Immunoassay Market Trend, Share, Growth, Demand, Size and Forecast 2032

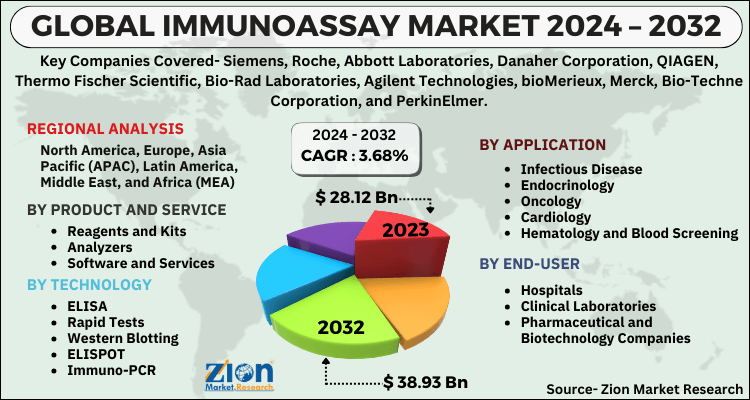

Immunoassay Market by Product & Service (Reagents & Kits, Analyzers, and Software & Services), by Platform (Chemiluminescence Immunoassays, Fluorescence Immunoassays, Enzyme Immunoassays, Radioimmunoassay, and Others), by Technology (ELISA, Rapid Tests, Western Blotting, ELISPOT, Immuno-PCR, and Others), by Application (Infectious Disease, Endocrinology, Oncology, Cardiology, Hematology & Blood Screening, Autoimmune Disorders, and Others), by End-User (Hospitals, Clinical Laboratories, Pharmaceutical and Biotechnology Companies, Contract Research Organization, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

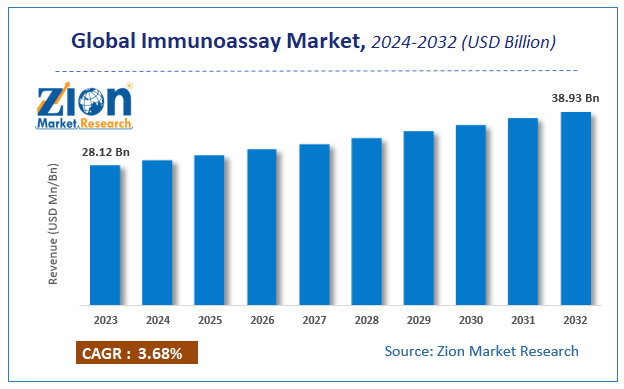

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 28.12 Billion | USD 38.93 Billion | 3.68% | 2023 |

Immunoassay Market Insights

The global Immunoassay market size accrued earnings worth approximately USD 28.12 Billion in 2023 and is predicted to gain revenue of about USD 38.93 Billion by 2032, is set to record a CAGR of nearly 3.68% over the period from 2024 to 2032. The study includes drivers and restraints of the immunoassay market along with their impact on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the immunoassay market on a global level.

Global Immunoassay Market: Overview

In order to give the users of this report a comprehensive view of the immunoassay market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Immunoassay is a type of biochemistry technique that is used either qualitatively or quantitatively to detect the presence of analytes. The analytes present can be in the form of large proteins or antibodies that may be produced due to an infection. This type of test can be used in laboratories or at the site itself. Antibodies or antigens are used as biorecognition agents for detecting the presence of analytes.

According to the National Cancer Institute, in 2018, approximately 1,800,000 new cases of cancer were registered in the U.S. and it caused about 6,00,000 people deaths. This increase in the occurrence of cancer leading to the increased disease diagnosis is likely to drive the immunoassay market in the future. The growing prevalence of other chronic and infectious diseases, such as tuberculosis, AIDS, etc., is projected to further fuel the immunoassay market over the estimated timeframe. The growing awareness about immunoassay techniques for drug and alcohol detection, rising research activities related to immunological disorders and cancer, rapid technological advancements made by major companies, increasing funding by government for the treatment of chronic diseases, and growing biotechnological and pharmaceutical companies in developing countries are also anticipated to boost the global immunoassay market in the years ahead. However, strict regulation for approval of consumables and instruments and unfavorable reimbursement policies may hinder the growth of the immunoassay market globally.

Immunoassay Market: Segmentation Analysis

The global immunoassay market is divided into product and service, technology, application, platform, and end-user.

By product & service, the market for immunoassay is segmented into reagents & kits, software & services, and analyzer. The reagents and kits segment is anticipated to dominate the immunoassay market over the forecast time period, owing to the increasing prevalence of chronic and infectious diseases.

By platform, the immunoassay market is segmented into fluorescence immunoassays, radioimmunoassays, enzyme immunoassays, chemiluminescence immunoassays, and others. The enzyme immunoassays segment is anticipated to grow considerably in the global market due to its accurate results related to the detection of various diseases.

By technology, the market is segmented into ELISA, ELISPOT, immuno-PCR, rapid tests, western blotting, and others. ELISA dominated the market in 2018, due to its use in the detection of various diseases, such as cancer, infectious disease. The application segment of the market includes oncology, endocrinology, cardiology, infectious diseases, autoimmune disorders, hematology and blood screening, and others. Infectious diseases are expected to dominate the immunoassay market in the upcoming years, owing to the growing prevalence of tuberculosis in developing nations, such as India and China.

By end-user, the market is segmented into pharmaceutical and biotechnology companies, clinical laboratories, contract research organization, hospitals, and others. Hospitals are anticipated to dominate the immunoassay market globally.

Immunoassay Market: Regional Analysis

By region, North America is projected to dominate the global immunoassay market in the upcoming years, owing to rising healthcare expenditure, increasing prevalence of chronic diseases, and growing research activities related to immunological disorders. The Asia Pacific immunoassay market is projected to show the highest rate of growth over the forecast time period, owing to the rising prevalence of infectious diseases in China and India, increasing product launches, growing investments made in R&D by the government, and increased establishments of the pharmaceutical and biotechnological companies.

Immunoassay Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Immunoassay Market |

| Market Size in 2023 | USD 28.12 Billion |

| Market Forecast in 2032 | USD 38.93 Billion |

| Growth Rate | CAGR of 3.68% |

| Number of Pages | 207 |

| Key Companies Covered | Siemens, Roche, Abbott Laboratories, Danaher Corporation, QIAGEN, Thermo Fischer Scientific, Bio-Rad Laboratories, Agilent Technologies, bioMerieux, Merck, Bio-Techne Corporation, and PerkinElmer |

| Segments Covered | By product and service, By platform, By technology, By application, By end-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Immunoassay Market: Competitive Players

Some key players of the global immunoassay market are -

- Siemens

- Roche

- Abbott Laboratories

- Danaher Corporation

- QIAGEN

- Thermo Fischer Scientific

- Bio-Rad Laboratories

- Agilent Technologies

- bioMerieux

- Merck

- Bio-Techne Corporation

- PerkinElmer.

This report segments the global immunoassay market into:

Global Immunoassay Market: Product and Service Analysis

- Reagents and Kits

- Analyzers

- Software and Services

- Global Immunoassay Market: Platform Analysis

- Chemiluminescence Immunoassays (CLIAs)

- Fluorescence Immunoassays (FIAs)

- Enzyme Immunoassays (EIs)

- Radioimmunoassays (RIAs)

- Others

Global Immunoassay Market: Technology Analysis

- ELISA

- Rapid Tests

- Western Blotting

- ELISPOT

- Immuno-PCR

- Others

Global Immunoassay Market: Application Analysis

- Infectious Disease

- Endocrinology

- Oncology

- Cardiology

- Hematology and Blood Screening

- Autoimmune Disorders

- Others

Global Immunoassay Market: End-User Analysis

- Hospitals

- Clinical Laboratories

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Blood Banks

- Others

Global Immunoassay Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed