Global Erectile Dysfunction Drugs Market Size, Share, Growth Analysis Report - Forecast 2034

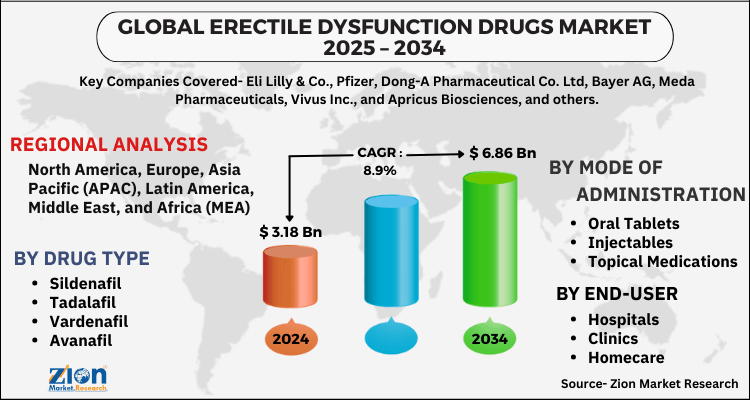

Erectile Dysfunction Drugs Market By Drug Type (Sildenafil, Tadalafil, Vardenafil, Avanafil, Others), By Mode of Administration (Oral Tablets, Injectables, Topical Medications), End-User (Hospitals, Clinics, Homecare), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

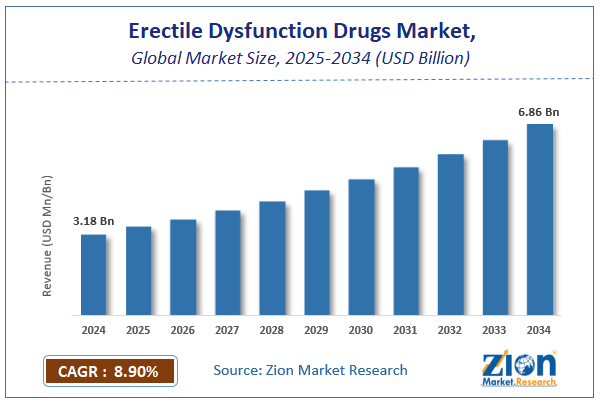

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.18 Billion | USD 6.86 Billion | 8.9% | 2024 |

Erectile Dysfunction Drugs Market Size

The global erectile dysfunction drugs market size was worth around USD 3.18 Billion in 2024 and is predicted to grow to around USD 6.86 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.9% between 2025 and 2034.

The report analyzes the global erectile dysfunction drugs market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the erectile dysfunction drugs industry.

Erectile Dysfunction Drugs Market: Overview

Erectile dysfunction is the incapability to attain and maintain a hard erection for sexual activity. Having problems with erection isn't usually a reason for fear. However, if erectile dysfunction is a long-term condition, it can create stress, lower self-esteem, and lead to marital issues. Problems obtaining or maintaining an erection can be a symptom of a more serious underlying health issue, as well as a possible risk for cardiovascular disease. To treat such conditions several drugs are available on the market that can help to maintain the erection during sexual intercourse. With a change in lifestyle and increased stress conditions need for these drugs is on the rise.

The increasing prevalence of Erectile Dysfunction (ED) is one of the key factors driving market growth over the forecast period. ED is a condition where men are unable to maintain a penile erection due to physical and psychological health issues, including diabetes, high cholesterol, smoking, stress, and mental health issues. According to a WHO report, approximately 15% of men are affected by ED each year, which is projected to reach 320 million by 2025. ED is closely linked to both physical and psychological health. Major risk factors include diabetes mellitus, heart disease, hypertension, and increased HDL levels. In addition, medications for hypertension, diabetes, depression, and cardiovascular disease can contribute to erectile difficulties.

ED is a highly prevalent condition in geriatric men. Natural decline in testosterone levels, reduced blood flow, and other age-related physiological changes contribute to the higher incidence of ED among older men. This disease has a significant impact on a patient’s quality of life and healthcare resources. The geriatric population is more likely to have chronic conditions such as diabetes, cardiovascular disease, and hypertension, which are major risk factors for ED. Thus, the increasing geriatric population is a major factor in the prevalence of ED in men in the coming years.

Key Insights

- As per the analysis shared by our research analyst, the global erectile dysfunction drugs market is estimated to grow annually at a CAGR of around 8.9% over the forecast period (2025-2034).

- Regarding revenue, the global erectile dysfunction drugs market size was valued at around USD 3.18 Billion in 2024 and is projected to reach USD 6.86 Billion by 2034.

- The erectile dysfunction drugs market is projected to grow at a significant rate due to increasing prevalence of erectile dysfunction due to aging populations and lifestyle-related diseases, coupled with growing awareness and acceptance of treatment options.

- Based on Drug Type, the Sildenafil segment is expected to lead the global market.

- On the basis of Mode of Administration, the Oral Tablets segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-User, the Hospitals segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Erectile Dysfunction Drugs Market: Growth Drivers

Growth in embracing poor lifestyle choices may boost the market growth over the forecast period.

With the surge in the adoption of a bad lifestyle, diabetes, obesity, and cardiovascular disease are on the rise, which in turn leads to problems like ED as people become older. The present lifestyle of youth in many emerging countries is very stressful resulting in increased alcoholism, smoking, and fast food or ready-to-eat food consumption. Due to these factors, overall health and fitness are getting compromised which in turn increases the chances of ED. Furthermore, as the senior population grows, so does the number of ED patients, which is a significant driver of the global erectile dysfunction drugs market throughout the projection period.

Erectile Dysfunction Drugs Market: Restraints

Low awareness and side effects associated with erectile dysfunction drugs may hinder the market growth.

Erectile dysfunction drugs are majorly sold in developed and emerging economies; however, the percentage of their sale is less in low- and middle-income countries. This is mainly due to less knowledge about these types of medication, low buying power, and less willingness to adopt such kinds of medications in lifestyle. Furthermore, side effects associated with these drugs such as headache, upset stomach, flushing, nasal congestion, vision problems, dizziness, diarrhea, and rash also contribute to the slow growth of the market.

Erectile Dysfunction Drugs Market: Opportunities

Increased pharmaceutical manufacturing in emerging countries is likely to offer better growth opportunities for market expansion.

In the last couple of years, major and emerging brands in pharmaceutical industries have increased their investments in emerging countries like India, China, Africa, and major Middle East countries. This has significantly lowered the cost of medicine along with the supply and the distribution of drugs within the countries which is expected to offer significance. Furthermore, increased investments in advertisements are also likely to contribute significantly to the expansion of the global erectile dysfunction drugs market.

Erectile Dysfunction Drugs Market: Challenges

An increase in the availability of counterfeit erectile dysfunction medicines poses a major challenge to the market expansion.

The expanding manufacture of generic erectile dysfunction pharmaceuticals, as well as the growing availability of bogus erectile dysfunction drugs, are two important challenges for the market. Consumers typically choose lower-cost generic erectile dysfunction pills over more expensive blockbuster kinds due to the profitable marketing of counterfeit erectile dysfunction drugs at considerably cheaper prices than either patented or generic pharmaceuticals. Aside from that, when patents on blockbuster pharmaceuticals expire, new generic equivalents are entering the market, generally at inexpensive rates.

Erectile Dysfunction Drugs Market: Segmentation Analysis

The global erectile dysfunction drugs market is segmented based on Drug Type, Mode of Administration, End-User, and region.

Based on Drug Type, the global erectile dysfunction drugs market is divided into Sildenafil, Tadalafil, Vardenafil, Avanafil, Others.

On the basis of Mode of Administration, the global erectile dysfunction drugs market is bifurcated into Oral Tablets, Injectables, Topical Medications.

By End-User, the global erectile dysfunction drugs market is split into Hospitals, Clinics, Homecare.

Erectile Dysfunction Drugs Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Erectile Dysfunction Drugs Market |

| Market Size in 2024 | USD 3.18 Billion |

| Market Forecast in 2034 | USD 6.86 Billion |

| Growth Rate | CAGR of 8.9% |

| Number of Pages | 190 |

| Key Companies Covered | Eli Lilly & Co., Pfizer, Dong-A Pharmaceutical Co. Ltd, Bayer AG, Meda Pharmaceuticals, Vivus Inc., and Apricus Biosciences, and others. |

| Segments Covered | By Drug Type, By Mode of Administration, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

May 2020, Metuchen Pharmaceuticals, L.L.C., a privately owned biopharmaceutical aimed at defining, developing, gaining, and commercializing revolutionary therapeutics for male sexual health conditions, and Neurotrope, Inc. ("Neurotrope") officially revealed that the two firms have decided to enter into a concise merger agreement within which Metuchen and Neurotrope, Inc. will unite in an all-stock purchase arising in a newly formed partnership firm ("Petros"). Petros is anticipated to become a Nasdaq-listed corporation specializing in men's health.

Erectile Dysfunction Drugs Market: Regional Landscape

North America is projected to lead the global market over the forecast period.

North America is likely to dominate the global erectile dysfunction drugs market. This is mainly due to the expanding senior population and superior healthcare infrastructure, as per a Rural Health Information Center report released in April 2019 stated that there are more than 46 million older persons in the United States, with that figure predicted to climb to about 90 million by 2050. When the last of the baby boom cohorts reach 65, the number of older individuals is predicted to climb by roughly 18 million between 2020 and 2030. Because ED is particularly frequent in men over the age of 40, the rise in the elderly male population is predicted to increase the number of individuals suffering from it. The domination of these countries is due to the availability of numerous ED medicines by OTC and internet outlets. The National Institute of Diabetes and Digestive and Kidney Diseases stated roughly 30 million men in the United States suffer from ED. Furthermore, the United States has the greatest rate of self-reported ED. As a result, rising ED prevalence in the US is likely to fuel market growth throughout the projection period.

Erectile Dysfunction Drugs Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the erectile dysfunction drugs market on a global and regional basis.

The global erectile dysfunction drugs market is dominated by players like:

- Eli Lilly & Co.

- Pfizer

- Dong-A Pharmaceutical Co. Ltd

- Bayer AG

- Meda Pharmaceuticals

- Vivus Inc.

- and Apricus Biosciences

The global erectile dysfunction drugs market is segmented as follows;

By Drug Type

- Sildenafil

- Tadalafil

- Vardenafil

- Avanafil

- Others

By Mode of Administration

- Oral Tablets

- Injectables

- Topical Medications

By End-User

- Hospitals

- Clinics

- Homecare

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global erectile dysfunction drugs market is expected to grow due to rising prevalence of erectile dysfunction, increasing awareness and acceptance of treatment options, advancements in drug formulations, and the growing aging male population seeking effective solutions.

According to a study, the global erectile dysfunction drugs market size was worth around USD 3.18 Billion in 2024 and is expected to reach USD 6.86 Billion by 2034.

The global erectile dysfunction drugs market is expected to grow at a CAGR of 8.9% during the forecast period.

North America is expected to dominate the erectile dysfunction drugs market over the forecast period.

Leading players in the global erectile dysfunction drugs market include Eli Lilly & Co., Pfizer, Dong-A Pharmaceutical Co. Ltd, Bayer AG, Meda Pharmaceuticals, Vivus Inc., and Apricus Biosciences, among others.

The report explores crucial aspects of the erectile dysfunction drugs market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed