Construction Adhesive Tapes Market Size, Share & Trends 2034

Construction Adhesive Tapes Market By Resin Type (Acrylic, Rubber, and Others), By Technology (Hot-Melt Based, Solvent-based, and Others), By Application (Flooring, Windows & Doors, Roofing, HVAC & Insulation, Walls, and Others), By End-User (Residential and Non-Residential), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

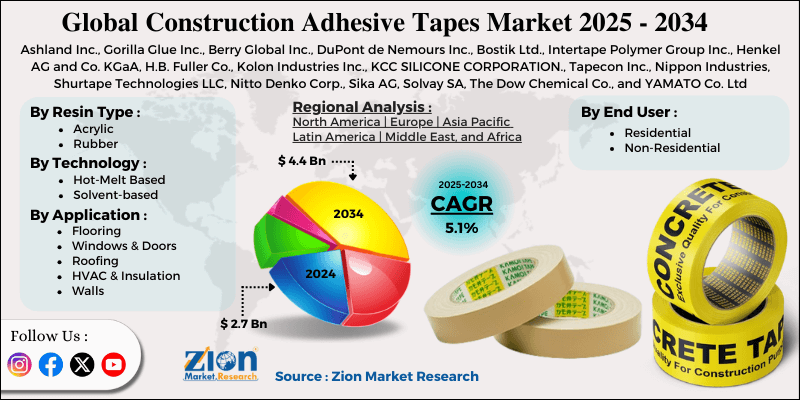

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.7 Billion | USD 4.4 Billion | 5.1% | 2024 |

Construction Adhesive Tapes Industry Prospective

The global construction adhesive tapes market size was worth around USD 2.7 billion in 2024 and is predicted to grow to around USD 4.4 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.1% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global construction adhesive tapes market is estimated to grow annually at a CAGR of around 5.1% over the forecast period (2025-2034).

- In terms of revenue, the global construction adhesive tapes market size was valued at around USD 2.7 billion in 2024 and is projected to reach USD 4.4 billion by 2034.

- The increasing construction sector is expected to drive the construction adhesive tapes market over the forecast period.

- Based on the resin type, the acrylic segment is expected to dominate the market over the projected period.

- Based on the technology, the hot-melt-based segment is expected to capture the largest market share over the projected period.

- Based on the application, the flooring segment holds a substantial market share.

- Based on the end user, the residential segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Construction Adhesive Tapes Market: Overview

Construction adhesive tapes are professional, pressure-sensitive, heat-activated tape-like materials intended for various applications in residential, commercial, and civil engineering. The substrates that are bonded, sealed, insulated, and protected include concrete, metal, glass, wood, plastics, drywall, and composites. Tapes of this kind have several advantages over conventional fasteners or liquid adhesives, including immediate adhesion, uniform stress distribution, resistance to vibration, and a small application size that avoids drilling and the curing wait. They are used in applications such as installing windows and doors, attaching façades and cladding, sporting, roofing and waterproofing, HVAC insulation, surface protection, and finishing. Among other attributes, there are different types of construction adhesive tapes—single-sided, double-sided, foam, acrylic, rubber-based, and silicone—that not only make the installation process faster but also improve the structural performance and are in line with the modern building practices that promote durability, energy efficiency, and reduced labor costs.

Construction Adhesive Tapes Market Dynamics

Growth Drivers

Why does the expansion of the global construction sector propel the construction adhesive tapes industry growth?

The expansion of the construction industry worldwide is the main driver of the construction adhesive tapes market, as increased investments in residential, commercial, and infrastructure projects will directly increase demand for high-efficiency bonding and sealing solutions. Construction activity in both developed and developing countries is fueled by urbanization, population growth, and mega infrastructure projects (e.g., smart cities, transportation networks, and public utilities). Due to its rapid bonding, uniform load distribution, and clean application, construction adhesive tape is increasingly used alongside mechanical fasteners and liquid adhesives in modern construction. It has now been applied to various areas, including window and door installation, cladding, insulation, flooring, and roofing. In addition, the growing number of renovation and remodeling projects, particularly in developed markets, is boosting demand for tape, as these solutions are less time-consuming and less intrusive than traditional methods.

Thus, the continuous increase in global construction activities and the shift towards efficient, high-performance materials are the two main drivers of the worldwide construction adhesive tapes market. For instance, according to the Associated General Contractors (AGC) of America, Inc., construction is a major contributor to the U.S. economy. There were more than 919,000 construction establishments in the U.S. in the 1st quarter of 2023. The industry employs 8.0 million people and produces nearly $2.1 trillion in structures each year. Construction is one of the largest customers of manufacturing, mining, and a variety of services.

Restraints

How are stringent environmental regulations impeding the construction adhesive tapes market growth?

The construction adhesive tapes market might be hampered by stringent environmental regulations, which would increase production costs, limit formulation options, and slow product development. Many traditional adhesive tapes, especially those based on solvent-borne chemistries, release volatile organic compounds (VOCs) into the atmosphere, along with other chemicals that pollute the air and cause health problems. Manufacturers in North America, Europe, and some Asia-Pacific countries must comply with the stricter emissions standards set by regulatory bodies in these regions, which require reducing VOC content, phasing out hazardous substances, and making substantial investments in safer, environmentally friendly materials. The compliance requirements often force manufacturers to switch to water-based or bio-based adhesive technologies that are not only more expensive but also very difficult to develop technically to meet expectations for performance in terms of strength, durability, and weather resistance.

Additionally, the certification and testing processes under green building standards (e.g., LEED, BREEAM) add additional time and cost to market entry. Smaller players with limited R&D resources may find it very difficult to adapt quickly, leading to reduced competitiveness and slower overall market expansion. Consequently, even though the environmentally compliant tapes align with sustainability goals, the regulatory burden can still constrain the situation by increasing costs for both producers and end users, delaying product launches, and reducing the variety of adhesive solutions available in the market.

Opportunities

Does the growing product launch offer a potential opportunity for the construction adhesive tapes industry growth?

The growing number of product launches is expected to create opportunities for the construction adhesive tapes market over the projected period. For instance, in April 2025, Avery Dennison Performance Tapes unveiled a new Solar Panel Bonding Portfolio of pressure-sensitive adhesive (PSA) tapes that represent a revolutionary bonding method for solar panel manufacturers. The durable, UV-resistant solutions will be of great help as the home solar industry expands, as they are easy to use and automate, and enhance panel design.

Challenges

How does competition from alternative bonding/fastening methods pose a major challenge to market expansion?

Growth in the construction adhesive tapes market is primarily constrained by the existing range of binding and fastening methods. Among the most widely used methods in construction projects are liquid synthetic adhesives, mechanical fasteners (screws, bolts, and nails), and welding. Tape use in these applications is often regarded as weak, with a short service life and very low reliability in heavy-load, structural, or safety-critical situations. In these situations, contractors and engineers may use mechanical fastening or welding techniques that ensure the required maximum structural integrity set by building codes, load-bearing requirements, and the expectation of long service life. Moreover, liquid adhesives are usually preferred for applications that require deep penetration, permanent bonding, or resistance to very high or very low temperatures and environmental stress. Adhesive tapes, in contrast, offer significant advantages in terms of speed, ease of installation, and reduced labor.

Yet the very fact that the tapes are well-known to the parties involved, as well as the existence of standards and contractors' practices, may even be a disadvantage to their acceptance. This has made it hard for adhesive tape makers to achieve the desired market share, particularly in conservative construction industries where traditional mechanical bonding and fastening technologies are still in use due to concerns about performance and regulatory compliance.

Construction Adhesive Tapes Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Construction Adhesive Tapes Market Research Report |

| Market Size in 2024 | USD 2.7 Billion |

| Market Forecast in 2034 | USD 4.4 Billion |

| Growth Rate | CAGR of 5.1% |

| Number of Pages | 220 |

| Key Companies Covered | Ashland Inc., Gorilla Glue Inc., Berry Global Inc., DuPont de Nemours Inc., Bostik Ltd., Intertape Polymer Group Inc., Henkel AG and Co. KGaA, H.B. Fuller Co., Kolon Industries Inc., KCC SILICONE CORPORATION., Tapecon Inc., Nippon Industries, Shurtape Technologies LLC, Nitto Denko Corp., Sika AG, Solvay SA, The Dow Chemical Co., and YAMATO Co. Ltd |

| Segments Covered | By Resin Type, By Technology, By Application, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Construction Adhesive Tapes Market: Segmentation

By Resin Type, the acrylic segment is expected to dominate the market. The demand for high-performance bonding solutions that meet the ever-evolving requirements of modern building applications is the main driver of growth. Acrylic adhesive tapes are preferred because they provide strong adhesion to almost all construction substrates. The substrates include metals, glass, plastics, composites, and painted surfaces, making the tapes very useful for structural bonding, façade attachment, insulation, and sealing. Compared with other adhesive chemistries, perhaps the most significant advantage of acrylic tapes is their weather resistance, as they maintain bond strength even when exposed to extreme temperatures, UV radiation, and humidity. This kind of resistance is especially important for outdoor and long-lasting installations.

By Technology, the hot-melt-based segment is expected to hold the largest revenue share over the projected period. The market is growing mostly because it bonds well, works quickly, and is cheaper than other adhesive technologies. Hot-melt adhesives harden quickly as they cool. This means that they may be cured quickly and have immediate handling strength on building sites. This is a big plus for fast-paced residential, commercial, and infrastructure projects where time is of the essence. This quick setup reduces application time and labor costs, making hot-melt tapes highly desirable for builders and contractors who must meet tight deadlines.

By Application, the flooring segment is expected to capture a substantial market share because more and more people are using a variety of new flooring materials and need quick, reliable installation solutions. Construction adhesive tapes are commonly used in flooring projects like bonding underlays, luxury vinyl tiles (LVT), carpets, laminate panels, ceramic tiles, and specialty underlayment systems. They offer strong, consistent adhesion, great surface contact, and faster installation times than traditional adhesives and mechanical fastening methods. Because they can be used for so many different types of flooring jobs, they are perfect for both homes and businesses that need fast, long-lasting, and high-quality finishes.

By End User, the residential segment is expected to grow at the highest rate over the projected period, primarily because rising housing development, home improvement, and renovation activities increase demand for reliable, efficient bonding solutions in everyday building applications.

Construction Adhesive Tapes Market: Regional Analysis

North America captures over 40% of the construction adhesive tape market revenue share during the analysis period. The region's growth is driven by infrastructure development & construction demand. North America's construction industry, which includes residential, commercial, and infrastructure sectors, is expanding as governments and private companies invest in modernization projects, housing developments, and commercial real estate. This increases the need for effective, long-lasting adhesive tapes that improve installation speed and structural performance. Also, to meet the performance needs of different substrates in current building projects, manufacturers in North America are investing in new types of adhesives, such as hot-melt and pressure-sensitive solutions. As technology advances, tape becomes more durable, can withstand higher temperatures, and is easier to use, making it more competitive with older bonding methods.

Besides, the Asia Pacific is growing at the fastest CAGR over the projected period. The expansion is mainly the result of a combination of interrelated economic and industry factors. Large-scale construction is underway in the residential, commercial, and infrastructure sectors due to rapid urbanization and population growth in major economies worldwide, namely China, India, Japan, Malaysia, and Australia. An example of government spending on infrastructure is the construction of roads, bridges, housing facilities, and public utilities in the aforementioned countries, which has increased demand for adhesives and sealants, such as tapes for flooring, façade installation, HVAC systems, and insulation.

Construction Adhesive Tapes Market: Competitive Analysis

The global construction adhesive tapes market is dominated by players like

- Ashland Inc

- Gorilla Glue Inc

- Berry Global Inc

- DuPont de Nemours Inc

- Bostik Ltd

- Intertape Polymer Group Inc

- Henkel AG and Co KGaA

- H B Fuller Co

- Kolon Industries Inc

- KCC SILICONE CORPORATION

- Tapecon Inc

- Nippon Industries

- Shurtape Technologies LLC

- Nitto Denko Corp

- Sika AG

- Solvay SA

- The Dow Chemical Co

- YAMATO Co Ltd

The global construction adhesive tapes market is segmented as follows:

By Resin Type

- Acrylic

- Rubber

- Others

By Technology

- Hot-Melt Based

- Solvent-based

- Others

By Application

- Flooring

- Windows & Doors

- Roofing

- HVAC & Insulation

- Walls

- Others

By End User

- Residential

- Non-Residential

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed