Fiber Optic Test Equipment Market Size, Trends, And Share 2032

Fiber Optic Test Equipment Market By Product (OPM, DWDM, RFTS, OSA, OLS, OLTS, And OTDR), By End User (Aerospace, Cable Television, Military, Oil & Gas, Private Data Network, Telecom, And Broadband), By Region - Global And Regional Industry Overview, market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1090.88 Million | USD 1906.56 Million | 6.4% | 2023 |

Description

Global Fiber Optic Test Equipment Market: Insights

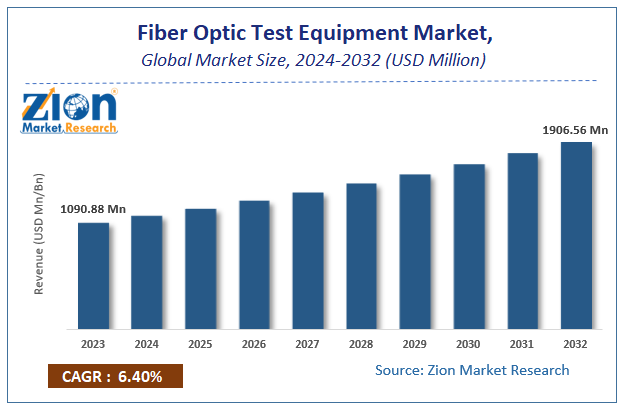

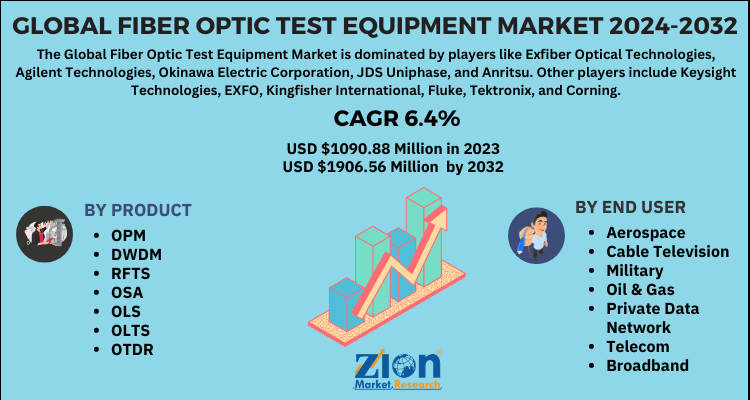

The global fiber optic test equipment market size was worth around USD 1090.88 million in 2023 and is predicted to grow to around USD 1906.56 million by 2032 with a compound annual growth rate (CAGR) of roughly 6.4% between 2024 and 2032. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD million). The report covers a forecast and an analysis of the Fiber Optic Test Equipment market on a global and regional level.

Key Insights

- As per the analysis shared by our research analyst, the fiber optic test equipment market is anticipated to grow at a CAGR of 6.4% during the forecast period (2024-2032).

- The global fiber optic test equipment market was estimated to be worth approximately USD 1090.88 billion in 2023 and is projected to reach a value of USD 1906.56 billion by 2032.

- The growth of the fiber optic test equipment market is being driven by the rising demand for reliable communication networks.

- Based on the product, the OPM segment is growing at a high rate and is projected to dominate the market.

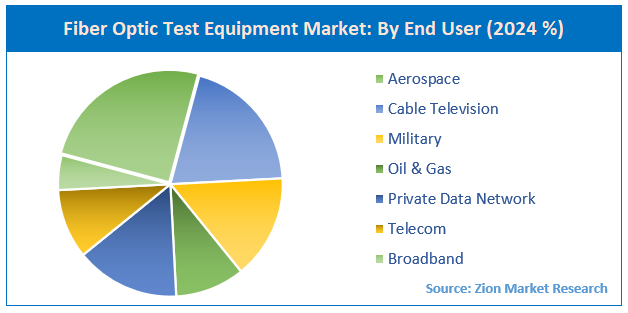

- On the basis of end user, the aerospace segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Global Fiber Optic Test Equipment Market: Overview

Fiber optic test equipment is usually used in the functioning of inspection operation, cleaning, and troubleshooting. It includes testers such as verification testers, advanced optical time-domain reflectometers testers, and certification testers. These testers are utilized in numerous industries such as telecom, oil and gas, military, and others. It is critical to transfer data for long distance business operations. Fiber optic test equipment is helpful in building, designing, and developing business strategies. There may be some loss of signal when the signal is sent through optical fibers. There are chances of loss of transmission when output signals and input signals are coupled. Hence, fiber optic test equipment is very effective to measure and characterize the physical attributes of light. It is a fundamental property of the fiber optic networks.

Global Fiber Optic Test Equipment Market: Growth Factors

The emergence of the next generation networks and new technologies across the world is expected to drive the global fiber optic test equipment market growth. Fiber-optic communication systems have brought a revolutionary change in the telecommunication industry, which is also expected to impact the growth of the market positively. Whereas the development of broadband infrastructure globally is anticipated to boost the global fiber optic test equipment market growth. Increasing demand for the faster and high-performance data transfers may drive the global market growth in future. It is considered that transfer of data through fiber optic is more cost effective. High-definition electronic products need greater bandwidth in case of both upstream and downstream applications; hence, fiber optic test equipment is widely used. Moreover, use of digital technologies is on the rise, which may influence the global fiber optic test equipment market is a positive way. Expansion in the deployment of FTTX is anticipated to fuel the demand in the coming future.

Recent Development

- In 2021, Fluke Corporation introduced the DSX CableAnalyzer Series, a next-generation fiber optic testing solution designed for enterprise, data center, and service provider networks. The tool offers faster testing times, advanced diagnostics, and enhanced reporting capabilities.

- In March 2023, Japan-based Santec launched the OPM 200 power meter, featuring a wide dynamic range (+8 dBm to −80 dBm), free-space detectors, large buffered output, and external triggering—positioning it as a versatile tool for precision optical measurements.

- In 2024, VIAVI unveiled NITRO Fiber Sensing, a real-time asset monitoring and analytics platform that leverages fiber sensing technology to support infrastructure applications such as pipelines and data centers.

- Also in 2024, Anritsu showcased the Network Master Pro MT1040A, a compact handheld instrument capable of testing 400 Gbps traffic. Presented at OFC2024 in collaboration with NTT, the device targets high-speed network environments.

- Between 2024 and early 2025, Amphenol acquired CommScope’s Outdoor Wireless Networks (OWN) and Distributed Antenna Systems (DAS) businesses for approximately US$2.1 billion in cash. While adjacent to traditional test equipment, these assets enhance Amphenol’s footprint in high-speed infrastructure and fiber interconnect ecosystems.

- In August 2025, Amphenol announced a major acquisition of CommScope’s Connectivity & Cable Solutions (CCS) business for US$10.5 billion. The deal includes fiber optic connectivity and cable products, further solidifying Amphenol’s role in support infrastructure that closely interplays with test and inspection markets.

Global Fiber Optic Test Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fiber Optic Test Equipment Market |

| Market Size in 2023 | USD 1090.88 Million |

| Market Forecast in 2032 | USD 1906.56 Million |

| Growth Rate | CAGR of 6.4% |

| Number of Pages | 209 |

| Key Companies Covered | Exfiber Optical Technologies, Agilent Technologies, Okinawa Electric Corporation, JDS Uniphase, and Anritsu. Other players include Keysight Technologies, EXFO, Kingfisher International, Fluke, Tektronix, and Corning |

| Segments Covered | By Product, By End User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Fiber Optic Test Equipment Market: Segmentation

The study provides a decisive view of the Fiber Optic Test Equipment Market by segmenting the market based on by product, by type, by end user and by region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on the End User, the global fiber optic test equipment market is segregated as aerospace, cable television, military, oil & gas, private data network, telecom, and broadband.

Based on the Product, the global market is classified as OPM, DWDM, RFTS, OSA, OLS, OLTS, and OTDR.

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Fiber Optic Test Equipment Market Dynamics

Key Growth Drivers

The Fiber Optic Test Equipment (FOTE) market is experiencing significant growth, driven by the explosive global demand for high-speed, high-bandwidth connectivity. This is primarily fueled by the massive rollout of 5G networks, which require dense fiber backhaul infrastructure to support high data rates and low latency. The continuous expansion of hyperscale data centers, which are essential for cloud computing, AI, and big data applications, also necessitates advanced FOTE to ensure the reliability and efficiency of their fiber networks. Furthermore, the global trend of "Fiber to the Home" (FTTH) and other last-mile fiber deployments is a major catalyst, as every new installation requires meticulous testing and verification to meet stringent performance standards and ensure seamless service for end-users.

Restraints

Despite the market's strong growth, several factors act as significant restraints. One of the main challenges is the high initial cost of advanced FOTE, such as Optical Time Domain Reflectometers (OTDRs) and other specialized instruments. This can be a major financial barrier for small businesses and technicians, limiting market penetration, particularly in developing regions. The technological complexity of these devices and the need for a highly skilled workforce for their operation and maintenance also present a challenge. A lack of trained professionals can hinder the adoption of advanced FOTE and lead to a suboptimal use of the equipment. Additionally, the industry is vulnerable to supply chain disruptions and the high cost of components, which can impact production costs and potentially lead to price volatility.

Opportunities

The FOTE market is ripe with opportunities for innovation and expansion. The increasing integration of smart technologies, AI, and IoT into test equipment is a key growth avenue. This enables the development of automated, predictive, and remote testing solutions that can reduce issue resolution time and enhance network monitoring. The growing demand for portable and user-friendly devices is another major opportunity, as technicians require lightweight, rugged, and accurate tools for on-site installations and maintenance. The market is also expanding into new application areas beyond telecommunications and data centers, such as in the aerospace, military and defense, and industrial automation sectors, which are increasingly adopting fiber optic technology for its immunity to electromagnetic interference and high data capacity.

Challenges

The FOTE market faces a number of complex challenges. A major challenge is ensuring the interoperability and standardization of test equipment across different vendors and network protocols. This can create confusion for technicians and complicate the process of troubleshooting and maintenance in multi-vendor environments. The industry must also contend with intense competition from a large number of global and local players, which can lead to price wars and thin profit margins. Furthermore, the rapid pace of technological advancements in fiber optics, such as the introduction of new fiber types and higher data rates, requires manufacturers to constantly innovate and update their product lines to remain relevant. This necessitates significant investment in research and development, which can be a financial burden.

Global Fiber Optic Test Equipment Market: Regional Analysis

Asia Pacific is the leading region in the global fiber optic test equipment market as the demand for fiber optic test equipment is high in this region. China is another region, which is growing at a faster rate due to increased demand for cable TV services. Fiber optic test equipment is required for troubleshooting and finding damaged optical fiber links; this has opened up new growth opportunities in the global market.

Global Fiber Optic Test Equipment Market: Competitive Players

Major players in the global fiber optic test equipment market are:

- Exfiber Optical Technologies

- Agilent Technologies

- Okinawa Electric Corporation

- JDS Uniphase

- Anritsu

- Keysight Technologies

- EXFO

- Kingfisher International

- Fluke

- Tektronix

- Corning

The global fiber optic test equipmentmarket is segmented as follows:

By Product

- OPM

- DWDM

- RFTS

- OSA

- OLS

- OLTS

- OTDR

By End User

- Aerospace

- Cable Television

- Military

- Oil & Gas

- Private Data Network

- Telecom

- Broadband

Global Fiber Optic Test Equipment Market: Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

What Report Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

Fiber optic test equipment is usually used in the functioning of inspection operation, cleaning, and troubleshooting. It includes testers such as verification testers, advanced optical time-domain reflectometers testers, and certification testers.

According to study, the Fiber Optic Test Equipment Market size was worth around USD 1090.88 million in 2023 and is predicted to grow to around USD 1906.56 million by 2032.

The CAGR value of Fiber Optic Test Equipment Market is expected to be around 6.4% during 2024-2032.

Asia Pacific has been leading the Fiber Optic Test Equipment Market and is anticipated to continue on the dominant position in the years to come.

The Fiber Optic Test Equipment Market is led by players like Exfiber Optical Technologies, Agilent Technologies, Okinawa Electric Corporation, JDS Uniphase, and Anritsu, Keysight Technologies, EXFO, Kingfisher International, Fluke, Tektronix, and Corning.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed