Environmental Social Governance Investing Market Size, Share, Trends, Growth 2034

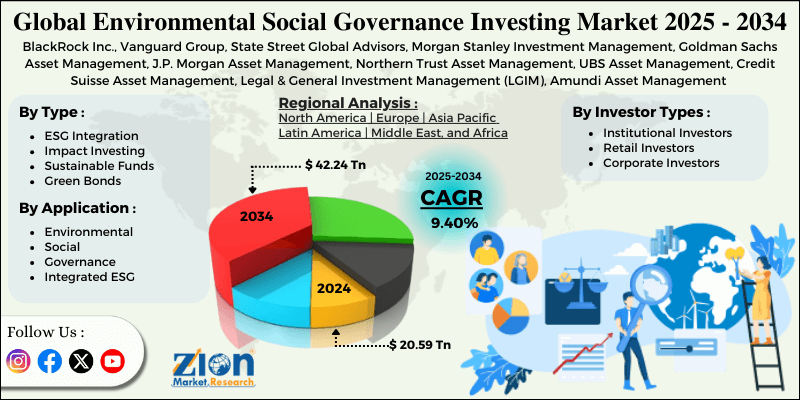

Environmental Social Governance Investing Market By Type (ESG Integration, Impact Investing, Sustainable Funds, Green Bonds, and Others), By Investor Types (Institutional Investors, Retail Investors, Corporate Investors), By Application (Environmental, Social, Governance, Integrated ESG), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

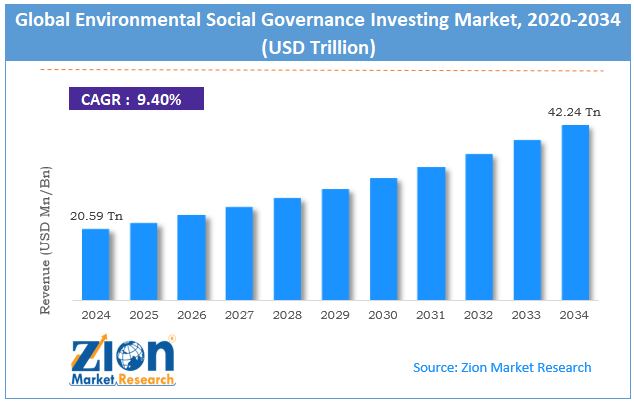

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 20.59 Trillion | USD 42.24 Trillion | 9.40% | 2024 |

Environmental Social Governance Investing Market: Industry Perspective

The global environmental social governance investing market size was worth around USD 20.59 trillion in 2024 and is predicted to grow to around USD 42.24 trillion by 2034, with a compound annual growth rate (CAGR) of roughly 9.40% between 2025 and 2034.

Environmental Social Governance Investing Market: Overview

Environmental, social, and governance (ESG) investing is an investment method that incorporates ethical consideration and sustainability alongside customary financial metrics. It emphasizes evaluating a company’s performance in domains like environmental responsibility, social impact, and governance. The global environmental social governance investing market is projected to witness substantial growth driven by the growing awareness of climate change, surging demand for responsible and ethical investments, and institutional investor participation. Investors are actively conscious of the social and financial risks associated with climate change. Companies that decrease carbon emissions and install renewable energy solutions appeal to more ESG-focused capital.

Moreover, investors and consumers are prioritizing ethical business practices, including diversity, fair labor, and inclusion. ESG funding offers an avenue for aligning organizational or personal values with investment portfolios. Furthermore, significant pension funds, sovereign wealth funds, and insurance companies are actively distributing major shares of their portfolios to ESG assets. For example, the Norwegian Sovereign Wealth Fund has denied funding for companies violating ESG criteria, setting a role model across the globe.

Although drivers exist, the global market is challenged by factors like the lack of standardized ESG metrics, greenwashing risks, and high-priced reporting and compliance. Fluctuations in ESG reporting and scoring increase challenges for investors to compare companies precisely, restricting adoption. Companies may overstress ESG credentials to draw more investments, underscoring trust in ESG markets. Implementing ESG reporting architectures and practices can be costly, particularly for mid-sized and small enterprises.

Even so, the global environmental social governance investing industry is well-positioned due to green bonds and sustainable debt instruments, technological solutions for ESG analytics, and corporate ESG transformation initiatives. Insurance of social bonds, green bonds, and sustainability-associated loans is speedily expanding, offering fresh investment opportunities.

Additionally, blockchain and AI can enhance ESG reporting precision, improve investor confidence, and reduce greenwashing. Companies are also enthusiastically embedding ESG strategies into core operations, offering avenues for ESG-based consulting services and capital allocation.

Key Insights:

- As per the analysis shared by our research analyst, the global environmental social governance investing market is estimated to grow annually at a CAGR of around 9.40% over the forecast period (2025-2034)

- In terms of revenue, the global environmental social governance investing market size was valued at around USD 20.59 trillion in 2024 and is projected to reach USD 42.24 trillion by 2034.

- The environmental, social, and governance (ESG) investing market is projected to grow significantly due to increasing investor preference for impact-driven and ethical portfolios, the integration of ESG factors into corporate governance architecture, and enhanced reporting standards and transparency requirements.

- Based on type, the ESG integration segment is expected to lead the market, while the sustainable funds segment is expected to grow considerably.

- Based on investor types, the institutional investors segment is the dominating segment, while the retail investors segment is projected to witness sizeable revenue over the forecast period.

- Based on the application, the integrated ESG segment is expected to lead the market compared to the environmental segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by North America.

Environmental Social Governance Investing Market: Growth Drivers

How is the global environmental, social, and governance investing market driven by the risk mitigation benefits of ESG investments and strong performance?

Multiple studies have shown that ESG-focused portfolios can outshine customary investments in volatility mitigation and risk-adjusted returns.

Investors are increasingly recognizing that businesses with strong ESG practices typically have better governance structures, stronger stakeholder relationships, and lower operational risks, leading to improved sustainable performance. News from BlackRock in 2024 underscored their move towards ESG-focused ETFs, mentioning resilience during industry downturns as a central propeller for rising ESG investment distributions.

Technological improvements in ESG data analytics considerably fuel the market growth

The growth of mature ESG data platforms, AI-based risk assessment tools, and ML models has streamlined companies' evaluation for investors accurately. Platforms like Sustainalytics, Bloomberg ESG Data, and MSCI ESG Ratings offer real-time scoring and data, aiding investors in making well-informed decisions.

Recent studies present that AI-driven ESG analytics adoption in asset management companies increased by 35% in 2023. This allows enhanced portfolio enhancement, impact measurement, and risk mitigation. The availability of high-quality ESG data improves confidence among investors and reduces information asymmetry, thus propelling the growth of the worldwide environmental social governance investing market.

Environmental Social Governance Investing Market: Restraints

How are misleading ESG claims and the risk of greenwashing hindering the development of the environmental, social, and governance (ESG) investing market?

Greenwashing, where companies falsify or exaggerate their ESG initiatives, poses a major threat to industry trust. Investors may inadvertently fund companies that are not truly sustainable, highlighting the credibility of ESG investments.

According to a 2023 report by the European Commission, nearly all ESG funds lacked adequate transparency to verify their environmental, social, and governance claims. Recent dishonors of large corporations for overplaying carbon reduction objectives have garnered significant media attention, underscoring the risks associated with unreliable ESG reporting. This hampers investor confidence and reduces industry adoption.

Environmental Social Governance Investing Market: Opportunities

How do corporate ESG commitments create lucrative opportunities for the environmental, social, and governance investing industry?

Companies are broadly embedding ESG into core operations, comprising carbon neutrality, strong governance practices, and diversity programs. These corporate commitments offer fresh avenues for investors to fund impactful programs, ultimately impacting the global environmental social governance investing industry.

For example, Unilever's 2024 sustainability report underscored investments in climate-positive supply chains, offering fresh prospects for ESG-aligned investment products. Institutional investors are availing themselves of these commitments to achieve long-term sustainable returns and diversify ESG portfolios.

Environmental Social Governance Investing Market: Challenges

Inconsistent ESG reporting and standards restrict the market growth

The lack of standardized ESG metrics creates comparison intricacies and confusion. According to the 2023 survey by the CFA Institute, nearly 60% of investment professionals struggle with unstable ESG reporting, marking it as a key challenge.

This unreliability and instability may create reputational risks and hamper investment decisions, reducing the adoption. Regulators are working towards universal standards, but full harmonization is still years away.

Environmental Social Governance Investing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Environmental Social Governance Investing Market |

| Market Size in 2024 | USD 20.59 Trillion |

| Market Forecast in 2034 | USD 42.24 Trillion |

| Growth Rate | CAGR of 9.40% |

| Number of Pages | 214 |

| Key Companies Covered | BlackRock Inc., Vanguard Group, State Street Global Advisors, Morgan Stanley Investment Management, Goldman Sachs Asset Management, J.P. Morgan Asset Management, Northern Trust Asset Management, UBS Asset Management, Credit Suisse Asset Management, Legal & General Investment Management (LGIM), Amundi Asset Management, Allianz Global Investors, AXA Investment Managers, BNP Paribas Asset Management, Invesco Ltd., and others. |

| Segments Covered | By Type, By Investor Types, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Environmental Social Governance Investing Market: Segmentation

The global environmental social governance investing market is segmented based on type, investor types, application, and region.

Based on type, the global environmental social governance investing industry is divided into ESG integration, impact investing, sustainable funds, green bonds, and others. The ESG integration segment thoroughly integrates environmental, social, and governance factors into customary investment analysis. It allows investors to recognize long-term risks and prospects beyond standard financial metrics. Most large institutional investors, comprising asset managers and pension funds, use ESG integration in bonds, equities, and portfolios. This extensive adoption makes ESG integration the dominating segment in the market worldwide.

Based on investor types, the global environmental social governance investing market is segmented as institutional investors, retail investors, and corporate investors. The institutional investors segment registered a substantial share of the market. They have a long-term investment horizon and the capital scale to integrate ESG factors in large portfolios. Several institutional investors have dedicated teams and formal ESG policies to access opportunities and sustainability risks. Their major participation fuels the total growth and credibility of the market.

Based on application, the global market is segmented into environmental, social, governance, and integrated ESG. The integrated ESG segment captures the maximum market share and will lead over the coming years. It considers environmental, social, and governance factors to offer an exhaustive view of a company’s sustainability performance. Investors use this all-inclusive approach to identify long-term opportunities and manage multi-dimensional risks. It is broadly adopted by retail and institutional investors looking for balanced ESG portfolios; this integration fuels the segment dominance across the globe.

Environmental Social Governance Investing Market: Regional Analysis

What enables Europe to have a strong foothold in the global Environmental Social Governance Investing Market?

Europe is likely to sustain its leadership in the environmental social governance investing market due to a strong regulatory architecture, high investor demand and awareness, and an advanced financial market ecosystem. Europe has implemented some of the leading exhaustive ESG norms, like the EU Taxonomy for sustainable activities and the EU Sustainable Finance Disclosure Regulation (SFDR). These architectures require fund managers and investors to disclose ESG-related information, thereby enhancing transparency. Moreover, European investors, both retail and institutional, present a strong preference for ethical and sustainable investment options.

According to surveys, more than 70% of European investors prefer ESG factors in their investment choices, as compared to low percentages in other regions. This elevated awareness fuels inflows into ESG funds, integrated ESG portfolios, and green bonds. The region also hosts well-established financial platforms and markets that support ESG investing, comprising mutual funds, ESG-focused ETFs, and green bonds. Economies like France and Germany have established dedicated trading platforms and ESG indices. This infrastructure simplifies access to ESG products and appeals to the global and domestic investors.

North America continues to secure the second-highest share in the environmental social governance investing industry owing to the rising institutional investor adoption, development of ESG investment products, and corporate ESG commitments. Institutional investors in North America, comprising endowments, pension funds, and asset managers, have incorporated mainly ESG criteria into their portfolios. A 2023 data survey says that the United States' ESG-focused assets surpassed USD 13 trillion, reflecting strong institutional adoption. This trend has ranked the region as the second-dominating region in the global market.

The North American industry offers a broader range of ESG products, comprising sustainable ETFs, green bonds, and impact investment funds. Major financial institutions like Vanguard and BlackRock have increased ESG fund offerings to satisfy investor demand. The availability of different ESG instruments appeals to both international and domestic capital.

Also, several regional companies are implementing strong ESG practices, comprising carbon reduction targets, transparent governance policies, and diversity initiatives. Companies like Tesla, Apple, and Microsoft have committed to sustainability objectives that attract ESG investors. Hence, corporate leadership in environmental, social, and governance (ESG) improves industry confidence and fuels investment flows.

Environmental Social Governance Investing Market: Competitive Analysis

The leading players in the global environmental social governance investing market are:

- BlackRock Inc.

- Vanguard Group

- State Street Global Advisors

- Morgan Stanley Investment Management

- Goldman Sachs Asset Management

- J.P. Morgan Asset Management

- Northern Trust Asset Management

- UBS Asset Management

- Credit Suisse Asset Management

- Legal & General Investment Management (LGIM)

- Amundi Asset Management

- Allianz Global Investors

- AXA Investment Managers

- BNP Paribas Asset Management

- Invesco Ltd.

Environmental Social Governance Investing Market: Key Market Trends

Integration of advanced ESG data analytics:

Investors are actively using big data, AI, and machine learning to analyze ESG risks and performance. These tools allow more precise scoring, predictive insights, and real-time monitoring for investment choices. Improved analytics decrease greenwashing risks and enhance portfolio optimization.

Rise of impact and thematic investing:

Investors are actively targeting measurable environmental and social outcomes like affordable housing, clean energy, and healthcare initiatives. Impact investments and thematic funds are increasing, offering societal benefits and financial returns. This trend is fueling advancements in reporting standards and product offerings.

The global environmental social governance investing market is segmented as follows:

By Type

- ESG Integration

- Impact Investing

- Sustainable Funds

- Green Bonds

- Others

By Investor Types

- Institutional Investors

- Retail Investors

- Corporate Investors

By Application

- Environmental

- Social

- Governance

- Integrated ESG

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Environmental, social, and governance (ESG) investing is an investment method that incorporates ethical consideration and sustainability alongside customary financial metrics. It emphasizes evaluating a company’s performance in domains like environmental responsibility, social impact, and governance.

The global environmental social governance investing market is projected to grow due to growing awareness of climate change and ecological sustainability, improvements in ESG data analytics, and pressure from institutional investors for sustainable practices.

According to study, the global environmental social governance investing market size was worth around USD 20.59 trillion in 2024 and is predicted to grow to around USD 42.24 trillion by 2034.

The CAGR value of the environmental social governance investing market is expected to be around 9.40% during 2025-2034.

Technological advancements, including big data analytics and AI, are allowing real-time ESG performance tracking and risk assessment, enhancing investment decision-making. This reduces information gaps, improves transparency, and encourages greater adoption of ESG-focused portfolios.

ESG investment products, such as ESG ETFs and green bonds, are seeing slightly higher fees due to compliance, data, and reporting costs. However, growing demand and increased competition are progressively driving fee compression across mainstream ESG offerings.

Major challenges include greenwashing, inconsistent ESG standards, and limited historical performance data, which hamper investor confidence. Moreover, economic volatility and high implementation costs restrict broader market adoption.

Europe is expected to lead the global environmental social governance investing market during the forecast period.

The key players profiled in the global environmental social governance investing market include BlackRock Inc., Vanguard Group, State Street Global Advisors, Morgan Stanley Investment Management,Goldman Sachs Asset Management, J.P. Morgan Asset Management, Northern Trust Asset Management, UBS Asset Management, Credit Suisse Asset Management, Legal & General Investment Management (LGIM), Amundi Asset Management, Allianz Global Investors, AXA Investment Managers, BNP Paribas Asset Management, and Invesco Ltd.

The report examines key aspects of the environmental social governance investing market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

List of Contents

Environmental Social Governance InvestingIndustry PerspectiveOverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisCompetitive AnalysisKey Market TrendsThe global environmental social governance investing market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed