Global Cannabis Testing Market Size, Share, Growth Analysis Report - Forecast 2034

Cannabis Testing Market By Technology (Chromatography and Spectroscopy), By Test Type (Potency Testing, Pesticide Screening, Residual Solvent Screening, Heavy Metal Testing, Terpene Testing, and Mycotoxin Testing), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.91 Billion | USD 7.38 Billion | 16.2% | 2024 |

Cannabis Testing Market Size

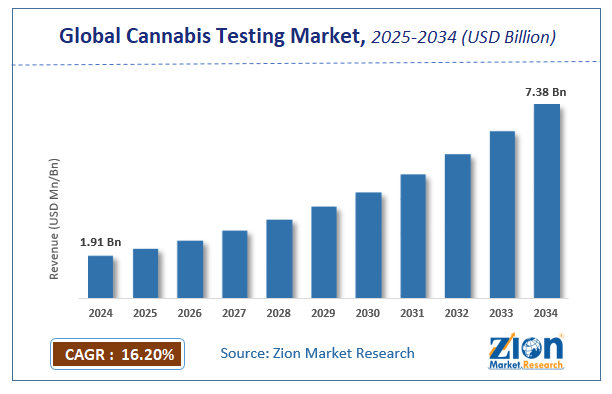

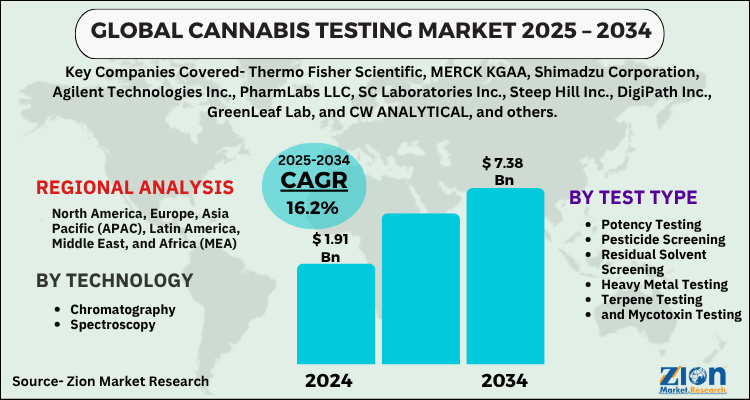

The global cannabis testing market size was worth around USD 1.91 Billion in 2024 and is predicted to grow to around USD 7.38 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 16.2% between 2025 and 2034.

The report analyzes the global cannabis testing market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cannabis testing industry.

Cannabis Testing Market: Overview

Cannabis testing is the process of analyzing a single sample of cannabis to evaluate CBD, THC, and terpene levels, as well as pollutants and impurities such as mold spores, residual solvents, infection, and pesticide residue. Each state and municipality has the authority to set their own rules and regulations for what must be tested and printed on cannabis labeling.

Individual producers may also choose to adhere to more severe guidelines, even having their samples tested for CBG and CBC levels. Only qualified chemists and lab workers are permitted to conduct this testing. Cannabis production and sales were formerly prohibited worldwide for numerous years.

Cannabis is a type of psychoactive drug that has recreational and medicinal uses. Cannabis mainly consists of THC (tetrahydrocannabinol) that causes changes in perception, increases appetite and sensation of euphoria. There are different types of cannabis, such as topical cannabis, inhaling cannabis, solid edible cannabis, and liquid edible cannabis, which are tested during the cannabis testing procedure.

Key Insights

- As per the analysis shared by our research analyst, the global cannabis testing market is estimated to grow annually at a CAGR of around 16.2% over the forecast period (2025-2034).

- Regarding revenue, the global cannabis testing market size was valued at around USD 1.91 Billion in 2024 and is projected to reach USD 7.38 Billion by 2034.

- The cannabis testing market is projected to grow at a significant rate due to rising legalization of cannabis, stringent regulatory requirements, and increasing demand for product safety and quality assurance.

- Based on Technology, the Chromatography segment is expected to lead the global market.

- On the basis of Test Type, the Potency Testing segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Cannabis Testing Market: Growth Drivers

The market is fostering medical cannabis legalization and increasing cannabis testing labs

Medical cannabis has shown to be helpful in a number of medical uses, including lowering intraocular pressure in glaucoma patients, managing muscular spasms in multiple sclerosis patients, boosting appetite in AIDS patients, and minimizing chemotherapy-induced nausea. Medical cannabis is legal in a number of countries due to its health benefits. Italy, Brazil, Israel, the Netherlands, Germany, the United Kingdom, Portugal, Spain, North Korea, Canada, and Australia have all approved it in the last few years.

Furthermore, 25 states in the United States legalized medical cannabis, with four states—Alaska, Oregon, Washington, and Colorado legalizing cannabis for use for both recreational and medical purposes. Thus, with the rising legalization of cannabis, an increase in adoption of its testing is been witnessed which in turn is fostering the growth of the global cannabis testing market. In addition to this, the increasing number of cultivators and the growing necessity for the safety & efficacy of cannabis products are also some of the key factors that are fueling the market growth.

The increase in the use of medical cannabis for various applications, such as reduction of nausea caused after chemotherapy, stimulation of appetite in patients suffering from AIDS, and controlling of muscle spasms, is fueling the demand for cannabis globally. This increase in demand has led to the legalization of cannabis by governments in various countries. For instance, Australia legalized medical cannabis in 2016, which is fuelling the growth of the global cannabis testing market. The rise in adoption of the cannabis software namely LIMS in the cannabis testing labs and the rise in the number of awareness programs such as workshops and conferences in various countries is also driving the global market for cannabis testing. However, the high cost of instruments and the lack of skilled professionals are hampering the development of the global cannabis testing market.

Cannabis Testing Market: Restraints

The cannabis testing market may be hampered by a lack of universal testing standards.

For delivering a precise and accurate dose of cannabis for medical purposes, certain standards of quality control and regulation are essential. There is, however, a lack of consistency in quality standards among countries. For example, different states in the United States have varied rules and variances governing medical and adult-use cannabis. Various states have different possession limits. The wide range of legislation governing the use of medical cannabis presents a considerable problem for testing laboratories when assessing the quality of these products. Such disparities between states in the United States and between European countries may stymie business growth.

Cannabis Testing Market: Opportunities

Growing necessity of heavy metal testing for cannabis is likely to drive the market during the forecast period.

Besides pesticides, microbiological organisms, and residual solvents, heavy metals are one of the most common pollutants detected in cannabis and its derivatives. Furthermore, heavy metals are highly poisonous and can cause poisoning and other issues when exposed. As a result, heavy metal testing for cannabis and its derivatives is becoming extremely prevalent. Several government agencies have made heavy metal testing for cannabis products mandatory. All such factors coupled with the use of advanced instruments like HPLC techniques are likely to generate ample opportunities for the growth of the global cannabis testing market during the forecast period.

Cannabis Testing Market: Challenges.

High cost associated with the set-up of cannabis testing laboratories acts as a major challenge for the market

One of the most critical challenges in this market is the high startup expenses for cannabis testing laboratories. These labs must invest a large amount of money in order to purchase and maintain expensive, modern analytical equipment. Accreditations & certifications such as ISO certification processes, software requirements, standardization & upgrades of equipment, and the need for qualified experts all add to the operating costs. Also, because of the ambiguity in the cannabis testing market, many banks refuse to fund or provide any other type of support to these laboratories. Furthermore, several governments are working on a plan to impose taxes on cannabis testing labs. Thus, the high cost associated with the set-up of cannabis testing laboratories poses a major challenge for the market growth.

Cannabis Testing Market: Segmentation

The global cannabis testing market is divided based on technology, test type, and region.

Based on the technology, the global market is split into spectroscopy and chromatography.

By test type, the marke t is categorized into mycotoxin testing, terpene testing, heavy metal testing, residual solvent screening, pesticide screening, and potency testing.

Cannabis Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cannabis Testing Market |

| Market Size in 2024 | USD 1.91 Billion |

| Market Forecast in 2034 | USD 7.38 Billion |

| Growth Rate | CAGR of 16.2% |

| Number of Pages | 188 |

| Key Companies Covered | Thermo Fisher Scientific, MERCK KGAA, Shimadzu Corporation, Agilent Technologies Inc., PharmLabs LLC, SC Laboratories Inc., Steep Hill Inc., DigiPath Inc., GreenLeaf Lab, and CW ANALYTICAL, and others. |

| Segments Covered | By Technology, By Test Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In February 2022, ACS Laboratory, the biggest cannabis and hemp cannabis testing laboratory in the eastern United States, introduced an HHC Potency Test and related Metals Testing Bundle targeted at HHC (hexahydrocannabinol) products to strengthen consumer trust and increase product quality. ACS Laboratory currently tests for 23 cannabinoids, more than any other lab in the United States.

- In July 2021, PureVita Labs opened new hemp and cannabis analytical testing lab to open in Rhode Island. The lab reported that the state health department has granted it permission to sample & test cannabis for contaminants and potency.

Cannabis Testing Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the cannabis testing market on a global and regional basis.

The global cannabis testing market is dominated by players like:

- Thermo Fisher Scientific

- MERCK KGAA

- Shimadzu Corporation

- Agilent Technologies Inc.

- PharmLabs LLC

- SC Laboratories Inc.

- Steep Hill Inc.

- DigiPath Inc.

- GreenLeaf Lab

- and CW ANALYTICAL

The global cannabis testing market is segmented as follows;

By Technology

- Chromatography

- Spectroscopy

By Test Type

- Potency Testing

- Pesticide Screening

- Residual Solvent Screening

- Heavy Metal Testing

- Terpene Testing

- and Mycotoxin Testing

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global cannabis testing market is expected to grow due to increasing legalization of cannabis, rising quality control regulations, and expanding applications in medical and recreational sectors.

According to a study, the global cannabis testing market size was worth around USD 1.91 Billion in 2024 and is expected to reach USD 7.38 Billion by 2034.

The global cannabis testing market is expected to grow at a CAGR of 16.2% during the forecast period.

North America is expected to dominate the cannabis testing market over the forecast period.

Leading players in the global cannabis testing market include Thermo Fisher Scientific, MERCK KGAA, Shimadzu Corporation, Agilent Technologies Inc., PharmLabs LLC, SC Laboratories Inc., Steep Hill Inc., DigiPath Inc., GreenLeaf Lab, and CW ANALYTICAL, among others.

The report explores crucial aspects of the cannabis testing market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed