Global Palm Oil Market Size, Share, Growth Analysis Report - Forecast 2034

Palm Oil Market By Type (Crude Palm Oil, Palm Kernel Oil, Fractionated Palm Oil, Others), By Application (Food & Beverages, Cosmetics & Personal Care, Biofuel & Energy, Pharmaceuticals, Industrial), By End-user (Household, Commercial, Industrial), By Distribution Channel (Direct, Indirect), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

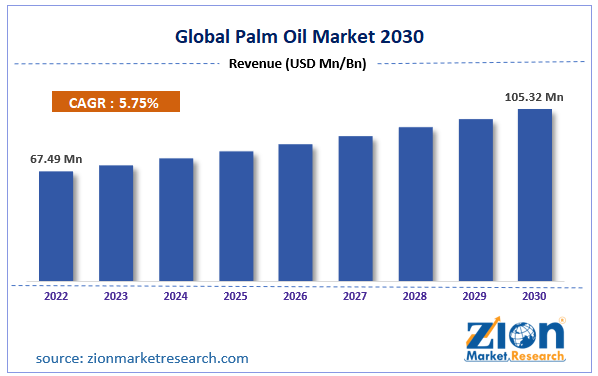

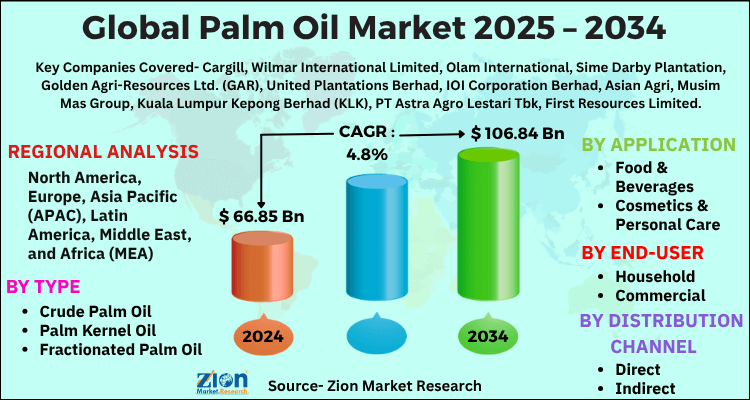

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 66.85 Billion | USD 106.84 Billion | 4.8% | 2024 |

Global Palm Oil Market: Industry Perspective

The global palm oil market size was worth around USD 66.85 Billion in 2024 and is predicted to grow to around USD 106.84 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.8% between 2025 and 2034. The report analyzes the global palm oil market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the palm oil industry.

Global Palm Oil Market: Overview

Palm oil is derived from the reddish pulp or mesocarp of the oil palm fruit. It is an edible vegetable oil and has extensive applications in the production of beauty products, food items, and biofuel. The high popularity of palm oils is a result of the flavor maintaining and stabilizing attribute of these oils making it highly desirable amongst several food manufacturers. Palm oils naturally appear red due to the high content of beta-carotene. The oil palm tree mainly grows in tropical environments and the consumption of palm oil is significantly higher in developing countries but the application of the oil in other factors apart from food manufacturing has driven the current demand for quality palm oil.

Another advantage of using palm oil is the higher versatility of the product. At room temperature, it can be found in a semi-solid state and is highly resistant to oxidation which improves the overall shelf-life of the product it is used in. At high temperatures, palm oil remains stable and hence can be used to prepare fried food products. However, the market for palm oil is also plagued with several concerns that are expected to restrict the growth trend during the forecast period.

Global Palm Oil Market: Growth Drivers

Increasing consumption in the cosmetics industry to drive market growth

The global palm oil market is expected to be driven by the increasing demand for palm oil in the cosmetics industry. It is one of the fastest-growing sectors. The main reason for high application is the moisturizing ability of palm oil along with its texturizing properties. These are two of the main selling points for any cosmetic or personal care products. Some of the most popular derivatives of palm oil in the cosmetic industry include fatty acids and glycerol. These contents impart foaming properties making the derivatives desirable ingredients for shampoo, face wash, and body wash products.

The surge in population and an increasing number of buyers in the cosmetics and personal care sector have led to higher consumption of palm oil. In addition to this, manufacturers of cosmetic items have invested heavily in product line expansion, meaning producing several variants of cosmetics in the same category. The extensive line differs in terms of pricing making the brand reach a broader consumer group. In February 2023, Hindustan Unilever (HUL), the Indian subsidiary of Unilever, undertook massive campaigns and product launches to offset the slump in revenue that it had registered due to reduced sales of winter skincare products. From December 2022 until February 2023, the company’s beauty and personal care division grew by 10% in terms of revenue.

Growing consumption of palm oil for cooking purposes to drive market growth

The global palm oil market demand is projected to take a higher trajectory due to the rise in consumption of palm oil for cooking purposes. The edible oil is economical to produce and does not cost as much as olive oil or other substitutes. This has led to higher demand for palm oil in developing and underdeveloped countries with low per capita income. Additionally, the versatility of the oil in addition to being a rich source of vitamin E and fatty acids, the product meets the nutritional requirements of a larger population section. In September 2023, it was reported that India’s exports of palm oil increased from 1.09 million tons recorded in July 2023 to 1.12 million tons.

Palm Oil Market: Restraints

Concerns over the impact of palm oil cultivation on the environment to restrict market growth

Since the consumption of palm oil has grown at an exponential rate, there have been several incidents in which the naturally existing tropical forests were converted into oil palm plantations. This has led to irreversible damage to the essential habitat leading to an increase in the number of species falling into the endangered category. Animals such as elephants, rhinoceros, and tigers have lost their living environment. Moreover, burning is one of the most commonly adopted methods of clearing vegetation which ultimately adds to the overall air pollution rate in addition to soil and water contamination. Several international environmental agencies have raised concerns and are calling for the control of palm oil production thus creating barriers to further growth in the palm oil industry.

Palm Oil Market: Opportunities

Increasing measures toward organic palm oil production to create expansion prospects

The high dependency of the commercial world on palm oil has led to several companies investing in research and developing the production of organic palm oil. Studies showcase that when production is controlled and conducted in the right manner, palm oil production can be sustainable and environment-friendly. This includes measures taken against the production of conflict palm oil which deals with massive labor and environmental abuse. Growing environmental awareness among consumers is pushing for higher organic palm oil demand. Government support and favorable policies for organic palm oil have been crucial in the change as they are trying to curb the supply of conflict palm oil.

Increasing investments in palm oil-based biofuel to deliver better results

The players operating in the palm oil industry are expected to benefit from the growing demand for biofuel. Palm oils are important ingredients for these fuel variants. For instance, the recent G20 Summit held in India laid strong emphasis on biofuel production. The participating nations concluded that an initial investment of USD 100 billion would be required to help the biofuel industry reach an optimum momentum in the next 3 years.

Palm Oil Market: Challenges

Availability of substitutes for palm oil may challenge market growth

There is an extensive market for alternatives to palm oil especially in the food & beverages industry. These substitutes include sunflower oil, olive oil, avocado oil, grapeseed oil, and many more with each product offering certain advantages over palm oil. Some of the options are healthier as well thus catering to the needs of a health-conscious population. The presence and consumption of other oils could pose a challenge against the growth trend in the palm oil sector.

Key Insights

- As per the analysis shared by our research analyst, the global palm oil market is estimated to grow annually at a CAGR of around 4.8% over the forecast period (2025-2034).

- Regarding revenue, the global palm oil market size was valued at around USD 66.85 Billion in 2024 and is projected to reach USD 106.84 Billion by 2034.

- The palm oil market is projected to grow at a significant rate due to Wide application in food, cosmetics, and biofuels drives demand. Cost-effectiveness and high yield compared to other oils contribute to market growth.

- Based on Type, the Crude Palm Oil segment is expected to lead the global market.

- On the basis of Application, the Food & Beverages segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-user, the Household segment is projected to swipe the largest market share.

- By Distribution Channel, the Direct segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Global Palm Oil Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Palm Oil Market |

| Market Size in 2024 | USD 66.85 Billion |

| Market Forecast in 2034 | USD 106.84 Billion |

| Growth Rate | CAGR of 4.8% |

| Number of Pages | 220 |

| Key Companies Covered | Cargill, Wilmar International Limited, Olam International, Sime Darby Plantation, Golden Agri-Resources Ltd. (GAR), United Plantations Berhad, IOI Corporation Berhad, Asian Agri, Musim Mas Group, Kuala Lumpur Kepong Berhad (KLK), PT Astra Agro Lestari Tbk, First Resources Limited, Apical Group Ltd, Société des Palmeraies de l'Ouest, Bunge Limited., and others., and others. |

| Segments Covered | By Type, By Application, By End-user, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Palm Oil Market: Segmentation Analysis

The global palm oil market is segmented based on Type, Application, End-user, Distribution Channel, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on Type, the global palm oil market is divided into Crude Palm Oil, Palm Kernel Oil, Fractionated Palm Oil, Others.

On the basis of Application, the global palm oil market is bifurcated into Food & Beverages, Cosmetics & Personal Care, Biofuel & Energy, Pharmaceuticals, Industrial.

By End-user, the global palm oil market is split into Household, Commercial, Industrial.

In terms of Distribution Channel, the global palm oil market is categorized into Direct, Indirect.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Palm Oil Market: Regional Analysis

From 2025 to 2034, the palm oil market is expected to witness varied regional growth, with Asia-Pacific dominating due to strong consumption in countries like India, China, and Indonesia, driven by food, personal care, and biofuel applications. Southeast Asia, particularly Indonesia and Malaysia, will remain the largest producers, benefiting from favorable climatic conditions and established supply chains. Meanwhile, the Middle East and Africa are emerging as high-potential markets due to increasing demand for affordable edible oils and expanding food processing industries. In Europe and North America, growth will be more moderate, constrained by regulatory concerns and rising demand for sustainably sourced palm oil, although demand in the biofuel and processed food sectors will continue to provide steady opportunities.

Global Palm Oil Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the palm oil market on a global and regional basis.

The global palm oil market is dominated by players like:

- Cargill

- Wilmar International Limited

- Olam International

- Sime Darby Plantation

- Golden Agri-Resources Ltd. (GAR)

- United Plantations Berhad

- IOI Corporation Berhad

- Asian Agri

- Musim Mas Group

- Kuala Lumpur Kepong Berhad (KLK)

- PT Astra Agro Lestari Tbk

- First Resources Limited

- Apical Group Ltd

- Société des Palmeraies de l'Ouest

- Bunge Limited.

- Others

Global Palm Oil Market: Segmentation Analysis

The global palm oil market is segmented as follows;

By Type

- Crude Palm Oil

- Palm Kernel Oil

- Fractionated Palm Oil

- Others

By Application

- Food & Beverages

- Cosmetics & Personal Care

- Biofuel & Energy

- Pharmaceuticals

- Industrial

By End-user

- Household

- Commercial

- Industrial

By Distribution Channel

- Direct

- Indirect

Global Palm Oil Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed