Global Dimethyl Disulfide Market Size, Share, Growth Analysis Report - Forecast 2034

Dimethyl Disulfide Market By Purity (High Purity DMDS (>99%), Technical Grade DMDS), By End-Use Industry (Oil & Gas, Agriculture, Chemical Manufacturing, Food Processing, Pharmaceuticals, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 275.1 Million | USD 520.46 Million | 6.1% | 2024 |

Dimethyl Disulfide Industry Perspective:

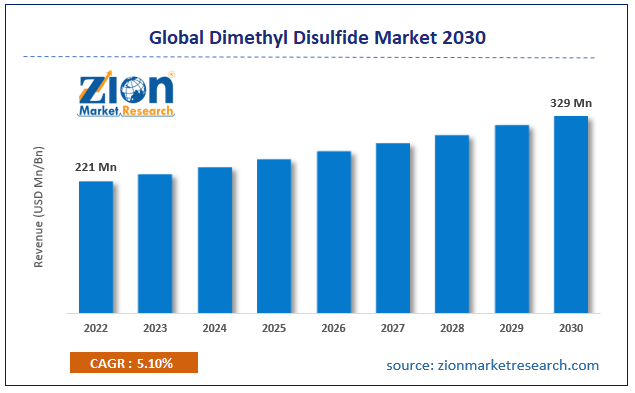

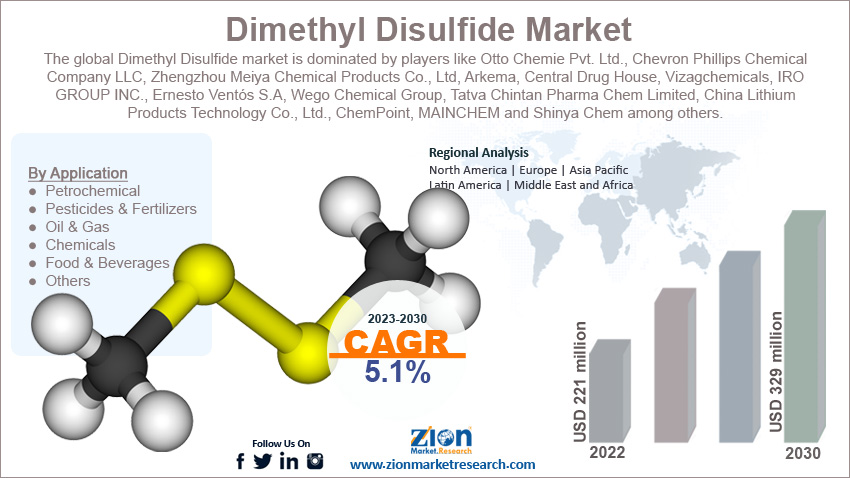

The global dimethyl disulfide market size was worth around USD 275.1 Million in 2024 and is predicted to grow to around USD 520.46 Million by 2034 with a compound annual growth rate (CAGR) of roughly 6.1% between 2025 and 2034. The report analyzes the global dimethyl disulfide market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the dimethyl disulfide industry.

Dimethyl Disulfide Market: Overview

The chemical compound dimethyl disulfide (DMDS) has the molecular formula CH3SSCH3. It's a combustible liquid with a bad smell that resembles garlic. Even though impure samples frequently seem yellowish, the chemical is colorless. Dimethyl disulfide (DMDS) doesn't emit any hazardous substances and is safe for the environment. Dimethyl disulfide, or DMDS, is a chemical molecule that is flexible and can be employed in a wide range of applications.

Key Insights

- As per the analysis shared by our research analyst, the global dimethyl disulfide market is estimated to grow annually at a CAGR of around 6.1% over the forecast period (2025-2034).

- Regarding revenue, the global dimethyl disulfide market size was valued at around USD 275.1 Million in 2024 and is projected to reach USD 520.46 Million by 2034.

- The dimethyl disulfide market is projected to grow at a significant rate due to increasing demand for cleaner fuels in oil refining, rising adoption in agriculture as a soil fumigant, and growing use in chemical synthesis across pharmaceuticals and agrochemicals.

- Based on Purity, the High Purity DMDS (>99%) segment is expected to lead the global market.

- On the basis of End-Use Industry, the Oil & Gas segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Dimethyl Disulfide Market: Growth Drivers

The growing agriculture sector drives market growth

The market for DMDS is mostly driven by the agriculture industry. Nematodes, fungi, and other soil-borne diseases can be controlled by the use of DMDS, a soil fumigant and pest control agent. The need for DMDS in agriculture is driven by the growing need to safeguard and increase crop yields due to the growing worldwide population. For instance, the Food and Agriculture Organization (FAO) has estimated that to feed the 9.3 billion people on the planet by 2050, 60 percent more food would need to be produced globally. Thus, the aforementioned stats are expected to propel the market growth over the forecast period.

Dimethyl Disulfide Market: Restraints

Concerns related to health and the environment might be hampering the market growth

Inhaling or absorbing DMDS via the skin might be hazardous due to its strong and unpleasant odor. More severe safety laws and actions resulting from worker safety concerns while handling DMDS in various applications may impact the use of DMDS in certain sectors. They may also harm the environment, especially if used as a fumigant in soil. Regulations may be imposed and the expansion of the dimethyl disulfide industry may be hampered by concerns about its effects on the environment, including contaminated soil & water and possible harm to non-target species.

Dimethyl Disulfide Market: Opportunities

Increasing investment in renewable energy offers a lucrative opportunity for market growth

The growing investment in renewable energy is expected to offer a lucrative opportunity for dimethyl disulfide market growth during the forecast period. Dimethyl disulfide plays a crucial role in converting vegetable oils and agri-food waste into renewable fuels. For instance, in September 2023, at its Beaumont facility in the United States, Arkema, a prominent manufacturer of dimethyl disulfide (DMDS), is expanding its capacity for producing this essential additive globally. Vegetable oils and agri-food waste are converted into renewable fuels by DMDS, which is an essential component of the rapidly expanding biofuel sector driven by sustainability and decarbonization needs in air and road transportation. In addition to strengthening Arkema's position in sulfur derivatives and enhancing its capacity to service clients locally throughout Europe, Asia, and North America, this $137 million investment is in line with the company's commitment to assisting the shift to renewable energy. The project will help create jobs in the Beaumont area and is scheduled to start operations in the second quarter of 2025.

Dimethyl Disulfide Market: Challenges

The availability of substitutes poses a major challenge to market growth

The DMDS industry is challenged by the availability of substitute chemicals and techniques for soil treatment and pest management. Industries and consumers together may choose substitutes that are thought to be more ecologically friendly or safer. Thus, acting as a major challenge for the market expansion.

Dimethyl Disulfide Market: Segmentation

The global dimethyl disulfide industry is segmented based on the type, application, distribution channel, end-user, and region.

Based on the type, the global market is bifurcated into food grade and industrial grade. The industrial-grade segment is expected to hold the largest market share over the forecast period. The requirement for efficient and secure chemical solutions in a variety of industrial processes shapes the market for industrial-grade DMDS. In many applications, safety and regulatory compliance are critical, particularly in the oil and gas industry. The need for industrial-grade DMDS could evolve and increase in tandem with industry changes and increasing concerns over safety and the environment. Thereby, driving the segment expansion.

Based on the application, the global dimethyl disulfide industry is bifurcated into petrochemicals, pesticides & fertilizers, oil & gas, chemicals, food & beverages, and others. The petrochemical segment is expected to dominate the market over the forecast period. Petrochemicals, which are used to make gasoline, diesel, jet fuel, and other goods, use it as a raw ingredient. The past few years have seen an increase in the consumption rate of dimethyl disulfide (DMDS) due to the growing population and rising disposable income levels driving up demand for petrochemicals. Besides, the pesticides & fertilizers segment is expected to grow significantly during the forecast period. There is a growing need for chemical pesticide substitutes as the agriculture sector looks to implement more ecologically friendly and sustainable methods. Considering that DMDS has a lesser environmental impact and is more effective than certain older chemical pesticides, it is considered a feasible choice.

Based on the distribution channel, the global dimethyl disulfide market is bifurcated into online and offline.

Based on the end user, the global dimethyl disulfide industry is bifurcated into residential, commercial, and industrial.

Dimethyl Disulfide Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dimethyl Disulfide Market |

| Market Size in 2024 | USD 275.1 Million |

| Market Forecast in 2034 | USD 520.46 Million |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 226 |

| Key Companies Covered | Sigma-Aldrich (Merck KGaA), Alkyl Amines Chemicals Ltd., Sumitomo Seika Chemicals Co., Ltd., Hebei Yanuo Chemical Industry Co., Ltd., Arkema Shanghai Distribution Co., Ltd., Shandong Zhicheng Chemical Co., Ltd., Chemos GmbH & Co. KG, Chevron Oronite Company LLC, Parchem Fine & Specialty Chemicals, Hubei Xingfa Chemicals Group Co., Ltd., and others. |

| Segments Covered | By Purity, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dimethyl Disulfide Market: Regional Analysis

Asia Pacific is expected to dominate the market over the forecast period

The Asia Pacific is expected to dominate the dimethyl disulfide market during the forecast period. The market growth in the region is owing to the increasing growth in the agriculture industry. A sizable fraction of the world's population resides in the Asia Pacific area, where food consumption is rising. Agriculture is always growing to fulfill this need, which raises the need for soil fumigants like DMDS. According to the UNFPA, the most populous nations in the world, China and India, are located in the Asia and Pacific area, which is home to 60% of the world's population, or 4.3 billion people. Additionally, a movement toward more environmentally friendly and sustainable farming methods is being driven by growing environmental consciousness. This may influence the use of DMDS and spur the development of substitute pest management strategies.

Besides, North America is expected to grow at a substantial rate over the forecast period. The market growth is driven by the utilization of DMDS in the chemical sector. In the chemical industry, DMDS is used as an intermediate in the synthesis of a variety of chemicals, such as insecticides, drugs, and organic compounds. The demand for DMDS is fueled largely by North America's well-established chemical manufacturing industry. According to secondary sources, as of 2023, there were 4,006 Chemical Product Manufacturing companies in the US, up 3.6% from the previous year. Therefore, the aforementioned stats are expected to propel the market growth in the region during the forecast period.

Dimethyl Disulfide Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the dimethyl disulfide market on a global and regional basis.

The global dimethyl disulfide market is dominated by players like:

- Sigma-Aldrich (Merck KGaA)

- Alkyl Amines Chemicals Ltd.

- Sumitomo Seika Chemicals Co. Ltd.

- Hebei Yanuo Chemical Industry Co. Ltd.

- Arkema Shanghai Distribution Co. Ltd.

- Shandong Zhicheng Chemical Co. Ltd.

- Chemos GmbH & Co. KG

- Chevron Oronite Company LLC

- Parchem Fine & Specialty Chemicals

- Hubei Xingfa Chemicals Group Co. Ltd.

The global dimethyl disulfide market is segmented as follows;

By Purity

- High Purity DMDS (>99%)

- Technical Grade DMDS

By End-Use Industry

- Oil & Gas

- Agriculture

- Chemical Manufacturing

- Food Processing

- Pharmaceuticals

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The chemical compound dimethyl disulfide (DMDS) has the molecular formula CH3SSCH3. It's a combustible liquid with a bad smell that resembles garlic. Even though impure samples frequently seem yellowish, the chemical is colorless. Dimethyl disulfide (DMDS) doesn't emit any hazardous substances and is safe for the environment. Dimethyl disulfide, or DMDS, is a chemical molecule that is flexible and can be employed in a wide range of applications.

The global dimethyl disulfide market is expected to grow due to rising demand in agrochemicals and oil & gas industries, increasing use as a soil fumigant, and growth in shale gas exploration.

According to a study, the global dimethyl disulfide market size was worth around USD 275.1 Million in 2024 and is expected to reach USD 520.46 Million by 2034.

The global dimethyl disulfide market is expected to grow at a CAGR of 6.1% during the forecast period.

Asia-Pacific is expected to dominate the dimethyl disulfide market over the forecast period.

Leading players in the global dimethyl disulfide market include Sigma-Aldrich (Merck KGaA), Alkyl Amines Chemicals Ltd., Sumitomo Seika Chemicals Co., Ltd., Hebei Yanuo Chemical Industry Co., Ltd., Arkema Shanghai Distribution Co., Ltd., Shandong Zhicheng Chemical Co., Ltd., Chemos GmbH & Co. KG, Chevron Oronite Company LLC, Parchem Fine & Specialty Chemicals, Hubei Xingfa Chemicals Group Co., Ltd., among others.

The report explores crucial aspects of the dimethyl disulfide market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed