E-Mobility Insulation Battery Market Size, Share, Trends, Growth & Forecast 2034

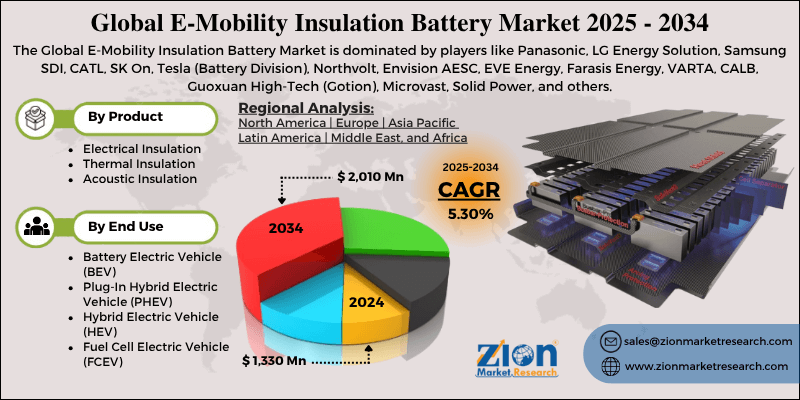

E-Mobility Insulation Battery Market By Product (Electrical Insulation, Thermal Insulation, Acoustic Insulation), By End Use (Battery Electric Vehicle [BEV], Plug-In Hybrid Electric Vehicle [PHEV], Hybrid Electric Vehicle [HEV], Fuel Cell Electric Vehicle [FCEV]), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

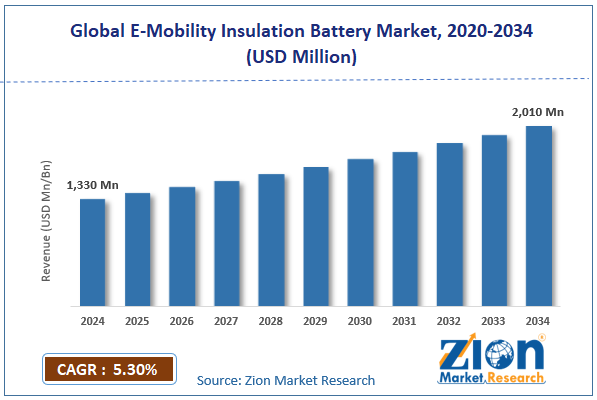

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,330 Million | USD 2,010 Million | 5.30% | 2024 |

E-Mobility Insulation Battery Industry Perspective:

The global e-mobility insulation battery market size was worth around USD 1,330 million in 2024 and is predicted to grow to around USD 2,010 million by 2034, with a compound annual growth rate (CAGR) of roughly 5.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global e-mobility insulation battery market is estimated to grow annually at a CAGR of around 5.30% over the forecast period (2025-2034)

- In terms of revenue, the global e-mobility insulation battery market size was valued at around USD 1,330 million in 2024 and is projected to reach USD 2,010 million by 2034.

- The e-mobility insulation battery market is projected to grow significantly due to the rising demand for high-energy-density battery systems, safety regulations for thermal insulation in EV batteries, and the growth in fast-charging infrastructure deployment.

- Based on product, the electrical insulation segment is expected to lead the market, while the thermal insulation segment is expected to grow considerably.

- Based on end use, the Battery Electric Vehicle (BEV) segment is expected to lead the market compared to the Plug-In Hybrid Electric Vehicle (PHEV) segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

E-Mobility Insulation Battery Market: Overview

E-mobility insulation batteries are dedicated energy storage systems used in hybrid platforms and electric vehicles, designed with improved insulation materials to provide thermal stability, long lifecycle performance, and electrical safety. These batteries integrate coatings, insulation films, and separators that prevent short circuits, protect cells from mechanical stress, and manage heat more efficiently. The global e-mobility insulation battery market is poised for notable growth owing to accelerating EV sales worldwide, stringent thermal runway & fire-safety regulations, and thermal management pressure for fast charging. Growing penetration of electric vehicles, buses, cars, and LCVs is augmenting the installed battery base and insulation demand per kWh deployed. Worldwide EV sales surpassed ~14 million vehicles in 2023 and are anticipated to exceed 30 million by 2030.

As volumes scale up, OEMs lock in insulation suppliers with long-term sourcing contracts. Post-incident regulations from UNECE R100, Chinese GB standards, and FMVSS mandate multi-layer insulation protection. Penetration, new crash, and flame propagation tests elevate quality specifications and insulation thickness. Regulatory tightening creates non-negotiable demand for certified insulation materials. Ultrafast charging cycles increase core temperature, amplifying insulation fatigue and shrinkage. OEMs use high-thermal resistance films, coated separators, and aerogels to mitigate degradation. This connection between insulation reliability and charging speed drives premium material deployments.

Nevertheless, the global market faces limitations due to factors such as high material costs of advanced insulators and qualification and certification barriers. Premium ceramic, aerogel coatings, and PI coatings carry a 3-8x cost uplift compared to papers or legacy foams. OEM cost-down pressure conflicts with the speed of safety-driven adoption. Price sensitivity delays premium insulation penetration in low-cost EV segments. Moreover, new insulation materials need 12-24 months of validation in lifecycle, compliance, and abuse tests. Slow approval cycles delay commercial deployment and volume ramp-up. This prolongs ROI for insulation innovators.

Still, the global e-mobility insulation battery industry benefits from several favorable factors, such as the scale-out of ceramic-coated separators and aerogel-based ultra-thin insulation pads. As ceramic separators become the de facto standard in high-voltage EVs, suppliers can gain multi-gigafactory recurring volumes. High micro-porosity improvements and adhesion unveil premium pricing tiers. Worldwide separator supply lines are actively regionalized.

Additionally, aerogel boards offer extreme thermal blocking with minimal thickness, crucial for fast-charge packs. Adoption of premium electric vehicle segments creates margin-rich early wins. Scaling will migrate aerogels downstream to mid-segment EVs.

E-Mobility Insulation Battery Market Dynamics

Growth Drivers

How is the e-mobility insulation battery market driven by safety mandates for preventing thermal runaway and fire propagation?

Thermal runaway is a significant cause of EV battery failures, accounting for 37% of worldwide recalls in 2023-24, prompting OEMs to enhance insulation between cells. In 2024, Hyundai recalled ~27,000 EVs to improve battery safety with added thermal obstacles. Regulatory updates, such as NHTSA's 2025 draft on insurance penalties and heat dispersion for inadequate insulation, are fueling the demand for high-performing battery insulation, thereby impacting the growth of the e-mobility insulation battery market.

How is the growth of solid-state and LFP cell adoption boosting new insulation formats, fueling the e-mobility insulation battery market?

Solid-state EV batteries began pilot commercialization in 2024, needing novel insulation designs for anode interfaces and thin separators. LFP now represents >48% of EV batteries shipped in H1-2024, triggering insulation reformulation for flatter pack layouts. CATL’s introduction of the Shenxing Ultra-fast LFP pack in August 2024 increased contracts for aerogel-based insulation. Material suppliers are adopting ceramic coatings, mica composites, and nano-porous obstacles to meet changing chemistries.

Restraints

Supply chain disruptions and raw material shortages unfavorably impact the market progress

The global market depends mainly on specialty insulation films and mica sheets, with Germany and China as the leading producers. In 2024, a temporary mica mine showdown in China resulted in delays impacting ~20% of European EV pack production. Logistics barriers in freight cost inflation and Southeast Asia worsen delivery uncertainties. OEMs report multi-month lead times for high-dielectric polymers needed in 800V packs. The lack of pressure results in localized alternative sourcing, but quality consistency remains a concern, limiting the speedy global deployment of insulation solutions.

Opportunities

How does the increasing focus on battery safety and consumer trust create promising avenues for the growth of the e-mobility insulation battery industry?

Regulators and consumers are focusing on EV safety following high-profile fatal accidents in 2024. OEMs like BYD, Tesla, and Hyundai are now marketing strengthened insulation as a safety feature. This trend allows insulation suppliers to rank products as differentiators for fire prevention and thermal management. Extended battery warranties of 8-10 years create extra incentives to adopt cutting-edge insulation solutions. Improved consumer trust campaigns provide insulation manufacturers with opportunities to co-brand and certify products for first-class safety ratings, thereby impacting the growth of the e-mobility insulation battery industry.

Challenges

Competition from alternative thermal management solutions limits the market growth

Innovations in liquid cooling, integrated heat spreaders, and phase-change materials can partially replace traditional insulation. Stellantis and Hyundai pilots in 2024 showed a 20-25% decrease in insulation thickness using PCM. This substitution decreases standalone insulation demand per vehicle. Insulation vendors should innovate or bundle solutions with cooling tech to stay relevant. Failure may result in loss of industry share and margin compression.

E-Mobility Insulation Battery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | E-Mobility Insulation Battery Market |

| Market Size in 2024 | USD 1,330 Million |

| Market Forecast in 2034 | USD 2,010 Million |

| Growth Rate | CAGR of 5.30% |

| Number of Pages | 214 |

| Key Companies Covered | Panasonic, LG Energy Solution, Samsung SDI, CATL, SK On, Tesla (Battery Division), Northvolt, Envision AESC, EVE Energy, Farasis Energy, VARTA, CALB, Guoxuan High-Tech (Gotion), Microvast, Solid Power, and others. |

| Segments Covered | By Product, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

E-Mobility Insulation Battery Market: Segmentation

The global e-mobility insulation battery market is segmented based on product, end use, and region.

Based on product, the global e-mobility insulation battery industry is divided into electrical insulation, thermal insulation, and acoustic insulation. The electrical insulation segment leads the global market since it is needed in every EV battery to prevent leakage, dielectric failure, and avoid arcing. This move to 800-1000V frameworks raises voltage stress, fueling the need for high-grade and thicker insulation. Being safety-critical and mandatory, electrical insulation registers for the most stable and largest revenue share in EV domains and regions.

Conversely, the thermal insulation segment holds a second-leading share, helping to slow or contain thermal runaway in high-density and fast-charging packs. Materials like ceramic boards, silicone foams, and aerogels are progressively adopted in response to evolving UNECE/GB and recall regulations. While less broad than electrical insulation, the per-pack value of this material is increasing as OEMs prioritize heat safety.

Based on end use, the global e-mobility insulation battery market is segmented into Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV), and Fuel Cell Electric Vehicle (FCEV). The Battery Electric Vehicle (BEV) segment holds a leading industry share since it depends entirely on high-voltage battery packs, making insulation vital for performance, safety, and regulatory compliance. With more than 14 million BEVs sold in 2023, the demand for thermal and electrical insulation is growing. High-voltage frameworks, dense cell layouts, and fast charging drive OEMs towards multi-layer and premium insulation, increasing the segmental prominence.

Nonetheless, the Plug-In Hybrid Electric Vehicle (PHEV) segment holds a second rank, assimilating smaller high-voltage batteries with combustion engines. Though battery capacity is lower, regulatory and safety standards still need quality insulation. As OEMs extend fast-charging capabilities and electric range, insulation adoption in PHEVs is rising, contributing a substantial yet smaller share to the global market compared to BEVs.

E-Mobility Insulation Battery Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global E-Mobility Insulation Battery Market?

Asia Pacific is projected to maintain its dominant position in the global e-mobility insulation battery market due to the rapid adoption of EVs in China, robust battery manufacturing infrastructure, and government incentives and favorable policies. China leads the EV industry, with more than 7.1 million EVs sold in 2023, accounting for over 50% of worldwide EV sales. The scale of EV production fuels huge demand for battery insulation materials, comprising thermal and electrical layers. Battery manufacturers and OEMs heavily invest in local supply chains for insulation to meet export and domestic demand.

Moreover, APAC houses prominent pack and cell manufacturers like LG Energy Solution, BYD, CATL, and Samsung SDI, together producing more than 60% of the worldwide EV battery capacity. High-capacity gigafactories need advanced insulation solutions to meet thermal, safety, and regulatory standards. The dense industrial cluster enables insulation suppliers to scale quickly with the least logistical barriers. Economies like South Korea, Japan, and China offer tax benefits, subsidies, and EV mandates, motivating battery adoption and production. Policy support decreases total production cost and augments EV penetration, fueling insulation demand. Regulatory architectures also mandate electrical and thermal safety standards, forcing high-class insulation for all new EV models.

Europe maintains its position as the second-leading region in the global e-mobility insulation battery industry due to strong EV adoption, rising presence of battery manufacturers and OEMs, and emphasis on safety and crash compliance. Europe has set ambitious EV adoption targets under the EU Green Deal, seeking 50% of new car sales to be electric by 2030. These mandates fuel the demand for high-class battery insulation to meet thermal, safety, and crash standards. Regulatory enforcement assures all European EVs use certified thermal and electrical insulation systems.

Europe houses the leading EV OEMs like Stellantis, BMW, and Volkswagen, along with battery players like Mercedes-Benz Energy and Northvolt. Combined, European manufacturers are increasing production to hit more than 200 GWh of battery capacity by 2030. This scale creates a steady demand for insulation materials in modules, cells, and packs. European NCAP safety ratings and UNECE standards drive automakers to adopt advanced insulation layers for dielectric and thermal protection. Thermal runaway and fire safety prevention are mandatory, with increasing adoption of thermal and electrical insulation per pack. This regulatory pressure fuels the penetration of premium insulation materials.

E-Mobility Insulation Battery Market: Competitive Analysis

The leading players in the global e-mobility insulation battery market are:

- Panasonic

- LG Energy Solution

- Samsung SDI

- CATL

- SK On

- Tesla (Battery Division)

- Northvolt

- Envision AESC

- EVE Energy

- Farasis Energy

- VARTA

- CALB

- Guoxuan High-Tech (Gotion)

- Microvast

- Solid Power

E-Mobility Insulation Battery Market: Key Market Trends

Adoption of high-voltage 800V+ architectures:

OEMs are actively moving to 800V and above battery systems to support ultrafast and higher energy density. This trend fuels the need for elevated electrical insulation, comprising ceramic-coated separators and high-dielectric films. Insulation materials should now tolerate high voltage stress, driving the demand for premium solutions.

Localized manufacturing and regional supply chains:

Suppliers are setting up production facilities close to the leading EV manufacturers' centers in Europe, North America, and the Asia Pacific. Localized supply assures faster delivery, compliance with regional regulations like U.S. IRA and EU CBAM, and lower logistics costs. This trend is fastening regional industry leadership and motivating innovation.

The global e-mobility insulation battery market is segmented as follows:

By Product

- Electrical Insulation

- Thermal Insulation

- Acoustic Insulation

By End Use

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

E-mobility insulation batteries are dedicated energy storage systems used in hybrid platforms and electric vehicles, designed with improved insulation materials to provide thermal stability, long lifecycle performance, and electrical safety. These batteries integrate coatings, insulation films, and separators that prevent short circuits, protect cells from mechanical stress, and manage heat more efficiently.

The global e-mobility insulation battery market is projected to grow due to the speedy adoption of electric vehicles (EVs), the expansion of commercial electric fleets (buses, trucks, logistics), and increasing investments in battery gigafactories.

According to study, the global e-mobility insulation battery market size was worth around USD 1,330 million in 2024 and is predicted to grow to around USD 2,010 million by 2034.

The CAGR value of the e-mobility insulation battery market is expected to be around 5.30% during 2025-2034.

What are the various stages in the value chain of the global e-mobility insulation battery industry?

The value chain of the global E-Mobility Insulation Battery industry includes raw material suppliers, insulation material manufacturers, cell & module manufacturers, battery pack integrators, EV OEMs, distributors/dealers, and end users.

Asia Pacific is expected to lead the global e-mobility insulation battery market during the forecast period.

China is the major contributor to the global E-Mobility Insulation Battery Market, driven by the extensive battery manufacturing capacity, the world's largest EV production, and strong government incentives for electric mobility.

The key players profiled in the global e-mobility insulation battery market include Panasonic, LG Energy Solution, Samsung SDI, CATL, SK On, Tesla (Battery Division), Northvolt, Envision AESC, EVE Energy, Farasis Energy, VARTA, CALB, Guoxuan High-Tech (Gotion), Microvast, and Solid Power.

The competitive landscape of the E-Mobility Insulation Battery market is fragmented, with specialized material manufacturers, global tier-1 insulation suppliers, and regional players competing across battery pack integrators and OEMs.

The report examines key aspects of the e-mobility insulation battery market, providing a detailed analysis of current growth factors and restraints, along with future opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed