Exempt Solvents Market Size, Share, Growth, Analysis 2032

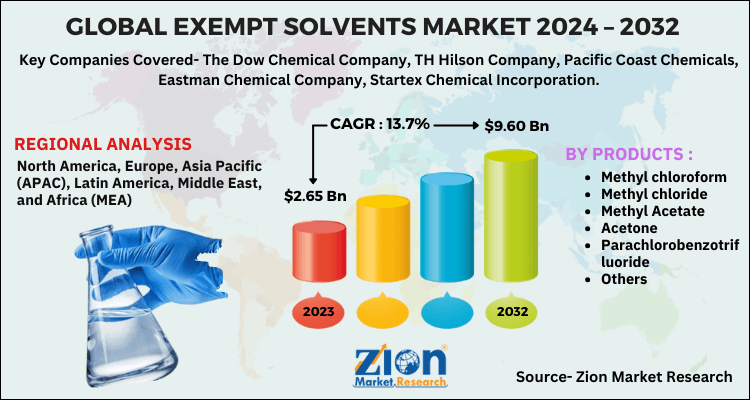

Exempt Solvents Market by Product (Methyl chloroform, Methyl chloride, Methyl Acetate, Acetone and Parachlorobenzotrifluoride, and Others): Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032-

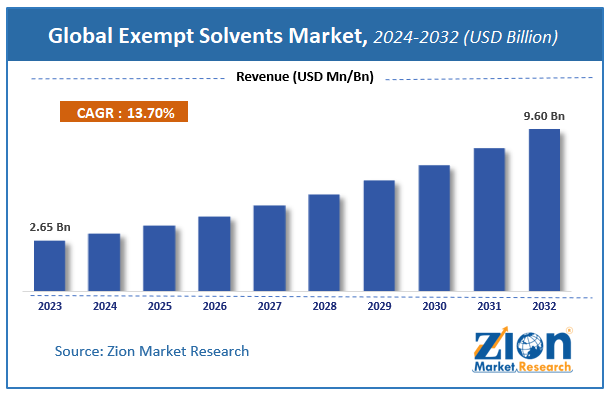

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.65 Billion | USD 9.60 Billion | 13.7% | 2023 |

Exempt Solvents Market Insights

According to Zion Market Research, the global Exempt Solvents Market was worth USD 2.65 Billion in 2023. The market is forecast to reach USD 9.60 Billion by 2032, growing at a compound annual growth rate (CAGR) of 13.7% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Exempt Solvents Market industry over the next decade.

Market Overview

Exempt solvents are organic compounds that are released from restrictions placed on most volatile organic compounds. This solvents mostly includes acetone, methyl acetate, dimethyl carbonate, parachlorobenzotrifluoride, tert-Butyl acetate, and propylene carbonate. These compounds are mostly used in manufacturing of lacquers, enamels, inks, adhesives, thinners and industrial cleaners.

In addition, various mergers and acquisition by major players will also have a towering impact on the Exempt Solvents market in the years to come. For example, in March 2018, GC Chemicals Americas Inc. based in the U.S. has claimed that it possess eco-friendly fluorinated precision cleaning solvent referred as Amolea AT2for medical equipment producers. The company sources further claimed that it is a best substitute for n-propyl as well as trichloroethylene solvents routinely used by manufacturers of medical devices.

COVID-19 Impact Analysis

The global Exempt Solvents market has witnessed a slight decline in the sales for short term to the lockdown enforcement placed by governments in order to contain COVID spreading. The restrictions imposed by various nations to contain COVID had stopped the production resulting in a disruption across the whole supply chain. However, the global markets are slowly opening to their full potential and theirs a surge in demand of Exempt Solvents. The market would remain bullish in upcoming year.

The significant decrease in the global Exempt Solvents market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Growth Factors

Surging product demand in coatings along with growing concerns over environmental pollution caused as a result of solvent release can optimistically leverage the growth trajectory of exempt solvents market over the forecast period. Moreover, humungous popularity of the product in developing countries such as China and India will further influence the business sphere in the years to come.

Steep rise in the use of green solvents as a result of government support, however, may limit the growth of exempt solvents market. Nevertheless, strict rules governing the use of volatile organic compounds will offer lucrative avenues for growth of exempt solvents market in the years ahead, thereby normalizing the impact of hindrances on the exempt solvents market.

Exempt Solvents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Exempt Solvents Market |

| Market Size in 2023 | USD 2.65 Billion |

| Market Forecast in 2032 | USD 9.60 Billion |

| Growth Rate | CAGR of 13.7% |

| Number of Pages | 120 |

| Key Companies Covered | The Dow Chemical Company, TH Hilson Company, Pacific Coast Chemicals, Eastman Chemical Company, Startex Chemical Incorporation |

| Segments Covered | By Product, By Application and By Region |

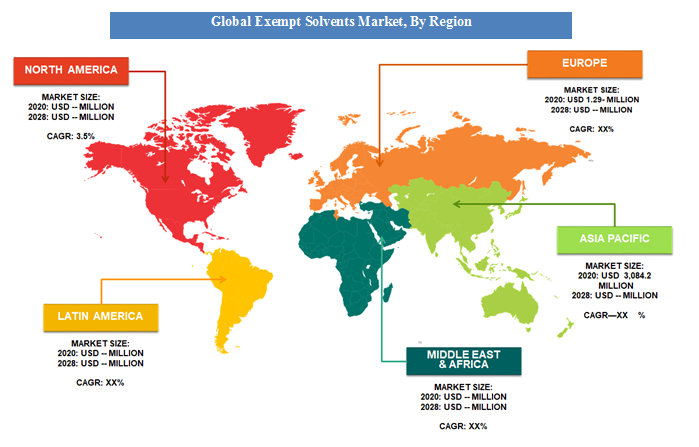

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Products Segment Analysis Preview

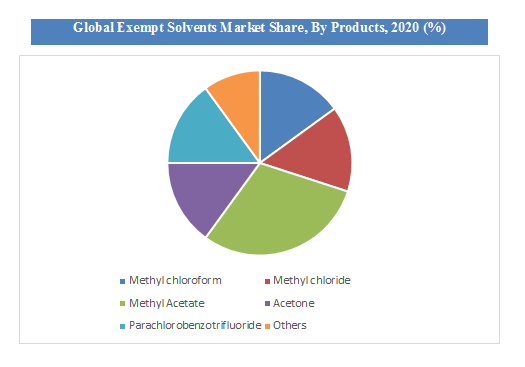

The global market for Exempt Solvents is divided into two categories: Products and region. The market is segmented into Products, such as Methyl Chloroform, Methyl Chloride, Methyl Acetate, Acetone, Parachlorobenzotrifluoride And Other Products. Among them, the demand for methyl acetate is relatively higher and the trend is anticipated to remain so over the next few years, notes the research report.

Key Market Players & Competitive Landscape

Some of the major players of global Exempt Solvents Market includes-

- The Dow Chemical Company

- TH Hilson Company

- Pacific Coast Chemicals

- Eastman Chemical Company

- Startex Chemical Incorporation.

The global Exempt Solvents Market is segmented as follows:

By Products

- Methyl chloroform

- Methyl chloride

- Methyl Acetate

- Acetone

- Parachlorobenzotrifluoride

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Exempt Solvents Market size is set to expand from $ 2.65 Billion in 2023

Exempt Solvents Market size is set to expand from $ 2.65 Billion in 2023 to $ 9.60 Billion by 2032, with an anticipated CAGR of around 13.7% from 2024 to 2032.

Increasing number of smart city projects and rising cost of non-renewable sources are the Surging product demand in coatings along with growing concerns over environmental pollution.

Europe has been leading the worldwide exempt solvents market and is anticipated to continue on the dominant position in the years to come, states the exempt solvents market study. A sharp expansion of automotive sector along with presence of automotive behemoths is the main factor behind the dominance of the Europe exempt solvents market.

Some of the major players of global Exempt Solvents Market includes The Dow Chemical Company, TH Hilson Company, Pacific Coast Chemicals, Eastman Chemical Company, and Startex Chemical Incorporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed