Endocrine Peptide Test Market Size, Share, Growth, Forecast 2034

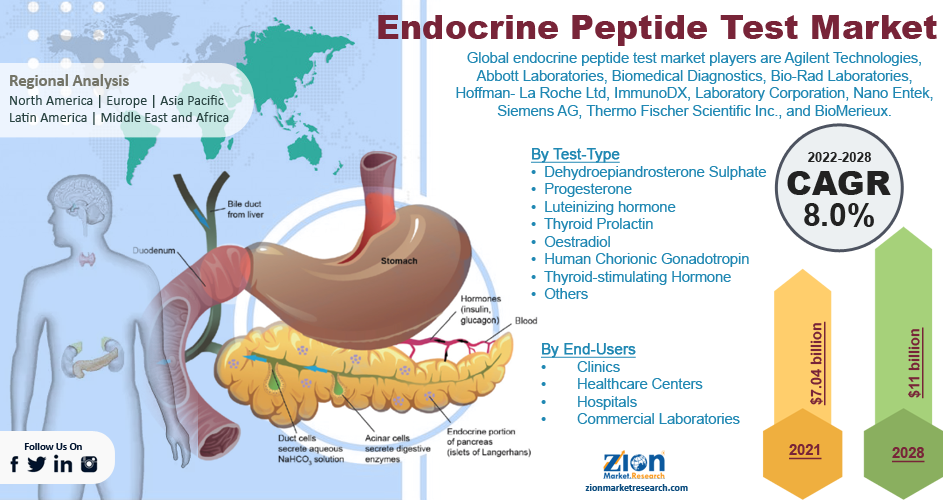

Endocrine Peptide Test Market By Test Type (Dehydroepiandrosterone Sulfate, Progesterone, Luteinizing Hormone, Thyroid Prolactin, Estradiol, Gonadotropin, Thyroid-stimulating Hormone, and Others), By End-User (Clinics, Healthcare Centers, Hospitals, and Commercial Laboratories), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

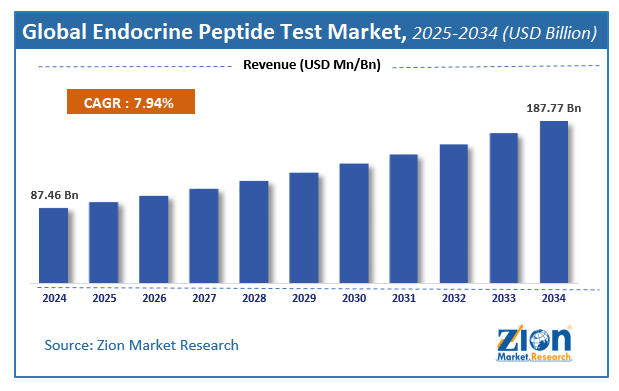

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 87.46 Billion | USD 187.77 Billion | 7.94% | 2024 |

Endocrine Peptide Test Industry Perspective

The global endocrine peptide test market size was worth around USD 87.46 Billion in 2024 and is predicted to grow to around USD 187.77 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.94% between 2025 and 2034. The report analyzes the global endocrine peptide test market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the endocrine peptide test industry.

Endocrine Peptide Test Market: Overview

Endocrine peptide test is done to measure the level of C-peptide present in the bloodstream. They are very similar to insulin and they both are found in equal quantities in the body. The quantity of glucose is managed by insulin. The C-peptide measures the insulin secreted by the pancreas.

The sugar level in a person has no bearing on the c-peptide. It just gives the measure to indicate the insulin levels to test whether they are normal or below nominal. C-peptide is otherwise termed a connecting peptide. It is basically 31-amino acid polypeptide. This test is done to check whether somebody is diabetic-prone or the type of diabetes they have.

The test is basically performed by injecting the glucose inside the body and radiating energy. This will show the result as to what amount of C-peptide is actually present. They are also used to diagnose similar diseases with the measurement of C-peptide levels in the blood serum.

Key Insights

- As per the analysis shared by our research analyst, the global endocrine peptide test market is estimated to grow annually at a CAGR of around 7.94% over the forecast period (2025-2034).

- Regarding revenue, the global endocrine peptide test market size was valued at around USD 87.46 Billion in 2024 and is projected to reach USD 187.77 Billion by 2034.

- The endocrine peptide test market is projected to grow at a significant rate due to rising prevalence of hormonal disorders, increased awareness of early diagnosis, advancements in diagnostic technologies, and growing healthcare expenditure.

- Based on Test Type, the Insulin segment is expected to lead the global market.

- On the basis of Technology, the ELISA segment is growing at a high rate and will continue to dominate the global market.

- Based on the End User, the Hospitals segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Covid-19 Impact:

The exponential increase in the number of infected patients during the pandemic triggered a huge demand for specialist treatment methods and tests. The healthcare infrastructure that is currently available was not capable enough to treat millions of people who fell ill during the pandemic times. Any chance to improve diagnosis methods and treatments was implemented and supported by the governments to satisfy the massive demand. Hence the endocrine peptide test market grew at a considerable rate with so many diabetic and immuno-compromised people waiting to get tested when the pandemic was in a rage. Although people suffered to commute to reach clinics and hospitals due to severe lockdowns and curfews, the demand for such testing routines increased rapidly.

Endocrine Peptide Test Market: Growth Drivers

Prevalence of diabetes amongst the masses induces market growth

One of the main factors that propel the demand for endocrine peptide testing is the extreme prevalence of diabetic patients all over the world. Thyroid disorders and infertility have also been very predominant in recent times which triggers excessive leverage of endocrine peptide tests.

The other factors which drive market growth t a large extent are supposed to be the decreasing level of immunity in people across the world. There is always a high risk of contracting any chronic diseases because of the complications that prevail today amongst people. Technological advancements in medical fields with testing and diagnosing methods have become more prominent and any infrastructural improvisations along those lines are welcomed & accepted exclusively. This also boosts growth in the global endocrine peptide test market as many people consume the test in excess.

Home-based diagnoses for all sicknesses and diseases are also gaining a lot of demand. The easily accessible kits make the testing easier for people as the geriatric population in every region has increased to a certain level. The complications and risk of developing chronic diseases amongst the older population have triggered them to opt for self-diagnosis and treatment methods. These cost-effective diagnostic kits for home testing also improve the leverage quotient of the tests thereby spiking up the market rate.

Endocrine Peptide Test Market: Restraints

High costs associated with endocrine peptide testing methods hamper the market growth

The cost and expenses associated with these testing methods impede market growth to a certain extent. Lack of awareness and appropriate healthcare infrastructures to provide these tests in developing countries also lessen the consumption of these diagnostic tests. All these factors restrain the market growth of endocrine peptide tests to a large extent

Endocrine Peptide Tests Market: Opportunities

Advancement in the endocrine testing method to bring precision is a great opportunity for market expansion

The endocrine peptide tests conducted in recent times are now integrated with mass spectrometry to increase the accuracy of the result. This aids the testing methods to be fully automated and brings precision to the output thereby improving the consumption rate. This factor provides lucrative opportunities for market expansion in the future.

Endocrine Peptide Tests Market: Challenges

High costs associated with these testing methods pose a challenge to the market

The affordability and accessibility of these endocrine testing in developing countries are still a problem due to the high cost associated with these testing methods. The rising prominence of diseases and chronic illness across the world trigger people to opt for low-cost testing methods. This factor poses a challenge to the market growth of the global endocrine peptide test market.

Lack of proper healthcare infrastructure also poses a challenge to the market growth

Many developing countries across the world suffer from the evident lack of good healthcare infrastructures to support such testing methods. Hence the accessibility of these endocrine peptide testing methods is very low which induces a challenge to the global market.

Endocrine Peptide Test Market: Segmentation

The global endocrine peptide test market is fragmented into its test type, end-user industry, and region.

On the basis of the test type, the global market is segregated into dehydroepiandrosterone sulfate, progesterone, luteinizing hormone, thyroid prolactin, oestradiol, human chorionic gonadotropin, thyroid-stimulating hormone, and others.

On the basis of the end-user industry, the market is categorized into clinics, healthcare centers, hospitals, and commercial laboratories.

Recent Developments:

In June 2022, at ENDO 2022, the Endocrine Society presented a clinical study about the development of PEC-Direct, a stem cell-based therapy to treat high-risk type 1 diabetes. It is deemed to function as a replacement pancreas.

Endocrine Peptide Test Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Endocrine Peptide Test Market |

| Market Size in 2024 | USD 87.46 Billion |

| Market Forecast in 2034 | USD 187.77 Billion |

| Growth Rate | CAGR of 7.94% |

| Number of Pages | 260 |

| Key Companies Covered | Agilent Technologies, Abbott Laboratories, Biomedical Diagnostics, Bio-Rad Laboratories, Hoffman- La Roche Ltd, ImmunoDX, Laboratory Corporation, Nano Entek, Siemens AG, Thermo Fischer Scientific Inc., and BioMerieux, and others. |

| Segments Covered | By Test Type, By Technology, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Endocrine Peptide Test Market: Regional Landscape:

North America leads as the major contributor to the global endocrine peptide tests market due to the excessive presence of endocrine disorders in that region. There is also an increase in the overall rate of the geriatric population which leads to an increase in the leverage of endocrine tests. Western Europe trails as the second-best contributor to the global market owing to the improving healthcare infrastructures.

Government initiatives to ease the affordability and accessibility of healthcare services trigger a huge demand thereby improving the market rate as well.

Endocrine Peptide Test Market: Competitive Space

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the endocrine peptide test market on a global and regional basis.

The global Endocrine Peptide Test market profiles key players such as:

- Agilent Technologies

- Abbott Laboratories

- Biomedical Diagnostics

- Bio-Rad Laboratories

- Hoffman- La Roche Ltd

- ImmunoDX

- Laboratory Corporation

- Nano Entek

- Siemens AG

- Thermo Fischer Scientific Inc

- BioMerieux

Global Endocrine Peptide Test Market is segmented as below:

By Test-Type

- Dehydroepiandrosterone Sulphate

- Progesterone

- Luteinizing hormone

- Thyroid Prolactin

- Oestradiol

- Human Chorionic Gonadotropin

- Thyroid-stimulating Hormone

- Others

By End-Users

- Clinics

- Healthcare Centers

- Hospitals

- Commercial Laboratories

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global endocrine peptide test market is expected to grow due to rising endocrine disorders, advancements in diagnostic technologies, and increased awareness of hormonal health.

According to a study, the global endocrine peptide test market size was worth around USD 87.46 Billion in 2024 and is expected to reach USD 187.77 Billion by 2034.

The global endocrine peptide test market is expected to grow at a CAGR of 7.94% during the forecast period.

North America is expected to dominate the endocrine peptide test market over the forecast period.

Leading players in the global endocrine peptide test market include Agilent Technologies, Abbott Laboratories, Biomedical Diagnostics, Bio-Rad Laboratories, Hoffman- La Roche Ltd, ImmunoDX, Laboratory Corporation, Nano Entek, Siemens AG, Thermo Fischer Scientific Inc., and BioMerieux, among others.

The report explores crucial aspects of the endocrine peptide test market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed