Global Fire Insurance Market Size, Share, Growth Analysis Report - Forecast 2034

Fire Insurance Market By Coverage (Standard Coverage, Optional Coverage), By Enterprise Size (Large Enterprises, Small and Medium Enterprises), Industry Vertical (Manufacturing, Healthcare, Energy & Utilities, Retail & Consumer Goods, IT & Telecom, Hospitality, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 80.67 Billion | USD 213.06 Billion | 10.2% | 2024 |

Fire Insurance Market Size And Industry Analysis

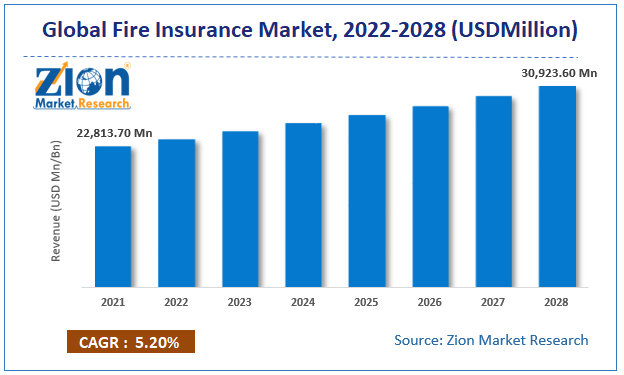

The global fire insurance market size was worth around USD 80.67 Billion in 2024 and is predicted to grow to around USD 213.06 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 10.2% between 2025 and 2034. The report analyzes the global fire insurance market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the fire insurance industry.

Fire Insurance Market: Overview

Fire insurance is an agreement between the policyholder and the insurance company to cover all loss and damage caused by fire to the insured's property. Fire accidents are sudden and can happen instantaneously anywhere, including businesses, homes, and other places, due to fire, explosion, water tank rupture, and other causes. These factors cause enormous damage and expose policyholders to financial risk, driving consumer demand for fire insurance policies.

Fire insurance is a type of property insurance often included in a homeowner's policy and provides Coverage against property damage caused by fire. Key factors driving the development of fire insurance market trends include growing demand for insurance policies, growing need for financial security in the face of increased uncertainties, and the growing number of assets. In addition, the lack of knowledge about fire insurance policies and high insurance costs hinders the market growth. Furthermore, the implementation of technologies in existing products and service lines and government initiatives related to fire insurance policies are expected to provide lucrative opportunities for market expansion during the forecast period.

COVID-19 Impact:

The COVID-19 pandemic has impacted businesses of the fire insurance. The COVID-19 pandemic spread throughout the world as strict lock-downs are implemented by governments and shut down companies. Thus, the movement of people is restricted during the covid-19 pandemic; the global fire insurance market is likely to be impacted considerably during the forecast period. Besides that, the adoption of fire insurance moved the market growth during the pandemic period.

Key Insights

- As per the analysis shared by our research analyst, the global fire insurance market is estimated to grow annually at a CAGR of around 10.2% over the forecast period (2025-2034).

- Regarding revenue, the global fire insurance market size was valued at around USD 80.67 Billion in 2024 and is projected to reach USD 213.06 Billion by 2034.

- The fire insurance market is projected to grow at a significant rate due to growing awareness of property risk, urban development, increasing asset values, and stricter regulatory requirements for fire safety.

- Based on Coverage, the Standard Coverage segment is expected to lead the global market.

- On the basis of Enterprise Size, the Large Enterprises segment is growing at a high rate and will continue to dominate the global market.

- Based on the Industry Vertical, the Manufacturing segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Fire Insurance Market: Growth Drivers

The rising need for financial safety aids the global market growth

As the number of people needing fire insurance coverage for things like lightning strikes, fire, aircraft damage, riots, strikes, and intentional damage increases, insurers are under pressure to invest and create new products that are less popular, have strong coverage, and people financially secure in the event of destruction, replacement, or other damage. In recent years, more accidents have occurred, such as hurricanes, hurricanes, and tornadoes. This makes fire insurance even more critical. Most businesses and homeowners rely on fire insurance to protect against future financial losses caused by damage such as property, furniture, and home furnishings. Insurers have added more Coverage to their products to make them easier to use and stay ahead of competitors in the global fire insurance market in the forecast period.

Fire Insurance Market: Restraints

The lack of awareness regarding fire insurance may hamper the global market growth.

The fire insurance market is hindered as people do not fully understand fire insurance. Consumer experience and fire insurance are two of the most important things to consider. This can be done by filling the knowledge gaps in the fire insurance market. In 2020, the Insurance Information Institute surveyed 9% of respondents who did not know their fire policy covers disaster or moderate conditions. Furthermore, market growth is hampered by customer misunderstanding about premium rates and lack of knowledge about family insurance in developing Asia-Pacific countries, among other countries.

Fire Insurance Market: Opportunities

The supportive government initiatives bring up several growth opportunities

More and more insurance service providers are using advanced technologies such as geolocation, fire alarm warning, fire security detection, fireproof skeleton protection, artificial intelligence (A.I.), fingerprint, blockchain, and big data. This gives market underwriters new ways of doing business; with these technological advancements, fire delivery platforms will offer more averaging, such as averaging policy, consequential loss policy, claim policy, and others, faster and more accessible at the point of sale. Additionally, digital transformation enables fire insurers to provide highly personalized user experiences to their customers. Also, to maintain their position in the global fire insurance market, insurance companies are looking at using big data analytics, which can help them charge high premiums. In addition, technologies help collect data to meet individual customer needs, calculate risk, and detect fraud. Therefore, technological advances that make fire insurance easier to buy and use more conveniently will likely create good business opportunities for insurers.

Fire Insurance Market: Segmentation

The global fire insurance market is segregated based on coverage, enterprise size, industry vertical, and region.

By coverage, the market is divided intostandard coverage and optional coverage. Among these, standard fire insurance is a type of property insurance usually part of a home insurance policy. It protects from physical damage caused by fire. Therefore, it is the dominant segment in the coverage segment.

By enterprise size, the market is bifurcated into large enterprises and small & medium-sized enterprises. Over the forecast period, the large enterprise segment is expected to develop at the fastest rate due to the rising adoption of fire insurance. These enterprises purchase insurance to avoid loss and damage from fire. They also want coverage for maintenance and repair of broken machinery and equipment to improve enterprise operations while it's closed.

Recent Developments

- May 2022 – Amica Insurance Company has partnered with Rocket Mortgage to enter the mortgage insurance space.

- May 2022 – Liberty Mutual Insurance has decided to acquire Fetch Technology to purchase certain technology assets of insurance portal services.

Fire Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fire Insurance Market |

| Market Size in 2024 | USD 80.67 Billion |

| Market Forecast in 2034 | USD 213.06 Billion |

| Growth Rate | CAGR of 10.2% |

| Number of Pages | 267 |

| Key Companies Covered | Amica, Allianz, Allstate Insurance Company, AXA, GEICO, Liberty Mutual Insurance, State Farm Mutual Automobile Insurance Company, USSA, etc., and others. |

| Segments Covered | By Coverage, By Enterprise Size, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fire Insurance Market: Competitive Landscape

Some of the main competitors dominating the global fire insurance market include –Amica Mutual Insurance Company, Allianz S.E., Axa S.A., Assicurazioni Generali S.p.A., Ping An Insurance Company of China Ltd., Liberty Mutual Fire Insurance Company, State Farm Insurance, The Government Employees Insurance Company, The Allstate Corporation, and United Services Automobile Association.

Fire Insurance Market: Regional Landscape

The presence of market players and growing geriatric population help North America dominate the global market

the global fire insurance market revenue was dominated by North America in 2021 and is expected to maintain its position during the forecast period. Key factors driving market growth in this region include the presence of key players such as Allstate Insurance Company and USAA. Furthermore, the increase in the incidence of lightning strikes, fires, accidents, injuries, and property damage by others is driving the adoption of fire insurance in this area.

However, the Asia-Pacific region is expected to witness a significant growth rate during the forecast period due to increased construction and real estate activities. In addition, the International Fire Safety Standards in Asia focus on developing regulations to improve investment in infrastructure and provide more consistency in fire safety levels and minimal fire by setting specific standards, which is expected to offer lucrative opportunities for the market in this region.

Fire Insurance Market: Competitive Space

The global Fire Insurance market profiles key players such as:

- Amica Mutual Insurance Company

- Allianz S.E.

- Axa S.A.

- Assicurazioni Generali S.p.A.

- Ping An Insurance Company of China Ltd

- Liberty Mutual Fire Insurance Company

- State Farm Insurance

- The Government Employees Insurance Company

- The Allstate Corporation

- United Services Automobile Association

Global fire insurance market is segmented as follows:

By Coverage

- Standard Coverage

- Optional Coverage

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Industry Vertical

- Manufacturing

- Healthcare

- Energy and Utilities

- Retail and Consumer Goods

- I.T. and Telecom

- Hospitality

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global fire insurance market is expected to grow due to increased risk awareness, rising property values, and regulatory requirements for asset protection against fire-related losses.

According to a study, the global fire insurance market size was worth around USD 80.67 Billion in 2024 and is expected to reach USD 213.06 Billion by 2034.

The global fire insurance market is expected to grow at a CAGR of 10.2% during the forecast period.

North America is expected to dominate the fire insurance market over the forecast period.

Leading players in the global fire insurance market include Amica, Allianz, Allstate Insurance Company, AXA, GEICO, Liberty Mutual Insurance, State Farm Mutual Automobile Insurance Company, USSA, etc., among others.

The report explores crucial aspects of the fire insurance market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed