Energy Bar Market Size, Share, Trends, Growth & Forecast 2034

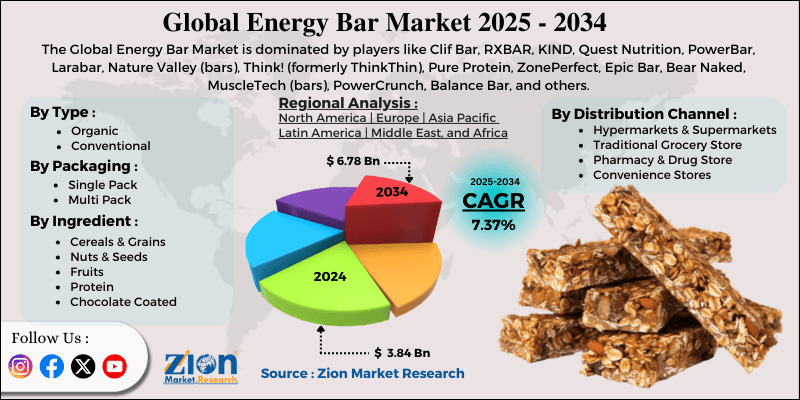

Energy Bar Market By Type (Organic, Conventional), By Packaging (Single Pack, Multi Pack), By Ingredient (Cereals & Grains, Nuts & Seeds, Fruits, Protein, and Chocolate Coated), By Distribution Channel (Hypermarkets & Supermarkets, Traditional Grocery Store, Pharmacy & Drug Store, Convenience Stores, Online, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

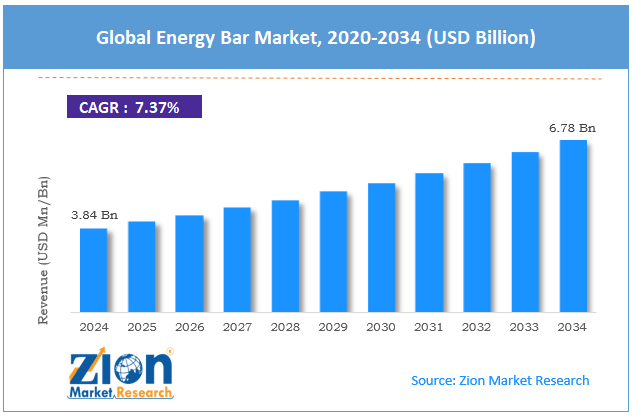

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.84 Billion | USD 6.78 Billion | 7.37% | 2024 |

Energy Bar Industry Perspective:

What will be the size of the global energy bar market during the forecast period?

The global energy bar market size was around USD 3.84 billion in 2024 and is projected to reach USD 6.78 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.37% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global energy bar market is estimated to grow annually at a CAGR of around 7.37% over the forecast period (2025-2034)

- In terms of revenue, the global energy bar market size was valued at around USD 3.84 billion in 2024 and is projected to reach USD 6.78 billion by 2034.

- The energy bar market is projected to grow significantly owing to increased participation in sports and fitness activities, the expansion of plant‑based and natural-ingredient options, and product innovation and flavor diversification.

- Based on type, the conventional segment is expected to lead the market, while the organic segment is expected to grow considerably.

- Based on packaging, the multi-pack segment is the dominant segment, while the single-pack segment is projected to witness sizeable revenue over the forecast period.

- Based on ingredients, the cereals & grains segment dominates the market, while the nuts & seeds segment is anticipated to grow steadily.

- Based on the distribution channel, the hypermarkets & supermarkets segment is expected to lead the market, followed by the online segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Energy Bar Market: Overview

An energy bar is a portable, convenient snack designed to provide a quick source of energy, typically containing a blend of protein, fats, carbohydrates, minerals, and vitamins. Commonly used by travelers, athletes, and busy individuals, energy bars help sustain stamina and prevent fatigue during long periods of physical activity without food. The global energy bar market is projected to witness substantial growth, driven by rising health and fitness awareness, a busy lifestyle, on-the-go consumption, and active and sports lifestyle trends. Consumers today are more focused on maintaining health and wellness. Energy bars offer a convenient way to supplement nutrition and support active lifestyles. This awareness fuels elevated adoption of nutrient- and protein-rich bars.

Moreover, modern work schedules and travel demand portable and quick meals. Their convenience makes them a preferred snack for busy individuals. Furthermore, athletes and fitness enthusiasts seek products that improve recovery and performance. Energy bars supply vital nutrients to sustain energy during exercise. This trend contributes to sturdy market growth.

Although drivers exist, the global market faces challenges, including higher costs than traditional snacks, perceptions of processed ingredients, and regulatory and labeling hurdles. Energy bars are high-priced than conventional snack options. Price-sensitive consumers may avoid buying them, thus restricting broader adoption in some regions. Some bars contain additives and sweeteners despite health marketing. Health-conscious buyers may consider them less natural. This perception may hamper sales growth. Likewise, labeling and nutritional standards vary in nations. Compliance increases production costs and complexity. Exporting products can be challenging for manufacturers.

Even so, the global energy bar industry is well-positioned due to personalized nutrition solutions, clean-label and organic certifications, and the integration of functional ingredients. Bars targeting specific needs, such as weight management, athletes, or seniors, are growing rapidly. Personalized nutrition appeals to health-conscious people. This offers niche market segments. Non-GMO, organic, and preservative-free bars appeal to premium buyers. Certifications improve brand credibility. The growing demand for natural products is fueling industry growth. Additionally, adding adaptogens, collagen, probiotics, and superfoods increases product value. Functional ingredients attract wellness-focused consumers. Innovation drives sales and differentiation.

Energy Bar Market: Dynamics

Growth Drivers

How is ingredient innovation and product diversification fueling the energy bar market?

The global market has expanded to include keto-friendly, functional ingredients and plant-based options such as adaptogens and probiotics. Fresh launches with natural sweeteners, allergen-free formulations, and superfoods are attracting different dietary segments. These innovative products mostly command premium prices, surging category value. As retailers stock more of these variants, repeat purchases and consumer trial are increasing.

How is the expansion of retail and e‑commerce channels driving the energy bar market?

Energy bars are broadly available in specialty stores, supermarkets, and online, fueling faster growth of the energy bar market. E-commerce is growing rapidly with targeted marketing, easy comparison, and subscription-based nutritional profiles. Physical stores augment sales through displays, promotions, and sampling, encouraging impulse and repeat purchases. This multi-channel presence promises a wide reach in different consumer segments.

Restraints

Consumer skepticism over health claims adversely impacts the market progress

Despite positioning as health foods, most energy bars still contain added sugars, high-calorie counts, or artificial ingredients that contradict wellness expectations. Growing consumer awareness around ingredient quality has made buyers more doubtful of marketing claims. When labels don’t support perceived benefits, trust erodes, and repeat purchases fail. Regulatory scrutiny over misleading health claims is growing, compelling reformulations and transparent labeling. This caution reduces impulse buying and may deter initial trial.

Opportunities

How is customization and personalized nutrition creating promising avenues for the energy bar industry's growth?

Improvements in digital health platforms and consumer data enable personalized nutrition recommendations, creating opportunities for customized energy bars. Leading companies can offer choices based on activity level, specific goals such as muscle gain or weight management, and dietary restrictions. Direct-to-consumer models allow personalized bundles and subscription services. This deep personalization strengthens consumer engagement and repeat purchases. As consumers seek individualized solutions, customized nutrition stands as a high-value growth vector. This ultimately impacts the growth of the energy bar industry.

Challenges

Cannibalization within the broader snack market limits the industry's growth

Energy bars increasingly compete not only with each other, but also with meal replacement, fortified beverages, and protein snacks. As adjacent segments innovate rapidly, some consumers substitute bars for other formats they consider more satisfying or convenient. The proliferation of alternative nutrition solutions dilutes category share and puts pressure on the relevance of energy bars. Brands should continually clarify unique value propositions to lessen cannibalization. Otherwise, growth may shift to adjacent formats instead of expanding core bar consumption.

Energy Bar Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Energy Bar Market |

| Market Size in 2024 | USD 3.84 Billion |

| Market Forecast in 2034 | USD 6.78 Billion |

| Growth Rate | CAGR of 7.37% |

| Number of Pages | 212 |

| Key Companies Covered | Clif Bar, RXBAR, KIND, Quest Nutrition, PowerBar, Larabar, Nature Valley (bars), Think! (formerly ThinkThin), Pure Protein, ZonePerfect, Epic Bar, Bear Naked, MuscleTech (bars), PowerCrunch, Balance Bar, and others. |

| Segments Covered | By Type, By Packaging, By Ingredient, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Energy Bar Market: Segmentation

The global energy bar market is segmented based on type, packaging, ingredient, distribution channel, and region.

Based on type, the global energy bar industry is divided into organic and conventional. The conventional energy bars segment holds nearly 77% of the total market share due to their broad availability, wide consumer appeal in mass-market channels, and lower prices.

On the other hand, the organic energy bars segment captures 35% of the total market. The segment currently accounts for a smaller share but is growing faster as health-conscious consumers increasingly seek clean, additive-free, and natural options.

Based on packaging, the global market is segmented into single packs and multi pack. The multi-pack segment dominates with 41% market share, offering cost-efficient bulk purchases, lower per-unit costs, and convenience for regular consumers, attracting households and frequent shoppers.

Conversely, the single pack segment holds a second position due to its strong appeal for on-the-go convenience, individual consumption, and impulse buying in convenience and retail channels.

Based on ingredients, the global energy bar market is segmented into cereals & grains, nuts & seeds, fruits, protein, and chocolate-coated. The cereals & grains segment accounts for 37% of the market. These bars are made with rice crisps, oats, wheat flakes, and similar ingredients, which hold a leading share due to their sustained energy and wide consumer preference.

However, the nuts & seeds segment progresses with 30% of the total market. They are highly valued for their rich nutrient profile, like fiber, healthy fats, and protein, and are broadly used in energy bar formulations, making them the next major ingredient category after grains and cereals.

Based on distribution channel, the global market is segmented into hypermarkets & supermarkets, traditional grocery stores, pharmacy & drug stores, convenience stores, online, and others. The hypermarkets & supermarkets account for 50% of the market share due to their high consumer footfall, extensive retail footprint, strong in-store visibility, and wide product variety, which encourage impulse and bulk purchases.

Nonetheless, the online retail segment holds 30% of the total market. The segment is growing rapidly as consumers increasingly shop online for convenience, home delivery, a wider product selection, and subscription options. Owing to these features, the segment will be the next major distribution channel after traditional physical retail.

Energy Bar Market: Regional Analysis

Why does North America hold a dominant position in the global Energy Bar Market?

North America is likely to sustain its leadership in the energy bar market, with a 7.3% CAGR, driven by a large market share, steady demand, a strong health and fitness culture, and extensive e-commerce and retail reach. North America registers for nearly 44% of the total market, making it the leading market by revenue. This dominant share signifies broader consumer adoption of energy bars as daily snacks and meal alternatives. A mature market infrastructure with diverse products further strengthens this dominance.

Moreover, consumers in North America show elevated awareness of wellness, health, and fitness trends, fueling demand for low-sugar, high-protein, and functional bars. Active lifestyles and participation in sports drive consumption as energy bars are used for recovery and performance. This cultural focus on nutrition drives continuous industry growth.

Furthermore, the region benefits from well-established retail networks, with hypermarkets, supermarkets, and online channels broadly offering energy bars. Regional e-commerce sales for energy bars have grown significantly, improving accessibility and variety. Strong distribution and supply chains further support robust market penetration.

Europe continues to hold the second-highest share, with a 7.8% CAGR in the energy bar industry, owing to strong market share and consumer base, health consciousness and functional food demand, and regulatory support and quality standards. Europe registers for nearly 31% of the total market, making it the fastest-growing region after North America. This substantial share denotes broader adoption of energy bars in Central and Western Europe. High nutrition awareness and urbanization support consistent demand.

European consumers are largely prioritizing health-oriented snacks with high-protein, clean-label attributes, and low sugar. This shift expands the energy bar beyond athletes to everyday snacking occasions. Manufacturers respond with plant-based and functional formulations that support these wellness trends. Additionally, stringent labeling and safety standards from EU bodies motivate product quality and transparent ingredient disclosure. This regulatory focus builds consumer confidence in clean-label products and nutrition claims. It also compels brands to innovate with healthier formulations.

Energy Bar Market: Competitive Analysis

The leading players in the global energy bar market are:

- Clif Bar

- RXBAR

- KIND

- Quest Nutrition

- PowerBar

- Larabar

- Nature Valley (bars)

- Think! (formerly ThinkThin)

- Pure Protein

- ZonePerfect

- Epic Bar

- Bear Naked

- MuscleTech (bars)

- PowerCrunch

- Balance Bar

What are the key trends in the global Energy Bar Market?

Sustainable & ethical packaging focus:

Sustainability is impacting purchasing behavior, with leading companies adopting responsibly sourced ingredients and biodegradable or recyclable packaging. Consumers are rewarding products with eco-friendly and fair-trade credentials. This trend backs long-term brand loyalty among environmentally aware shoppers.

Digital & e‑commerce expansion:

Online retail channels, comprising subscription and direct-to-consumer models, are growing speedily for energy bars. E-commerce provides better accessibility, personalized shopping experiences, and variety. Influencer marketing and social media further drive visibility and engagement for emerging and niche brands.

The global energy bar market is segmented as follows:

By Type

- Organic

- Conventional

By Packaging

- Single Pack

- Multi Pack

By Ingredient

- Cereals & Grains

- Nuts & Seeds

- Fruits

- Protein

- Chocolate Coated

By Distribution Channel

- Hypermarkets & Supermarkets

- Traditional Grocery Store

- Pharmacy & Drug Store

- Convenience Stores

- Online

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed