Cocoa Liquor Market Size, Share, Trends, Growth and Forecast 2034

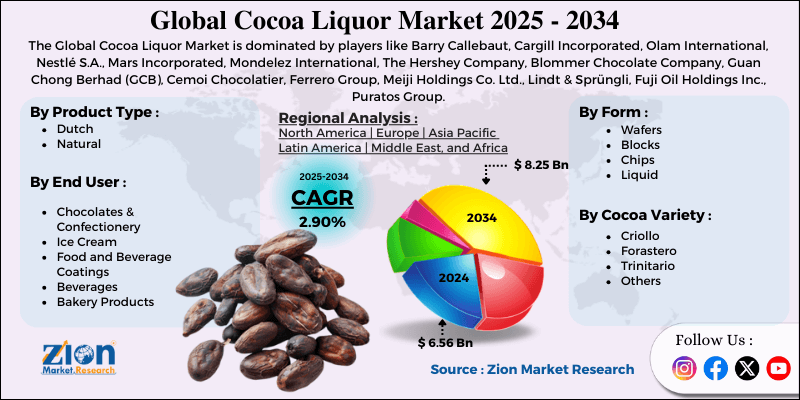

Cocoa Liquor Market By Product Type (Dutch, Natural), By Form (Wafers, Blocks, Chips, Liquid), By Cocoa Variety (Criollo, Forastero, Trinitario, and Others), By End Use Industry (Chocolates & Confectionery, Ice Cream, Food and Beverage Coatings, Beverages, Bakery Products, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

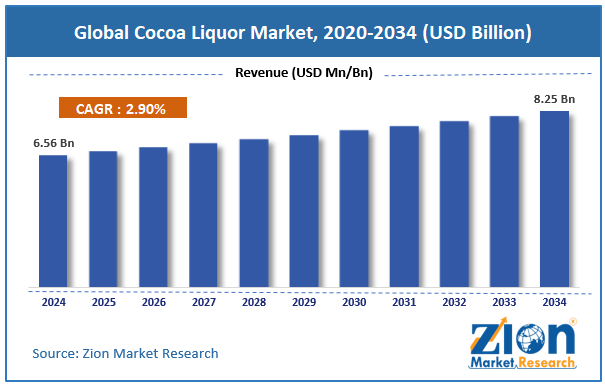

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.56 Billion | USD 8.25 Billion | 2.90% | 2024 |

Cocoa Liquor Industry Perspective:

The global cocoa liquor market size was worth around USD 6.56 billion in 2024 and is predicted to grow to around USD 8.25 billion by 2034, with a compound annual growth rate (CAGR) of roughly 2.90% between 2025 and 2034.

Cocoa Liquor Market: Overview

Cocoa liquor is a main ingredient in chocolate production, made by grinding roasted cocoa nibs into a thick, smooth paste. It comprises cocoa butter and cocoa solids in natural proportions, offering a creamy texture and rich flavor. It does not contain alcohol and is called liquor because of its liquid state when ground. The global cocoa liquor market is poised for notable growth owing to the health benefits of cocoa products, the progressing confectionery and bakery sector, and the premiumization of chocolate products. Cocoa liquor contains antioxidants and flavonoids, which are primarily associated with cognitive and cardiovascular health benefits. Consumers are showing a rising preference for functional foods and dark chocolate enriched with cocoa liquor. Cocoa liquor improves texture, flavor, and color in pastries, biscuits, and cakes.

Growing demand for convenience foods and urban lifestyles continues to fuel bakery expansion, indirectly driving the cocoa liquor sector. Consumers, mainly in North America and Europe, are primarily seeking artisanal, high-quality, and origin-specific chocolate. Hence, the premiumization trend motivates the use of cocoa liquor with higher cocoa content and traceable sourcing.

Nevertheless, the global market faces limitations due to factors such as price fluctuations of cocoa beans and health concerns over chocolate and sugar consumption. Cocoa liquor prices are directly associated with raw cocoa bean costs, which fluctuate because of pests, weather, and political instability in the producing economies. This variation creates uncertainty in supply chains and negatively affects profit margin for producers.

Also, while cocoa liquor has health benefits, several chocolate consumables are high in fat and sugar, increasing concerns about diabetes and obesity. Rising health consciousness among consumers may limit the growth of mainstream chocolate, ultimately affecting the demand for cocoa liquor.

Still, the global cocoa liquor industry benefits from several favorable factors, like the growth in vegan and plant-based markets and nutraceutical and functional applications. The worldwide vegan food market is anticipated to reach $36 billion by 2030, fueling the demand for plant-based chocolate. Cocoa liquor serves as a dairy-free and natural base, complying perfectly with lactose-intolerant and vegan consumer requirements. Cocoa liquor's antioxidant-rich composition increases its suitability for functional beverages and nutraceuticals. Producers are developing cocoa-enriched energy bars, drinks, and supplements, offering fresh growth opportunities.

Key Insights:

- As per the analysis shared by our research analyst, the global cocoa liquor market is estimated to grow annually at a CAGR of around 2.90% over the forecast period (2025-2034)

- In terms of revenue, the global cocoa liquor market size was valued at around USD 6.56 billion in 2024 and is projected to reach USD 8.25 billion by 2034.

- The cocoa liquor market is projected to grow significantly due to the increasing consumption of dark and premium chocolate, the growing use in personal care products and cosmetics, and the rise of modern retail channels and e-commerce.

- Based on product type, the natural segment is expected to lead the market, while the Dutch segment is expected to grow considerably.

- Based on form, the liquid segment is the dominating segment, while the blocks segment is projected to witness sizeable revenue over the forecast period.

- Based on cocoa variety, the forastero segment leads, while the trinitario segment will gain substantial share in the coming years.

- Based on end-use industry, the chocolates & confectionery segment is expected to lead the market compared to the bakery products segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by Latin America.

Cocoa Liquor Market: Growth Drivers

How is emerging market consumption fueling the global cocoa liquor market growth?

In Southeast Asia, a youthful consumer base and growing spending power are driving improved demand for snacking and indulgence. The chocolate confectionery industry in Indonesia progressed by 8% in 2023, backed by local manufacturing investments from Barry Callebaut and Mondelez. African markets, though small, are experiencing increased penetration via regional players and affordable single-serve products tapping into middle-class growth.

Foe cocoa liquor, these developing markets create incremental demand pools that offset stagnation in well-established nations.

Deforestation-free regulations and traceability spur the market growth

With Europe accounting for approximately 45% of worldwide cocoa imports, compliance has become a vital element in sourcing tactics. Chocolate brands are now prioritizing qualified and segregated liquor streams over uncertified beans to protect industry access.

For the cocoa liquor market, these regulatory shifts boost consolidation towards processors with the ability to deliver traceable and compliant products. Liquor is becoming more than just a commodity – an audit-proof and value-added ingredient that holds sustainability and compliance premiums, thus fueling structured demand growth.

Cocoa Liquor Market: Restraints

Disease outbreaks and climate vulnerability negatively impact market progress

Cocoa production is primarily exposed to disease pressure and climate change. This heavy supply-side risk underscores the reliability of liquor production across the globe. Processors reliant on steady bean inflows find it challenging to maintain continuous liquor output, compelling them to adjust or ration production. Smaller grinders are especially exposed since they lack diversified sourcing systems.

Cocoa Liquor Market: Opportunities

How is the global cocoa liquor market opportunistic to the rising demand in bakery, ice cream, and snacking applications?

Liquor is now supplied in many places beyond bars. It is primarily used in chips, inclusions, coatings, and fillings for desserts, snacks, and bakery products. Ice cream is another progressing market: the industry surpassed USD 80 billion in 2023, with quality chocolate-coated products gaining prominence in APAC. The brands introduced liquor-based snacking advancements like Kinder Bueno Ice-Cream, KitKat Bites, and Oreo Dipped.

This modification broadens the global cocoa liquor industry beyond seasonal tablet sales, and year-round demand in multiple product categories offers steady consumption progress for liquor suppliers.

Cocoa Liquor Market: Challenges

How are growing compliance and regulatory burdens restricting the growth of the cocoa liquor market?

The European Union’s deforestation law (2023) and the United States labor law scrutiny are increasing compliance prices for cocoa supply chains. Farmer training, traceability, and certification programs require substantial new investment. Barry Callebaut alone devoted Euro 100 million towards compliance systems in 2023.

These costs are mainly challenging for smaller exporters and grinders who cannot match the investment volume of multinationals. Compliance pressures also slow industry fluidity, since uncertified liquor and beans lose access to major markets like the EU.

Cocoa Liquor Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cocoa Liquor Market |

| Market Size in 2024 | USD 6.56 Billion |

| Market Forecast in 2034 | USD 8.25 Billion |

| Growth Rate | CAGR of 2.90% |

| Number of Pages | 212 |

| Key Companies Covered | Barry Callebaut, Cargill Incorporated, Olam International, Nestlé S.A., Mars Incorporated, Mondelez International, The Hershey Company, Blommer Chocolate Company, Guan Chong Berhad (GCB), Cemoi Chocolatier, Ferrero Group, Meiji Holdings Co. Ltd., Lindt & Sprüngli, Fuji Oil Holdings Inc., Puratos Group, and others. |

| Segments Covered | By Product Type, By Form, By Cocoa Variety, By End Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cocoa Liquor Market: Segmentation

The global cocoa liquor market is segmented based on product type, form, cocoa variety, end-use industry, and region.

Based on product type, the global cocoa liquor industry is divided into Dutch and natural. The natural cocoa liquor segment registers a substantial share of the market since it is less processed, retains high levels of flavonoids and antioxidants, and is broadly used in bakery, dark chocolate, and health-oriented applications.

On the other hand, the dutch segment ranks second since it is widely favored in beverages, confectionery, and bakery uses.

Based on form, the global market is segmented into wafers, blocks, chips, and liquid. The liquid form captured a remarkable share since chocolate producers and confectionery companies extensively use it.

Conversely, the block form is the second-largest segment, primarily utilized by small chocolate makers, bakeries, and foodservice industries, as it provides superior storage, handling, and transportation capabilities compared to liquid forms, making it ideal for medium-scale operations.

Based on cocoa variety, the global cocoa liquor market is segmented as Criollo, Forastero, Trinitario, and others. The forastero segment leads the market due to its bulk availability and affordability, increasing its preference for large-scale cocoa liquor production and mass-market production.

However, the trinitario holds a second-leading share since it offers the right balance of stronger flavor than forastero and better resilience than Criollo.

Based on end-use industry, the global market is segmented as chocolates & confectionery, ice cream, food and beverage coatings, beverages, bakery products, and others. The chocolates & confectionery segment dominates the global market since the cocoa liquor is the vital base for the production of all premium chocolate types.

Nonetheless, the bakery also grows substantially since it is extensively used in pastries, brownies, cakes, and biscuits to improve texture and flavor.

Cocoa Liquor Market: Regional Analysis

What gives Europe a competitive edge in the global Cocoa Liquor Market?

Europe is projected to maintain its dominant position in the global cocoa liquor market owing to the strong chocolate consumption rate, developed confectionery market, and advanced cocoa grinding capacity. Europe is a leading consumer of chocolate worldwide, registering for approximately 50% of the total chocolate sales. Nations like Germany, Switzerland, and the United Kingdom account for the highest per capita chocolate consumption, averaging 10-11 kg/person yearly. This robust consumer base directly fuels significant demand for cocoa liquor as the primary chocolate ingredient.

Moreover, Europe houses the leading confectionery companies like Ferrero, Mondelez, Lindt & Sprüngli, and Nestlé. These companies have strong manufacturing facilities in the region, promising large-scale cocoa liquor use. The presence of established brands ranks the region as a key hub for the demand for cocoa liquor. Furthermore, the region leads in cocoa processing, with Belgium, the Netherlands, and Germany among the leading cocoa grinders worldwide. This advanced infrastructure reinforces the region's prominence in the production of cocoa liquor.

Latin America maintains its position as the second-leading region in the global cocoa liquor industry due to the dominance in fine-flavor cocoa exports, rising domestic chocolate consumption, and the growing cocoa processing sector. Ecuador alone manufactures more than 60% of the world's fine-flavor Arriba Nacional cocoa, prized for its exceptional taste and aroma. Latin American cocoa is widely utilized in specialty and premium chocolate markets, providing the region with a competitive edge.

Additionally, the growing middle-class populations in economies like Mexico and Brazil are fueling chocolate consumption. Brazil represents the largest chocolate market in Latin America, estimated at more than $7 billion in 2023, with steady progress expected. This rising domestic demand fuels cocoa liquor use in Latin America itself.

The region has also been investing in local cocoa grinding to hold more value in the supply chain. Ecuador, for instance, processed nearly 2,00,000 metric tons of cocoa in 2022, becoming a regional leader in exporting cocoa liquor. Local processing capacity decreases dependence on raw bean exports and boosts the liquor industry.

Cocoa Liquor Market: Competitive Analysis

The leading players in the global cocoa liquor market are:

- Barry Callebaut

- Cargill Incorporated

- Olam International

- Nestlé S.A.

- Mars Incorporated

- Mondelez International

- The Hershey Company

- Blommer Chocolate Company

- Guan Chong Berhad (GCB)

- Cemoi Chocolatier

- Ferrero Group

- Meiji Holdings Co. Ltd.

- Lindt & Sprüngli

- Fuji Oil Holdings Inc.

- Puratos Group

Cocoa Liquor Market: Key Market Trends

Ethical sourcing and sustainability initiatives:

Rainforest Alliance, Fairtrade, and other certifications are becoming paramount in cocoa liquor supply chains. Regulators and consumers in North America and Europe demand traceable and sustainable cocoa. The leading brands are responding by investing in a transparent supply chain and responsible sourcing.

Technological improvements in traceability and processing:

Cocoa processors are adopting advanced fermentation, blockchain-based traceability systems, and roasting. These solutions enhance production efficiency, flavor consistency, and supply chain transparency. These advancements improve competitiveness in premium cocoa liquor and the mass market.

The global cocoa liquor market is segmented as follows:

By Product Type

- Dutch

- Natural

By Form

- Wafers

- Blocks

- Chips

- Liquid

By Cocoa Variety

- Criollo

- Forastero

- Trinitario

- Others

By End Use Industry

- Chocolates & Confectionery

- Ice Cream

- Food and Beverage Coatings

- Beverages

- Bakery Products

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cocoa liquor is a main ingredient in chocolate production, made by grinding roasted cocoa nibs into a thick, smooth paste. It comprises cocoa butter and cocoa solids in natural proportions, offering a creamy texture and rich flavor. It does not contain alcohol and is called liquor because of its liquid state when ground.

The global cocoa liquor market is projected to grow due to a rise in beverage and bakery applications, surging demand for confectionery and chocolate products, and rising health awareness of cocoa's antioxidants.

According to study, the global cocoa liquor market size was worth around USD 6.56 billion in 2024 and is predicted to grow to around USD 8.25 billion by 2034.

The CAGR value of the cocoa liquor market is expected to be around 2.90% during 2025-2034.

Emerging trends in the cocoa liquor market include fairtrade and sustainable sourcing, rising demand for premium single-origin cocoa, and growth into cosmetics and nutraceuticals. Innovations such as AI-driven processing, advanced fermentation, and blockchain traceability are improving supply chain transparency and quality.

Macroeconomic factors, such as growing disposable incomes in developing economies, will boost cocoa liquor and chocolate consumption. Nonetheless, currency fluctuations, inflation, and global trade disturbances may upsurge production costs and hinder supply chain stability.

Europe is expected to lead the global cocoa liquor market during the forecast period.

Ecuador is a major contributor to the global cocoa liquor market, known for producing more than 60% of the global fine-flavor cocoa.

The key players profiled in the global cocoa liquor market include Barry Callebaut, Cargill Incorporated, Olam International, Nestlé S.A., Mars Incorporated, Mondelez International, The Hershey Company, Blommer Chocolate Company, Guan Chong Berhad (GCB), Cemoi Chocolatier, Ferrero Group, Meiji Holdings Co., Ltd., Lindt & Sprüngli, Fuji Oil Holdings Inc., and Puratos Group.

The report examines key aspects of the cocoa liquor market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed