Endoscopy Devices Market Size, Share, And Growth Report 2032

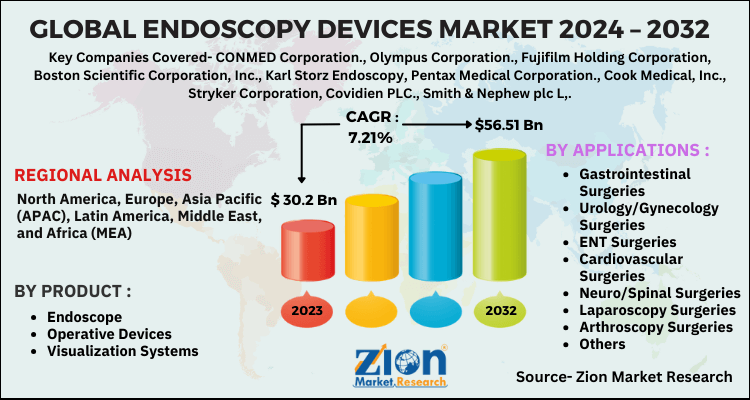

Endoscopy Devices Market by Product (Endoscope, Operative Devices and Visualization System) By Application (Gastrointestinal Surgeries, Urology/Gynecology Surgeries, ENT Surgeries, Cardiovascular Surgeries, Neuro/Spinal Surgeries, Laparoscopy Surgeries, Arthroscopy Surgeries, and others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

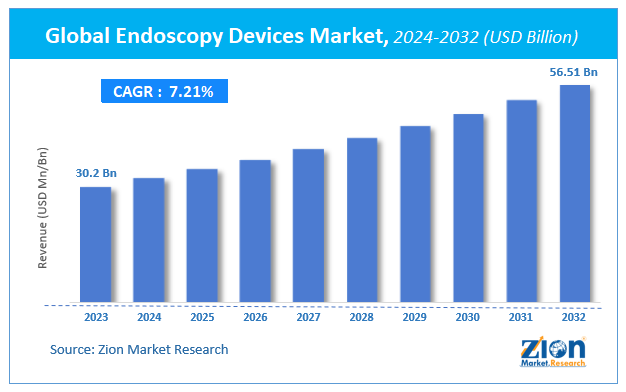

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 30.2 Billion | USD 56.51 Billion | 7.21% | 2023 |

Endoscopy Devices Market Size

According to Zion Market Research, the global Endoscopy Devices Market was worth USD 30.2 Billion in 2023. The market is forecast to reach USD 56.51 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.21% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Endoscopy Devices Market industry over the next decade.

Endoscopy Devices Market: Overview

Endoscopy is the enclosure of an elongated, shrill tube directly into the body to perceive a core organ or nerve in aspect. The Endoscopy device is also used in other major surgeries. Endoscopes are nominally offensive and can be injected into the openings of the body such as mouth. Endoscopy is beneficial for examining many structures within the human body, for instance Gastro intestinal tract, Respiratory tract, Ear, Urinary tract and Female reproductive tract.

The players in the industry are focusing aggressively on innovation, as well as on including advanced devices technologies. Over the coming years, they are also expected to take up partnerships and mergers and acquisitions as their key strategy for business development, states the Endoscopy Devices market study.

COVID-19 Impact Analysis:

The restrictions imposed by various nations to contain COVID had stopped the demand and supply resulting in a disruption across the whole supply chain. However, the global markets are slowly opening to their full potential and theirs a surge in demand. The market would remain bullish in upcoming year. The significant decrease in the Global Endoscopy Devices market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Endoscopy Devices Market: Growth Factors

The major boosters of the Endoscopy Devices market are increasing adoption of technologically advanced devices such as capsule endoscopes with ultra-high definition visualization. The number of yearly GI (gastrointestinal) surgeries is continually increasing due to the rise in the general population. This, in turn, boosts the endoscopy devices market. In addition to this, the increasing occurrence of digestive disorders impacting all types of the population as well as the extending therapeutic abilities of the devices is set to bolster the endoscopy devices market. Some of the major GI disorders boosting the procedural volume in the endoscopy devices market are digestive cancer, gastro-esophageal reflux disorder (reflux or GERD), dyspepsia, gastroenteritis, and gallstones. The prevalence of these conditions is noteworthy and ever expanding, boosting the endoscopy devices market.

Endoscopy Devices Market: Segmentation

Segment Analysis Preview

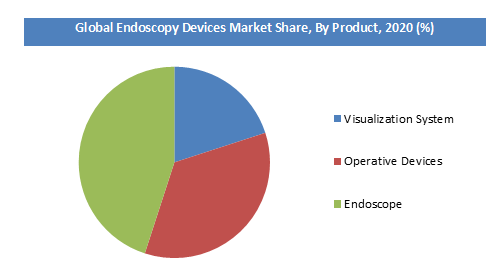

Endoscopy Devices market is divided into application, Product, and region. Product is bifurcated into Endoscope, Operative Devices and Visualization System. Endoscope market is subjected to grow on account of rising frequency of ailments requiring endoscopic analysis. Moreover, the rising demand for endoscope is because of cost effectiveness, safety and efficacy.

By Application the market is segmented into Gastrointestinal Surgeries, Urology/Gynecology Surgeries, ENT Surgeries, Cardiovascular Surgeries, Neuro/Spinal Surgeries, Laparoscopy Surgeries, Arthroscopy Surgeries, and others. The Gastrointestinal Surgeries is anticipated to grow on account of increasing geriatric population, rising number of colonoscopy in developed nations and improvisation of healthcare facilities in developing countries.

Endoscopy Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Endoscopy Devices Market |

| Market Size in 2023 | USD 30.2 Billion |

| Market Forecast in 2032 | USD 56.51 Billion |

| Growth Rate | CAGR of 7.21% |

| Number of Pages | 167 |

| Key Companies Covered | CONMED Corporation., Olympus Corporation., Fujifilm Holding Corporation, Boston Scientific Corporation, Inc., Karl Storz Endoscopy, Pentax Medical Corporation., Cook Medical, Inc., Stryker Corporation, Covidien PLC., Smith & Nephew plc L,. |

| Segments Covered | By Product, By Applications and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

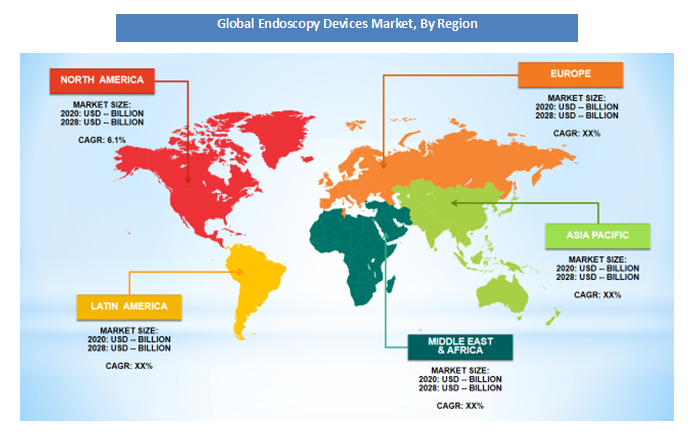

Endoscopy Devices Market: Regional Analysis

North America dominates the global endoscopy devices market, driven by advanced healthcare infrastructure, a high prevalence of chronic diseases, and significant adoption of minimally invasive surgical procedures. The presence of leading market players and continuous technological advancements in endoscopy devices further strengthen the region's leadership. The growing geriatric population and rising demand for diagnostic and therapeutic procedures contribute to sustained growth in this market.

Endoscopy Devices Market: Competitive Players

The report covers detailed competitive outlook including the market share and company profiles of the key participants operating in the global air quality control system market are:

- CONMED Corporation.

- Olympus Corporation.

- Fujifilm Holding Corporation

- Boston Scientific Corporation Inc.

- Karl Storz Endoscopy

- Pentax Medical Corporation.

- Cook Medical Inc.

- Stryker Corporation

- Covidien PLC.

- Smith & Nephew plc.

The Global Endoscopy Devices Market is segmented as follows:

By Product

- Endoscope

- Rigid Endoscope

- Flexible Endoscope

- Capsule Endoscope

- Robot Assisted Endoscope

- Operative Devices

- Energy Systems

- Suction/Irrigation Systems

- Access Devices

- Operative Hand Instruments

- Others (Insufflation Devices, Wound Protectors, Snares)

- Visualization Systems

- Ultrasound Devices

- Standard Definition (SD) Visualization Systems

- High Definition (HD) Visualization Systems

By Applications

- Gastrointestinal Surgeries

- Urology/Gynecology Surgeries

- ENT Surgeries

- Cardiovascular Surgeries

- Neuro/Spinal Surgeries

- Laparoscopy Surgeries

- Arthroscopy Surgeries

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Endoscopy devices are medical instruments used to examine the interior of the body through minimally invasive procedures. They include flexible or rigid tubes equipped with cameras and lights, allowing visualization, diagnosis, and treatment of conditions in organs such as the stomach, colon, or lungs.

According to study, the Endoscopy Devices Market size was worth around USD 30.2 billion in 2023 and is predicted to grow to around USD 56.51 billion by 2032.

The CAGR value of Endoscopy Devices Market is expected to be around 7.21% during 2024-2032.

North America has been leading the Endoscopy Devices Market and is anticipated to continue on the dominant position in the years to come.

The Endoscopy Devices Market is led by players like CONMED Corporation., Olympus Corporation., Fujifilm Holding Corporation, Boston Scientific Corporation, Inc., Karl Storz Endoscopy, Pentax Medical Corporation., Cook Medical, Inc., Stryker Corporation, Covidien PLC., Smith & Nephew plc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed