Global Edible Oils and Fats Market Size, Share, Growth Analysis Report - Forecast 2034

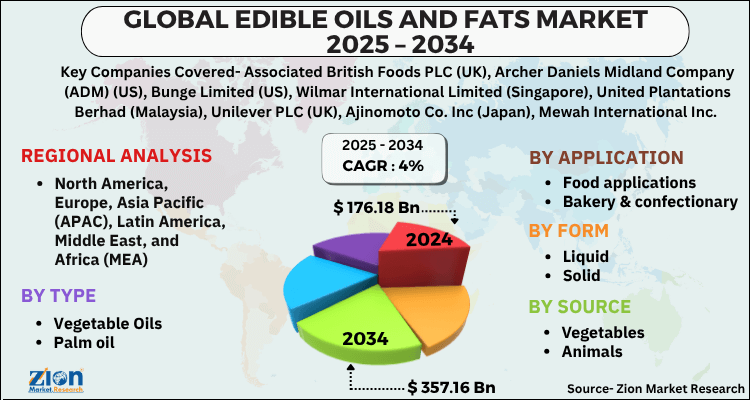

Edible Oils and Fats Market By Type (Vegetable Oils, Palm oil, Soybean oil, Sunflower oil, Rapeseed oil, Olive oil, Other oils, Fats, Butter & margarine, Lard, Tallow & grease and Other fats)), By Application (Food applications, Bakery & confectionary, Bakery, Confectionery, Processed food, Snacks & savory, R.T.E foods/Convenience foods, Sauces, spreads, and dressings, Other foods (incl. meat products), Industrial applications, Biodiesel, Other industrial appli), Form (Liquid and Solid), Source (Vegetable and Animals), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

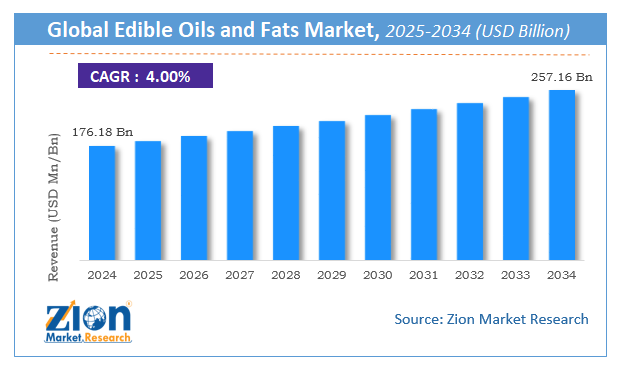

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 176.18 Billion | USD 257.16 Billion | 4% | 2024 |

Edible Oils and Fats Market: Industry Perspective

The global edible oils and fats market size was worth around USD 176.18 Billion in 2024 and is predicted to grow to around USD 257.16 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4% between 2025 and 2034. The report analyzes the global edible oils and fats market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the edible oils and fats industry.

Global Edible Oils and Fats Market: Overview

In the Global Edible Oils and Fats Market Report, The growing importance of vegetable oils as key functional ingredients that reduce the risk of cardiovascular disorders as well as the possibility of breast cancer is expected to continue to be a positive growth driver. Furthermore, because of its exceptional anti-inflammatory properties, the omega-3 fatty acid is expected to gain popularity as a nutritional constituent in the food industry, prompting the adoption of oil produced from soybean, canola, and flax seeds. Over the last few years, cooking oil manufacturers have increased their investment in the development of low-cholesterol products. Furthermore, changing dietary patterns and a hectic lifestyle among working-class professionals are expected to shift consumer preferences and drive demand for sunflower and coconut oil for cooking. Coconut oil is high in fatty acids, which help to protect against bacteria and other pathogens. Olive oil, on the other hand, is capable of balancing the HDL to LDL cholesterol ratio, ensuring proper blood circulation.

Concerns about the negative effects of trans-fat consumption, such as an increased risk of coronary heart disease, type 2 diabetes, and brain stroke, are expected to promote the use of vegetable oil as a cooking alternative. Furthermore, because of the exceptional aroma of peanut or groundnut oil, edible oils are used as a flavouring agent. The growing number of hotels and restaurant chains from developing countries is expected to increase the utility of edible oils as a result of supportive government policies aimed at improving city infrastructure.

Edible oils and fats are used in cooking activities such as frying and baking. Both oils and fats have a similar composition, but fats are partly solid and oils are liquid at room temperature. Edible fats and oils contain esters derived from carboxylic acids and propane-1, 2, 3-triol, known as triglycerides. The traditional method of oil extraction includes various preliminary operations such as dehulling, cracking, and shelling after that paste is formed by grinding crop. Edible fats and oils are refined in order to remove toxic substances and impurities. Refining process of oils involves deodorization, bleaching, and cooling.

There are various uses of edible oils and fats in food preparation, including cooking oils, manufacturing of margarine, processed food products such as potato chips, mayonnaise, french fries, canned fish, and sandwich, which is a major factor driving the edible oils and fats market growth. Growing population, rapid urbanization, increasing choices of consumers towards processed and fried food, rising number of the food chain, restaurants, and hotels are the key factors projected to fuel the growth of the market for edible oils and fats within the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global edible oils and fats market is estimated to grow annually at a CAGR of around 4% over the forecast period (2025-2034).

- Regarding revenue, the global edible oils and fats market size was valued at around USD 176.18 Billion in 2024 and is projected to reach USD 257.16 Billion by 2034.

- The edible oils and fats market is projected to grow at a significant rate due to increasing population growth, rising disposable incomes, changing dietary habits, and the expanding food processing industry, alongside the growing demand for biofuels and industrial applications.

- Based on Type, the Vegetable Oils segment is expected to lead the global market.

- On the basis of Application, the Food applications segment is growing at a high rate and will continue to dominate the global market.

- Based on the Form, the Liquid segment is projected to swipe the largest market share.

- By Source, the Vegetable segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Edible Oils and Fats Market: Growth Drivers

Driver: Increased food demand helps boost global consumption of vegetable oils.

To produce uniformity in high-quality oil, edible oil products such as palm oil, sunflower oil, soybean oil, and canola oil, among others, are generally purified using various methods such as degumming, neutralizing, bleaching, and deodorizing. Minor components, which are considered impurities, are physically or chemically separated during the purification process. Refined oils are the most common term for high-quality edible oils. Monounsaturated fats are abundant in refined oils. High-quality oils are produced using cutting-edge technology and are regarded as a rich source of nutrition. As a result, their consumption is increasing year after year due to increased application and a growing population.

Restraint: Fat and oil product labeling, and safety concerns

Significant changes in the competitive position of major vegetable oils imply significant cost impacts and potential threats to some food products. The global vegetable oil market is under pressure as a result of various legislations in this environment. Furthermore, due to the use of ambiguous terms such as vegetable fats or vegetable oils, there is a high degree of anonymity in the exact content of the food ingredients. As a result, the exact composition of the ingredient, as well as its role in the overall formulation, are unknown. New regulations requiring the labelling of trans-fatty acid levels in foods are putting pressure on manufacturers to switch to different formulations for producing hydrogenated oils, increasing demand for oils as an alternative to trans-fats.

Opportunity: Emerging use of fats and oils as trans-fat substitutes

Trans-fats are unsaturated fatty acids that are formed during the hydrogenation of vegetable oils or that are naturally produced in the guts of grazing animals. Trans fat consumption raises the level of low-density lipoprotein cholesterol in the blood. A high LDL cholesterol level in the blood can increase the risk of developing cardiovascular disease. Trans-fats are gradually being replaced by a much healthier substitute, namely unsaturated liquid vegetable oils such as olive, canola, corn, or soy oils, as consumer health consciousness grows.

Challenge: High reliance on imports, resulting in high end-product costs

Due to the scarcity of oilseeds in some domestic markets, there is a significant gap between demand and supply of oilseed processed products such as edible oil. Because of these countries' favorable climatic conditions, India and European countries import a large amount of palm oil from Indonesia and Malaysia, which are the leading producers. Because these countries rely heavily on imports of palm oil and shea butter, respectively, their import costs and end-product prices rise, posing a challenge to the market.

Global Edible Oils and Fats Market: Segmentation

The global edible oils and fats market is segmented based on Type, Application, Form, Source, and region.

By type, the market is classified into Vegetable Oils, Palm oil, Soybean oil, Sunflower oil, Rapeseed oil, Olive oil, Other oils, Fats, Butter & margarine, Lard, Tallow & grease, and Other fats. This category had a significant share in 2021 and is expected to maintain its dominance throughout the forecast period. The Palm oil segment is expected to grow the fastest in the global market in 2021. Some of the factors that have driven the market for fats and oils include health benefits, ease of availability, and cost-effectiveness. Palm oil has dominated the vegetable oil market because it is widely available and relatively more stable than other oils.

On the basis of Application, the global edible oils and fats market is bifurcated into Food applications, Bakery & confectionary, Bakery, Confectionery, Processed food, Snacks & savory, R.T.E foods/Convenience foods, Sauces, spreads, and dressings, Other foods (incl. meat products), Industrial applications, Biodiesel, Other industrial appli.

By source, the market is divided into vegetables and animals. Vegetable oils derived from sunflower, rapeseed, soybean, palm, cottonseed, and coconut are widely used in food applications, fueling the market for vegetable-sourced oils. Low-fat, low-cholesterol, and low-calorie content are attributes associated with vegetable oils that are gaining traction in the market. The market for vegetable oils has also been driven by the variety of uses of vegetable oils in food as well as other industries such as oleo-chemical industries, animal feed, and the energy & biomass industries.

By Form, the global edible oils and fats market is split into Liquid and Solid.

Edible Oils and Fats Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Edible Oils and Fats Market |

| Market Size in 2024 | USD 176.18 Billion |

| Market Forecast in 2034 | USD 257.16 Billion |

| Growth Rate | CAGR of 4% |

| Number of Pages | 194 |

| Key Companies Covered | Associated British Foods PLC (UK), Archer Daniels Midland Company (ADM) (US), Bunge Limited (US), Wilmar International Limited (Singapore), United Plantations Berhad (Malaysia), Unilever PLC (UK), Ajinomoto Co. Inc (Japan), Mewah International Inc. (Singapore)., and others. |

| Segments Covered | By Type, By Application, By Form, By Source, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Landscape

North America is expected to have a significant rise in the market over the forecast period. This is due to the presence of various oil and fat producers in the region. Furthermore, the introduction of healthy edible oils by manufacturers in order to capitalize on the growing health-consciousness trend is expected to boost regional revenue in the edible oils and fats market.

In 2021, Asia Pacific led the market, accounting for more of the global share. As a result of population growth, rising disposable income, and urbanization in emerging economies such as China, India, and Bangladesh, the segment is expected to grow at an impressive CAGR. Furthermore, the rising popularity of low-calorie oil among the middle-income age groups in the aforementioned economies is expected to have a positive impact on the market.

Recent Developments

- In May 2021, ADM planned to construct the world's first specialized soybean crusher and refinery in the United States to address rising demand from food, feed, industrial, and biofuel customers, including renewable diesel makers.

- In December 2018, Richardson International has bought Conagra Food Inc.'s Wesson Oil brand, which is a well-known edible oil brand in the United States. Vegetable oils, canola oils, corn oils, and mixed oils are among the products available, which might help Richardson gain a solid presence in the North American market.

Global Edible Oils and Fats market Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the edible oils and fats market on a global and regional basis.

The global edible oils and fats market is dominated by players like:

- Associated British Foods PLC (UK)

- Archer Daniels Midland Company (ADM) (US)

- Bunge Limited (US)

- Wilmar International Limited (Singapore)

- United Plantations Berhad (Malaysia)

- Unilever PLC (UK)

- Ajinomoto Co., Inc. (Japan)

- Mewah International Inc. (Singapore).

The market is segmented as follows:

By type

- Vegetable Oils

- Palm oil

- Soybean oil

- Sunflower oil

- Rapeseed oil

- Olive oil

- Other oils

- Fats

- Butter & margarine

- Lard

- Tallow & grease

- Other fats

By application

- Food applications

- Bakery & confectionary

- Bakery

- Confectionery

- Processed food

- Snacks & savory

- R.T.E foods/Convenience foods

- Sauces, spreads, and dressings

- Other foods (incl. meat products)

- Industrial applications

- Biodiesel

- Other industrial applications

- Oleochemicals

- Animal feed

By form

- Liquid

- Solid

By source

- Vegetables

- Animals

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

In the Global Edible Oils and Fats Market Report, The growing importance of vegetable oils as key functional ingredients that reduce the risk of cardiovascular disorders as well as the possibility of breast cancer is expected to continue to be a positive growth driver.

The global edible oils and fats market is expected to grow due to growing awareness of nutritional benefits, increasing demand for healthier cooking oils, rising consumption of processed and convenience foods, and expanding applications in the food, bakery, and confectionery industries.

According to a study, the global edible oils and fats market size was worth around USD 176.18 Billion in 2024 and is expected to reach USD 257.16 Billion by 2034.

The global edible oils and fats market is expected to grow at a CAGR of 4% during the forecast period.

Asia-Pacific is expected to dominate the edible oils and fats market over the forecast period.

Leading players in the global edible oils and fats market include Associated British Foods PLC (UK), Archer Daniels Midland Company (ADM) (US), Bunge Limited (US), Wilmar International Limited (Singapore), United Plantations Berhad (Malaysia), Unilever PLC (UK), Ajinomoto Co. Inc (Japan), Mewah International Inc. (Singapore)., among others.

The report explores crucial aspects of the edible oils and fats market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed