Cleaner & Degreaser Aftermarket Market Size, Share, Trends, Growth 2034

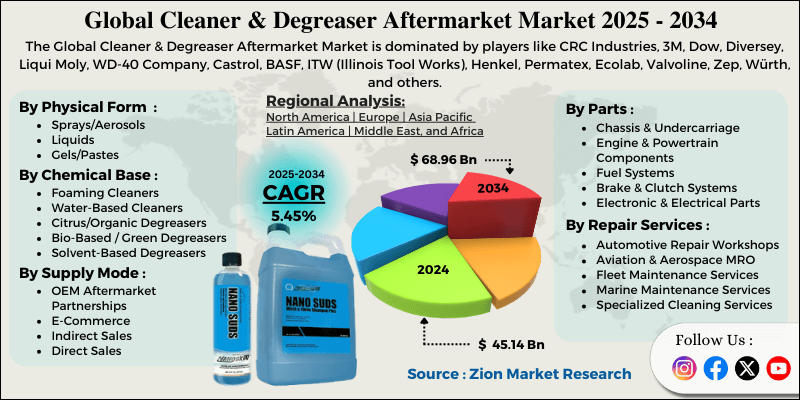

Cleaner & Degreaser Aftermarket Market By Parts (Chassis & Undercarriage, Engine & Powertrain Components, Fuel Systems, Brake & Clutch Systems, Electronic & Electrical Parts, Hydraulic & Pneumatic Components, and Tools & Workshop Equipment), By Physical Form (Sprays/Aerosols, Liquids, Gels/Pastes, and Wipes/Pre-moistened Pads), By Chemical Base (Foaming Cleaners, Water-Based Cleaners, Citrus/Organic Degreasers, Bio-Based / Green Degreasers, Solvent-Based Degreasers, and Others), By Supply Mode (OEM Aftermarket Partnerships, E-Commerce, Indirect Sales, and Direct Sales), By Repair Services (Commercial & Industrial Maintenance, Automotive Repair Workshops, Aviation & Aerospace MRO, Fleet Maintenance Services, Marine Maintenance Services, and Specialized Cleaning Services), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

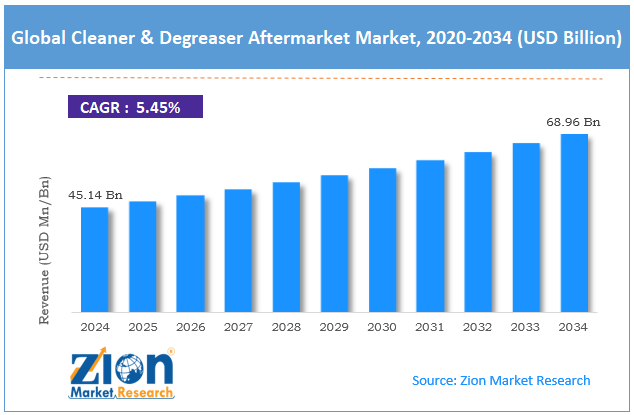

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 45.14 Billion | USD 68.96 Billion | 5.45% | 2024 |

Cleaner & Degreaser Aftermarket Industry Perspective:

What will be the global cleaner & degreaser aftermarket market size during the forecast period?

The global cleaner & degreaser aftermarket market size was worth around USD 45.14 billion in 2024 and is predicted to grow to around USD 68.96 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.45% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global cleaner & degreaser aftermarket market is estimated to grow annually at a CAGR of around 5.45% over the forecast period (2025-2034)

- In terms of revenue, the global cleaner & degreaser aftermarket market size was valued at around USD 45.14 billion in 2024 and is projected to reach USD 68.96 billion by 2034.

- The global cleaner & degreaser aftermarket market is projected to grow at a significant rate due to the rising rate of vehicle ownership across the globe.

- Based on the parts, the engine & powertrain components segment is growing at a high rate and will continue to dominate the global market, as per industry projections

- Based on the chemical base, the water-based cleaners segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Cleaner & Degreaser Aftermarket Market: Overview

The aftermarket cleaner and degreaser industry involves the production, sale, and distribution of cleaning products used after machinery, equipment, or automobiles have undergone initial purchase from the original equipment manufacturer (OEM). Aftermarket cleaners are developed to remove dust, dirt, and other unwanted materials from a surface, whereas degreasers are used for the removal of heavy oils, waxes, and other stubborn materials. The demand for cleaners and degreasers in the aftermarket segment is driven by rising focus on repairing and maintaining automotives, heavy machinery, and other equipment that are frequently exposed to harsh environments.

During the forecast period, revenue in the cleaner & degreaser aftermarket industry is expected to continue growing, driven by rising vehicle ownership rates, increasing adoption of preventive care practices across industrial facilities, and expansion of the e-commerce industry. Additionally, the industry may face growth challenges due to high market competitiveness and the environmental impacts of the chemical formulations used in cleaners and degreasers.

Cleaner & Degreaser Aftermarket Market: Dynamics

Growth Drivers

Why will increasing the vehicle ownership rate influence the cleaner & degreaser aftermarket growth rate?

The global cleaner & degreaser aftermarket market is expected to witness high growth due to the rising rate of vehicle ownership across the globe. Automotive vehicles, including cars, trucks, and two-wheelers, are some of the largest end-user segments. All automobiles must be regularly cleaned and degreased to enhance their longevity. As per industry research, frequent maintenance of an automobile can increase its lifetime by more than 10% compared with improperly maintained vehicles. Rising awareness among vehicle owners of the importance of regular maintenance and repair will further increase demand for cleaners and degreasers.

In addition, cleaning products available among aftermarket service providers are cost-efficient and easily accessible, which will help the industry ensure sustained growth over extended periods.

Growing industrialization worldwide is expected to influence demand for cleaners & degreasers in the aftermarket segment

A major growth propeller for aftermarket-based cleaning and degreasing solutions is the rapid industrialization observed worldwide. The integration of advanced machinery and equipment across industries such as manufacturing, power generation, and construction, among others, has significantly influenced demand for cleaning solutions. This machinery is frequently subjected to harsh operating conditions, including heavy loads, high temperatures, grease, chemicals, and oil residue. Insufficient and improper maintenance of machinery can impact overall business performance, leading to compromised revenue. Industries across the globe are increasingly investing in the deployment of next-generation machinery to scale business performance and keep up with intensifying competition. This, in turn, will help promote demand in the global cleaner & degreaser aftermarket market in the coming years.

Restraints

How will extreme competitiveness affect revenue in the cleaner & degreaser aftermarket industry?

The global aftermarket for cleaners and degreasers is projected to be constrained by intense market competition. The presence of a growing number of regional and global players operating in the industry will lead to extreme price pressures, thus impacting the final revenue generated by the companies. On the other hand, the availability of a high number of options can be overwhelming for customers, further restricting market expansion trends in the coming years.

Opportunities

Consistent product innovation will continue to create growth opportunities for the market players

The global cleaner & degreaser aftermarket market is expected to experience growth opportunities due to ongoing product innovation reported in the industry. The availability of high-performance and eco-friendly cleaners & degreasers among aftermarket service providers is anticipated to prove beneficial to the industry players in the coming years. In 2024, MPM International Oil Company, a leading aftermarket provider of automotive fluids and lubricants, announced the launch of MPM GreenQleaner. It is an eco-friendly, high-performance multifunctional cleaner with no storage restrictions and hazard labels.

According to the company's claims, the product does not have any negative impact on materials or users. Similarly, in July 2025, Gear Hugger, a prominent aftermarket automotive brand, launched Gear Hugger Concentrated Car Wash, a plant-based formula for automotive cleaning. The products are made from non-toxic, biodegradable materials for cleaning trucks, cars, outdoor gear, and bikes. The rapidly evolving landscape of contaminants that affect the overall performance of machinery, automotive components, or electronic items has created an urgent demand for product innovation in cleaners and degreasers in the aftermarket industry.

Challenges

What challenges will regulatory hurdles pose in the cleaner & degreaser aftermarket industry?

The global cleaner & degreaser aftermarket industry is projected to be challenged by the presence of regulatory hurdles that impact business decisions. Traditionally used cleaners & degreasers are environmentally damaging and have significant health impacts on users. Because many cleaners and degreasers contain toxic substances, the industry is heavily regulated, posing considerable barriers to growth for market players.

Cleaner & Degreaser Aftermarket Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cleaner & Degreaser Aftermarket Market |

| Market Size in 2024 | USD 45.14 Billion |

| Market Forecast in 2034 | USD 68.96 Billion |

| Growth Rate | CAGR of 5.45% |

| Number of Pages | 223 |

| Key Companies Covered | CRC Industries, 3M, Dow, Diversey, Liqui Moly, WD-40 Company, Castrol, BASF, ITW (Illinois Tool Works), Henkel, Permatex, Ecolab, Valvoline, Zep, Würth, and others. |

| Segments Covered | By Parts, By Physical Form, By Chemical Base, By Supply Mode, By Repair Services, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cleaner & Degreaser Aftermarket Market: Segmentation

The global cleaner & degreaser aftermarket market is segmented based on parts, physical form, chemical base, supply mode, repair services, and region.

Why will the engine & powertrain components segment dominate the cleaner & degreaser aftermarket industry?

Based on parts, the global market segments are chassis & undercarriage, engine & powertrain components, fuel systems, brake & clutch systems, electronic & electrical parts, hydraulic & pneumatic components, and tools & workshop equipment. In 2024, the highest growth was listed in the engine & powertrain components segment. These elements are consistently exposed to severe forms of contaminants. Additionally, regular maintenance of engine & powertrain components is essential to ensure smooth functioning of an automotive vehicle or machinery. The growing demand for effective engine and power system cleaning agents will help fuel segmental demand.

Based on physical form, the global cleaner & degreaser aftermarket industry is divided into sprays/aerosols, liquids, gels/pastes, and wipes/pre-moistened pads.

What position will the water-based cleaners segment hold in the cleaner & degreaser aftermarket market?

Based on chemical base, the global market is divided into foaming cleaners, water-based cleaners, citrus/organic degreasers, bio-based/green degreasers, solvent-based degreasers, and others. The industry was dominated by the water-based cleaners segment in 2024, and similar patterns are expected in the future. Water-based cleaners have low content of toxic elements and therefore have wider applications. Furthermore, they are cost-effective and environmentally friendly, further driving the segmental sales rate.

Based on supply mode, the global market is fragmented into OEM aftermarket partnership, e-commerce, indirect sales, and direct sales.

Why does the automotive repair workshop dominate the cleaner & degreaser aftermarket market?

Based on repair services, the global market is divided into commercial & industrial maintenance, automotive repair workshops, aviation & aerospace MRO, fleet maintenance services, marine maintenance services, and specialized cleaning services. The automotive repair workshop segment delivered the highest revenue in 2024. The rising rate of vehicle ownership and growing focus on vehicle maintenance will promote segmental growth in the future.

Cleaner & Degreaser Aftermarket Market: Regional Analysis

Which will North America continue to dominate the cleaner & degreaser aftermarket market?

The global cleaner & degreaser aftermarket market is expected to be led by North America during the projection period. It accounted for nearly 35.01% of global revenue in 2024 and may deliver a CAGR exceeding 3.9% over the forecast period. Growth in North America is led by the presence of a mature cleaner & degreaser aftermarket. The industry provides cleaning and degreasing products to several end-user verticals, including automotive, aerospace, and heavy machinery.

Additionally, stringent regulations existing across North America help regulate the market more efficiently. The ongoing efforts toward deeper integration of eco-friendly variants of cleaners & degreasers will help the regional market flourish during the projection period.

At what CAGR will the Asia-Pacific cleaner & degreaser aftermarket market grow?

Asia-Pacific is projected to emerge as the fastest-growing region in the automotive repair workshop industry with a CAGR of 4.1% over the coming years. The rapid expansion of the regional automotive industry and the growing development of large-scale manufacturing facilities will help promote higher revenue across the Asia-Pacific.

Additionally, regional players are experimenting with new chemical solutions to deliver more effective but less harmful cleaning and degreasing products. Moreover, growing regulatory pressure to improve workplace safety, reduce emissions, and ensure environmental sustainability will further expand the regional presence over the forecast period.

Cleaner & Degreaser Aftermarket Market: Competitive Analysis

The global cleaner & degreaser aftermarket market is led by players like:

- CRC Industries

- 3M

- Dow

- Diversey

- Liqui Moly

- WD-40 Company

- Castrol

- BASF

- ITW (Illinois Tool Works)

- Henkel

- Permatex

- Ecolab

- Valvoline

- Zep

- Würth

What are the key trends in the Cleaner & Degreaser Aftermarket Market?

Partnership with OEMs

A promising trend in the cleaner & degreaser aftermarket industry is the increasing number of partnerships between industry players and OEMs. It promotes compatibility between aftermarket products and OEM specifications, thereby increasing revenue for the stakeholders involved.

Customization

Providing customized solutions tailored to industrial requirements is another emerging trend expected to shape the growth trajectory of the cleaner & degreaser aftermarket industry. Providing personalized solutions is an effective strategy that can help industry players survive the extreme competition existing in the market.

The global cleaner & degreaser aftermarket market is segmented as follows:

By Parts

- Chassis & Undercarriage

- Engine & Powertrain Components

- Fuel Systems

- Brake & Clutch Systems

- Electronic & Electrical Parts

- Hydraulic & Pneumatic Components

- Tools & Workshop Equipment

By Physical Form

- Sprays/Aerosols

- Liquids

- Gels/Pastes

- Wipes/Pre-moistened Pads

By Chemical Base

- Foaming Cleaners

- Water-Based Cleaners

- Citrus/Organic Degreasers

- Bio-Based / Green Degreasers

- Solvent-Based Degreasers

- Others

By Supply Mode

- OEM Aftermarket Partnerships

- E-Commerce

- Indirect Sales

- Direct Sales

By Repair Services

- Commercial & Industrial Maintenance

- Automotive Repair Workshops

- Aviation & Aerospace MRO

- Fleet Maintenance Services

- Marine Maintenance Services

- Specialized Cleaning Services

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

List of Contents

Cleaner Degreaser AftermarketIndustry Perspective:Key Insights:Cleaner Degreaser Aftermarket OverviewCleaner Degreaser Aftermarket DynamicsCleaner Degreaser Aftermarket Report ScopeCleaner Degreaser Aftermarket SegmentationCleaner Degreaser Aftermarket Regional AnalysisCleaner Degreaser Aftermarket Competitive AnalysisWhat are the key trends in the Cleaner Degreaser Aftermarket Market?The global cleaner degreaser aftermarket market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed