Chemical Tankers Market Size, Share, And Growth Report 2032

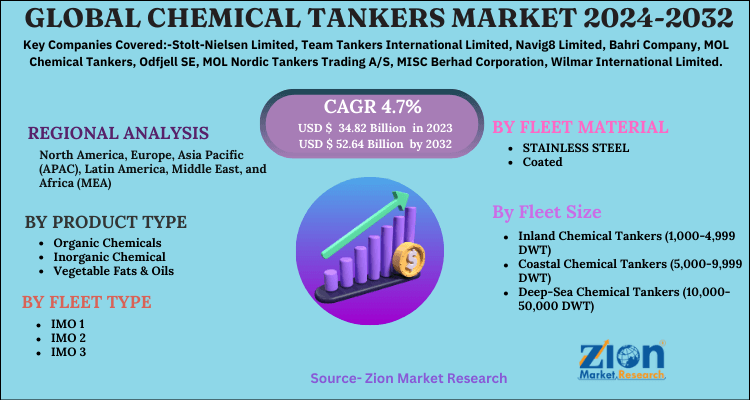

Chemical Tankers Market- By Product Type (Organic Chemicals, Inorganic Chemical, and Vegetable Fats & Oils), By Fleet Type (IMO 1, IMO 2, and IMO 3), By Fleet Material (STAINLESS STEEL And Coated), And By Fleet Size (Inland Chemical Tankers (1,000-4,999 DWT), Coastal Chemical Tankers (5,000-9,999 DWT), and Deep-Sea Chemical Tankers (10,000-50,000 DWT)), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

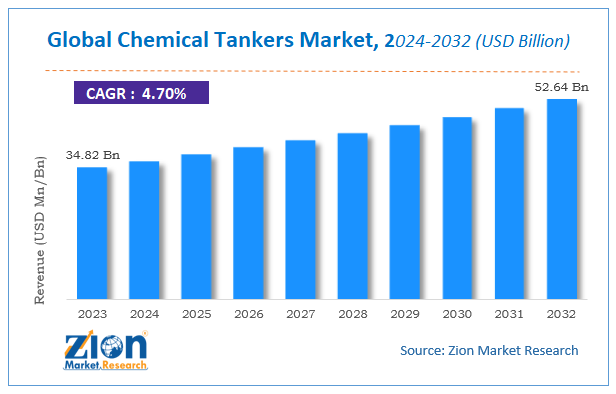

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 34.82 Billion | USD 52.64 Billion | 4.7% | 2023 |

Chemical Tankers Market Size

According to Zion Market Research, the global Chemical Tankers Market was worth USD 34.82 Billion in 2023. The market is forecast to reach USD 52.64 Billion by 2032, growing at a compound annual growth rate (CAGR) of 4.7% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Chemical Tankers Market industry over the next decade.

Chemical Tankers Market: Overview

Chemical tankers are cargo ships designed for carrying liquid chemicals in bulk. They carry industrial chemicals and pure petroleum items. These include caustic soda, palm oil, methanol, vegetable oils, and tallow. Reportedly, these products transport harmful materials as well as substances that are less hazardous. Moreover, chemical tankers comprise of various kinds of cargo tanks and have specialized coating application such as zinc paint coating. However, some of the cargo tanks are made up of stainless steel material.

Growing development in the chemical industry is the major factor driving the growth of the global chemical tankers market. Growing chemical industries leads to large-scale chemicals’ production, which, in turn, contributes to the growing demand for chemical tankers. Moreover, increasing demand for vegetable fats and oils and oilseeds is also anticipated to fuel the expansion of chemical tankers market during the forecast timeframe. In addition, increasing regulations regarding the safe shipment of hazardous chemicals are also contributing to this market growth. Furthermore, the demand for the stainless steel chemical tankers has also increased, as these tankers offer better chemical resistance. However, increasing geopolitical issues and unstable political conditions are hampering the development of chemical tankers market globally.

Chemical Tankers Market: Growth Dynamics

Escalating requirement of safe transport of large number of chemicals, harmful products, and food items is predicted to elevate market expansion. Moreover, flourishing chemical sector has favorably impacted demand for water transport along with safe transfer of chemicals from place of production to destination. Apart from this, end-use sectors including food & beverages sector are making use of chemical tankers for transporting fats and vegetable oils. Hence, rise in manufacture of fats as well as vegetable oils are projected to tremendously contribute towards expansion of chemical tankers industry over forecasting timespan.

Chemical Tankers Market: Segmentation

On the basis of product type, the chemical tankers market is categorized into organic, inorganic chemicals, vegetable fats and oils, and others. Based on the fleet type, this market is classified into IMO 1, IMO 2, and IMO 3.

On the basis of fleet material, this market is bifurcated into coated and stainless steel. Based on fleet size, this market is segmented into deep-sea chemical tankers (10,000-50,000 DWT), inland chemical tankers (1,000-4,999 DWT), and coastal chemical tankers (5,000-9,999 DWT).

Chemical Tankers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Chemical Tankers Market |

| Market Size in 2023 | USD 34.82 Billion |

| Market Forecast in 2032 | USD 52.64 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 155 |

| Key Companies Covered | Stolt-Nielsen Limited, Team Tankers International Limited, Navig8 Limited, Bahri Company, MOL Chemical Tankers, Odfjell SE, MOL Nordic Tankers Trading A/S, MISC Berhad Corporation, Wilmar International Limited, Iino Kaiun Kaisha, Ltd., Stena Bulk Company, and Maersk Tankers |

| Segments Covered | By Product Type, By Fleet Type, By Fleet Material, By Fleet Size and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Chemical Tankers Market: Regional Analysis

Asia Pacific To Make Notable Contributions Towards Regional Market Revenue By 2032

Growth of chemical tankers industry in Asia Pacific over forecast timespan is subject to massive presence of chemical manufacturers in countries such as India, South Korea, Japan, and China. In addition to this, swift demand of chemical tankers in countries such as India will embellish regional market scope. Additionally, humongous popularity of sunflower oil and palm oil in sub-continent will proliferate expansion of chemical tankers in Asia Pacific over forecast timespan.

Chemical Tankers Market: Competitive Players

Key players influencing growth of chemical tankers market and profiled in report are:

- Stolt-Nielsen Limited

- Team Tankers International Limited

- Navig8 Limited

- Bahri Company

- MOL Chemical Tankers

- Odfjell SE

- MOL Nordic Tankers Trading A/S

- MISC Berhad Corporation

- Wilmar International Limited

- Iino Kaiun Kaisha Ltd.

- Stena Bulk Company

- Maersk Tankers

The global Chemical Tankers Market is segmented as follows:

By Product Type

- Organic Chemicals

- Inorganic Chemical

- Vegetable Fats & Oils

By Fleet Type

- IMO 1

- IMO 2

- IMO 3

By Fleet Material

- STAINLESS STEEL

- Coated

By Fleet Size

- Inland Chemical Tankers (1,000-4,999 DWT)

- Coastal Chemical Tankers (5,000-9,999 DWT)

- Deep-Sea Chemical Tankers (10,000-50,000 DWT)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Chemical tankers are specialized vessels designed to transport liquid chemicals in bulk. They feature multiple cargo tanks, often made of stainless steel or coated with protective linings, to safely carry a wide range of chemicals, including acids, alcohols, and petroleum products, while preventing contamination and spillage.

According to study, the Chemical Tankers Market size was worth around USD 34.82 billion in 2023 and is predicted to grow to around USD 52.64 billion by 2032.

The CAGR value of Chemical Tankers Market is expected to be around 4.7% during 2024-2032.

Asia Pacific has been leading the Chemical Tankers Market and is anticipated to continue on the dominant position in the years to come.

The Chemical Tankers Market is led by players like Stolt-Nielsen Limited, Team Tankers International Limited, Navig8 Limited, Bahri Company, MOL Chemical Tankers, Odfjell SE, MOL Nordic Tankers Trading A/S, MISC Berhad Corporation, Wilmar International Limited, Iino Kaiun Kaisha Ltd., Stena Bulk Company, and Maersk Tankers.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed