Breath Analyzers Market Size, Share, Trends, Growth and Forecast 2032

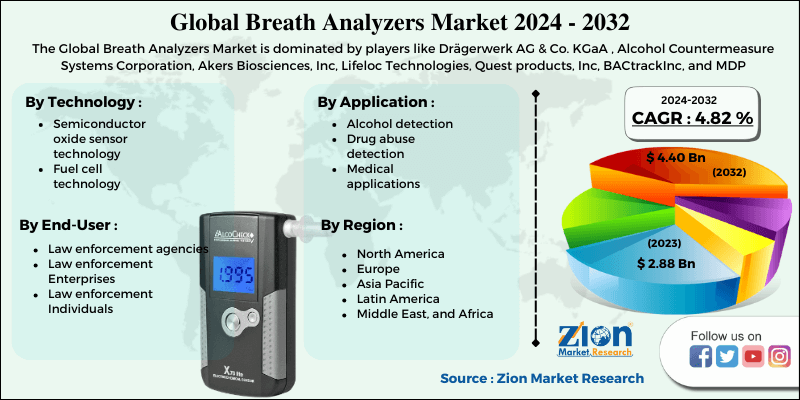

Breath Analyzers Market By Technology (Semiconductor oxide sensor technology and Fuel cell technology), By Applications (Alcohol detection, Drug abuse detection, and Medical applications) By End User (Law enforcement agencies, Law enforcement Individuals, Law enforcement Enterprises): Global Industry Perspective, Comprehensive Analysis And Forecast, 2024-2032

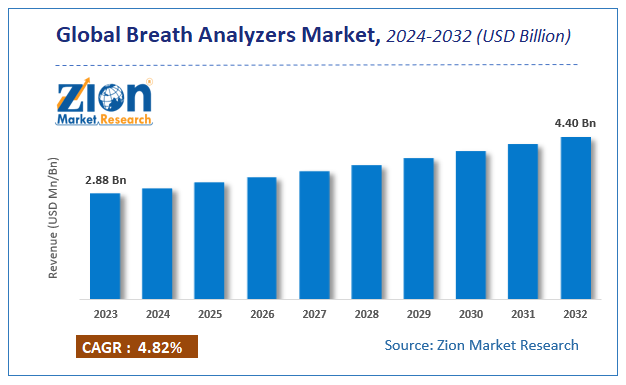

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.88 Billion | USD 4.40 Billion | 4.82% | 2023 |

Breath Analyzers Market Insights

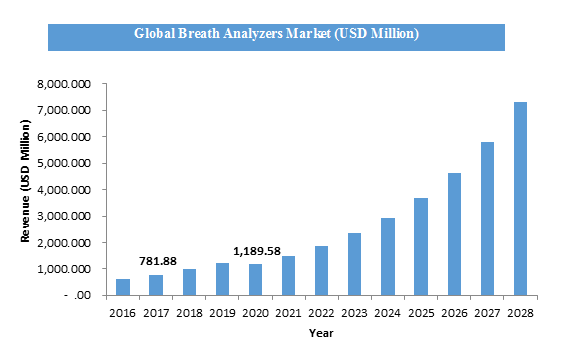

According to a report from Zion Market Research, the global Breath Analyzers Market was valued at USD 2.88 Billion in 2023 and is projected to hit USD 4.40 Billion by 2032, with a compound annual growth rate (CAGR) of 4.82% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Breath Analyzers Market industry over the next decade.

Market Overview

Breath analyzer, also known as a Breathalyzer, is an instrument used by police to measure the level of alcohol in a person's system that is suspicious of being drunk. A specific amount of the suspect's exhaled breath is filtered into a Technology of potassium dichromate and sulfuric acid in the analyser; the difference in the colour of the Technology is equal to the amount of alcohol in the air sample, which is directly related to the amount of alcohol in the blood. When the blood alcohol content in the blood reaches 80 milligrams per 100 millilitres, driving performance is severely compromised. Breath analyzers are an important method for detecting narcotics, tobacco, tuberculosis, asthma, and other illnesses. Breath analyzers are recognised as major equipment in applying drink and drive regulations since a vast number of road crash incidents are observed globally due to the over ingestion of alcohol while driving. Breath analyzers may be used by both individuals and experts to prevent intoxicated people from approaching the workplace and other social settings.

Breath analyzer is a medical device for estimating blood alcohol content from a breath sample. Breath analyzers are compact, accurate, and easy to use medical device. It considered as an essential tool for the recognition of drugs, alcohol, asthma, tuberculosis, cancer, and other diseases. Globally, almost half of road accidents are predictable to occur due to excessive alcohol consumption and drug misuse, breath analyzers are major equipment enforcing drink and drive laws and regulations. Thus, alcohol enforcements remain the main concern for governments across the world.

Increasing alcohol consumption and drug abuse, strict government laws and regulations are the major driving factor for breath analyzers market. Furthermore, growing demand from healthcare industry for disease identification and increase use of smart phone based breath analyzers are the factors expected to drive the breath analyzer market through the upcoming years.A number of factors that affects the worldwide market of breath analyzers are unhygienic conditions for use and lower accuracy of the devices.

COVID-19 Impact Analysis

The global Breath Analyzers market has witnessed a slight decline in the growth for short term due to the lockdown enforcement placed by governments in order to contain COVID spreading. The restrictions imposed by various nations to contain COVID had stopped the people coming out and social gatherings which resulted in less use of breath analyzers by cops. However, the global markets are slowly opening to their full potential and theirs a surge in demand of Breath Analyzers as people are coming out back with the new normal. The market would remain bullish in upcoming year.

The significant decrease in the global Breath Analyzers market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Growth Factors

The global breath analyzer market is expected to be driven by an increase in alcohol and substance misuse, as well as stricter government regulations. At traffic lights, police officers use breath analyzers to ascertain whether or not the driver is driving under the influence of alcohol. This has affected the market for breath analyzers ever more. Growing use of breath analyzers in medical applications is one of key factor that would increase the demand for breath analyzers market globally. Various non-governmental organizations (NGOs) are now taking important action and aggressively campaigning to raise concerns of drug abuse and the negative consequences of heavy alcohol use. However, the low accuracy rate of breath analyzers and unsanitary conditions resulting in hospital acquired infections in patients are expected to stymie the market's growth in the coming years. Dual sensor technology's arrival and an emphasis on emerging markets are two main opportunities for this business to develop.

Breath Analyzers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Breath Analyzers Market |

| Market Size in 2023 | USD 2.88 Billion |

| Market Forecast in 2032 | USD 4.40 Billion |

| Growth Rate | CAGR of 4.82% |

| Number of Pages | 150 |

| Key Companies Covered | Drägerwerk AG & Co. KGaA , Alcohol Countermeasure Systems Corporation, Akers Biosciences, Inc, Lifeloc Technologies, Quest products, Inc, BACtrackInc, and MDP |

| Segments Covered | By Technology, By Application, By End-User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Technology Segment Analysis Preview

Breath Analyzers market is segmented into three types: Technology, Application and End-User.

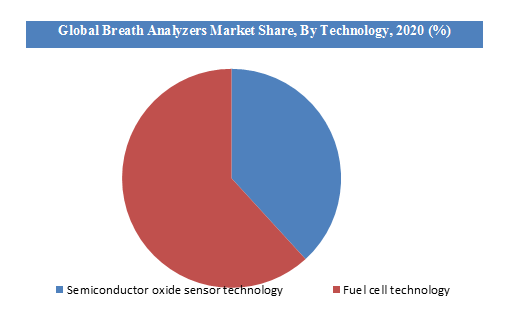

The market is further segmented into two types: Semiconductor oxide sensor technology and Fuel cell technology. In 2020, the global breath analyzers market will be dominated by the fuel cells segment. In breath analyzers, fuel cells are the most commonly used equipment. Breath analyzers mounted on fuel cells have a high degree of precision, sensitivity, and durability. They are designed to detect alcohol uniquely and do not need many sensors. For both personal and technical use, these analyzers are considered the gold standard of portable alcohol testers.

Application Segment Analysis Preview

The market is segmented into three types: Alcohol detection, Drug abuse detection and Medical applications. In 2020, the alcohol detection field had the highest market share. During the forecast period, this section is also expected to have the highest Growth rate. Stringent laws and rules for driving under the influence are mainly driving this segment's expansion (DUI).

End-User Segment Analysis Preview

The market is segmented into three types: Law enforcement agencies, Law enforcement Enterprises and Law enforcement Individuals. The segment of law enforcement authorities had the largest share of the global breath analyzers market in 2020. The use of breath analyzers in law enforcement is being driven by strict safety legislation against DUI and the growing scale of screening and evidential checking.

The breath analyzer market is characterized on the basis of technology, applications, end user and regions. The technology type segment of the breath analyzer market includes semiconductor oxide sensor technology and fuel cell technology. Fuel cell technology emerged as potential segments due to proficient functioning, high accuracy, calibration stability, longer working life and consistency of the breath analyzer devices. Based on applications, the breath analyzer market is segmented into alcohol detection, drug abuse detection, and medical applications.On the basis of the end user, the market is segmented into law enforcement agencies, enterprises, and individuals. Law enforcement agencies accounted for the major share of the global market in 2015,owing to increasing execution of regulations against drug and alcohol misuse.

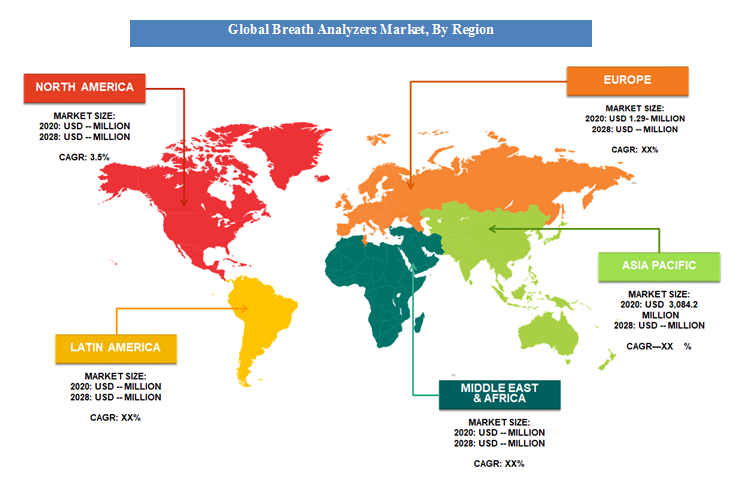

Geographically, North America accounted for the largest share of the breath analyzers markets followed by Europe in 2015. The market growth in this region is anticipated by many reasons such as excessive alcohol consumption, increasing awareness, and government initiatives.Additionally, demand for breath analyzers is increasing in Asia-Pacific region due to increasing focus on improvement of breath testing devices for medical diagnosis in this region. The market in this region may be driven by the rising number of vehicle accidents due to excessive alcohol consumption.

Key Market Players & Competitive Landscape

Major market players of Breath Analyzers market comprise-

- Drägerwerk AG & Co. KGaA

- Alcohol Countermeasure Systems Corporation

- Akers Biosciences

- Lifeloc Technologies

- Quest products

- BACtrackInc

- MDP.

The global Breath Analyzers Market is segmented as follows:

By Technology

- Semiconductor oxide sensor technology

- Fuel cell technology

By Application

- Alcohol detection

- Drug abuse detection

- Medical applications

By End-User

- Law enforcement agencies

- Law enforcement Enterprises

- Law enforcement Individuals

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Breath Analyzers Market size worth at USD 2.88 Billion in 2023

Breath Analyzers Market size worth at USD 2.88 Billion in 2023 and projected to USD 4.40 Billion by 2032, with a CAGR of around 4.82% between 2024-2032.

The global breath analyzer market is expected to be driven by an increase in alcohol and substance misuse, as well as stricter government regulations. Growing use of breath analyzers in medical applications is one of key factor that would increase the demand for breath analyzers market globally.

Geographically, North America has dominated the global market for breath analyzers and is expected to continue to do so in the years ahead. The domination of the North American breath analyzer industry is due to the availability of well-established medical and healthcare technology services as well as qualified healthcare service providers.

Some of the major companies operating in Breath Analyzers are Drägerwerk AG & Co. KGaA , Alcohol Countermeasure Systems Corporation, Akers Biosciences, Inc, Lifeloc Technologies, Quest products, Inc, BACtrackInc, and MDP.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed