Cookie and Cracker Market Size, Share, Trends, Growth & Forecast 2034

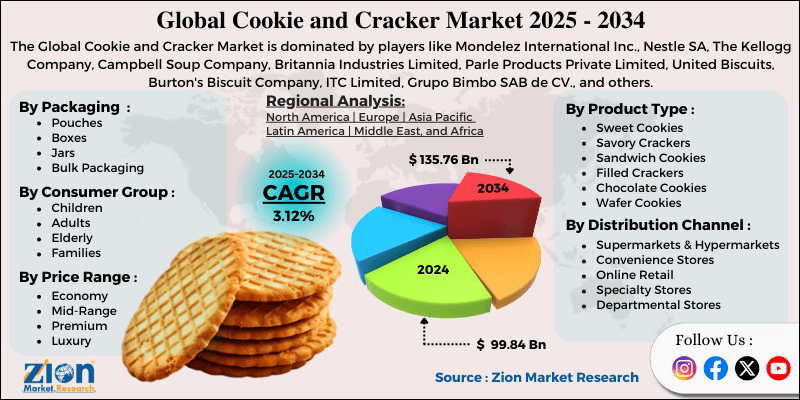

Cookie and Cracker Market By Product Type (Sweet Cookies, Savory Crackers, Sandwich Cookies, Filled Crackers, Chocolate Cookies, Wafer Cookies, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Departmental Stores, Bakeries), By Packaging (Pouches, Boxes, Jars, Bulk Packaging, Single-Serve Packs), By Consumer Group (Children, Adults, Health-Conscious Consumers, Elderly, Families), By Price Range (Economy, Mid-Range, Premium, Luxury), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

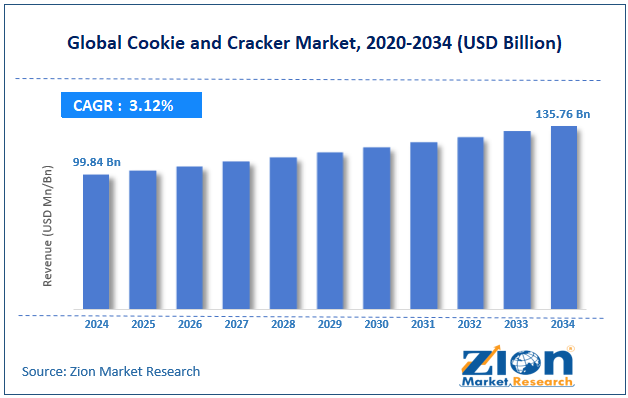

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 99.84 Billion | USD 135.76 Billion | 3.12% | 2024 |

Cookie and Cracker Industry Perspective:

The global cookie and cracker market size was worth approximately USD 99.84 billion in 2024 and is projected to grow to around USD 135.76 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.12% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global cookie and cracker market is estimated to grow annually at a CAGR of around 3.12% over the forecast period (2025-2034).

- In terms of revenue, the global cookie and cracker market size was valued at approximately USD 99.84 billion in 2024 and is projected to reach USD 135.76 billion by 2034.

- The cookie and cracker market is projected to grow significantly due to the rising snacking culture, increasing urbanization, busy lifestyles requiring convenient food options, and growing retail penetration in developing markets.

- Based on product type, the sweet cookies segment is expected to lead the cookie and cracker market, while the savory crackers segment is anticipated to experience significant growth.

- Based on distribution channel, the supermarkets and hypermarkets segment is expected to lead the cookie and cracker market, while the online retail segment is anticipated to witness notable growth.

- Based on packaging, the pouches segment is the dominating segment, while the single-serve packs segment is projected to witness sizeable revenue over the forecast period.

- Based on the consumer group, the adults segment is expected to lead the market compared to the children segment.

- Based on region, North America is projected to dominate the global cookie and cracker market during the estimated period, followed by Europe.

Cookie and Cracker Market: Overview

Cookies and crackers are baked snack products that are convenient, sweet, or savory foods enjoyed across various eating occasions. Cookies are generally made with sugar, chocolate chips, nuts, dried fruits, and other flavorings, offering indulgent taste experiences for all ages. Crackers provide a savory option made with wheat flour, herbs, seeds, cheese, and seasonings, often paired with dips or spreads for light meals or appetizers. Production involves mixing, shaping, baking, and packaging ingredients such as flour, fats, sweeteners, and leavening agents to maintain quality and shelf life. These products are created by small artisanal bakeries as well as large industrial manufacturers supplying global markets. Popular varieties include chocolate chip cookies, shortbread, butter cookies, saltine crackers, whole-grain crackers, and cultural specialty types. Health-oriented formulations include whole grains, reduced sugar, added fiber, and natural ingredients for wellness-focused consumers. Gluten-free, organic, and non-GMO options further support dietary preferences while flavor innovations and seasonal releases sustain consumer interest.

The increasing demand for convenient snacking options and expanding retail distribution networks are expected to drive growth in the cookie and cracker market throughout the forecast period.

Cookie and Cracker Market Dynamics

Growth Drivers

How are changing lifestyles and urbanization driving growth in the cookie and cracker market?

The cookie and cracker market is growing quickly because modern urban lifestyles create steady demand for convenient snacks suited to busy daily routines. Longer working hours in cities increase reliance on quick food options that provide quick energy during short breaks. Heavy traffic and long commutes reduce time for proper meals, encouraging frequent snacking during travel. The decline in shared family meals leads people to eat smaller portions throughout the day instead of structured sit-down meals. Working parents balance jobs and childcare, choosing packaged snacks that children can eat easily without supervision.

Single-person households prefer individual packs offering quick consumption without waste. Dual-income families have limited time for baking, leading to increased purchases of ready-to-eat products. Small urban kitchens offer little space for baking equipment, making it less practical to make homemade snacks. Offices, schools, and public areas offer vending machines providing continuous snack access. Cafés encourage pairing beverages with simple baked snacks during short social breaks, while fitness routines promote small, frequent meals, creating more snacking moments.

Innovation in flavors and health-conscious formulations

The global cookie and cracker market is growing steadily as producers create new products designed to match changing preferences for fresh flavors and healthier snacking choices. Exotic ingredients like matcha, cardamom, turmeric, and yuzu attract consumers seeking new taste experiences across different eating occasions. Fusion products mixing sweet and savory elements, such as salted caramel cookies or sweet chili crackers, appeal to shoppers with more adventurous palates. Limited-edition seasonal flavors create excitement and encourage repeat visits among consumers searching for unique varieties across stores.

Partnerships with popular food brands introduce flavors like cookies and cream, pumpkin spice, and birthday cake into widely recognized cookie formats. Health-focused innovations include functional additions like protein, probiotics, omega-3 fatty acids, and vitamins supporting wellness goals among many consumer groups. Whole-grain recipes increase fiber while keeping familiar taste profiles that appeal to broad audiences across global markets. Reduced sugar options address growing concerns about high sugar intake among health-conscious shoppers. Ancient grains such as quinoa, spelt, and amaranth add nutritional diversity, while superfood additions create appealing marketing messages.

Restraints

Health concerns and negative perceptions are affecting consumption patterns.

The cookie and cracker market faces several restraints influencing growth across many regions. Rising health awareness reduces demand as consumers limit products high in sugar, salt, and refined ingredients. Strong competition from healthier snack categories, such as granola bars, nuts, and yogurt, pulls attention away from traditional baked snacks. Price-sensitive shoppers hesitate to buy premium varieties during economic uncertainty, reducing sales for brands offering higher-cost products.

Private-label alternatives increase pressure by offering similar items at lower prices, making it difficult for established brands to maintain market share. Fluctuating prices of key ingredients like wheat, sugar, and vegetable oils create unpredictable production costs for manufacturers. Strict food regulations and labeling rules increase compliance expenses and slow product development timelines. Growing demand for clean-label, allergen-free, and natural ingredients also challenges producers, who must reformulate products without affecting taste or texture.

Opportunities

How is the expansion in emerging markets creating new opportunities for the cookie and cracker market?

The cookie and cracker industry is gaining strong growth opportunities as rising incomes and lifestyle changes in developing regions create large new consumer groups. Population expansion across Africa, Asia, and Latin America provides huge potential markets where overall snack consumption remains relatively low. Economic development increases middle-class purchasing power, allowing families to buy packaged snacks beyond basic household essentials.

Younger consumers in emerging regions show a high interest in international foods and adopt global snacking patterns easily. Improved transportation systems help manufacturers distribute products across smaller towns and rural areas previously difficult to reach. Growth in supermarkets and convenience stores increases shelf space for cookie and cracker brands seeking broader visibility. Rising education levels support a preference for branded packaged foods over traditional options. Western cultural influence through media and travel encourages interest in global snack products. Growth in tourism exposes local consumers to international preferences while promoting stronger demand for packaged snacks.

Challenges

How is intense competition and market saturation creating challenges for the cookie and cracker industry?

The cookie and cracker industry faces many obstacles, as crowded markets and strong price pressure reduce profit margins and make brand separation difficult. Numerous brands compete for limited shelf space in retail outlets, creating challenges for visibility and trial among new shoppers. Private-label products offer similar quality at lower prices, drawing customers away from established branded options. Major manufacturers engage in price reductions during competitive periods, which further reduces overall margins across the category. Promotional spending increases as companies fund discounts and offers designed to attract attention in busy retail environments.

Consolidation among retailers gives large chains strong bargaining power, increasing pressure to accept lower wholesale prices. Advertising expenses rise as brands compete across multiple media channels, seeking consistent consumer engagement. Rapid product proliferation forces companies to launch new varieties frequently to hold retail support and consumer interest. Declining loyalty encourages shoppers to switch easily between competing options during routine purchasing.

Cookie and Cracker Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cookie and Cracker Market |

| Market Size in 2024 | USD 99.84 Billion |

| Market Forecast in 2034 | USD 135.76 Billion |

| Growth Rate | CAGR of 3.12% |

| Number of Pages | 215 |

| Key Companies Covered | Mondelez International Inc., Nestle SA, The Kellogg Company, Campbell Soup Company, Britannia Industries Limited, Parle Products Private Limited, United Biscuits, Burton's Biscuit Company, ITC Limited, Grupo Bimbo SAB de CV., and others. |

| Segments Covered | By Product Type, By Distribution Channel, By Packaging, By Consumer Group, By Price Range, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cookie and Cracker Market: Segmentation

The global cookie and cracker market is segmented based on product type, distribution channel, packaging, consumer group, price range, and region.

Based on product type, the global cookie and cracker industry is segregated into sweet cookies, savory crackers, sandwich cookies, filled crackers, chocolate cookies, wafer cookies, and others. Sweet cookies lead the market due to universal appeal across age groups, associations with treats and comfort foods, and versatile consumption occasions from breakfast to dessert.

Based on distribution channel, the industry is divided into supermarkets and hypermarkets, convenience stores, online retail, specialty stores, departmental stores, and bakeries. Supermarkets and hypermarkets lead the market due to their dominant retail presence, ability to stock wide product varieties, promotional activities that drive trial and purchase, and one-stop shopping convenience for consumers.

Based on packaging, the global cookie and cracker market is segmented into pouches, boxes, jars, bulk packaging, and single-serve packs. Pouches are expected to lead the market during the forecast period due to their cost-effectiveness, lightweight designs that reduce transportation costs, and shelf appeal that catches consumer attention.

Based on consumer group, the global market is classified into children, adults, health-conscious consumers, the elderly, and families. Adults hold the largest market share due to their purchasing power and frequent snacking throughout the workday.

Based on price range, the global market is categorized into economy, mid-range, premium, and luxury. Mid-range products hold the largest market share due to their balance of quality and affordability, and accessibility to broad consumer segments.

Cookie and Cracker Market: Regional Analysis

What factors are contributing to North America's dominance in the global cookie and cracker market?

North America leads the cookie and cracker market because long-standing snacking habits, strong brand recognition, and advanced retail systems support high consumption across many daily situations. The United States records a very high per capita intake of these products, with consistent use across age groups and lifestyles in both urban and rural communities. Snacking between meals forms a normal eating pattern across the region, creating frequent opportunities for packaged items during busy daily routines. Childhood traditions involving cookies as treats and comfort foods shape early emotional connections and influence preferences that often continue into adulthood. School lunches commonly include packaged items, helping young consumers become familiar with and develop early loyalty to well-known brands.

Workplaces provide constant access through vending machines and break areas, encouraging routine consumption during short breaks and long shifts. Coffee culture supports pairing hot beverages with simple baked snacks during social gatherings and informal meetings in offices and cafés. Holiday seasons include strong cookie traditions, offering seasonal flavors and gift boxes that boost sales throughout the winter months.

Extensive distribution networks secure availability across supermarkets, convenience stores, gas stations, and pharmacy chains in every region. Iconic brands such as Oreo, Chips Ahoy, Ritz, and Wheat Thins benefit from decades of loyalty built through consistent quality and wide marketing exposure. Marketing strategies include television campaigns, digital outreach, influencer support, and experiential events designed to maintain strong visibility among diverse audiences.

Innovation from North American manufacturers introduces new flavors and product formats that influence global market trends across multiple regions. Demographic diversity supports demand for both mainstream offerings and specialized varieties designed for specific cultural preferences. Canada shows similar patterns, with bilingual packaging and regional flavors contributing to unique market characteristics.

Asia Pacific is experiencing significant growth.

Asia Pacific is experiencing strong growth in the cookie and cracker market, driven by rising incomes, rapid urbanization, and shifting food habits that are increasing demand for packaged snacks across many regions. China offers the largest opportunity due to its huge population, fast-growing middle class, and increasing interest in Western-style snacking among younger consumers. India presents significant potential, as a young population with rising disposable incomes begins purchasing packaged snacks more frequently across urban and semi-urban areas.

Urban migration concentrates people in cities where modern retail outlets introduce new products and encourage trial among first-time buyers. Long-standing tea traditions across many Asian countries create natural moments for pairing hot beverages with sweet or savory baked snacks in daily routines. Gifting customs support strong premium cookie sales, especially during festivals when elaborate boxes increase appeal and enhance perceived value.

Local tastes inspire unique varieties using red bean, taro, green tea, mango, and other regional ingredients, enjoyed across diverse cultural groups. Japan maintains a highly developed snack market offering premium products with refined packaging and seasonal releases targeted toward quality-seeking shoppers. South Korea supports strong distribution through convenience stores, where cookies and crackers receive prominent placement across busy retail environments. Southeast Asian countries show rapid adoption of snacking habits as economic growth expands access to packaged products in major cities. Expanding manufacturing capacity across Asia reduces production costs and improves supply chains serving regional markets. Rising participation of women in the workforce increases demand for convenient food solutions requiring minimal preparation. International travel exposes consumers to global brands, encouraging trial and shaping future purchase behavior among younger generations.

Recent Market Developments

- In November 2025, Chips Ahoy!, owned by Mondelēz International, launched a limited-edition “dark-themed” soft-chew cookie with a strawberry center, part of a tie-up with Stranger Things, aiming to attract Gen-Z consumers with bold flavor and pop-culture appeal.

- In 2025, Mondelēz added “breakfast-positioned” varieties to its Oreo cookie line, targeting morning consumers who want whole-grain, protein-boosted, or lower-sugar snacks suitable for breakfast times.

Cookie and Cracker Market: Competitive Analysis

The leading players in the global cookie and cracker market are:

- Mondelez International Inc.

- Nestle SA

- The Kellogg Company

- Campbell Soup Company

- Britannia Industries Limited

- Parle Products Private Limited

- United Biscuits

- Burton's Biscuit Company

- ITC Limited

- Grupo Bimbo SAB de CV.

The global cookie and cracker market is segmented as follows:

By Product Type

- Sweet Cookies

- Savory Crackers

- Sandwich Cookies

- Filled Crackers

- Chocolate Cookies

- Wafer Cookies

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Departmental Stores

- Bakeries

By Packaging

- Pouches

- Boxes

- Jars

- Bulk Packaging

- Single-Serve Packs

By Consumer Group

- Children

- Adults

- Health-Conscious Consumers

- Elderly

- Families

By Price Range

- Economy

- Mid-Range

- Premium

- Luxury

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed