Contact Center Analytics Market Size, Share, Trends, Growth 2034

Contact Center Analytics Market By Component (Solution and Service), By Deployment (On-premise and Hosted), By Enterprise Size (Large Enterprises and Small & Medium Enterprises), By Application (Automatic Call Distributor, Real-Time Monitoring & Reporting, Customer Experience Management, Log Management, Workforce Optimization, Risk & Compliance Management, and Others), By Industry Vertical (BFSI, Travel & Hospitality, Consumer Goods & Retail, Healthcare, Government, IT & Telecom, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

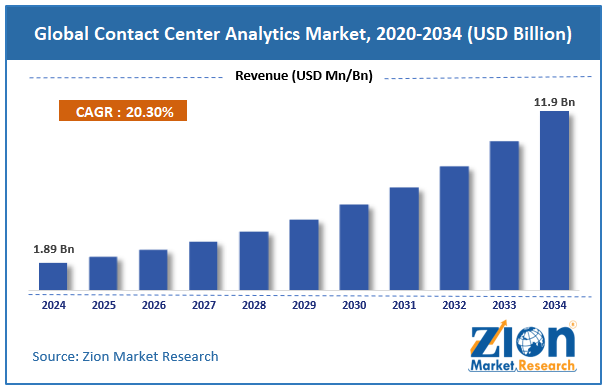

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.89 Billion | USD 11.9 Billion | 20.3% | 2024 |

Contact Center Analytics Industry Perspective:

What will be the size of the global contact center analytics market during the forecast period?

The global contact center analytics market size was worth around USD 1.89 billion in 2024 and is predicted to grow to around USD 11.9 billion by 2034, with a compound annual growth rate (CAGR) of roughly 20.3% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global contact center analytics market is estimated to grow annually at a CAGR of around 20.3% over the forecast period (2025-2034).

- In terms of revenue, the global contact center analytics market size was valued at around USD 1.89 billion in 2024 and is projected to reach USD 11.9 billion by 2034.

- Rise of omnichannel customer engagement is expected to drive the contact center analytics market.

- Based on the component, the solution segment captured the largest market share, over 65%, in 2024.

- Based on the deployment, on-premises holds a dominant position in the market.

- Based on the enterprise size, the large enterprise segment is expected to capture a prominent revenue share over the analysis period.

- Based on the application, the customer experience management segment is expected to capture a prominent revenue share over the analysis period.

- Based on the industry vertical, the IT & telecom hold the largest market share in 2024.

- Based on region, in 2024, the North America region had the largest market share, exceeding 30%.

Contact Center Analytics Market: Overview

The contact center analytics system is a comprehensive set of technologies, software solutions, and professional services that businesses use to gather, analyze, and evaluate data from customer interactions across contact center communication channels, such as voice calls, email, live chat, social media, and messaging apps. The analytics tools use cutting-edge technologies, such as natural language processing (NLP), speech analytics, text analytics, and machine learning (ML), to transform structured and unstructured data into useful information. Companies use contact center analytics systems to monitor key performance indicators (KPIs) and assess customer satisfaction, agent performance, business operations, regulatory compliance, and the customer experience. The market offers both cloud-based and on-premises deployment options for the banking, financial, and insurance (BFSI), healthcare, retail, telecommunications, and government industries that need to improve service quality while lowering operational costs and providing personalized customer engagement.

Contact Center Analytics Market: Dynamics

Growth Drivers

Why does the rising demand for enhanced Customer Experience (CX) act as a major catalyst for contact center analytics market growth?

The contact center analytics market is growing as more businesses seek better Customer Experience (CX) solutions. This is because they know that customer experience drives more sales, brand loyalty, and a stronger market position. Customers are increasingly expecting businesses to deliver speedy, personalized service through a variety of communication methods, including voice, chat, email, and social media. Businesses need to analyze a lot of customer interaction data because it helps them understand how people behave and feel, identify problems with their services, and understand how their business operates.

Companies use contact center analytics solutions to track key business metrics, understand customer sentiment in real time, predict customer attrition, and resolve recurring issues. These tools transform raw interaction data into actionable business solutions, enabling companies to shift from traditional customer care to customer engagement strategies that anticipate customer needs. As more people seek better customer experiences, companies are investing in advanced analytical tools, such as AI-based voice and text analysis. This speeds up the overall market growth.

Restraints

Data privacy and security concerns are impeding the industry's development

The contact center analytics sector is struggling to grow because businesses are concerned about data privacy and security, making it hard for them to adopt solutions that require processing and storing highly sensitive customer information. Analytics platforms that leverage cloud deployment methods, artificial intelligence, and the ability to combine data from multiple channels are more likely to experience data breaches, illicit access, and the exploitation of consumer information. Companies in banking and financial services, healthcare, and telecommunications must follow strict rules for data protection. This makes compliance with the rules more costly and causes operational problems.

When companies use advanced analytics tools, they face several major challenge including protecting data sovereignty, complying with cross-border data transfer limits, and navigating constantly evolving cybersecurity concerns. Security mistakes can lead to financial penalties, damage a company's reputation, and erode customer trust. This makes companies more careful about how they spend their money. Solutions for contact center analytics are increasingly challenged by privacy and security concerns, making them difficult to adopt widely.

Opportunities

Does the rise in innovation present a development opportunity for the contact center analytics market?

The contact center analytics industry is expected to grow significantly due to increased innovation, which presents a major growth opportunity. Artificial intelligence (AI), machine learning (ML), natural language processing (NLP), predictive analytics, and generative AI are just a few of the new technologies that are making contact center analytics systems more powerful. Organizations use new technologies like real-time voice analytics, emotion detection, automated quality monitoring, predictive customer behavior modeling, and smart virtual assistants to engage customers more quickly and personally with data. Companies are more likely to switch to advanced analytics solutions when they can derive greater strategic benefits from their upgraded platforms.

For instance, in June 2025, TCN, a top global provider of cloud-based contact center solutions, announced improvements to its Business Intelligence (BI) features. These now include a data pipeline builder and an inspector tool that enable users to perform extensive analytics and reporting. The new tools help businesses run more effectively by improving how they manage their employees, measure agent performance, and track client interactions across multiple platforms. Smart reporting, full performance monitoring, and configurable reporting tools work together to help businesses change how they understand their operations and improve their performance.

Challenges

Does the need for a skilled workforce and training pose a significant challenge to the contact center analytics industry’s growth?

The contact center analytics field has struggled to grow because it requires significant training to keep staff up to date. Companies need specific technical capabilities to build and operate modern contact center analytics solutions that leverage AI, ML, voice analytics, and predictive modeling. It's hard for small and medium-sized businesses (SMEs) to find personnel who know how to use data analytics, combine AI, and set up systems. The skills gap delays the implementation of analytics solutions, making them less useful.

Businesses are also hiring more external consultants, which increases costs. Contact center agents need to continually learn to use dashboards, extract insights, and integrate analytical outputs into service improvement methods. Companies that don't provide their employees with sufficient training can't use advanced features such as sentiment analysis, real-time monitoring, and predictive churn modeling. This could diminish their return on investment (ROI). Because technology changes so quickly, businesses need to learn new skills, which takes a lot of time and money. The lack of competent staff and the need for continual training are structural problems that slow adoption and make it harder for enterprises in developing nations and those with limited resources.

Contact Center Analytics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Contact Center Analytics Market |

| Market Size in 2024 | USD 1.89 Billion |

| Market Forecast in 2034 | USD 11.9 Billion |

| Growth Rate | CAGR of 20.3% |

| Number of Pages | 218 |

| Key Companies Covered | Oracle Corp, 8X8 Inc., Mitel Networks Corp., CallMiner, Enghouse Interactive, Nice Ltd., Genesys, Five9 Inc., Cisco Systems Inc., SAP SE, Genpact Ltd., Verint Systems Inc, CSG Systems Inc., TTEC, and others. |

| Segments Covered | By Component, By Deployment, By Enterprise Size, By Application, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Contact Center Analytics Market: Segmentation

Component Insights

Why is the solution segment expected to dominate the contact center analytics market during the analysis period?

The solution segment captured the largest market share, over 65%, in 2024. The need for enhanced customer experiences is what drives this sector's growth. Companies nowadays know that providing customers with great experiences gives them an edge over competitors. Companies use contact center analytics tools to gather and analyze large volumes of consumer interaction data from multiple sources, including voice, chat, email, and social media. The firm uses the insights to better understand how customers think, what they like, and what makes them unhappy. This leads to faster issue solving and more tailored service.

Deployment Insights

Why does on-premise hold the largest share in the contact center analytics market?

On-premises holds a dominant position in the market. Companies choose on-premises installations because they allow them to customize the software to their own needs. When firms put contact center solutions on their own premises, they have full control over their systems, which are supported by their telephony personnel and IT department. Companies that require specific levels of data protection and business continuity for their operations prefer solutions installed on their own premises.

Enterprise Size Insights

Why does the large enterprise segment dominate the contact center analytics industry?

The large enterprise segment is expected to account for a significant share of revenue over the analysis period. One of the main reasons large companies require contact center analytics is that they receive a high volume of calls. In big companies, customer data is spread out across all channels. Analytics solutions enable agents to identify the appropriate data for the customer's needs and deliver it at the right moment.

Application Insights

What factors cause the customer experience management segment to be in a dominating position in the contact center analytics market?

The customer experience management segment is expected to capture a prominent revenue share over the analysis period. The segment's growth might be linked to the advantages that contact center analytics bring to customer experience management processes. These advantages include lower customer attrition rates, better crisis management, and lower marketing expenses.

Customer experience management is the process of collecting customer feedback, transaction data, interaction records, and agent information to produce a report that assesses both customer experience and agent performance. Customer experience management systems let businesses analyze customer data from many sources and develop strategies to run their contact centers more effectively.

Industry Vertical Insights

Why does the IT & telecom segment capture the largest share in 2024 in the contact center analytics market?

The IT & telecom hold the largest market share in 2024. IT and telecom companies use contact center analytics solutions to automate their business processes. These technologies enable IT and telecommunications agents to answer client calls and manage the entire service request process simultaneously. The solutions benefit organizations in several ways, including improving customer satisfaction, reducing operating costs, and providing enhanced business intelligence tools. These technologies help IT and telecom businesses understand what affects how well they serve customers.

Regional Insights

Why does North America hold the largest share in the contact center analytics market?

In 2024, the North America region had the largest market share, exceeding 30%. The growth is driven by companies undergoing a full digital transformation, using the latest technologies to engage customers and connect with various cloud infrastructure providers. Businesses in the area are working to improve the customer experience, operational efficiency, and the integration of omnichannel analytics. This means that there is still a need for advanced analytics solutions and services. As large technology companies enter the area and customer service companies compete, the market expands further.

Contact Center Analytics Market: Competitive Analysis

The global contact center analytics market is dominated by players like:

- Oracle Corp

- 8X8 Inc.

- Mitel Networks Corp.

- CallMiner

- Enghouse Interactive

- Nice Ltd.

- Genesys

- Five9 Inc.

- Cisco Systems Inc.

- SAP SE

- Genpact Ltd.

- Verint Systems Inc

- CSG Systems Inc.

The global contact center analytics market is segmented as follows:

By Component

- Solution

- Service

By Deployment

- On-premise

- Hosted

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Application

- Automatic Call Distributor

- Real-Time Monitoring & Reporting

- Customer Experience Management

- Log Management

- Workforce Optimization

- Risk & Compliance Management

- Others

By Industry Vertical

- BFSI

- Travel & Hospitality

- Consumer Goods & Retail

- Healthcare

- Government

- IT & Telecom

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed