Coconut Syrup Market Size, Share, Trends, Growth & Forecast 2034

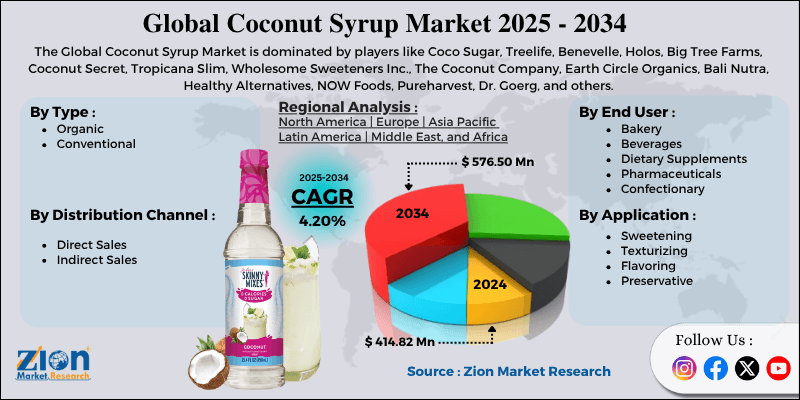

Coconut Syrup Market By Type (Organic, Conventional), By Application (Sweetening, Texturizing, Flavoring, Preservative), By End-User (Bakery Beverages, Dietary Supplements, Pharmaceuticals, Confectionery), By Distribution Channel (Direct Sales, Indirect Sales), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

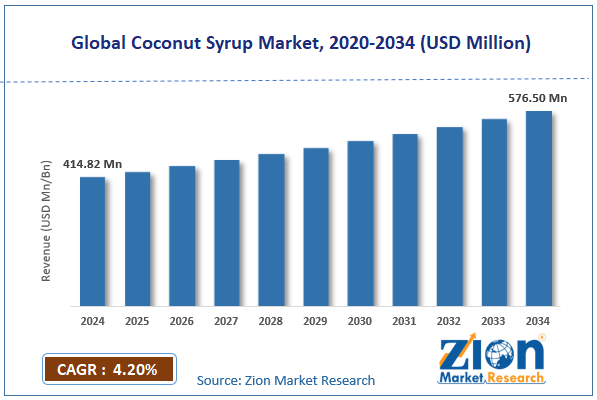

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 414.82 Million | USD 576.50 Million | 4.20% | 2024 |

Coconut Syrup Industry Perspective:

The global coconut syrup market size was approximately USD 414.82 million in 2024 and is projected to reach around USD 576.50 million by 2034, with a compound annual growth rate (CAGR) of approximately 4.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global coconut syrup market is estimated to grow annually at a CAGR of around 4.20% over the forecast period (2025-2034)

- In terms of revenue, the global coconut syrup market size was valued at around USD 414.82 million in 2024 and is projected to reach USD 576.50 million by 2034.

- The coconut syrup market is projected to grow significantly due to the increasing consumer inclination toward clean-label products, the expansion of the vegan and vegetarian food market, and the growth of the functional food and beverage industry.

- Based on type, the organic segment is expected to lead the market, while the conventional segment is expected to grow considerably.

- Based on application, the sweetening segment is the largest, while the flavoring segment is projected to experience substantial revenue growth over the forecast period.

- Based on the end-user, the bakery segment is expected to lead the market compared to the beverages segment.

- Based on the distribution channel, the indirect sales segment is the dominating segment, while the direct sales segment is projected to witness sizeable revenue over the forecast period.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Coconut Syrup Market: Overview

Coconut syrup is a natural sweetener made of the sap of coconut blossoms, offering a lower glycemic index than refined sugar and a rich caramel-like flavor. It is broadly used in desserts, beverages, health foods, and bakery products as a healthier sugar alternative. Its popularity is attributed to its vegan-friendly and organic nature, primarily among health-conscious individuals. The global coconut syrup market is expected to expand rapidly, driven by growing health awareness, increasing demand for plant-based and vegan products, and the expansion of the food and beverage sector. Rising health consciousness is driving consumers away from refined sugars and toward natural sweeteners. Coconut syrup's content and low glycemic index appeal to weight-conscious individuals and those with diabetes. This move is driving continuous demand in clean-label and health-focused product categories.

Moreover, the rise in plant-based diets and veganism has led to coconut syrup being ranked as the best sugar alternative. Its ethical sourcing and origin perfectly support vegan consumer values. Food manufacturers are integrating it into vegan beverages, desserts, and condiments to meet the growing demand. Furthermore, coconut syrup is progressively used in confectionery, bakery sauces, and drinks for texture benefits and flavor. Premium brands and artisanal products prefer it for its health appeal and authenticity. This diversification in applications has led to a significant increase in global consumption.

Despite the growth, the global market is hindered by factors such as limited supply chain infrastructure and a short shelf life. The industry faces challenges due to inadequate storage facilities and limited processing capabilities in producing regions. Coconut syrup's reliance on tropical cultivation also restricts scalability. Supply chain inefficiencies often result in inconsistent pricing and availability. Coconut syrup has a comparatively short shelf life due to its natural composition and the scarcity of preservatives. This makes long-distance export challenging without modernized packaging solutions. Manufacturers should invest in stabilization solutions to maintain optimal quality.

Nonetheless, the global coconut syrup industry stands to gain from several key opportunities, including expanding applications in food and beverages, as well as advancements in shelf life and packaging. Coconut syrup's unique caramel flavor and nutritional profile allow its use in sauces, mocktails, snacks, and coffee. Beverage manufacturers are discovering it as a natural sweetening base. This broad applicability offers producers diverse revenue streams.

Additionally, advanced packaging solutions, such as glass bottling and vacuum sealing, can extend the shelf life of coconut syrup. Eco-friendly and appealing packaging improves retail visibility. These advancements make the product more attractive for both domestic and export markets.

Coconut Syrup Market Dynamics

Growth Drivers

How is the shift from refined sugar and increasing health awareness driving the coconut syrup market?

Growing concerns about metabolic disorders, obesity, and diabetes are fueling consumers to seek low-glycemic sweetening alternatives like coconut syrup. Its natural composition, rich in minerals like zinc, potassium, and iron, ranks it as a healthier substitute for processed sugar. This awareness has triggered food brands like Big Tree Farms and Nature's Charm to promote coconut syrup as a 'functional sweetener'. The ingredient's perceived nutritional edge continues to appeal to health-conscious consumers and reformulators in the food sector.

How is the coconut syrup market augmented by the expanding applications in the food and beverage industry?

The versatility of coconut syrup in confectionery, bakery, functional foods, sauces, and beverages is boosting the penetration of the coconut syrup market. Food manufacturers are using it as a natural binding and flavor-improving ingredient, capitalizing on its caramel-like taste and low glycemic index. Monin introduced its new syrup range in 2024, targeting the growing craft beverage and cocktail industry. As consumer palates evolve toward exotic and tropical flavors, the adoption of coconut syrup in both mainstream and artisanal products is intensifying rapidly.

Restraints

Quality control and shelf-life challenges negatively impact the market progress

Coconut syrup's high sugar content and high moisture make it vulnerable to microbial contamination and fermentation if not stored properly. According to the reports, approximately 12% of exported coconut syrup batches experienced spoilage issues because of inadequate storage during shipment. Maintaining consistent viscosity, flavor, and color in batches is another technical issue for producers. The lack of universal quality standards or harmonized labeling regulations further complicates international trade. For example, in 2023, the EFSA delayed approvals for many imported coconut syrup brands, mentioning microbial testing data. These issues create significant limitations for small producers seeking to expand globally.

Opportunities

How do product innovation and value-added derivatives offer advantageous conditions for the development of the coconut syrup market?

Advancements in flavor variants, packaging formats, and organic certification are fostering new revenue streams in the global coconut syrup industry. Companies are experimenting with flavored syrups, such as cacao-coconut and vanilla-coconut, as well as sustainable packaging, to attract environmentally conscious consumers. For instance, Dr. Goerg launched a carbon-neutral production model in 2024 to appeal to green consumers in Europe. This advancement-driven diversification can improve brand differentiation and fuel premium pricing opportunities.

Challenges

Market price volatility and competition pressure restrict the market growth

The fluctuating price of raw sap coconut sap, fueled by regional demand and weather, creates price instability for syrup producers. According to the World Bank Commodity Data 2024, a 13% spike in coconut product prices following drought conditions in the Philippines and Indonesia. Simultaneously, coconut syrup competes with low-cost sweeteners, such as corn syrup and agave, which benefit from economies of scale. Leading buyers usually negotiate rigorously, squeezing profit margins for small producers. Without hedging mechanisms or cooperative price stabilization policies, this volatility is still a recurring financial challenge in the market.

Coconut Syrup Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Coconut Syrup Market |

| Market Size in 2024 | USD 414.82 Million |

| Market Forecast in 2034 | USD 576.50 Million |

| Growth Rate | CAGR of 4.20% |

| Number of Pages | 212 |

| Key Companies Covered | Coco Sugar, Treelife, Benevelle, Holos, Big Tree Farms, Coconut Secret, Tropicana Slim, Wholesome Sweeteners Inc., The Coconut Company, Earth Circle Organics, Bali Nutra, Healthy Alternatives, NOW Foods, Pureharvest, Dr. Goerg, and others. |

| Segments Covered | By Type, By Application, By End User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Coconut Syrup Market: Segmentation

The global coconut syrup market is segmented by type, application, end-user, distribution channel, and region.

Based on type, the global coconut syrup industry is divided into organic and conventional. The organic segment holds a leading share because of the rising demand for chemical-free, sustainably produced, and natural sweeteners.

On the other hand, the conventional segment holds a second-leading share since it is broadly accessible and more affordable for large-scale food processing.

Based on application, the global market is segmented into sweetening, texturizing, flavoring, and preservative. The sweetening segment leads the market due to its primary use as a natural sugar alternative in the food sector.

Conversely, the flavoring segment holds the second position, as coconut syrup enhances the aroma and taste of bakery, beverage, and confectionery products.

Based on end-user, the global coconut syrup market is segmented into bakery, beverages, dietary supplements, pharmaceuticals, and confectionery. The bakery segment dominates the market due to its extensive use as a sweetener and flavor enhancer in pastries, desserts, and breads.

Nonetheless, the beverages segment ranks second, as coconut syrup is increasingly used in smoothies, coffees, and health drinks for its nutritional benefits and rich taste.

Based on the distribution channel, the global market is segmented into direct sales and indirect sales. The indirect sales segment holds leadership due to the strong presence of specialty stores, e-commerce platforms, and supermarkets, expanding product accessibility.

However, the direct sales segment holds a second-leading position since manufacturers increasingly supply coconut syrup directly to industrial buyers and food processors.

Coconut Syrup Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Coconut Syrup Market?

The Asia Pacific is expected to maintain its leading position in the global coconut syrup market, driven by the abundant availability of raw materials, strong export-oriented production, and increasing demand for natural sweeteners. The Asia Pacific, particularly Indonesia, the Philippines, Sri Lanka, and Thailand, produces more than 85% of the world's coconuts, according to the FAO (2024). This rich supply of raw materials promises cost-effective and steady production of coconut syrup. The region's strong agricultural base reduces its reliance on imports, offering a natural production advantage.

Moreover, economies like Indonesia and the Philippines are leaders in exporting coconut-based products, including syrup. Export volumes of coconut-derived sweeteners from Southeast Asia progressed by 11% YoY in 2024, denoting strong international demand. Supportive trade policies and government-supported coconut development programs improve export competitiveness. The region's health-conscious population and rapidly urbanizing areas are moving towards natural sugar substitutes. Coconut syrup is favored due to its nutrient-rich and low glycemic index profile, which supports regional wellness trends. Markets like Japan, South Korea, and India are experiencing double-digit growth in natural sweetener consumption.

North America ranks as the second-largest region in the global coconut syrup industry, driven by the expansion of the plant-based and vegan market, a strong e-commerce and retail presence, and the broad adoption of coconut syrup in the food industry. North America's vegan population surpassed 10 million in 2024, leading to increased consumption of plant-based products. Coconut syrup complements lactose-free and vegan formulations perfectly.

Food brands are integrating it into beverage, dairy-alternative, and bakery categories to meet health-driven and ethical consumer demand. The region's advanced retail structure, led by Whole Foods, Walmart, and Amazon, improves product accessibility. E-commerce platforms have boosted sales of artisanal and organic coconut syrups with convenient online delivery. The region is expected to account for approximately 30% of worldwide online natural sweetener sales in 2024.

Additionally, restaurants and leading food manufacturers are substituting refined sugars with coconut syrup in product formulations. Its rich caramel-like flavor is broadly used in specialty coffees, sauces, and desserts. Constant product innovation and premium ranking in the food industry sustain regional dominance.

Coconut Syrup Market: Competitive Analysis

The leading players in the global coconut syrup market are:

- Coco Sugar

- Treelife

- Benevelle

- Holos

- Big Tree Farms

- Coconut Secret

- Tropicana Slim

- Wholesome Sweeteners Inc.

- The Coconut Company

- Earth Circle Organics

- Bali Nutra

- Healthy Alternatives

- NOW Foods

- Pureharvest

- Dr. Goerg

Coconut Syrup Market: Key Market Trends

Rising use in functional foods and beverages:

Coconut syrup is gaining prominence as a natural sweetener in smoothies, energy drinks, nutritional bars, and mocktails. Its low glycemic index and rich flavor make it a preferred alternative to refined sugars. Beverage producers are using it to improve product taste and support wellness trends.

Flavor diversification and product innovation:

Producers are launching infused and flavored coconut syrups, such as caramel, vanilla, and cinnamon, to expand their usage in beverages and desserts. Advancements in packaging, including bottle jars and squeezable bottles, are improving consumer convenience. This diversification enables brands to reach a wider range of demographic segments.

The global coconut syrup market is segmented as follows:

By Type

- Organic

- Conventional

By Application

- Sweetening

- Texturizing

- Flavoring

- Preservative

By End User

- Bakery

- Beverages

- Dietary Supplements

- Pharmaceuticals

- Confectionary

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Coconut syrup is a natural sweetener made of the sap of coconut blossoms, offering a lower glycemic index than refined sugar and a rich caramel-like flavor. It is broadly used in desserts, beverages, health foods, and bakery products as a healthier sugar alternative. Its popularity is attributed to its vegan-friendly and organic nature, primarily among health-conscious individuals.

The global coconut syrup market is projected to grow due to escalating demand for natural and plant-based sweeteners, increasing use of coconut-based ingredients in bakery and confectionery, and the speedy expansion of the organic food market.

According to study, the global coconut syrup market size was worth around USD 414.82 million in 2024 and is predicted to grow to around USD 576.50 million by 2034.

The CAGR value of the coconut syrup market is expected to be approximately 4.20% from 2025 to 2034.

Market trends and consumer preferences in the coconut syrup market are shifting toward clean-label, organic, and sustainably sourced sweeteners, driven by the growing adoption of a plant-based lifestyle and increasing health consciousness.

Regulatory and environmental factors influencing the coconut syrup market include sustainable farming requirements, stringent organic certification standards, and environmental policies that promote eco-friendly coconut cultivation practices.

Pricing trends in the coconut syrup market indicate a steady rise, driven by organic certification expenses, increasing production costs, and premium positioning. However, bulk sourcing and competition are helping to stabilize prices in key regions.

Asia Pacific is expected to lead the global coconut syrup market during the forecast period.

The key players profiled in the global coconut syrup market include Coco Sugar, Treelife, Benevelle, Holos, Big Tree Farms, Coconut Secret, Tropicana Slim, Wholesome Sweeteners Inc., The Coconut Company, Earth Circle Organics, Bali Nutra, Healthy Alternatives, NOW Foods, Pureharvest, and Dr. Goerg.

The report examines key aspects of the coconut syrup market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed