Digital Signature Market Size, Share, Growth Report 2032

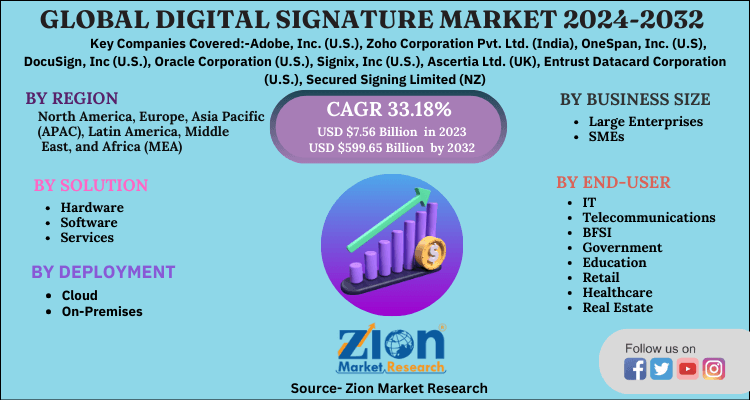

Digital Signature Market By Solution (Hardware, Software, and Services), By Deployment (Cloud and On-Premises), By Business Size (Large Enterprises and SMEs), By End-User (IT, Telecommunications, BFSI, Government, Education, Retail, Healthcare, Real Estate, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

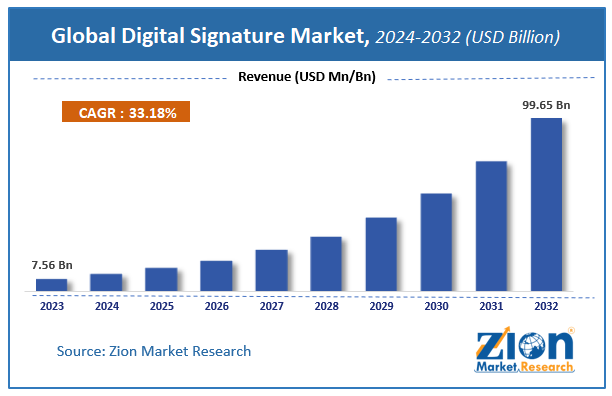

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.56 Billion | USD 99.65 Billion | 33.18% | 2023 |

Digital Signature Market Insights

According to a report from Zion Market Research, the global Digital Signature Market was valued at USD 7.56 Billion in 2023 and is projected to hit USD 99.65 Billion by 2032, with a compound annual growth rate (CAGR) of 33.18% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Digital Signature Market industry over the next decade.

Digital Signature is an encrypted electronic stamp used to validate the authenticity and integrity of digital messages or documents like PDF, Word, and legal contract papers. It aims to reduce the risk of duplication of the documents and enable the beneficiary to verify the identity and assurance that no damage has occurred. The market is primarily driven by the rising demand for digital solutions and paperless transactions in the business. The emergence of digital transformation has brought in the need to transform towards greater security. Minimizing papers and going paperless are two-lined concepts, and several Country's Government are transforming into Digital Experience. The growing trend has boosted demand for digital signatures.

Growth Factors

The increase in the number of partnerships and acquisitions in the IT and BFSI sectors will stimulate the market's growth over the forecasted period. Currently, it has provided clarity and distinctness among the partners. The rapid automation and digitalization in the IT and BFSI sectors have made it possible to carry out processes in simple ways. An increase in falsification in the software processes and financial dealings has anticipated augmenting the digital signature market and reducing fraud cases.

The integration of blockchain technology is the best opportunity for the market to grow in the forecasted period. The aim is to offer the customers an improved experience with a proper timestamp during the transactions. The inclusion of blockchain will secure the data against forgery and make data authentic throughout the process. Zoho Sign's blockchain-based timestamping feature has publicly established signer's accountability with only the hash of the signed document to be added to the public blockchain.

Digital Signature Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Signature Market |

| Market Size in 2023 | USD 7.56 Billion |

| Market Forecast in 2032 | USD 99.65 Billion |

| Growth Rate | CAGR of 33.18% |

| Number of Pages | 120 |

| Key Companies Covered | Adobe, Inc. (U.S.), Zoho Corporation Pvt. Ltd. (India), OneSpan, Inc. (U.S), DocuSign, Inc (U.S.), Oracle Corporation (U.S.), Signix, Inc (U.S.), Ascertia Ltd. (UK), Entrust Datacard Corporation (U.S.), Secured Signing Limited (NZ), Gemalto N.V. (Netherlands), Thales eSecurity Inc. (France), Multicert (Portugal), IndenTrust, Inc. (U.S), Glykka LLC (U.S), nCipher Security, LLC (UK) |

| Segments Covered | By Type, By end-user And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Solution Segment Analysis Preview

The software segment held the largest market share in 2023. One of the primary purposes behind developing the digital signature software market is the expense and the convenience offered. The software segment is the largest and is supposed to be leading the market. The quick conversion of a signature to an electronic signature and the rise in implementation of paperless processes will drive the market. Further, the increase in the implementation by the end-users in various industries is expected to contribute more in the forecasted period. This is mainly attributed to the rise in digitization and enhancements in the technologies applied by several industries. The service segment is likely to grow faster due to the increasing demand for the solutions and integration with SAP.

Deployment Segment Analysis Preview

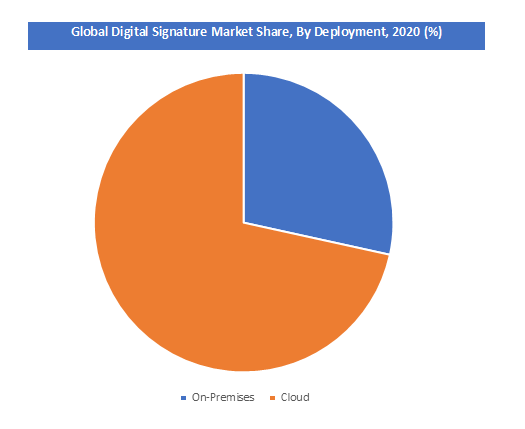

The on-premises segment held a share of 28.44% in 2020. This is accredited to the rising acceptance by many companies across the verticals. The on-premise software helps determine the company's requirements for authentication and complete control of the data. The cloud segment comes with security breaches, and blockchain technologies have been implemented for security advancements. The cloud segment favors the market due to its feature of signing the documents from any device making this mode manageable and target a large audience. Internet availability and use of smartphones with continuous internet facilities will boost the cloud segment in the forecasted years. Data exchange between the environment and signer is anticipated to grow in this segment in the Digital Signature market.

Business Size Segment Analysis Preview

The large enterprise segment is expected to dominate the market in forecasted years. This is accredited due to the increase in e-business and companies adopting paperless systems. Retail and IT Industries are boosting the implementation of digitization across all large enterprises. This segment is adopting cloud deployment solutions and simplifying the processes with added benefits like improved customer services and cost savings. It is expected to dominate the market in forecasted years. Small and Medium Enterprises (SMEs) are expected to grow in the market during the forecasted years. SMEs and other startups will boost and use digital signatures due to the overall acceptance of the digital revolution across the industries and the rise in favor of the e-commerce model. It will improve the effectiveness and design the business processes better and streamlined.

End-User Segment Analysis Preview

The BFSI sector is expected to grow due to the shift in the digital medium. It allows the segment to simplify the financial transactions in an easy and faster way. Digital Signatures help secure the banks, bring out transparency and efficiency in the overall processes, and provide streamlined solutions to the clients like centralizing documents. The increase in the e-commerce model has paved a way out for Retail industries to digitalize. The retail industry deals with many paper works that will go paperless and save costs, time, improve security, reduce the document turn-around time, and faster the invoice process. These factors are likely to drive the market growth during the forecasted period. IT, Telecommunications, Government, Education, Healthcare, Real Estate, and others form the end-user segment.

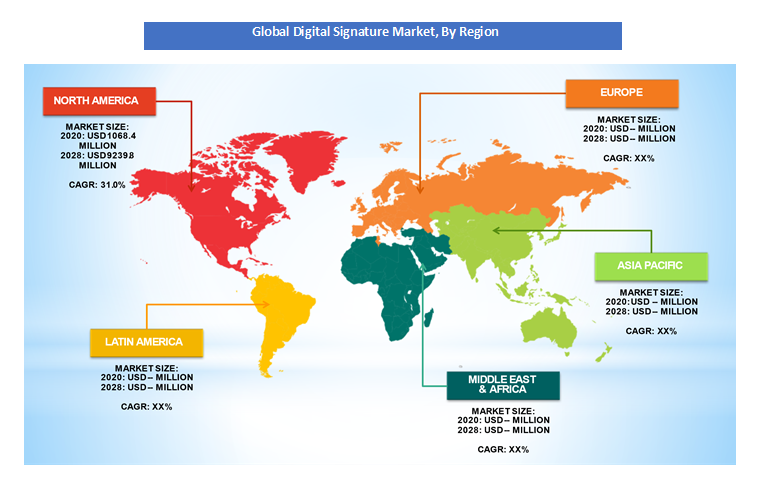

Regional Analysis Preview

North America accounted for a share of 40% in 2020. The tremendous growth opportunities in the financial, legal, and IT sectors in the U.S. have led North America to contribute heavily to the global market. The U.S. is the most significant contributor due to awareness of the paperless systems and its IDEA Act to improve the overall digital efficiency. Other legislations like Uniform Electronic Transactions Act and Electronic Signatures in Global and National Commerce Act in the U.S. promotes the digital signature market.

Europe is projected to grow at a CAGR of 30.9% during the forecast period. Europe's Digital Signature market is likely to witness a significant increase due to the rise in e-business. The eIDAS Regulation will also facilitate identifying the need for digital signatures in Europe and across the borders. The Cloud Signature Consortium of Brussels will foster the digital experience with the help of companies like Adobe and others.

Key Market Players & Competitive Landscape

Some of the key players in the Digital Signature market include:

- Adobe, Inc. (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

- OneSpan, Inc. (U.S)

- DocuSign, Inc (U.S.)

- Oracle Corporation (U.S.)

- Signix, Inc (U.S.)

- Ascertia Ltd. (UK)

- Entrust Datacard Corporation (U.S.)

- Secured Signing Limited (NZ)

- Gemalto N.V. (Netherlands)

- Thales eSecurity Inc. (France)

- Multicert (Portugal)

- IndenTrust, Inc. (U.S)

- Glykka LLC (U.S)

- nCipher Security, LLC (UK), among others.

These players are collaborating in providing cloud-based solutions. Many companies offer mobile-based signing solutions like DocuSign, Inc., providing all the documents and activities synced to one account.

The global Digital Signature market is segmented as follows:

By Solution

- Hardware

- Software

- Services

By Deployment

- Cloud

- On-Premises

By Business Size

- Large Enterprises

- SMEs

By End-User

- IT

- Telecommunications

- BFSI

- Government

- Education

- Retail

- Healthcare

- Real Estate

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

List of Contents

Market InsightsGrowth FactorsReport ScopeSolution Segment Analysis PreviewDeployment Segment Analysis PreviewBusiness Size Segment Analysis PreviewEnd-User Segment Analysis PreviewRegional Analysis Preview Key Market Players Competitive LandscapeThe global market is segmented as follows:By SolutionBy DeploymentBy Business SizeBy End-UserBy RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed