Camping Tent Market Size, Share, Trends, Growth 2034

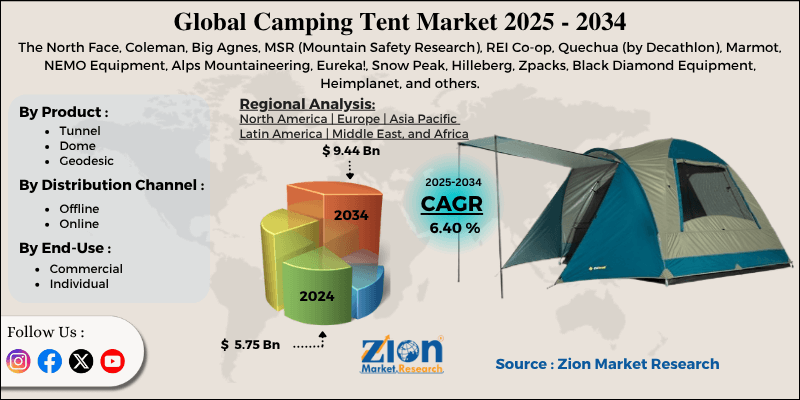

Camping Tent Market By Product (Tunnel, Dome, Geodesic), By Distribution Channel (Offline, Online), By End-Use (Commercial, Individual), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

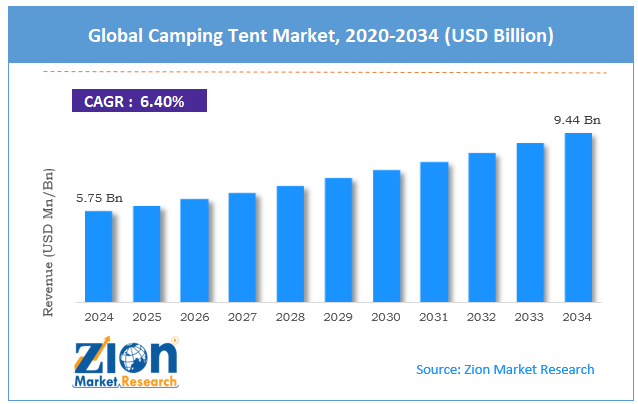

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.75 Billion | USD 9.44 Billion | 6.40% | 2024 |

Camping Tent Industry Perspective:

The global camping tent market size was worth around USD 5.75 billion in 2024 and is predicted to grow to around USD 9.44 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.40% between 2025 and 2034.

Camping Tent Market: Overview

A camping tent is a handy shelter specially designed for outdoor recreation, typically made of lightweight materials such as polyester or nylon. It offers protection against elements like wind, rain, and sunlight and is majorly used by campers, hikers, and outdoor enthusiasts. These tents are available in various sizes, ranging from two-person models to multiple-person models, offering comfort and flexibility during adventures.

The global camping tent market is expected to experience significant growth over the next seven years, driven by increasing outdoor recreation activities, growing nature retreat trends, urban stress, and advancements in tent materials.

Over 50% of Americans participated in outdoor activities in 2023, the highest rate recorded in the past decade, according to the Outdoor Foundation. The increasing participation in hiking, camping, and trekking fuels the demand for reliable tents, particularly among families and young people.

With the rise in screen time and urbanization, urban habitats are increasingly seeking relaxation in nature. Nature retreats and wellness tourism are triggering camping as a revitalizing activity, propelling the demand for comfort-improved tenting solutions.

Additionally, materials such as waterproof polyester, ripstop nylon, and heat-insulated fabrics are gaining prominence. They make tents more weather-resistant and durable. Automatic pop-up tents and inflatable tents are gaining popularity due to their ease of use and convenience.

Nevertheless, the global market is limited due to weather dependency, the high initial cost of advanced tents, and ecological concerns regarding non-biodegradable materials. Adverse weather conditions, such as extreme temperatures, heavy rains, and storms, may discourage individuals from camping, which can impact sales regionally and seasonally.

Specialized and high-quality tents, such as those used for glamping (a combination of glamorous and camping) or all-season tents, can be expensive. This restricts the adoption among price-sensitive groups, mainly in developing regions.

Most of the tents are made of synthetic fibers, which increases ecological issues during disposal. Strict regulations on plastic use may negatively impact material sourcing and product prices. Even so, the global camping tent industry is well-positioned due to eco-friendly tent products, the integration of smart features, and the development of emerging markets with rising tourism.

Biodegradable materials, recycled fabrics, and solar-powered tents offer brands an exceptional selling point. This meets the growing demand for environmentally friendly travel gear. Tents with built-in lighting, charging points, climate control, and solar panels are gaining prominence. These improvements cater to tech-savvy consumers and digital nomads. Nations such as Vietnam, Brazil, and India are experiencing a surge in adventure travel and domestic tourism, presenting unexplored sales opportunities for manufacturers.

Key Insights:

- As per the analysis shared by our research analyst, the global camping tent market is estimated to grow annually at a CAGR of around 6.40% over the forecast period (2025-2034)

- In terms of revenue, the global camping tent market size was valued at around USD 5.75 billion in 2024 and is projected to reach USD 9.44 billion by 2034.

- The camping tent market is projected to grow significantly due to the rising popularity of adventure tourism and outdoor recreation, changing consumer lifestyles, increasing disposable income, and improvements in tent materials and designs.

- Based on product, the dome segment is expected to lead the market, while the tunnel segment is expected to grow considerably.

- Based on distribution channel, the offline is the dominant segment, while the online segment is projected to witness sizable revenue growth over the forecast period.

- Based on end-use, the individual segment is expected to lead the market, surpassing the commercial segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Camping Tent Market: Growth Drivers

Government programs to promote camping infrastructure and eco-tourism boost market growth

Several governments are actively investing in rural development and eco-tourism, benefiting the camping tent market. For example, the Ministry of Tourism, India, introduced the ‘Dekho Apna Desh’ program, funding tented accommodations and motivating domestic tourism in offbeat locations.

Simultaneously, the United States (NPS) National Park Service distributed over $ 3 billion in 2023 for trail and campsite optimization under the Great American Outdoors Act.

Technological improvements in material technology and tent design considerably fuel the market growth

Improvements in design engineering and materials science are driving a new wave of tent advancements. These features include waterproof-breathable membranes, pop-up deployment, solar-powered integration, and modular compartments.

For instance, Decathlon introduced the 'Quechua 2 Seconds Easy' tent in 2024, featuring UV-resistant fabrics and a self-deploying technique that streamlines the setup for novice campers.

In addition, companies are integrating smart features like IoT sensors, inbuilt lighting, and temperature-controlled layers for tracking internal conditions and weather. This trend towards ultralight backpacking has fueled the demand for tents made of ripstop nylon and Dyneema, offering minimal weight and high tensile strength.

Camping Tent Market: Restraints

Competition from inferior-quality and low-cost manufacturers negatively impacts market progress

The global camping tent market is experiencing increasing competition from counterfeit and unbranded products, primarily from low-cost producers in emerging economies. These low-priced tents are made with weak stitching, substandard fabrics, and non-waterproof materials, which appeal to budget-conscious consumers but highlight overall brand value and consumer trust in the industry.

Camping Tent Market: Opportunities

Commercial adoption in resorts, events, and disaster relief favorably impacts the market progress

Beyond recreational use, tents are widely adopted for institutional and commercial purposes, primarily in luxury resorts, marathons, emergency shelters during natural disasters, and music festivals (also known as glamping). The increasing use of these activities is positively impacting the growth of the camping tent industry.

Similarly, the growth in temporary hospitality setups in exotic and rural destinations has fueled the demand for reusable, heavy-duty, and luxury-grade tents. Under Canvas, a United States-based glamping brand has declared plans to expand to Europe in 2024. The plan includes safari-style tents dedicated to high-class tourists.

Camping Tent Market: Challenges

Short product lifespan and environmental impact restrict the growth of the market

While tents support environmentally friendly tourism, they also contribute to ecological degradation when improperly disposed of or poorly manufactured. Non-recyclable and inexpensive tents are typically discarded after a single use or at music festivals, primarily in North America and Europe.

The Clean Up Britain campaign projected that over 2,50,000 tents are abandoned every year in the United Kingdom, most of which are left in landfills because of their synthetic composition.

This raises concerns about waste management and reputational damage for leading companies in an era where consumers prioritize sustainability. In addition, low-quality tents typically have a short usable life, often lasting just 1-2 trips, resulting in increased waste, high turnover, and rising consumer criticism regarding single-use outdoor gear.

Camping Tent Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Camping Tent Market |

| Market Size in 2024 | USD 5.75 Billion |

| Market Forecast in 2034 | USD 9.44 Billion |

| Growth Rate | CAGR of 6.40% |

| Number of Pages | 215 |

| Key Companies Covered | The North Face, Coleman, Big Agnes, MSR (Mountain Safety Research), REI Co-op, Quechua (by Decathlon), Marmot, NEMO Equipment, Alps Mountaineering, Eureka!, Snow Peak, Hilleberg, Zpacks, Black Diamond Equipment, Heimplanet, and others. |

| Segments Covered | By Product, By Distribution Channel, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Camping Tent Market: Segmentation

The global camping tent market is segmented based on product, distribution channel, end-use, and region.

Based on product, the global camping tent industry is divided into tunnel, dome, and geodesic. The dome tent segment held the largest market share due to its ease of setup, versatile design, and affordability. Their arched pole structure allows for quick pitching and offers a stable frame, making them more suitable for beginners and casual campers. These tents are highly compact and portable, appealing to small families and solo travelers. Dome tents are also ideal for moderate weather conditions and are widely available through online and offline retail platforms. Their prominence is fueled by their use in weekend camping activities, recreational events, and festivals in Europe, the Asia Pacific, and North America.

Based on distribution channel, the global camping tent market is segmented into offline and online. The offline segment, comprising specialty outdoor stores, hypermarkets, branded outlets, and sporting goods retailers, is the leading distribution channel in the global market. Consumers typically opt for physically inspected tents due to their emphasis on material quality, size, and ease of setup. Retailers offer in-store demos, expert advice, and personalized assistance, enhancing consumer confidence. Additionally, offline stores cater well to last-minute campers and buyers in remote regions, primarily in Europe and North America.

Based on end-use, the global market is segmented into commercial and individual. The individual segment captured a substantial market share. It comprises personal users, such as families, couples, and solo travelers, who engage in weekend trips, hiking, road travel, and recreational camping. The growing prominence of outdoor lifestyles, budget-friendly nature getaways, and wellness tourism has remarkably increased the demand for personal-use tents. The segment is especially prominent in Europe and North America, where camping is a deep-rooted tradition.

Camping Tent Market: Regional Analysis

North America to witness significant growth over the forecast period

North America holds the largest regional share in the global camping tent market due to high participation in outdoor recreation, robust camping infrastructure, extensive national parks, and a growing trend of nature escapes and wellness retreats. North America, especially the United States, holds a leading outdoor participation rate.

In 2023, nearly 168 million people were engaged in outdoor activities, comprising 54 million people who enjoyed camping. This substantial cultural shift towards nature-based leisure fuels a steady demand for camping tents for personal use. Canada and the United States offer thousands of campgrounds, protected forests, and national parks, with over 400 U.S. national parks facilitating outdoor activities. RV parks, well-maintained campsites, and backcountry trails promote accessible and safe camping, increasing the use of tents for both extended stays and short trips.

Furthermore, following the COVID-19 pandemic, Americans are actively seeking wellness activities through camping and nature retreats. According to KOA (Kampgrounds of America), over 58% of campers cite relaxation and mental health as their primary motivation, resulting in longer and more frequent camping trips, which in turn leads to higher demand for tents.

Europe is another dominant region in the global camping tent industry, driven by a strong camping culture, growing cross-border and domestic travel, and a high adoption of family and group camping. Camping is deeply rooted in European leisure traditions, particularly in countries such as France, the Netherlands, the United Kingdom, and Germany.

Over 400 million nights were spent at the European Union campsites in 2023, according to Eurostat. This denoted a continuous demand for outdoor accommodation and tents. This cultural preference withstands steady industry growth. A majority of Europeans prefer eco-friendly and low-cost travel across the continent.

In 2023, over 60% of European Union residents preferred to visit neighboring countries or take domestic holidays, often via train travel or road trips. This motivates the use of camping tents, ideal for multi-stop journeys or weekend camping.

Additionally, Europeans usually camp in groups, leading to a demand for modular and larger tunnel-style tents. In Germany and France, over 30% of campers are families with young children, making weather-resistant and spacious tents a priority. This transformed the European industry's inclination towards functionally advanced products.

The rise of sustainable living trends and eco-tourism also fuels regional growth. Ecological awareness in Europe is driving the rise of minimalist travel and eco-tourism, sparking interest in non-motorized accommodations and nature-based vacations. Products made of PVC-free, recycled, and biodegradable materials are growing in demand, fueling advancements among tentmakers.

Camping Tent Market: Competitive Analysis

The leading players in the global camping tent market are:

- The North Face

- Coleman

- Big Agnes

- MSR (Mountain Safety Research)

- REI Co-op

- Quechua (by Decathlon)

- Marmot

- NEMO Equipment

- Alps Mountaineering

- Eureka!

- Snow Peak

- Hilleberg

- Zpacks

- Black Diamond Equipment

- Heimplanet

Camping Tent Market: Key Market Trends

Surge in luxury and glamping tents:

The prominence of glamping (glamorous camping) is driving demand for spacious, high-end, and visually appealing tents. Eco-lodges and resorts are investing heavily in yurts, bell tents, and canvas safari tents, all of which are designed with modern equipment. The worldwide glamping market is anticipated to grow at 11.8% CAGR by 2030, with tents being the center of attraction for this progress.

Growth in multi-room and modular designs:

Modular tents with attachable rooms, adaptable layouts, and vestibules are gaining traction among group campers and families. These designs offer enhanced usability and customization, mainly for more extended stays. Demand is growing in commercial and consumer segments, such as tour operators and campgrounds.

The global camping tent market is segmented as follows:

By Product

- Tunnel

- Dome

- Geodesic

By Distribution Channel

- Offline

- Online

By End-Use

- Commercial

- Individual

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A camping tent is a handy shelter specially designed for outdoor recreation, typically made of lightweight materials such as polyester or nylon. It offers protection against elements like wind, rain, and sunlight and is majorly used by campers, hikers, and outdoor enthusiasts.

The global camping tent market is projected to grow due to increasing participation by Gen Z and millennials, the growth of direct-to-consumer sales and e-commerce, and a rise in glamping and eco-tourism.

According to study, the global camping tent market size was worth around USD 5.75 billion in 2024 and is predicted to grow to around USD 9.44 billion by 2034.

The CAGR value of the camping tent market is expected to be approximately 6.40% from 2025 to 2034.

North America is expected to lead the global camping tent market during the forecast period.

The key players profiled in the global camping tent market include The North Face, Coleman, Big Agnes, MSR (Mountain Safety Research), REI Co-op, Quechua (by Decathlon), Marmot, NEMO Equipment, Alps Mountaineering, Eureka!, Snow Peak, Hilleberg, Zpacks, Black Diamond Equipment, and Heimplanet.

The report examines key aspects of the camping tent market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed