Fiber Reinforced Composites (FRC) Market Size, Share, Report, Research 2034

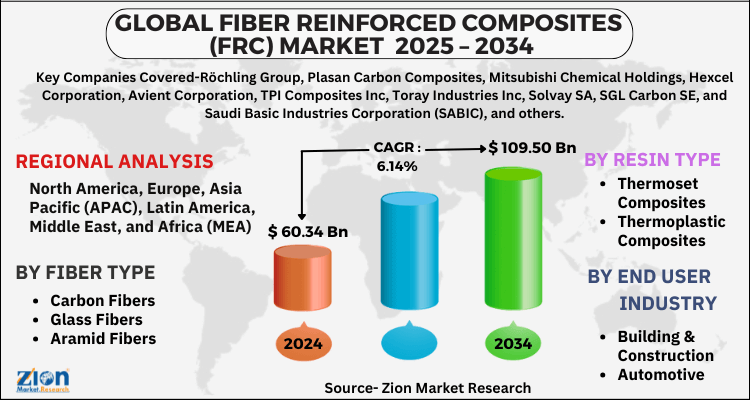

Fiber Reinforced Composites (FRC) Market By Fiber Type (Carbon Fibers, Glass Fibers, Aramid Fibers, and Others), By Resin Type (Thermoset Composites and Thermoplastic Composites), By End-User Industry (Building & Construction, Automotive, Electrical & Electronics, Aerospace & Defense, Sporting Goods, Wind Energy, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

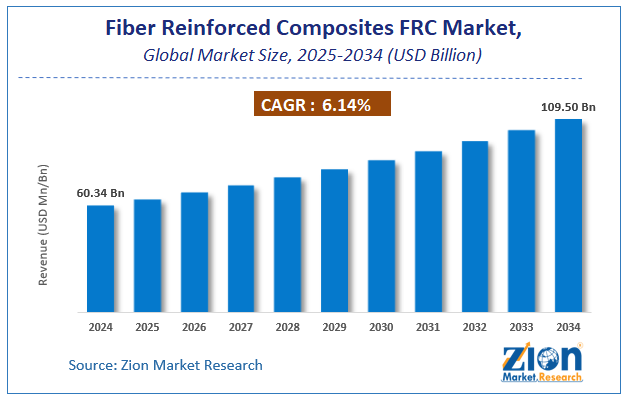

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 60.34 Billion | USD 109.50 Billion | 6.14% | 2024 |

Fiber Reinforced Composites (FRC) Industry Perspective:

The global fiber reinforced composites (FRC) market size was worth around USD 60.34 Billion in 2024 and is predicted to grow to around USD 109.50 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.14% between 2025 and 2034. The report analyzes the global fiber reinforced composites (FRC) market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the fiber reinforced composites (FRC) industry.

The study examines the drivers, restraints, and challenges in the fiber-reinforced composites (FRC) industry, as well as their impact on demand throughout the forecast period. The study also looks into the market for fiber-reinforced composites (FRC).

Fiber Reinforced Composites (FRC) Market: Overview

Fiber-reinforced composite (FRC) is a material made up of reinforcement fibers and a matrix. They provide exceptional strength and rigidity at a low weight when appropriately chosen. The reinforcement fiber's job is to give the matrix strength, while the matrix protects the fiber from external wear and tear. Natural fiber and synthetic fiber are the two types of reinforcement fibers used in FRCs. Luffa, hemp, palm, and coir are examples of natural fibers, while carbon, glass, and aramid materials are examples of manufactured fibers. Natural fibers are inexpensive and degradable, making them environmentally beneficial. Synthetic fibers provide additional rigidity. Attempts are being undertaken to combine two different types of fibers and blend them with a matrix material to create a hybrid material.

Fiber reinforced composites (FRC) is a composite building material that contains fibers, matrix, and the interface. Fiber-reinforced composites (FRC)are generally characterized by improved stiffness, high, and specific strength compared to other various materials.

Key Insights

- As per the analysis shared by our research analyst, the global fiber reinforced composites (FRC) market is estimated to grow annually at a CAGR of around 6.14% over the forecast period (2025-2034).

- Regarding revenue, the global fiber reinforced composites (FRC) market size was valued at around USD 60.34 Billion in 2024 and is projected to reach USD 109.50 Billion by 2034.

- The fiber reinforced composites (FRC) market is projected to grow at a significant rate due to increasing demand for lightweight and high-strength materials in automotive and aerospace industries, growth in wind energy projects, advancements in manufacturing technologies, and rising infrastructure development.

- Based on Fiber Type, the Carbon Fibers segment is expected to lead the global market.

- On the basis of Resin Type, the Thermoset Composites segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-User Industry, the Building & Construction segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Fiber Reinforced Composites (FRC) Market: Growth Drivers

Rising demand for carbon fiber composite in the aerospace industry to foster the market growth

The FRC industry is primarily driven by the desire for carbon fiber composite for long-haul and fuel-efficient aircraft. The usage of carbon fiber composites in wings can lower the aircraft's weight by up to 50,000 pounds. It has a minimal thermal expansion, has a high strength-to-weight ratio, and is rigid and chemically resistant. Its mechanical qualities can also be customized to the needs of the application. The use of matrix composites in commercial transport planes is advantageous since the lighter airframe allows for higher fuel economy and, as a result, lower operating costs. Carbon fiber is being used in the aircraft sector for a variety of reasons, including lower tooling & assembly costs, fewer parts, and decreased maintenance & longer design life. Owing to all such beneficial factors, carbon fiber composite in the aerospace industry is likely to drive the market.

The global fiber reinforced composites (FRC) market is anticipated to grow at a substantial rate in the near future. The growing demand for lightweight vehicles from emerging economies is anticipated to fuel the market growth. The increased use of fiber-reinforced composites (FRC) was widely observed in automotive, building & construction, aerospace, electrical & electronics, marine, and sports & leisure industries across the globe. The increased demand for fiber-reinforced composites (FRC) in lightweight vehicles industry is the prime driver for the global fiber reinforced composites (FRC) market within the forecast period. Automotive makers and OEMs are looking for innovative materials to achieve better fuel efficiency.

Stringent regulations regarding vehicle pollution are anticipated to play a major role in driving the global fiber reinforced composites (FRC) market in the coming years. Fluctuating raw material prices of fiber-reinforced composites (FRC) may hinder the market growth in the coming years. Nonetheless, product innovations and emerging markets in the Asia Pacific are likely to open new growth avenues for the major players of the market during the years to come.

Fiber Reinforced Composites (FRC) Market: Restraints

High costs associated with the FRC production hinder the market growth

Fiber reinforced composites manufacture is capital-intensive, which may stifle market expansion during the projection period. The high price is due to the high cost of reinforcement fibers, namely carbon and glass fiber. Carbon fiber is steeper to produce than glass fiber. Furthermore, fiberglass is more expensive than wool and steel, and other common materials can be used in their place.

Fiber Reinforced Composites (FRC) Market: Opportunities

Increasing studies & research to enhance the quality of FRC to boost the market

FRCs have excellent chemical and mechanical qualities, which could be improved further over the projection period. In order to improve the qualities and production technique of fiber-reinforced composites, research and studies are being conducted. Also, heavy investment is being done by the major players to stay competitive in the market. As a result, during the forecast period, new product innovations and launches are likely to provide new business opportunities for the global fiber-reinforced composites market.

Fiber Reinforced Composites (FRC) Market: Challenges.

Environment difficulties and concerns regarding FRC properties act as a challenge for the market growth

Due to their traditional qualities such as user easiness, superior shock absorption, superb toughness, high intensity, super strength, and lightweight, fiber reinforced composites (FRCs) have now become unavoidable and significantly convinced in the field of games and sports. A comprehensive understanding of the behavior of resin, reinforcement, and their combination, environmental effects, inspection methodology, structural assessments, test techniques, production technologies, and is necessary for the development of sophisticated FRCs for sports and aerospace applications.

However, due to the compounding of various and usually extremely stable fibers and matrices, traditional fiber-reinforced polymers can produce significant environmental difficulties owing to the difficulty in non-biodegradability or recycling at the end of their useable lives. In addition to this, for effective aircraft applications, concerns such as degradability, water absorption, fire & thermal resistance, and property variability, as well as trustworthy prediction tools, must be resolved in the future. All these concerns pose a challenge for market growth.

Fiber Reinforced Composites (FRC) Market: Segmentation

The global fiber reinforced composites market is divided based on fiber type, resin type, end-user, and region.

Based on the fiber type, the global market is segregated into aramid fibers, glass fibers, carbon fibers, and others.

The resin type segment is categorized based on thermoplastic composites and thermoset composites.

The end-user industry is divided based on wind energy, sporting goods, aerospace & defense, electrical & electronics, automotive, building & construction, and others.

Fiber Reinforced Composites (FRC) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fiber Reinforced Composites (FRC) Market |

| Market Size in 2024 | USD 60.34 Billion |

| Market Forecast in 2034 | USD 109.50 Billion |

| Growth Rate | CAGR of 6.14% |

| Number of Pages | 215 |

| Key Companies Covered | Röchling Group, Plasan Carbon Composites, Mitsubishi Chemical Holdings, Hexcel Corporation, Avient Corporation, TPI Composites Inc, Toray Industries Inc, Solvay SA, SGL Carbon SE, and Saudi Basic Industries Corporation (SABIC), and others. |

| Segments Covered | By Fiber Type, By Resin Type, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

In December 2020, Mitsubishi Chemical Corp has announced the opening of a new carbon fiber-reinforced thermoplastic (CFRTP) materials pilot facility in Fukui Prefecture, Japan.

Fiber Reinforced Composites (FRC) Market: Regional Landscape

North America to rule the market during the forecast period

Geographically, North America is expected to lead the global fiber reinforced composites (FRC) market during the forecast period. In recent years, North America has become one of the greatest markets for fiber reinforced composites. The construction industry is the primary market for fiber reinforced composites (FRCs), and it is predicted to offer the highest potential for market growth throughout the forecast period. Due to increased demand from sports/leisure, wind turbine, and defense & aerospace industries, this area is predicted to have the biggest demand for FRC. The market in this region is projected to be driven by a large concentration of aircraft manufacturers such as Airbus as well as automobile companies. The Asia Pacific is also estimated to grow at a higher rate during the forecast period.

Fiber Reinforced Composites (FRC) Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the fiber reinforced composites (FRC) market on a global and regional basis.

The global fiber reinforced composites (FRC) market is dominated by players like:

- Röchling Group

- Plasan Carbon Composites

- Mitsubishi Chemical Holdings

- Hexcel Corporation

- Avient Corporation

- TPI Composites Inc.

- Toray Industries Inc.

- Solvay SA

- SGL Carbon SE

- Saudi Basic Industries Corporation (SABIC)

The global fiber reinforced composites (FRC) market is segmented as follows:

By Fiber Type

- Carbon Fibers

- Glass Fibers

- Aramid Fibers

- Others

By Resin Type

- Thermoset Composites

- Thermoplastic Composites

By End User Industry

- Building & Construction

- Automotive

- Electrical & Electronics

- Aerospace & Defense

- Sporting Goods

- Wind Energy

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of The Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global fiber reinforced composites (FRC) market is expected to grow due to growing applications in aerospace, automotive, increasing demand for lightweight and high-strength materials, and construction industries, and advancements in manufacturing technologies.

According to a study, the global fiber reinforced composites (FRC) market size was worth around USD 60.34 Billion in 2024 and is expected to reach USD 109.50 Billion by 2034.

The global fiber reinforced composites (FRC) market is expected to grow at a CAGR of 6.14% during the forecast period.

Asia-Pacific is expected to dominate the fiber reinforced composites (FRC) market over the forecast period.

Leading players in the global fiber reinforced composites (FRC) market include Röchling Group, Plasan Carbon Composites, Mitsubishi Chemical Holdings, Hexcel Corporation, Avient Corporation, TPI Composites Inc, Toray Industries Inc, Solvay SA, SGL Carbon SE, and Saudi Basic Industries Corporation (SABIC), among others.

The report explores crucial aspects of the fiber reinforced composites (FRC) market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed