Global Electric Bus Charging Station Market Size, Share, Growth Analysis Report - Forecast 2034

Electric Bus Charging Station Market By Charger Type (Plug-in Charging, Pantograph Charging, Inductive Charging), By Charging Infrastructure (Depot Charging, Opportunity Charging), By Charging Power Output (Less than 50 kW, 50–150 kW, Above 150 kW), By Application (Public Transit, Private Fleets, School Buses, Others), By Installation Type (Fixed, Mobile), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034-

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.73 Billion | USD 48.73 Billion | 35.6% | 2024 |

Electric Bus Charging Station Market Size:

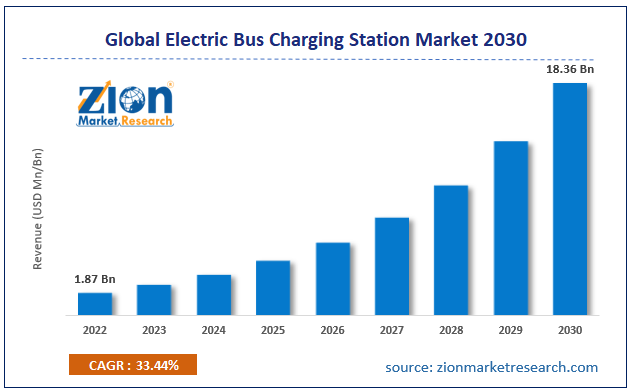

The global electric bus charging station market size was worth around USD 1.73 Billion in 2024 and is predicted to grow to around USD 48.73 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 35.6% between 2025 and 2034. The report analyzes the global electric bus charging station market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the electric bus charging station industry.

Electric Bus Charging Station Market: Overview

An electric bus charging station is a charging point for buses powered by electricity. Traditionally, private or public transport buses run on fuel, especially diesel. However, in recent times, more companies have been working on manufacturing electric buses that are a part of the larger electric vehicle segment. These buses are propelled using electric motors, unlike conventional buses that work with internal combustion engines. The electric versions can either be continuously fed electricity or power from an external source or they may store required electricity onboard whenever needed.

At present time, most electric buses run on batteries as in this variant energy is obtained using an onboard battery pack. An electric bus charging station, on the other hand, is a spot where battery packs for buses can be recharged for further application. These stations generally consist of a metal box with one or more charging chords or guns attached to it. Charging stations for electric buses are different from charging stations for cars and smaller vehicles since the former requires higher load capacity and faster charging. The electric bus charging station industry is expected to grow rapidly during the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global electric bus charging station market is estimated to grow annually at a CAGR of around 35.6% over the forecast period (2025-2034).

- Regarding revenue, the global electric bus charging station market size was valued at around USD 1.73 Billion in 2024 and is projected to reach USD 48.73 Billion by 2034.

- The electric bus charging station market is projected to grow at a significant rate due to Growing adoption of electric buses and need for supportive charging infrastructure fuel market growth.

- Based on Charger Type, the Plug-in Charging segment is expected to lead the global market.

- On the basis of Charging Infrastructure, the Depot Charging segment is growing at a high rate and will continue to dominate the global market.

- Based on the Charging Power Output, the Less than 50 kW segment is projected to swipe the largest market share.

- By Application, the Public Transit segment is expected to dominate the global market.

- In terms of Installation Type, the Fixed segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Electric Bus Charging Station Market: Growth Drivers

Growing focus on sustainable growth to drive market revenue

The global electric bus charging station market is projected to grow owing to the increasing focus on sustainable growth and reducing environmental pollution caused by excessive consumption of non-renewable sources of energy such as oil, gas, petrol, and diesel. As per official data, around 11.65% of the deaths worldwide are caused by air pollution. Earth’s temperature is rising at a worrying rate and the impact can be seen in dramatic climate changes with excessive rainfall, famine, drought, and flood. The automotive industry is one of the leading environmental polluters leading to an increased need and demand for environmentally friendly solutions. Electric vehicles (EVs) have tremendous potential to help in reducing the pressure on non-renewable energy sources. Several countries across the globe are promoting the manufacturing and use of electric buses in private and public sectors. A report published by Sustainable Bus claimed that Europe witnessed the registration of nearly 1767 electric buses in the first half of 2022.

Growing focus on enhancing public transport systems to promote higher adoption

With an increase in traffic congestion that ultimately leads to concerns over the safety of people and the environment alike, regional governments are working toward enhancing public transport infrastructure with an aim to encourage more people to opt for public transport including buses. Apart from being less harsh to the environment, electric buses are superior in performance since they provide a smooth riding experience and are faster than conventional buses. In August 2023, the Indian government announced its approval for a USD 7 billion project through which the country will introduce around 50,000 electric buses across 170 cities. With this move, India aims to reduce air pollution in the country while also creating jobs for its citizens. However, these buses cannot function efficiently without a functional charging station infrastructure. As the manufacturing of electric buses for public transport continues to grow, investments in the electric bus charging station industry are also expected to rise.

Electric Bus Charging Station Market: Restraints

High cost of initial investment to restrict market growth

Charging stations for buses are high-investment projects. The associated expense is multifaceted since it includes several layers. For instance, setting up an electric bus charging station would require extensive land away from residential areas to maintain safety. Additionally, the cost of a typical high-power Lever 2 charger is around USD 2000 to USD 5000. Installation costs can go as high as USD 1,000 to USD 10,000 depending on installation difficulty. Furthermore, since the electricity consumed by buses is higher than by smaller passenger vehicles, the operational cost of an electric bus charging station will always remain high and may be further pushed to higher limits in case of changes in the electricity supply. The current volatility observed in the global economy with rising inflation rates could limit global electric bus charging station market growth.

Electric Bus Charging Station Market: Opportunities

Launch of fast charging ports and continuous innovation to create growth opportunities

Since the investments in the electric bus sector are growing rapidly, manufacturers of charging ports used for powering electric buses have been adapting to the new demand and expectations from the end-consumers. In July 2023, ABC Companies in association with PG&E and Proterra announced the launch of North America’s largest bus or coach charging facility located in California. The charging unit can support around 1.4 megawatts of EV charging power and is equipped with 20 dual-cable EV charging dispensers with space for charging around 40 electric buses. In addition to this, several countries have evolved further and developed innovative charging solutions. In 2021, Volvo Buses launched an alternate method to charge electric buses with the introduction of a roof-mounted pantograph also known as panto up. This move will also allow Volvo buses to reduce on-board weight and will be currently available in Volvo 7900 Electric Articulated and Volvo 7900 Electric in Europe.

In 2015, ABB, a global leader in power and automation technology, introduced a fast charging system that allows buses to run for 24 hours and 7 days. Such technologies help in reaching zero emissions which is better for the environment and the companies operating electric buses. The charging port has a charge time of 46 minutes.

Electric Bus Charging Station Market: Challenges

Lack of supporting infrastructure to create challenges during the forecast period

The electric bus charging station industry players may face challenges owing to the lack of supporting infrastructure. For instance, countries with limited electricity generation capabilities or unfavorable government policies may refrain from investing in resource-intensive projects such as electric bus charging stations. In addition to this, in the case of 100% electric buses, there is an associated risk of buses running out of power before reaching the destination. Other issues such as the charging speed of power stations and lack of standardization are additional constraints faced by electric bus charging station service providers.

Electric Bus Charging Station Market: Segmentation

The global electric bus charging station market is segmented based on Charger Type, Charging Infrastructure, Charging Power Output, Application, Installation Type, and region.

Based on Charger Type, the global electric bus charging station market is divided into Plug-in Charging, Pantograph Charging, Inductive Charging.

On the basis of Charging Infrastructure, the global electric bus charging station market is bifurcated into Depot Charging, Opportunity Charging.

By Charging Power Output, the global electric bus charging station market is split into Less than 50 kW, 50–150 kW, Above 150 kW.

In terms of Application, the global electric bus charging station market is categorized into Public Transit, Private Fleets, School Buses, Others.

By Installation Type, the global Electric Bus Charging Station market is divided into Fixed, Mobile.

Electric Bus Charging Station Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electric Bus Charging Station Market |

| Market Size in 2024 | USD 1.73 Billion |

| Market Forecast in 2034 | USD 48.73 Billion |

| Growth Rate | CAGR of 35.6% |

| Number of Pages | 229 |

| Key Companies Covered | Proterra, ABB. Alstom, Siemens, Volvo Group, Heliox, Eaton, BYD, New Flyer Industries, ChargePoint, Keolis, Schneider Electric, Opbrid, Toshiba, EvoBus, IPT Technology, Yunex Traffic, Nuvve, Heliox, ABB TOSA., and others., and others. |

| Segments Covered | By Charger Type, By Charging Infrastructure, By Charging Power Output, By Application, By Installation Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electric Bus Charging Station Market: Regional Analysis

Asia-Pacific to dominate the market growth during the forecast period

The global electric bus charging station market is expected to witness the highest growth in Asia-Pacific with China, Japan, South Korea, and India leading the regional revenue. As of 2023, China has an extensive line of electric bus charging stations. The overall infrastructure is highly developed. On the other hand, Japan is known for its futuristic approach toward sustainable growth. As per official reports, in 2022, China invested in over 86000 new charging stations and it currently has 1.42 million electric charging units. In February 2023, it was reported that more than 1,38,000 units of electric buses were sold in China in 2022. On the other hand, Japan is aiming to achieve carbon neutrality by 2050. To achieve this goal, the Japanese government extended a subsidy of USD 911 million to build and construct EV charging stations.

Europe is projected to grow at a rapid rate driven by the increasing investments toward the construction of advanced and highly efficient electric bus charging stations. The European Commission has laid out several initiatives to reduce carbon emissions and dependence on fossil fuels, especially in the automotive industry. Europe’s market may benefit from an already well-established public transport system.

Electric Bus Charging Station Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the electric bus charging station market on a global and regional basis.

The global electric bus charging station market is dominated by players like:

- Proterra

- ABB. Alstom

- Siemens

- Volvo Group

- Heliox

- Eaton

- BYD

- New Flyer Industries

- ChargePoint

- Keolis

- Schneider Electric

- Opbrid

- Toshiba

- EvoBus

- IPT Technology

- Yunex Traffic

- Nuvve

- Heliox

- ABB TOSA.

- and others.

The global electric bus charging station market is segmented as follows;

By Charger Type

- Plug-in Charging

- Pantograph Charging

- Inductive Charging

By Charging Infrastructure

- Depot Charging

- Opportunity Charging

By Charging Power Output

- Less than 50 kW

- 50–150 kW

- Above 150 kW

By Application

- Public Transit

- Private Fleets

- School Buses

- Others

By Installation Type

- Fixed

- Mobile

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

An electric bus charging station is a dedicated facility that supplies electric power to recharge the batteries of electric buses. These stations can use various charging methods—such as plug-in, pantograph, or wireless charging—and are crucial for supporting the operation of zero-emission public transportation systems.

The global electric bus charging station market is expected to grow due to Growing adoption of electric buses and need for supportive charging infrastructure fuel market growth.

According to a study, the global electric bus charging station market size was worth around USD 1.73 Billion in 2024 and is expected to reach USD 48.73 Billion by 2034.

The global electric bus charging station market is expected to grow at a CAGR of 35.6% during the forecast period.

Asia-Pacific is expected to dominate the electric bus charging station market over the forecast period.

Leading players in the global electric bus charging station market include Proterra, ABB. Alstom, Siemens, Volvo Group, Heliox, Eaton, BYD, New Flyer Industries, ChargePoint, Keolis, Schneider Electric, Opbrid, Toshiba, EvoBus, IPT Technology, Yunex Traffic, Nuvve, Heliox, ABB TOSA., and others., among others.

The report explores crucial aspects of the electric bus charging station market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed