Colon Cancer Screening Market Size, Share, Trends, Growth & Forecast 2034

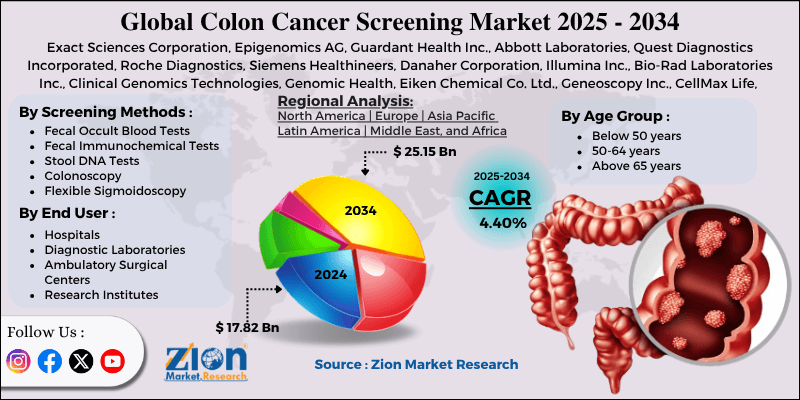

Colon Cancer Screening Market By Screening Methods (Fecal Occult Blood Tests [FOBT], Fecal Immunochemical Tests [FIT], Stool DNA Tests, Colonoscopy, Flexible Sigmoidoscopy, Virtual Colonoscopy [CT Colonography]), By Age Group (Below 50 years, 50-64 years, Above 65 years), By End-User (Hospitals, Diagnostic Laboratories, Ambulatory Surgical Centers, Research Institutes), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

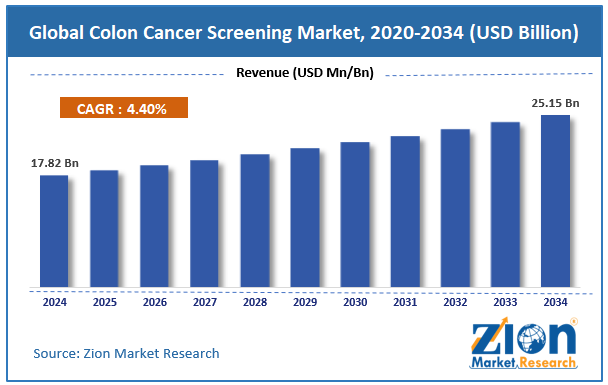

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.82 Billion | USD 25.15 Billion | 4.40% | 2024 |

Colon Cancer Screening Industry Perspective:

The global colon cancer screening market size was worth around USD 17.82 billion in 2024 and is predicted to grow to around USD 25.15 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.40% between 2025 and 2034.

Colon Cancer Screening Market: Overview

Colon cancer screening helps early detection of colorectal cancer through different tests to identify cancer or precancerous polyps in its primary stages, when treatment is highly effective. Standard screening techniques comprise fecal immunochemical tests, fecal occult blood tests, and stool DNA tests. The global colon cancer screening market is likely to expand rapidly, fueled by the growing elderly population, government-backed screening programs, and improvements in screening tools. The risk of colon cancer increases significantly after the age of 50. The global population aged 60 and above is projected to reach 2 billion by 2050, according to the UN's estimate, which will notably increase screening demand. The aging populace in the United States, China, and Germany is the leading driver.

Governments in nations like Germany, Australia, the UK, and the United States offer subsidized or free screening. The U.S. CDC's Colorectal Cancer Control Program has significantly increased screening demand among the underserved population. National guidelines and public insurance majorly increase mass adoption. Moreover, the launch of non-invasive tests, such as AI-based colonoscopies and Cologuard, has also occurred. Advancements enhance accuracy, patient comfort, and speed of diagnosis. Capsule endoscopy and digital colonoscopy are gaining traction as less invasive alternative methods.

Despite the growth, the global market is impeded by factors such as low access in low-income regions and patient discomfort and reluctance. Several middle- and low-income countries lack trained personnel, adequate infrastructure, and effective screening programs. Consequently, fewer than 10% of eligible people in sub-Saharan Africa undergo this screening. Additionally, fear of the procedure, embarrassment, and preparation requirements are some key obstacles to participation. Invasive tests prevent patient compliance, mainly among rural and elderly patients.

Nonetheless, the global colon cancer screening industry stands to gain from several key opportunities, including AI integration in colposcopy, remote testing services, telehealth, and advancements in liquid biopsy. AI-based detection systems are improving polyp detection precision. AI decreases oversight errors and backs real-time diagnostics, thereby enhancing patient outcomes. Also, incorporating telehealth platforms with remote test kits drives follow-up care and convenience. Companies offering home-to-lab services may dominate after the pandemic. Furthermore, the development of blood-based biomarkers for early colon cancer detection provides a painless alternative. Liquid biopsy is projected to transform early-stage diagnosis in the upcoming years.

Key Insights:

- As per the analysis shared by our research analyst, the global colon cancer screening market is estimated to grow annually at a CAGR of around 4.40% over the forecast period (2025-2034)

- In terms of revenue, the global colon cancer screening market size was valued at around USD 17.82 billion in 2024 and is projected to reach USD 25.15 billion by 2034.

- The colon cancer screening market is projected to grow significantly owing to increasing global colorectal cancer cases, surging demand for at-home screening kits, and improvements in diagnostic technologies.

- Based on screening methods, the colonoscopy segment is expected to lead the market, while the Fecal Immunochemical Tests (FIT) segment is expected to grow considerably.

- Based on age group, the 50-64 years segment is the dominating segment, while the above 65 years segment is projected to witness sizeable revenue over the forecast period.

- Based on end user, the hospitals segment is expected to lead the market compared to the diagnostic laboratories segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Colon Cancer Screening Market: Growth Drivers

Increased insurance coverage and healthcare spending spur market growth

The steady growth in healthcare expenditure worldwide, along with more exhaustive insurance coverage for predictive diagnostics, has significantly enhanced access to colon cancer screening. The WHO reports that global health expenditure hit USD 9.8 trillion in 2023, with higher distribution to non-communicable disease prevention. In the United States, private insurers and Medicare are required to cover colon cancer screening tests, including stool DNA tests, colonoscopies, and FIT tests, without patient copayments.

China's government-aided Healthy China 2030 initiative comprises goals to improve early cancer detection through subsidized screening. As insurance penetration increases, cost barriers are weakened, promoting stronger growth in the colon cancer screening market.

Growing public health campaigns and awareness remarkably fuel the market growth

Educational campaigns by NGOs, governments, and healthcare providers are increasing awareness regarding the significance of screening and its effect on survival rates. In the United States, programs like 'the 80% in Every Community' by the National Colorectal Cancer Roundtable aim to expand screening rates to 80% in all populations. As of 2023, the United States achieved screening compliance of approximately 69%, with remarkable progress among the underprivileged groups.

Colon Cancer Screening Market: Restraints

Test limitations and false negatives/positives hamper the market progress

Although colon cancer screenings are essential and increasing in number, restrictions in diagnostic precision continue to limit industry acceptance and trust. For example, fecal immunochemical tests may return false negatives in nearly 30% cases, comprising adenomatous polyps, which are likely to cause cancer. Stool DNA tests like the Cologuard test, despite being highly sensitive, may produce false positives in around 13% cases, resulting in patient anxiety and unnecessary colonoscopies.

Colon Cancer Screening Market: Opportunities

Collaborations with genomics and tech companies positively impact market growth

Strategic collaboration between biotechnology companies, technology companies, and diagnostic providers is offering new roads for advancements in colon cancer screening. Alliances in bioinformatics, genomic profiling, and multi-omics are improving the precision of early-stage detection via blood-based and molecular tests.

For example, GRAIL, supported by Illumina, is modernizing its Galleri test, which detects more than 50 types of cancers, including colorectal cancer, via a single blood sample. These collaborations are expected to boost the progress of the colon cancer screening industry.

Exact Sciences associated with the Mayo Clinic in 2023 to develop next-gen multi-cancer screening tools, while Roche Diagnostics capitalized on AI-based histopathology analysis to enhance diagnostic workflows.

Colon Cancer Screening Market: Challenges

Limited diagnostic infrastructure in rural areas limits the market growth

The lack of specialized centers and diagnostic equipment in remote and rural regions limits screening coverage. Colonoscopy, the gold-standard method, needs a high-endoscopy machine, sterilization, anesthesia, and an experienced workforce, all of which are usually not available outside urban hospitals.

This urban-rural disparity results in higher mortality rates and delayed diagnostics in underserved regions. Additionally, even where stool DNA tests and FIT are unavailable, poor specimen transport systems and a lack of laboratory networks can challenge the reliability of results.

Colon Cancer Screening Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Colon Cancer Screening Market |

| Market Size in 2024 | USD 17.82 Billion |

| Market Forecast in 2034 | USD 25.15 Billion |

| Growth Rate | CAGR of 4.40% |

| Number of Pages | 213 |

| Key Companies Covered | Exact Sciences Corporation, Epigenomics AG, Guardant Health Inc., Abbott Laboratories, Quest Diagnostics Incorporated, Roche Diagnostics, Siemens Healthineers, Danaher Corporation, Illumina Inc., Bio-Rad Laboratories Inc., Clinical Genomics Technologies, Genomic Health, Eiken Chemical Co. Ltd., Geneoscopy Inc., CellMax Life, and others. |

| Segments Covered | By Screening Methods, By Age Group, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Colon Cancer Screening Market: Segmentation

The global colon cancer screening market is segmented based on screening methods, age group, end user, and region.

Based on screening methods, the global colon cancer screening industry is divided into fecal occult blood tests (FOBT), fecal immunochemical tests (FIT), stool DNA tests, colonoscopy, flexible sigmoidoscopy, and virtual colonoscopy (CT Colonography). The colonoscopy segment remains the leading screening technique in the global market because of its high diagnostic accuracy, long screening intervals, and ability to detect and remove polyps during the same process. Colonoscopy registers for the largest share, mainly in developed regions, according to the American Cancer Society. This is because of the broader medical infrastructure and insurance coverage.

Based on age group, the global colon cancer screening market is segmented into below 50 years, 50-64 years, and above 65 years. The 50-64 years segment accounted for a larger industry share due to a high participation rate, growing awareness among this age group, and employer-sponsored health plans. This group has historically been the initial target of screening guidelines globally, like those from the USPSTF and European Commission, which long suggested beginning regular screening at 50 years of age.

Based on end user, the global market is segmented into hospitals, diagnostic laboratories, ambulatory surgical centers, and research institutes. The hospitals segment leads the global market. They conduct the majority of sigmoidoscopies, colonoscopies, and follow-up diagnostic procedures because of their multidisciplinary care, advanced infrastructure, and access to specialized equipment. Hospitals also serve as key hubs for outpatient and inpatient populations, making them crucial for colon cancer screening, particularly in developed and urban regions.

Colon Cancer Screening Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is anticipated to retain its leading role in the global colon cancer screening market as a result of high disease incidence rates, strong insurance coverage and reimbursement, and improved healthcare accessibility. North America, especially the U.S., holds the leading cases of colon cancer across the globe. As per the American Cancer Society, more than 1,52,000 fresh colon cancer cases are projected to hail from the U.S alone in 2024.

The growth in early-onset colon cancer has triggered increased policy shifts and awareness. Moreover, in North America, private and public insurers encompass a broader range of screening tests, comprising stool DNA tests, FIT, and colonoscopies. This strong financial support removes cost barriers and drives screening uptake in demographics.

Furthermore, the region boasts a robust healthcare infrastructure, featuring diagnostic laboratories and specialized gastroenterology centers. More than 6,000 hospitals and 15,000 outpatient centers in the United States offer screening services with trained personnel and advanced equipment. Accessibility in both rural and urban areas contributes to the increasing demand for screening.

Europe ranks as the second-largest region in the global colon cancer screening industry, driven by strong regulatory support, population-based and organized screening programs, and the rising adoption of painless testing methods. The European Society for Medical Oncology and Eurostat are increasingly supporting colon cancer prevention programs. The 'Europe's Beating Cancer Plan' by the EU aims for 90% eligible population to be offered screening tests by 2025, driving program funding and expansion. Several European nations run regional or national organized screening programs targeting adults aged 50-74 years.

For instance, the United Kingdom, France, the Netherlands, and Italy offer systematic population-wide screening tests (usually FIT every 2 years). These government-led and structured programs fuel early diagnosis and continuous participation.

European nations are broadly adopting non-invasive tools, such as stool DNA and FIT, in their screening regulations. FIT has largely replaced guaiac FOBT because of better patient adherence and sensitivity. This inclination enhances participation, particularly among asymptomatic individuals and those reluctant to undergo invasive tests.

Colon Cancer Screening Market: Competitive Analysis

The leading players in the global colon cancer screening market are:

- Exact Sciences Corporation

- Epigenomics AG

- Guardant Health Inc.

- Abbott Laboratories

- Quest Diagnostics Incorporated

- Roche Diagnostics

- Siemens Healthineers

- Danaher Corporation

- Illumina Inc.

- Bio-Rad Laboratories Inc.

- Clinical Genomics Technologies

- Genomic Health

- Eiken Chemical Co. Ltd.

- Geneoscopy Inc.

- CellMax Life

Colon Cancer Screening Market: Key Market Trends

Integration of artificial intelligence in colonoscopy:

AI-based tools are primarily integrated into colonoscopies to enhance polyp detection and minimize human error. Devices like Olympus' Endo-AID and Medtronic's GI Genius use real-time image analysis to facilitate gastroenterologists. This trend speeds up procedures, enhances diagnostic accuracy, and is gaining CE and FDA approvals.

Growth of government-funded screening programs:

Governments are scaling up national colon screening programs to fuel participation and lessen late-stage diagnoses. The European Union's Beating Cancer Plan aims for 90% screening coverage among eligible individuals by 2025, while Latin American nations and India are piloting similar programs. Public investments are increasing access, mainly in underprivileged regions.

The global colon cancer screening market is segmented as follows:

By Screening Methods

- Fecal Occult Blood Tests (FOBT)

- Fecal Immunochemical Tests (FIT)

- Stool DNA Tests

- Colonoscopy

- Flexible Sigmoidoscopy

- Virtual Colonoscopy (CT Colonography)

By Age Group

- Below 50 years

- 50-64 years

- Above 65 years

By End User

- Hospitals

- Diagnostic Laboratories

- Ambulatory Surgical Centers

- Research Institutes

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Colon cancer screening helps early detection of colorectal cancer through different tests to identify cancer or precancerous polyps in its primary stages, when treatment is highly effective. Standard screening techniques comprise fecal immunochemical tests, fecal occult blood tests, and stool DNA tests.

The global colon cancer screening market is projected to grow due to growing education and awareness on early cancer detection, NGO and government-led screening programs, and supportive reimbursement policies for colon cancer screening.

According to study, the global colon cancer screening market size was worth around USD 17.82 billion in 2024 and is predicted to grow to around USD 25.15 billion by 2034.

The CAGR value of the colon cancer screening market is expected to be around 4.40% during 2025-2034.

North America is expected to lead the global colon cancer screening market during the forecast period.

The key players profiled in the global colon cancer screening market include Exact Sciences Corporation, Epigenomics AG, Guardant Health Inc., Abbott Laboratories, Quest Diagnostics Incorporated, Roche Diagnostics, Siemens Healthineers, Danaher Corporation, Illumina Inc., Bio-Rad Laboratories Inc., Clinical Genomics Technologies, Genomic Health, Eiken Chemical Co., Ltd., Geneoscopy Inc., and CellMax Life.

The report examines key aspects of the colon cancer screening market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed