Conductive Polymers Market Size, Share, and Growth Report 2032

Conductive Polymers Market - by Type (Electrically conducting and Thermally conducting), by End Users (Electronics, Automotive, Healthcare, Industrial, Aerospace and Others), by Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) -Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

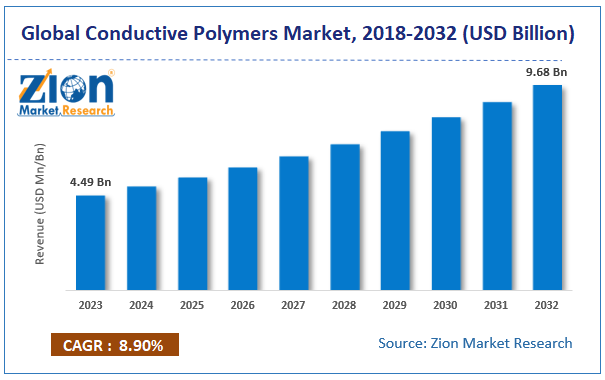

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.49 Billion | USD 9.68 Billion | 8.90% | 2023 |

The global conductive polymers market size was worth around USD 4.49 billion in 2023 and is predicted to grow to around USD 9.68 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.90% between 2024 and 2032.

Conductive Polymers Market: Overview

Conductive polymers are a new class of polymers having characteristic electrical and optical properties similar to that of metals and inorganic semiconductors. One of the key advantages of conductive polymers is that their electrical, physical, and chemical properties can be tailored depending on the application. Moreover, all of the above properties of conductive polymers can be altered and controlled through stimulation. Conductive polymers have large-scale applications in the microelectronics industry vis-à-vis light-emitting diodes (LEDs), batteries, photovoltaics, and displays.

The global conductive polymers market is driven by advancements in biomaterials, rising demand for display devices, growing demand for lightweight electronic components, availability of low-cost raw materials, new advances in electronics and electrical sectors, demand for lightweight electronic components, and increasing demand for smart materials. The low degree of conductivity of conductive polymers, poor selectivity of conductive polymers, falling prices of indium tin oxide, and manufacturers' preference for metal-based materials are the factors restraining the growth of the conductive polymer market for the forecast period.

Conductive polymers fall under the class of intrinsically conductive polymers (ICPs) having uncommon mechanical and conductive properties as compared to other polymers. Conductive polymer showcases optical and electrical properties similar to that of metals and inorganic semiconductors. They show exceptional control of electrical stimulus and have high conductivity to weight ratio. Conductive polymers can be engineered to be biocompatible, porous and biodegradable materials. They are being widely used in the microelectronics industry, diodes, batteries, electrochromic display and photovoltaic’s. Other key applications of conductive polymers include computer displays, surgical tools, fuel cells, and biosensors.

Conductive Polymers Market: Key Drivers

Rising demand for smart materials, low cost for raw materials, advancement in the electrical and electronic sector, growing display devices, demand for lightweight electronic components, a new advancement in biomaterials are some of the key drivers of conductive polymers market. Growth in conductive polymers market is hampered by falling prices of indium tin oxide, manufacturer preference towards metal-based materials, poor selectivity of conductive polymers and low degree conductivity compared to metal-based materials.

Conductive polymers, due to their unique electronic properties have been an area of interest since last three decades. They have been readily researched and applied in areas of sensors, energy storage systems, and actuators. New research development highlights developing conductive polymers that are of three dimensional in nature. These 3D based conductive polymers are used in the development of polymer-nanoparticle hybrid materials.

Conductive Polymers Market: Segmentation

The conductive polymer industry is segmented in terms of type and end users.

By type, the market is classified as electrically conducting materials and thermally conducting materials. The thermally conductive polymer materials segment is estimated to grow with the highest CAGR for the forecast period. The growth of thermally conductive polymers is propelled by rising demand for consumer electronics.

The end-user segment within the conductive polymer market is bifurcated in terms of automotive, healthcare, industrial, electronics, aerospace, and others. The automotive segment is growing with the highest CAGR for the forecasted period 2024-2032. The growth is largely driven by rising demand for hybrid electric vehicles/ electric vehicles. Conductive polymers are extensively used in vehicle heating systems, fuel systems, and touchscreen devices in automobiles.

Conductive Polymers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Conductive Polymers Market Research Report |

| Market Size in 2023 | USD 4.49 Billion |

| Market Forecast in 2032 | USD 9.68 Billion |

| Growth Rate | CAGR of 8.90% |

| Number of Pages | 110 |

| Key Companies Covered | BASF Inc., Celanese Corporation., Abtech Scientific Inc., 3M Company., Kemet Corporation., Polyone Corporation., Enthone Ltd., Hyperrion Catalysis International Inc., and Eeonyx Inc |

| Segments Covered | By Type, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Conductive Polymers Market: Regional Analysis

Conducting polymer market in the Asia Pacific is estimated to grow with the highest CAGR for the forecasted period. Growth amongst Asia Pacific countries is largely driven by the thriving consumer electronics & automobiles market, and increasing investment in infrastructural development across residential & commercial properties. Key markets for conductive polymers within Asia Pacific regions are Indonesia, Thailand, China, and India. Likewise, North America and Europe are holding the highest revenue share within the global conductive polymers market for the forecasted period. The growth of conductive polymers in North America and Europe is driven by favorable government & regulatory guidelines, the large-scale presence of original equipment manufacturers (OEMs), significant R&D expenditure, and adequate infrastructure.

Conductive Polymers Market: Competitive Space

- BASF Inc.

- Celanese Corporation.

- Abtech Scientific Inc.

- 3M Company.

- Kemet Corporation.

- Polyone Corporation.

- Enthone Ltd.

- Hyperrion Catalysis International Inc.

- Eeonyx Inc

The report segments the global Conductive Polymers Market as follows:

By Type

- Thermally conductive polymers

- Electrically conductive polymers

By End-Use Industry

- Aerospace

- Electronics

- Automotive

- Healthcare

- Industrial

- Others

By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Conductive polymers are a new class of polymers having characteristic electrical and optical properties similar to that of metals and inorganic semiconductors.

According to study, the global conductive polymers market size was worth around USD 4.49 billion in 2023 and is predicted to grow to around USD 9.68 billion by 2032.

The CAGR value of conductive polymers market is expected to be around 8.90% during 2024-2032.

Asia Pacific has been leading the global conductive polymers market and is anticipated to continue on the dominant position in the years to come.

The global conductive polymers market is led by players like BASF Inc., Celanese Corporation., Abtech Scientific Inc., 3M Company., Kemet Corporation., Polyone Corporation., Enthone Ltd., Hyperrion Catalysis International Inc., and Eeonyx Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed