost like mobile working.

Flexible Office Market: Growth Factors

Corporate organizations look for more agile and larger workspaces, which is symptomatic of a global move towards more flexible lease terms. In 2023, the “Space as a Service” model was accountable for some of the major flex deals in London and New York, which also included big brands like Amex, Microsoft, GSK, IBM, Facebook, and Adidas. Additionally, there has been a rise in the number of landlords in the U.S. and Asia that are collaborating with providers and launching their own co-working spaces.

This trend is already seen in Europe but is yet to take off. As the demand type is constantly changing and the value of occupiers in these flexible spaces is increasing, leading operators are likely to become more competitive and offer huge discounts in the key regions to gain maximum share of the flexible office market. The forecast suggests that in such a competitive environment, operators will be willing to offer 22% or more discount on the advertised rates to gain maximum share of the flexible office market.

Flexible Office Market: Segmentation

The study provides a decisive view of the flexible office market by segmenting it based on offering, space provider, vertical, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

The flexible office market is fragmented on the basis of offering into virtual offices, co-working spaces, private offices, and others.

By space provider, the flexible office market includes big brands and independent brands.

Based on vertical, the flexible office market comprises retail and consumer goods, media and entertainment, IT and telecommunications, and others.

Flexible Office Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Flexible Office Market |

| Market Size in 2023 | USD 1,994.30 Million |

| Market Forecast in 2032 | USD 3,703.10 Million |

| Growth Rate | CAGR of 7.24% |

| Number of Pages | 245 |

| Key Companies Covered | Alley, Croissant, Davinci Virtual, Greendesk, Hubble, Instant, JustCo, LiquidSpace, Office Freedom, Regus Group, Serendipity Labs, Servcorp, ShareDesk, TechSpace, WeWork Companies, The Office Group, and others. |

| Segments Covered | By Offering, By Space Provider, By Vertical, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Flexible Office Market: Regional Analysis

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Europe held the top spot in the flexible office market in 2023. However, the U.S. boasts the priciest rates globally. Co-working spaces have taken major U.S. cities by storm, with Los Angeles, New York, San Francisco, and Chicago averaging a staggering 38% of their workspace designated as co-working. These established cities, despite their maturity, have all witnessed impressive growth exceeding 20% in recent years.

The Asia Pacific region is poised for the fastest growth, with Australia experiencing a remarkable 38% increase in co-working centers and other flexible office spaces within just five years.

Flexible Office Market: Competitive Analysis

The global flexible office market is dominated by players like:

- Alley

- Croissant

- Davinci Virtual

- Greendesk

- Hubble

- Instant

- JustCo

- LiquidSpace

- Office Freedom

- Regus Group

- Serendipity Labs

- Servcorp

- ShareDesk

- TechSpace

- WeWork Companies

- The Office Group.

This report segments the global flexible office market into:

By Offering Analysis

- Private Offices

- Co-Working Spaces

- Virtual Offices

- Others

By Space Provider Analysis

- Big Brands

- Independent Brands

By Vertical Analysis

- IT and Telecommunications

- Media and Entertainment

- Retail and Consumer Goods

- Others

By Regional Analysis

-

North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A flexible office space is a workspace designed to adapt to a variety of needs. Unlike traditional offices with fixed layouts and dedicated desks.

According to a study, the global flexible office market size was worth around USD 1,994.30 million in 2023 and is expected to reach USD 3,703.10 million by 2032.

The global flexible office market is expected to grow at a CAGR of 7.24% during the forecast period.

Europe is expected to dominate the flexible office market over the forecast period.

Leading players in the global flexible office market include Alley, Croissant, Davinci Virtual, Greendesk, Hubble, Instant, JustCo, LiquidSpace, Office Freedom, Regus Group, Serendipity Labs, Servcorp, ShareDesk, TechSpace, WeWork Companies, and The Office Group, among others.

The flexible office market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed