Ethylene Methyl Acrylate Market Size, Share, Trends, Growth 2034

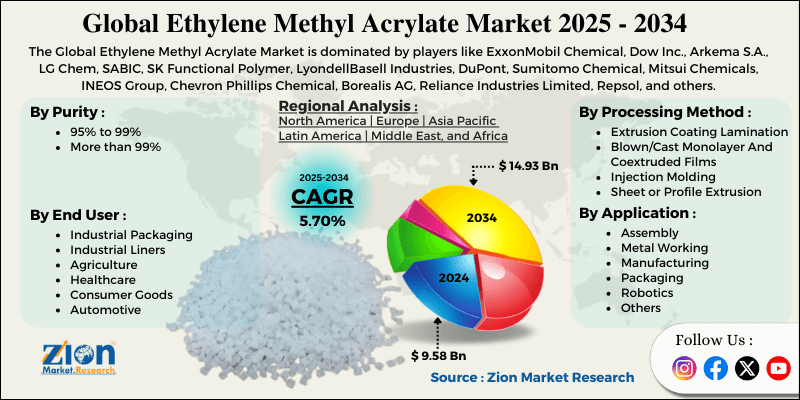

Ethylene Methyl Acrylate Market By Purity (95% to 99%, More than 99%), By Processing Method (Extrusion Coating Lamination, Blown/Cast Monolayer And Coextruded Films, Injection Molding, Sheet or Profile Extrusion, Blow Molding and Foam Extrusion), By Application (Construction, Cosmetic, Transportation, Textile, Lamination, Paints & Coatings, and Others), By End-Use Industry (Industrial Packaging, Industrial Liners, Agriculture, Healthcare, Consumer Goods, Automotive, and Bio-Degradable and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

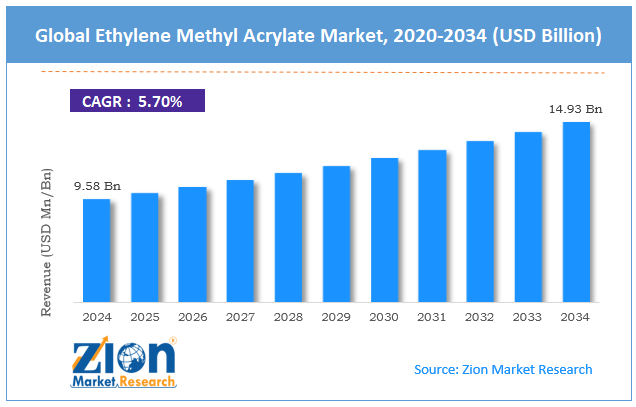

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.58 Billion | USD 14.93 Billion | 5.70% | 2024 |

Ethylene Methyl Acrylate Industry Perspective:

The global ethylene methyl acrylate market size was valued at around USD 9.58 billion in 2024 and is projected to reach approximately USD 14.93 billion by 2034, with a compound annual growth rate (CAGR) of approximately 5.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global ethylene methyl acrylate market is estimated to grow annually at a CAGR of around 5.70% over the forecast period (2025-2034)

- In terms of revenue, the global ethylene methyl acrylate market size was valued at approximately USD 9.58 billion in 2024 and is projected to reach USD 14.93 billion by 2034.

- The ethylene methyl acrylate market is projected to grow significantly due to the growth in the automotive industry for lightweight parts, the surging use in photovoltaic encapsulants, and the rising demand from the construction sector.

- Based on purity, the 95% to 99% segment is expected to lead the market, while the 'more than 99%' segment is expected to grow considerably.

- Based on the processing method, the extrusion coating lamination segment is the dominating segment. In contrast, the blown/cast monolayer and coextruded films segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the lamination segment holds a significant share, while the construction segment is expected to experience considerable growth over the coming years.

- Based on end-use industry, the industrial packaging segment is expected to lead the market, followed by the automotive segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Ethylene Methyl Acrylate Market: Overview

Ethylene methyl acrylate is a multipurpose copolymer composed of methyl and ethylene acrylate, widely valued for its toughness, flexibility, and strong adhesion properties. It offers superior resistance to heat, stress cracking, and chemicals, increasing its suitability for applications in wire and cable insulation, hot-melt adhesives, automotive parts, and packaging films. The global ethylene methyl acrylate market is poised for notable growth due to increasing demand in the packaging industry, the rise in automotive applications, and the expansion of the construction industry. The growing packaging sector, driven by the retail, e-commerce, and food industries, primarily fuels EMA consumption. Its use in heat-sealable layers and flexible packaging films offers brilliant durability and adhesion, increasing its significance for advanced packaging needs.

Automakers mainly utilize EMA in adhesives, interior trims, and coatings due to its impact-resistant and lightweight properties. The worldwide inclination towards electric and fuel-efficient vehicles further enhances EMA's role in improving performance and reducing vehicle weight. Additionally, EMA-based sealants and adhesives are broadly used in construction for roofing membranes, flooring, and waterproofing applications. Growing infrastructure projects and urbanization, primarily in the APAC region, are driving demand.

Nevertheless, the global market faces limitations due to factors such as volatility of raw material prices, environmental regulations, and concerns. EMA production depends on methyl and ethylene acrylate, whose prices are closely tied to the price of crude oil. Variations in oil prices lead to cost instability, affecting the profitability of EMA producers. Furthermore, the petrochemical origin of EMA increases sustainability issues. Strict norms for the use of plastics and emissions in packaging restrict their large-scale adoption in eco-conscious regions.

Still, the global ethylene methyl acrylate industry benefits from several favorable factors, like the rise of sustainable packaging, IoT growth, and smart electronics. EMA can be engineered for eco-friendly and recyclable packaging materials, supporting global initiatives for reducing disposable plastics. Moreover, with the growing adoption of smart devices, the demand for flexible wire and cable insulation is increasing, offering promising long-term growth prospects for the EMA industry.

Ethylene Methyl Acrylate Market Dynamics

Growth Drivers

How is the global ethylene methyl acrylate market fueled by the rising demand in the wire & cable industry?

EMA is widely used in wire and cable insulation due to its flame resistance, dielectric strength, and flexibility. The worldwide wire and cable industry exceeded $220 billion in 2023, with an anticipated 5.5% CAGR by 2030, fueled by 5G expansion and urbanization. EMA helps meet strict electrical safety standards, especially in telecommunications and power transmission. The growing demand for fiber-optic cables and ongoing electrification projects in Asia and North America are propelling EMA consumption.

How do advancements in the sealants and adhesives sector propel the ethylene methyl acrylate market growth?

EMA's strong adhesion, flexibility, and resin compatibility make it highly significant in sealants and adhesives. The worldwide adhesives industry is anticipated to surpass $100 billion by 2030, with EMA-based hot-melt adhesives gaining substantial attention. EMA enhances bonding in construction, packaging, and footwear applications, while advancements, such as Henkel's sustainable EMA blends, further improve performance and reduce environmental impact. This growth underscores EMA's increasing significance in industrial bonding solutions, which is impacting the development of the ethylene methyl acrylate market.

Restraints

Competition from alternative polymers negatively impacts the market progress

The EMA faces tough competition from other ethylene copolymers, such as EAA and EVA, which may offer equivalent properties at lower costs. The worldwide Eva industry, for example, was valued at USD 10.3 billion in 2023, growing faster than EMA in specific segments, such as packaging films. Companies usually choose substitutes based on performance, recyclability, and cost criteria. Recent advancements in bio-based EVA and biodegradable polymers have elevated competitive pressure. This competition limits the growth of the global market, mainly in cost-sensitive applications.

Opportunities

How do advancements in polymer blends offer advantageous conditions for the ethylene methyl acrylate market development?

EMA is primarily combined with other polymers to provide high-performance materials for the electronics, construction, and automotive sectors, enhancing durability and mechanical strength. Advanced EMA-modified sealants and adhesives are driving advancements, with polymer blends anticipated to grow at a 6.2% CAGR by 2030.

Recent research by Arkema on bio-based EMA blends underscores a move towards sustainable and eco-friendly applications. This trend enables manufacturers to offer distinctive products and capture premium industry segments. Hence, these improvements fuel the growth of the ethylene methyl acrylate industry.

Challenges

Unstable raw material supply restricts the market growth

Supply chain disturbances in EMA production offer instability in EMA manufacturing. The ICIS report highlighted supply scarcity in the Middle East and North America in 2023 due to maintenance shutdowns. These variations may increase operational costs and delay product delivery. Manufacturers reliant on a single supplier experience higher vulnerability. This challenge highlights the importance of robust supply chain strategies in ensuring industry stability.

Ethylene Methyl Acrylate Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ethylene Methyl Acrylate Market |

| Market Size in 2024 | USD 9.58 Billion |

| Market Forecast in 2034 | USD 14.93 Billion |

| Growth Rate | CAGR of 5.70% |

| Number of Pages | 212 |

| Key Companies Covered | ExxonMobil Chemical, Dow Inc., Arkema S.A., LG Chem, SABIC, SK Functional Polymer, LyondellBasell Industries, DuPont, Sumitomo Chemical, Mitsui Chemicals, INEOS Group, Chevron Phillips Chemical, Borealis AG, Reliance Industries Limited, Repsol, and others. |

| Segments Covered | By Purity, By Processing Method, By Application, By End Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ethylene Methyl Acrylate Market: Segmentation

The global ethylene methyl acrylate market is segmented based on purity, processing method, application, end-use industry, and region.

Based on purity, the global ethylene methyl acrylate industry is divided into 95% to 99% and more than 99%. The 95% to 99% purity segment holds a dominant share, as it offers a balance of cost efficiency and performance, making it widely used in adhesives, packaging, and cable applications.

Conversely, the ‘more than 99% purity segment held a second-leading share because of its demand in specialized and high-performing applications like electronics, advanced automotive components, and medical.

Based on processing method, the global market is segmented into extrusion coating lamination, blown/cast monolayer and coextruded films, injection molding, sheet or profile extrusion, and blow molding and foam extrusion. The extrusion coating lamination segment held a leading share, as it is widely used in paper coating, flexible packaging, and industrial films due to its sealing properties and strong adhesion.

On the other hand, the blown/cast monolayer and coextruded films segment holds second place, as it is primarily applied in multilayer packaging films for medical, food, and consumer goods, driven by the growing demand for barrier protection and durability.

Based on application, the global ethylene methyl acrylate market is segmented into construction, cosmetic, transportation, textile, lamination, paints & coatings, and others. The lamination segment holds a remarkable share of the market, as it is extensively used in paper, packaging, and industrial films due to its durability, strong adhesion, and flexibility.

However, the construction segment holds a secondary position in the market due to the increasing use of EMA-based adhesives, waterproofing materials, and sealants in building projects and infrastructure worldwide.

Based on end-use industry, the global market is segmented into industrial packaging, industrial liners, agriculture, healthcare, consumer goods, automotive, and bio-degradable and other. The industrial packaging segment captured a leading share, as EMA is widely used for laminates, flexible films, and adhesive coatings that promise product durability and protection.

Nonetheless, the automotive segment leads the industrial packaging segment due to the surging demand for impact-resistant, durable, and lightweight materials in adhesives, interior trims, and insulation components.

Ethylene Methyl Acrylate Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Ethylene Methyl Acrylate Market?

The Asia Pacific is projected to maintain its dominant position in the global ethylene methyl acrylate market, driven by urbanization, rapid industrialization, the booming packaging industry, and the expansion of the automotive industry. Economies in the APAC region, particularly India and China, are experiencing rapid industrial growth and urban expansion. This leads to elevated demand for EMA in construction materials, packaging solutions, and adhesives. The region's surging retail, e-commerce, and food sectors increased the demand for laminated and flexible packaging films made of EMA. Flexible packaging accounts for more than 40% of APAC's EMA demand, with nations such as South Korea and Japan adopting EMA for high-end industrial films.

Additionally, the APAC automotive industry, primarily in Thailand, China, and India, is rapidly expanding, driving up EMA consumption for interior trims, lightweight components, and adhesives. Ethylene methyl consumption in automotive applications is expected to surge by 6% CAGR by 2024, reflecting the region's focus on electric and fuel-efficient vehicles.

North America maintains its position as the second-leading region in the global ethylene methyl acrylate industry, driven by a well-developed packaging market, rising automotive applications, and improvements in specialty applications. North America boasts a well-established packaging industry, particularly in the pharmaceutical, food, and consumer goods sectors, which fuels demand for laminates and flexible films.

The region accounted for nearly 25% of the worldwide EMA consumption in 2024, indicating steady demand for high-performance packaging materials. EMA is primarily used in adhesives, automotive interiors, and insulation for impact-resistant and lightweight components. Adoption of EMA in North American automobiles is projected to rise at a 5% CAGR by 2024, driven by trends in fuel-efficient and electric vehicles.

Moreover, North American producers emphasize advanced EMA grades for high-performance applications, comprising medical packaging, specialty adhesives, and electronics. Specialty EMA products have experienced a double-digit growth in niche sectors, reinforcing the region's industry position.

Ethylene Methyl Acrylate Market: Competitive Analysis

The leading players in the global ethylene methyl acrylate market are:

- ExxonMobil Chemical

- Dow Inc.

- Arkema S.A.

- LG Chem

- SABIC

- SK Functional Polymer

- LyondellBasell Industries

- DuPont

- Sumitomo Chemical

- Mitsui Chemicals

- INEOS Group

- Chevron Phillips Chemical

- Borealis AG

- Reliance Industries Limited

- Repsol

Ethylene Methyl Acrylate Market: Key Market Trends

Innovation in coatings and adhesives:

EMA-based hot melt adhesives, sealants, and coatings are developed for multi-material and high-performance bonding. Improvements in specialty grades and polymer blends are offering opportunities in sectors such as electronics, construction, and healthcare.

Growth in high-purity and specialty grades:

The demand for EMA with a purity of over 99% is increasing in applications across the electronics, medical, and advanced automotive sectors. Specialty EMA products now account for 10-15% of the global demand, indicating a shift toward niche and high-performance applications.

The global ethylene methyl acrylate market is segmented as follows:

By Purity

- 95% to 99%

- More than 99%

By Processing Method

- Extrusion Coating Lamination

- Blown/Cast Monolayer And Coextruded Films

- Injection Molding

- Sheet or Profile Extrusion

- Blow Molding and Foam Extrusion

By Application

- Construction

- Cosmetic

- Transportation

- Textile

- Lamination

- Paints & Coatings

- Others

By End Use Industry

- Industrial Packaging

- Industrial Liners

- Agriculture

- Healthcare

- Consumer Goods

- Automotive

- Bio-Degradable and Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Ethylene methyl acrylate is a multipurpose copolymer composed of methyl and ethylene acrylate, widely valued for its toughness, flexibility, and strong adhesion properties. It offers superior resistance to heat, stress cracking, and chemicals, increasing its suitability for applications in wire and cable insulation, hot-melt adhesives, automotive parts, and packaging films.

The global ethylene methyl acrylate market is projected to grow due to increasing demand for flexible packaging materials, expanding applications in sealants and adhesives, and growing demand in the electronics and electrical industry.

According to a study, the global ethylene methyl acrylate market size was approximately USD 9.58 billion in 2024 and is projected to reach around USD 14.93 billion by 2034.

The CAGR value of the ethylene methyl acrylate market is expected to be approximately 5.70% from 2025 to 2034.

Emerging trends and innovations in the ethylene methyl acrylate market include the advanced polymer blends, development of high-purity grades, eco-friendly packaging solutions, specialty adhesives and coatings, and lightweight automotive applications.

Asia Pacific is expected to lead the global ethylene methyl acrylate market during the forecast period.

China is a leading contributor to the global ethylene methyl acrylate market, thanks to its robust industrial base, large-scale production capabilities, and surging demand across the automotive, packaging, and construction sectors.

The key players profiled in the global ethylene methyl acrylate market include ExxonMobil Chemical, Dow Inc., Arkema S.A., LG Chem, SABIC, SK Functional Polymer, LyondellBasell Industries, DuPont, Sumitomo Chemical, Mitsui Chemicals, INEOS Group, Chevron Phillips Chemical, Borealis AG, Reliance Industries Limited, and Repsol.

Leading players in the ethylene methyl acrylate market are implementing strategic initiatives, including capacity expansions, partnerships, mergers and acquisitions, and R&D investments, to expand their global market presence and enhance their product offerings.

The report examines key aspects of the ethylene methyl acrylate market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed