Endocrine Testing Market Size, Share, Analysis, Trends, Growth, 2032

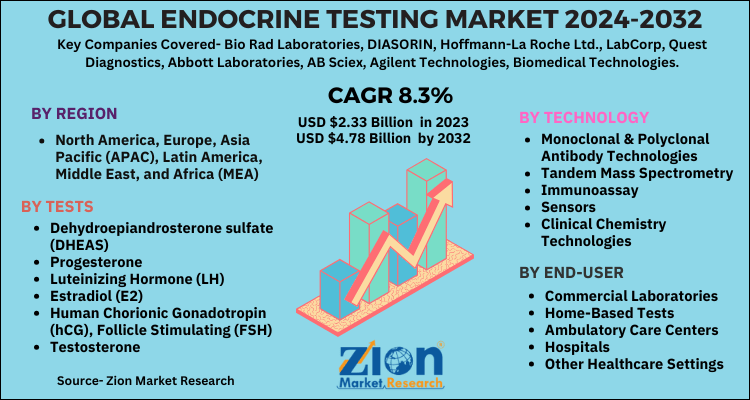

Endocrine Testing Market By Tests (Dehydroepiandrosterone sulfate (DHEAS), Progesterone, Luteinizing Hormone (LH),Estradiol (E2), Human Chorionic Gonadotropin (hCG), Follicle Stimulating (FSH), Testosterone, Thyroid prolactin, Thyroid Stimulating Hormone (TSH), cortisol, insulin, and Other Test), By Technology (Monoclonal & Polyclonal Antibody Technologies, Tandem Mass Spectrometry, Immunoassay, Sensors, Clinical Chemistry Technologies, and Others), By End-user (Commercial Laboratories, Home-Based Tests, Ambulatory Care Centers, Hospitals, and Other Healthcare Settings): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.33 Billion | USD 4.78 Billion | 8.3% | 2023 |

Endocrine Testing Market Insights

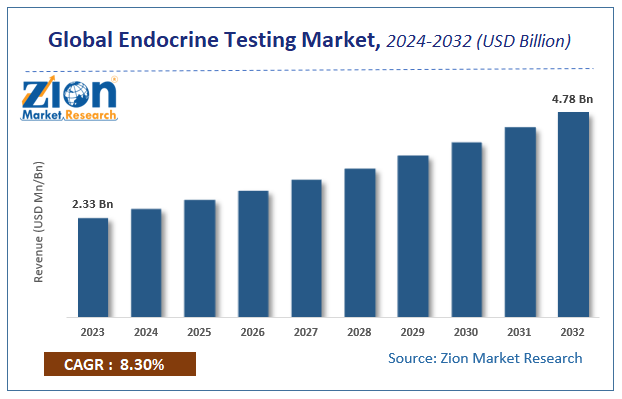

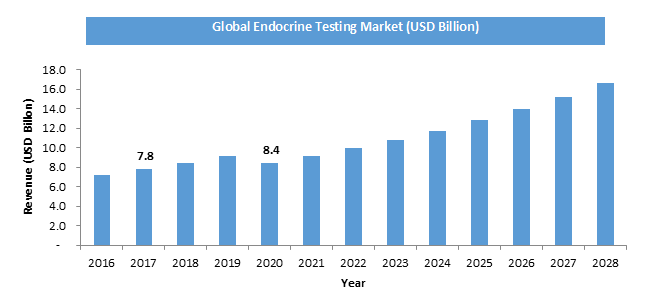

According to a report from Zion Market Research, the global Endocrine Testing Market was valued at USD 2.33 Billion in 2023 and is projected to hit USD 4.78 Billion by 2032, with a compound annual growth rate (CAGR) of 8.3% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Endocrine Testing Market industry over the next decade.

Endocrine Testing Market: Overview

The endocrine system is a setup of glands that produce and discharge hormones which aid control several vital body utilities, inclusive of the body's capability to alteration of calories into energy which commands organs and cells. The endocrine system impacts the way our heart beats, growth of bones and tissues, also the ability to make a kid. It plays a key role in developing diabetes, growth disorders, sexual dysTest, thyroid disease and a multitude of additional hormone-related disorders.

Key players in the industry are developing advanced testing devices for the end-users at a competitive price point. Major collaborations, technologically enhanced products and regulatory approvals are other factors stimulating the market.

Endocrine Testing Market: COVID-19 Impact Analysis

The restrictions imposed by various nations to contain COVID had stopped the demand and supply resulting in a disruption across the whole supply chain. However, the global markets are slowly opening to their full potential and theirs a surge in demand. The market would remain bullish in upcoming year. The significant decrease in the Global Endocrine Test market End-user in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Endocrine Testing Market: Growth Factors

Mounting health awareness, early endocrine disorder diagnosis, and favorable government policies is predicted to inflate the growth of endocrine testing market over the ensuing years. Apart from this, exponential increase in diabetes patients and elderly & obese population is forecast to augment the endocrine testing market End-user over the forthcoming years.

Soaring technology costs, however, is projected to inhibit the progression of endocrine testing market over the next few years. Nevertheless, massive funding of R&D activities and technological innovations are expected to open new growth opportunities for the business, thereby normalizing the impact of hindrances on the endocrine testing market.

Endocrine Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Endocrine Testing Market |

| Market Size in 2023 | USD 2.33 Billion |

| Market Forecast in 2032 | USD 4.78 Billion |

| Growth Rate | CAGR of 8.3% |

| Number of Pages | 120 |

| Key Companies Covered | Bio Rad Laboratories, DIASORIN, Hoffmann-La Roche Ltd., LabCorp, Quest Diagnostics, Abbott Laboratories, AB Sciex, Agilent Technologies, Biomedical Technologies, and bioMerieux SA, among others |

| Segments Covered | By Tests, By Technology, By End-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Segment Analysis Preview

Endocrine Testing market is segmented into Dehydroepiandrosterone sulfate (DHEAS), Progesterone, Luteinizing Hormone (LH), Estradiol (E2), Human Chorionic Gonadotropin (hCG), Follicle Stimulating (FSH), Testosterone, Thyroid prolactin, Thyroid Stimulating Hormone (TSH), cortisol, insulin and Other Test. Thyroid Stimulating Hormone (TSH) is anticipated to grow owing to increasing thyroid related disorders across the globe.

On the basis of technology the market is segmented into Monoclonal & Polyclonal Antibody Technologies, Tandem Mass Spectrometry, Immunoassay, Sensors, Clinical Chemistry Technologies, and Others. Clinical Chemistry Technologies segmented is projected to grow owing to major technical advancement coupled with enhanced diagnostics demand.

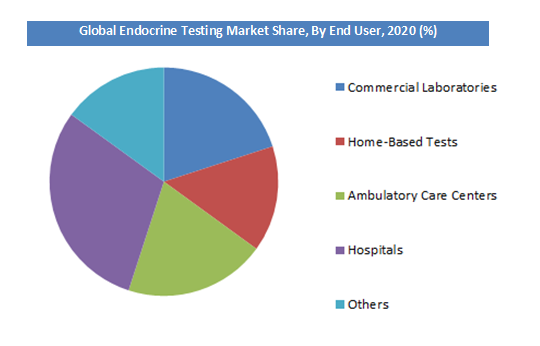

On the basis of End-user Endocrine Testing is segmented into Commercial Laboratories, Home-Based Tests, Ambulatory Care Centers, Hospitals, and Other Healthcare Settings. Hospital segment is anticipated to grow owing to increasing demand of health facilities across the globe.

North America region hold the major share in the market and is likely to remain dominant throughout the forecast period. This is due to the development of innovative easy-to-operate test kits equipped with biosensors that facilitate user-friendly and cost-effective home-based diagnosis is creating a positive outlook for the market.

Endocrine Testing Market: Competitive Landscape

The major players operating in the Endocrine Testing market are

- Bio Rad Laboratories

- DIASORIN

- Hoffmann-La Roche Ltd.

- LabCorp

- Quest Diagnostics

- Abbott Laboratories

- AB Sciex

- Agilent Technologies

- Biomedical Technologies

- bioMerieux SA

- among others.

The global Endocrine Testing market is segmented as follows:

By Tests

- Dehydroepiandrosterone sulfate (DHEAS)

- Progesterone

- Luteinizing Hormone (LH)

- Estradiol (E2)

- Human Chorionic Gonadotropin (hCG), Follicle Stimulating (FSH)

- Testosterone

- Thyroid prolactin

- Thyroid Stimulating Hormone (TSH), cortisol, insulin

- Other Test

By Technology

- Monoclonal & Polyclonal Antibody Technologies

- Tandem Mass Spectrometry

- Immunoassay

- Sensors

- Clinical Chemistry Technologies

- Others

By End-user

- Commercial Laboratories

- Home-Based Tests

- Ambulatory Care Centers

- Hospitals

- Other Healthcare Settings

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Endocrine Testing market was valued at USD 2.33 Billion in 2023.

The global Endocrine Testing market is expected to reach USD 4.78 Billion by 2032, growing at a CAGR of 8.3% between 2024 to 2032.

Some of the key factors driving the global Endocrine Testing market growth are rising health issues across the globe.

North America Endocrine Testing market is expected to show strong growth on account of growing technological spending and facilities.

The major players operating in the Endocrine Testing market are Bio Rad Laboratories, DIASORIN, Hoffmann-La Roche Ltd., LabCorp, Quest Diagnostics, Abbott Laboratories, AB Sciex, Agilent Technologies, Biomedical Technologies, and bioMerieux SA, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed