Europe Automotive Subframe Market Size, Share, And Growth Report 2032

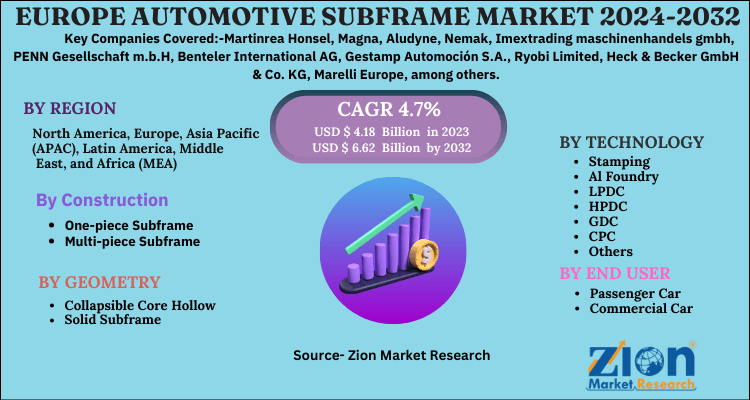

Europe Automotive Subframe Market By Construction (One-piece Subframe, Multi-piece Subframe) By Geometry (Collapsible Core Hollow, Solid Subframe) By Technology (Stamping, Al Foundry, (LPDC, HPDC, GDC,C PC, Others) Hydroforming, Extrusion) By End-User (Passenger Car, Commercial Car): Europe Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.18 Billion | USD 6.62 Billion | 4.7% | 2023 |

Europe Automotive Subframe Market Size

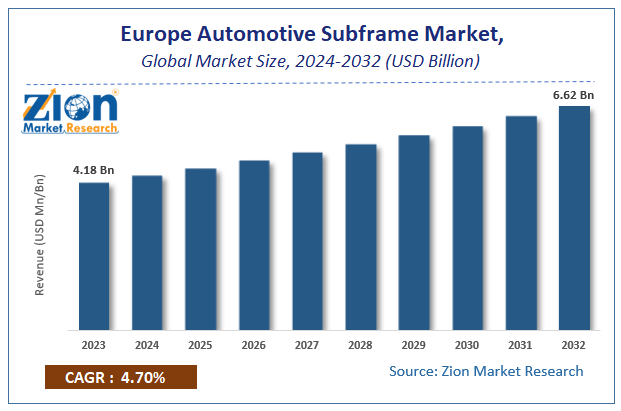

According to Zion Market Research, the Europe Automotive Subframe Market was worth USD 4.18 Billion in 2023. The market is forecast to reach USD 6.62 Billion by 2032, growing at a compound annual growth rate (CAGR) of 4.7% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Europe Automotive Subframe Market industry over the next decade.

Europe Automotive Subframe Market: Overview

The automotive subframe is a major structural component that should last the existence of the vehicle. There are occurrences where the subframe can become harmed or rusted to the where it can’t work. The worldwide auto subframe market can be limited by the expense of car subframe frameworks because the expense to supplant a subframe can be very high. The suppliers in the automotive materials market are feeling the squeeze to keep up with the expenses, alongside conveying top-notch materials to meet the rigid quality control and tests characterized. The developing deals of light business vehicles and electric vehicles increment the creation of electric vehicles, which thus drives the development of the auto subframe market.

COVID-19 Impact Analysis

COVID pandemic has several affected each and every sector across the globe. It proved to be the worst nightmare for the automotive sector. As a result, the market for subframe also witnessed the same impact on the demand. This resulted to due to complete and partial shutdown of the production facilities, limited movement of goods, ban on import and export activities, and closure of showrooms, among others. Moreover, due to loss of jobs or increased rate of unemployment people have postponed buying new cars indefinitely, which is likely to leave a long-term impact on the sales of automobiles.

The European automotive market has started witnessing a considerable recovery as most of the countries in the region have come out of the lockdown or relaxed the lockdown related norms. It has been found that most of the automotive manufacturers and dealers have restarted their operations at full capacity in selected locations and are also planning to reopen the manufacturing facilities as soon as possible.

Europe Automotive Subframe Market: Growth Factors

Vehicle light weighting benefits consumers through fuel savings, manufacturers through a more fuel-efficient vehicle portfolio, and the environment through reduced fossil fuel use and lower emissions. Vehicle components can be light weighted by replacing conventional materials with alternatives such as aluminum or composites.

Road transport is a major source of greenhouse gas emissions, producing around 15% of the Europe’s CO2 emissions. In line with this, the European Union Commission has already started focusing on the reduction of emissions from light-duty vehicles, heavy duty vehicles, and non-road mobile machinery.

Binding emission limits were already introduced for light and heavy-duty vehicles. As a result, automotive manufacturers are compelled to use lightweight materials such as aluminum.

Europe Automotive Subframe Market: Segmentation

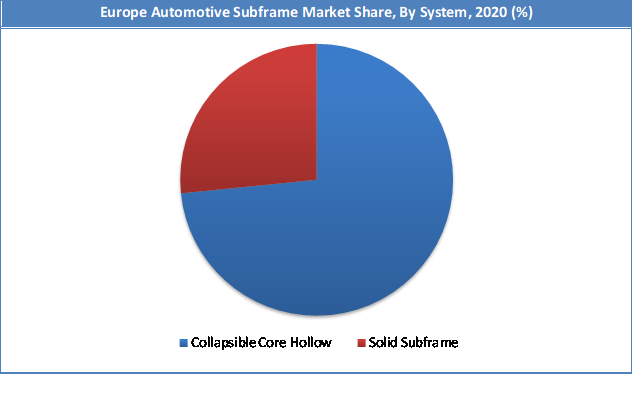

Geometry Segment Analysis Preview

Collapsible Core Hollow segment held a share of around 63.72% in 2020. This is attributable to the selection of a casting technique offering maximum part performance enabled not only a complete hollow design with thin walls, but also to meet the high strength and stiffness demands of a highly stressed chassis part. The demand for hollow aluminum chassis components for use in the construction of electric vehicles is on the rise.

Light weighting is increasingly important in the automotive sector, particularly in electric vehicles as it contributes vastly to increased battery range and makes electric a highly viable proposition. However, replacing solid steel with hollow aluminum while retaining the same degree of strength and safety as the original steel is not an easy task.

End Use Industry Segment Analysis

This is attributable to limited demand and production. In 2020, 2.1 million commercial vehicles were produced, the number is significantly lower than the passenger car. However, the aluminum subframe used in these vehicles are costlier than passenger vehicles.

Europe Automotive Subframe Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Europe Automotive Subframe Market |

| Market Size in 2023 | USD 4.18 Billion |

| Market Forecast in 2032 | USD 6.62 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 199 |

| Key Companies Covered | Martinrea Honsel, Magna, Aludyne, Nemak, Imextrading maschinenhandels gmbh, PENN Gesellschaft m.b.H, Benteler International AG, Gestamp Automoción S.A., Ryobi Limited, Heck & Becker GmbH & Co. KG, Marelli Europe, among others |

| Segments Covered | By Construction, By Geometry, By Technology, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Europe Automotive Subframe Market: Regional Analysis

The European has the major coverage, it is attributable to the presence of top companies such as PENN Gesellschaft m.b.H, Benteler International AG, Gestamp Automoción, among others. Moreover, the increasing usage of automotive subframe is expected to generate huge demand for the market in this region.

Europe is the leading consumer of aluminum subframes in terms of subframe units. As per our findings, BMW & VW are the leading consumers of aluminum subframes in the region. Currently, the demand for aluminum subframe is witnessing shallow growth due to strong presence of other alternatives such as steel due to lower cost and higher strength. However, the demand is likely to pick momentum in the future due to rapidly increasing production and demand for electric cars. This is further expected to be supported by favorable government regulations

Europe Automotive Subframe Market Key Market Players & Competitive Landscape

Some key players in Europe Automotive Subframe Market are

- Martinrea Honsel

- Magna

- Aludyne

- Nemak

- Imextrading maschinenhandels gmbh

- PENN Gesellschaft m.b.H

- Benteler International AG

- Gestamp Automoción S.A.

- Ryobi Limited

- Heck & Becker GmbH & Co. KG

- Marelli Europe

Magna International has delivered a prototype of a carbon fiber composite subframe that reduces mass by 34 percent compared to making a stamped steel equivalent. Magna has been able to reduce the number of parts in the composite subframe by 87 percent by replacing 45 steel parts with two molded and four metallic ones. The subframe is manufactured with Ashland’s epoxy vinyl ester resin and carbon fiber SMC technology.

In April 2021, Aludyne announced that it has acquired Shiloh Industries’ CastLight division. The CastLight acquisition strengthens and expands Aludyne’s position as a light weighting solutions provider. Aludyne will further diversify its customer base and add new facilities in the US, Netherlands, Poland and China. With the acquisition of Shiloh Industries’ CastLight business, Aludyne expands its product offering with high integrity, thin-walled components used in electrified drivetrains, e-motor housings, battery trays and automotive structural components.

The Europe automotive subframe market is segmented as follows:

By Construction

- One-piece Subframe

- Multi-piece Subframe

By Geometry

- Collapsible Core Hollow

- Solid Subframe

By Technology

- Stamping

- Al Foundry

- LPDC

- HPDC

- GDC

- CPC

- Others

- Hydroforming

- Extrusion

By End-User

- Passenger Car

- Commercial Car

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An automotive subframe is a structural component in a vehicle that supports the engine, transmission, suspension, or other systems. It is typically mounted to the main vehicle frame or unibody, providing strength, stability, and improved load distribution while isolating vibrations.

According to study, the Europe Automotive Subframe Market size was worth around USD 4.18 billion in 2023 and is predicted to grow to around USD 6.62 billion by 2032.

The CAGR value of Europe Automotive Subframe Market is expected to be around 4.7% during 2024-2032.

Europe has been leading the Europe Automotive Subframe Market and is anticipated to continue on the dominant position in the years to come.

The Europe Automotive Subframe Market is led by players like Martinrea Honsel, Magna, Aludyne, Nemak, Imextrading maschinenhandels gmbh, PENN Gesellschaft m.b.H, Benteler International AG, Gestamp Automoción S.A., Ryobi Limited, Heck & Becker GmbH & Co. KG, Marelli Europe, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed