Brown Sugar Syrup Market Size, Share, Trends, Growth & Forecast 2034

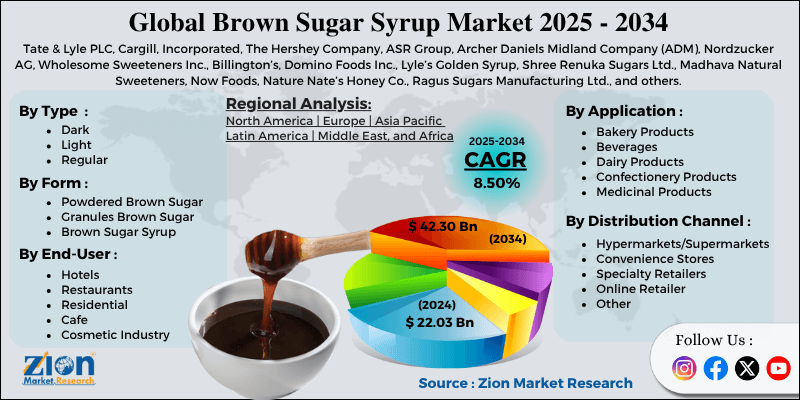

Brown Sugar Syrup Market By Type (Dark, Light, Regular), By Form (Powdered Brown Sugar, Granules Brown Sugar, Brown Sugar Syrup, Brown Sugar Cubes), By Application (Bakery Products, Beverages, Dairy Products, Confectionery Products, Medicinal Products), By End-User (Hotels, Restaurants, Residential, Café, Pharmaceutical Industry, Cosmetic Industry), By Distribution Channel (Retail, Food & Beverages, Healthcare, Automotive, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034-

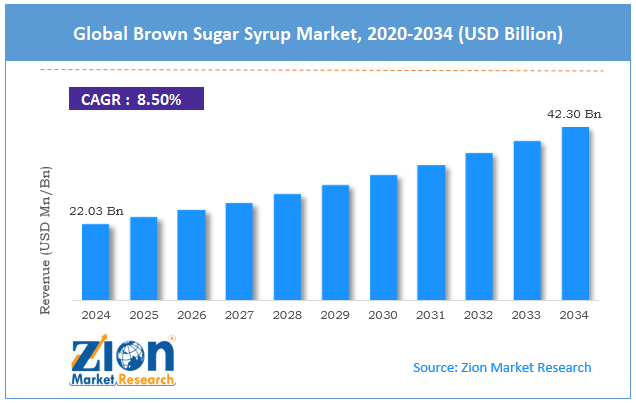

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.03 Billion | USD 42.30 Billion | 8.50% | 2024 |

Brown Sugar Syrup Industry Perspective:

The global brown sugar syrup market size was approximately USD 22.03 billion in 2024 and is projected to reach around USD 42.30 billion by 2034, with a compound annual growth rate (CAGR) of approximately 8.50% between 2025 and 2034. The report analyzes the global brown sugar syrup market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the retail earplugs industry.

Key Insights:

- As per the analysis shared by our research analyst, the global brown sugar syrup market is estimated to grow annually at a CAGR of around 8.50% over the forecast period (2025-2034)

- In terms of revenue, the global brown sugar syrup market size was valued at around USD 22.03 billion in 2024 and is projected to reach USD 42.30 billion by 2034.

- The brown sugar syrup market is projected to grow significantly due to the rising prominence of bakery and confectionery products, the expanding global foodservice and café culture, and the increasing disposable income and urbanization in developing regions.

- Based on type, the dark segment is expected to lead the market, while the light segment is anticipated to experience significant growth.

- Based on form, the brown sugar syrup segment is the dominant segment, while the granules brown sugar segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the beverages segment is expected to lead the market, followed by the bakery products segment.

- Based on end-user, the cafe segment is the dominant segment, while the restaurants segment is projected to witness sizable revenue growth over the forecast period.

- Based on the distribution channel, the hypermarkets/supermarkets segment is expected to lead the market compared to the online retailer segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Brown Sugar Syrup Market: Overview

Brown sugar syrup is a viscous and sweet liquid made by dissolving brown sugar in water, usually enriched with molasses to improve its rich brown hue and deep caramel flavor. It is widely used as a natural sweetener in bakery items, desserts, beverages, and sauces due to its warm taste profile and smooth texture. The global brown sugar syrup market is projected to experience substantial growth, driven by the increasing demand for natural sweeteners. Growing popularity of beverage and café culture, as well as the expanding confectionery and bakery industry. Consumers are shifting from synthetic sweeteners and refined sugars, augmenting the demand for brown sugar syrup as a natural alternative. Its lower mineral content and processing attract the health-conscious group. The preference for organic and clean-label products strengthens this shift.

Moreover, the global expansion of bubble tea and coffee chain tea shops has increased the use of brown sugar syrup as a core flavoring ingredient. It adds depth and richness to beverages, increasing consumer appeal. Furthermore, brown sugar syrup is highly valued for its exceptional moisture retention and distinctive molasses flavor in baked goods. The rising consumption of cookies, cakes, and desserts drives the use of this ingredient by commercial bakeries. Additionally, as urban lifestyles drive the demand for ready-to-eat sweets, syrup demand increases substantially.

Although drivers exist, the global market is challenged by factors such as the availability of cost-effective alternatives and health concerns regarding sugar consumption. White sugar syrup, corn syrup, and artificial sweeteners offer cost-effective substitutes. Mass producers favor these alternatives due to their wider availability and lower prices, which hinder the industry's expansion of brown sugar syrup in the budget segment. The growing cases of obesity and diabetes have resulted in decreased overall sugar intake. This health-focused trend impacts all sugary products, including natural syrups. Governments promoting sugar taxes further impact the industry demand.

Even so, the global brown sugar syrup industry is well-positioned due to the growing demand for organic products and the increasing popularity of plant-based foods. Consumers are increasingly preferring sustainability and transparency in food ingredients. This trend backs growth in clean-label and organic brown sugar syrup segments. Brands that emphasize ethical sourcing gain a competitive advantage in global markets.

Additionally, as plant-based diets gain popularity, the vegan-friendly nature of brown sugar syrup makes it a preferred sweetening agent. It supports environmentally sustainable and cruelty-free lifestyles. Manufacturers are leveraging this substitute to enter the niche vegan product segment.

Brown Sugar Syrup Market Dynamics

Growth Drivers

How is the growth of the clean label and organic food movement fueling the brown sugar syrup market?

The clean-label movement, which favors natural origins, transparency, and chemical-free ingredients, is transforming consumer purchasing behavior. Brown sugar syrup perfectly aligns with this trend due to its recognizable origin and simple composition. Organic brown sugar syrup is gaining prominence in regions such as Germany, the US, and Canada, where organic food sales increased by 9.1% in 2024. In recent news, Wholesome Sweeteners Inc. has expanded its USDA-certified organic brown sugar syrup line, reflecting strong demand from retailers and consumers for clean-label alternatives.

How is the brown sugar syrup market augmented by the increasing use in the processed food and Ready-to-Eat (RTE) segment?

Brown sugar syrup serves as both a humectant and flavoring in ready-to-eat meals, desserts, and marinades. The syrup improves shelf stability and flavor depth, making it suitable for convenience foods. In March 2025, Conagra Brands announced a shift towards more natural sweeteners, including brown sugar syrup, in its meal portfolio. The current growth of packaged and RTE food consumption worldwide offers a strong avenue for the global brown sugar syrup market growth.

Restraints

Competition from alternative natural sweeteners adversely impacts the market progress

The rapid emergence of plant-based and low-calorie sweeteners, such as agave syrup, stevia, and monk fruit extract, poses a significant competitive threat to traditional sweeteners. These substitutes are gaining prominence among health-conscious consumers for offering sweetness without added calories. Prominent beverage companies, such as Danone and The Coca-Cola Company, have already reformulated many of their brown sugar products to reduce sugar content by incorporating stevia blends. This substitution effect is restricting brown sugar syrup's share in the growing natural sweetener segment.

Opportunities

How do technological innovations in syrup processing and packaging offer advantageous conditions for the brown sugar syrup market development?

Improvements in syrup production, such as enzyme-assisted processing, aseptic packaging, and vacuum evaporation, are enhancing shelf life and product quality. Modern processing promises consistent flavor retention and viscosity, addressing past stability issues. Furthermore, advancements in smart packaging, such as barrier containers and recyclable pouches, enhance product preservation and sustainability appeal. These technological advancements make brown sugar more competitive against refined and synthetic sweeteners, thus impacting the growth of the brown sugar syrup industry.

Challenges

Regulatory and taxation pressures on sugary products restrict the market growth

Several governments are expanding sugar taxes and imposing labeling limitations to discourage excessive sugar consumption. For example, in 2024, the Philippines and Mexico raised excise duties on sweetened beverages, increasing production costs for syrup-based drinks. Similar policies are under review in parts of the Asia Pacific and Europe. These fiscal measures not only impact beverage manufacturers but also suppress demand from food producers looking for cost-effective sweetening agents.

Brown Sugar Syrup Market: Segmentation

The global brown sugar syrup market is segmented based on type, form, application, end-user, distribution channel, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on type, the global brown sugar syrup industry is divided into dark, light, and regular. The dark brown sugar syrup segment holds a leading share in the market due to its high molasses content and robust caramel flavor, which makes it highly preferred in desserts, beverages, and bakery applications.

Based on form, the global market is segmented into powdered brown sugar, granules brown sugar, brown sugar syrup, and brown sugar cubes. The brown sugar syrup segment dominates the market, as it is widely used in bakery items, desserts, and beverages due to its smooth texture and easy solubility.

Based on application, the global brown sugar syrup market is segmented into bakery products, beverages, dairy products, confectionery products, and medicinal products. The beverage segment holds a leading share, driven by its broader use in bubble tea, coffee, flavored drinks, and cocktails, where it adds caramel flavor and sweetness.

Based on end-user, the global market is segmented into hotels, restaurants, residential, café, pharmaceutical industry, and cosmetic industry. The café segment captures the maximum share of the market due to the rising prominence of specialty beverages, such as brown sugar bubble tea and flavored coffee, in urban markets.

Based on distribution channel, the global market is segmented into hypermarkets/supermarkets, convenience stores, specialty retailers, online retailers, and others. The hypermarkets/supermarkets segment holds a leadership position in the global market, as consumers prefer these outlets for their extensive product variety, attractive promotional offers, and brand availability.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Brown Sugar Syrup Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Brown Sugar Syrup Market |

| Market Size in 2024 | USD 22.03 Billion |

| Market Forecast in 2034 | USD 42.30 Billion |

| Growth Rate | CAGR of 8.50% |

| Number of Pages | 216 |

| Key Companies Covered | Tate & Lyle PLC, Cargill, Incorporated, The Hershey Company, ASR Group, Archer Daniels Midland Company (ADM), Nordzucker AG, Wholesome Sweeteners Inc., Billington’s, Domino Foods Inc., Lyle’s Golden Syrup, Shree Renuka Sugars Ltd., Madhava Natural Sweeteners, Now Foods, Nature Nate’s Honey Co., Ragus Sugars Manufacturing Ltd., and others. |

| Segments Covered | By Type, By Form, By Application, By End-User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Brown Sugar Syrup Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Brown Sugar Syrup Market?

Asia Pacific is likely to sustain its leadership in the brown sugar syrup market due to high consumption of sweetened beverages, the expanding food and beverage sector, and growing dessert and café culture. The APAC region leads the worldwide consumption of milk teas, bubble teas, and iced coffees, all of which prominently feature brown sugar syrup. Economies like China, Taiwan, and Japan are the major markets where 'brown sugar boba' trends have majorly driven syrup sales. The rapid industrialization and investment in food manufacturing in China, India, and ASEAN nations are driving the adoption of syrup in confectionery and bakery production. The flavor and natural profile of brown sugar syrup make it a preferred ingredient for export-oriented and premium food products.

Furthermore, the APAC region has experienced a rise in cafes, boutiques, artisanal bakeries, and dessert shops, particularly in urban areas. Economies like Japan and South Korea have experienced a more than 25% rise in café establishments over the past five years, primarily driven by a surge in syrup use.

North America continues to hold the second-highest share in the brown sugar syrup industry, driven by the strong confectionery and bakery industries, growing demand for natural ingredients, and the expansion of vegan products. The US bakery industry, estimated to be worth more than $55 billion in 2024, relies heavily on natural sweeteners, such as brown sugar syrup, for retaining moisture and flavor. It is commonly used in cakes, frostings, cookies, and fillings to improve texture and taste. This rising trend continues to fuel the use of syrups. North American consumers are becoming more conscious of health and ingredient transparency. Brown sugar syrup, being less refined and containing molasses, supports the clean-label movement, which is driving its adoption in packaged beverages and foods.

Additionally, the plant-based food industry in North America exceeded $10 billion in 2024, triggering the use of vegan-friendly sweeteners. Brown sugar syrup, obtained from sugarcane, is extensively used in vegan beverages and desserts. This dietary shift continues to create continuous industry opportunities for syrup producers.

Brown Sugar Syrup Market: Competitive Analysis

The leading players in the global brown sugar syrup market are:

- Tate & Lyle PLC

- Cargill

- Incorporated

- The Hershey Company

- ASR Group

- Archer Daniels Midland Company (ADM)

- Nordzucker AG

- Wholesome Sweeteners Inc.

- Billington’s

- Domino Foods Inc.

- Lyle’s Golden Syrup

- Shree Renuka Sugars Ltd.

- Madhava Natural Sweeteners

- Now Foods

- Nature Nate’s Honey Co.

- Ragus Sugars Manufacturing Ltd.

Brown Sugar Syrup Market: Key Market Trends

Rising popularity of brown sugar-based beverages:

The worldwide rise in bubble tea, café culture, and artisanal coffee has increased the significance of brown sugar syrup as a flavoring agent. The ‘brown sugar boba’ trend, originating in Asia, is skyrocketing in Europe and North America. This beverage-driven demand is shaping fresh product launches and flavor advancements in the industry.

Product diversification and flavor innovation:

Producers are introducing various brown sugar syrup variants, including vanilla-flavored, caramel-infused, and low-calorie options. These advancements cater to changing consumer preferences and the rising premium food segment. Customization for beverage, bakery, and dessert applications is fueling robust industry differentiation.

The global brown sugar syrup market is segmented as follows:

By Type

- Dark

- Light

- Regular

By Form

- Powdered Brown Sugar

- Granules Brown Sugar

- Brown Sugar Syrup

- Brown Sugar Cubes

By Application

- Bakery Products

- Beverages

- Dairy Products

- Confectionery Products

- Medicinal Products

By End-User

- Hotels

- Restaurants

- Residential

- Cafe

- Pharmaceutical Industry

- Cosmetic Industry

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Retailers

- Online Retailer

- Other

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Brown sugar syrup is a viscous and sweet liquid made by dissolving brown sugar in water, usually enriched with molasses to improve its rich brown hue and deep caramel flavor. It is widely used as a natural sweetener in bakery items, desserts, beverages, and sauces due to its warm taste profile and smooth texture.

The global brown sugar syrup market is projected to grow due to rising demand for natural and organic sweeteners, increasing applications in sauces, marinades, and dressings, as well as product innovations and flavor diversification by manufacturers.

According to study, the global brown sugar syrup market size was worth around USD 22.03 billion in 2024 and is predicted to grow to around USD 42.30 billion by 2034.

The CAGR value of the brown sugar syrup market is expected to be approximately 8.50% from 2025 to 2034.

Asia Pacific is expected to lead the global brown sugar syrup market during the forecast period.

China is a significant contributor to the global market, driven by strong bubble tea culture, large-scale production, and high domestic consumption of sweetened beverages.

The key players profiled in the global brown sugar syrup market include Tate & Lyle PLC, Cargill, Incorporated, The Hershey Company, ASR Group, Archer Daniels Midland Company (ADM), Nordzucker AG, Wholesome Sweeteners, Inc., Billington’s, Domino Foods, Inc., Lyle’s Golden Syrup, Shree Renuka Sugars Ltd., Madhava Natural Sweeteners, Now Foods, Nature Nate’s Honey Co., and Ragus Sugars Manufacturing Ltd.

The competitive landscape in the market is moderately fragmented, with key players focusing on organic certifications, product innovation, and collaboration with beverage and bakery brands to strengthen their global presence.

Stakeholders should focus on developing flavored and organic variants, expanding e-commerce presence, and forming strategic partnerships with bakery and beverage chains to remain competitive in the brown sugar syrup market.

The report examines key aspects of the brown sugar syrup market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed