Body-Worn Cameras Market Size, Share, Growth, & Forecast Report 2034

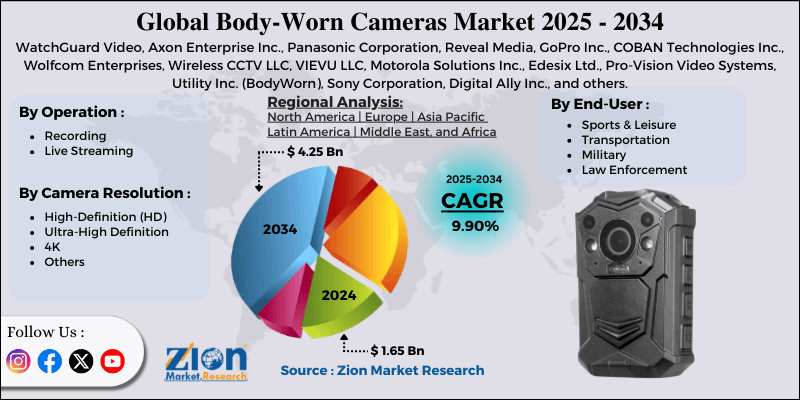

Body-Worn Cameras Market By Operation (Recording and Live Streaming), By Camera Resolution (High-Definition (HD), Ultra High Definition, 4K, and Others), By End-User (Sports & Leisure, Transportation, Military, Law Enforcement, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

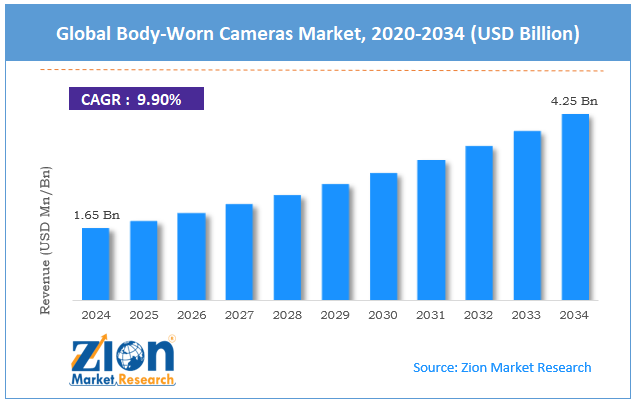

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.65 Billion | USD 4.25 Billion | 9.90% | 2024 |

Body-Worn Cameras Industry Perspective:

The global body-worn cameras market size was worth around USD 1.65 billion in 2024 and is predicted to grow to around USD 4.25 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.90% between 2025 and 2034.

Body-Worn Cameras Market: Overview

Body-worn cameras are compact devices that record audio and video. These gadgets are primarily used by law enforcement officers or military personnel for safety purposes. Body-worn cameras are meant to record interactions carried out by the wearer with the surrounding community. The recorded information can thus be used as effective evidence in the case of an investigation. The primary purposes of body-worn cameras used by law enforcement officers include gathering critical evidence, maintaining transparency, and protecting the interests of the parties involved. In recent times, body-worn cameras have witnessed extended application among civilian users.

For instance, several sports enthusiasts use such compact cameras to record their sport-related activities. During the forecast period, demand for body-worn cameras is expected to continue to grow amidst the rising national security concerns across global countries. In addition to this, government mandates regarding the compulsory use of body-worn cameras by law-enforcing officers will open new avenues for further growth. A critical growth retraining factor for the market players will emerge in the form of several technical limitations associated with the technology.

Key Insights:

- As per the analysis shared by our research analyst, the global body-worn cameras market is estimated to grow annually at a CAGR of around 9.90% over the forecast period (2025-2034)

- In terms of revenue, the global body-worn cameras market size was valued at around USD 1.65 billion in 2024 and is projected to reach USD 4.25 billion by 2034.

- The body-worn cameras market is projected to grow at a significant rate due to the growing use of compact cameras among law enforcement personnel.

- Based on the operation, the recording segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user, the law enforcement segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Body-worn Cameras Market: Growth Drivers

Growing use of compact cameras among law enforcement personnel to drive market revenue

The global body-worn cameras market is expected to be driven by the rising use of recording devices among law enforcement personnel. According to information published by the National Institute of Justice, body-worn cameras are used by local and state law enforcement agencies nationwide. According to official reports, approximately 86% of general-purpose law enforcement agencies that have acquired body-worn cameras have also drafted a formal body-worn camera policy. Officials state that effective use of body-worn cameras while on duty can significantly improve officer safety. It also helps in reducing complaints from civilians and increases the quality of evidence.

In May 2023, the US Department of Homeland Security announced the launch of the first Department-wide policy on Body-Worn Cameras (BWCs) for the agency’s law enforcement officers. In April 2024, highway patrol personnel of Bengaluru state police in India were mandated to use body-worn cameras. Initially, only the police officers from the state were required to use body-worn cameras while on duty.

Ongoing innovations in BWC technology will promote higher market revenue in the long run

Applications of body-worn cameras are rapidly expanding among civilian, military, and law enforcement officials. The surge in demand for efficient BWCs has encouraged market players to innovate high-performance solutions. Improvements in battery technology and camera resolution are some of the main areas of focus among industry players. Most BWC batteries have a life of 8 to 12 hours and must be recharged before next use. The ongoing research & development of batteries with higher lifespan and recording capacity can pave the way for further growth among industry players.

For instance, in a recent event, Betavolt, a Chinese company, announced that it has begun mass production of an eco-friendly and coin-sized battery called BV100. The energy-storing solution has a lifespan of 50 years. The global body worn cameras market may further benefit as the innovation rate intensifies across global platforms.

Body-worn Cameras Market: Restraints

Technical limitations of BWCs to impact final revenue during the forecast period

The global body-worn cameras industry is expected to be restricted due to the technical limitations associated with the technology. For instance, low-grade BWCs with poor camera resolution may fail to deliver as expected. Furthermore, frequent charging or changing of BWC batteries can be tiresome for the users. The lack of global mandates, ensuing large-scale adoption of body-worn cameras among law enforcement officers, may further dilute industry revenue according to research.

Body-worn Cameras Market: Opportunities

Increasing the use of BWCs among civilians to generate growth opportunities

The global body worn cameras market is expected to generate growth opportunities due to a surge in the use of the technology among civilians. In recent times, new BWCs have emerged in the market to meet the requirements of healthcare professionals. Such trends indicate product expansion and diversification strategies adopted by market players to generate additional revenue.

For instance, in January 2024, Axon, a leading global public safety technology provider, announced the launch of next-generation body-worn cameras specially designed for frontline workers in the healthcare and retail industries. Axon Body Workforce is expected to improve the safety of workers. According to official reports, the new range offers customization options and hence is more cost-effective for end-users. Additionally, the increased demand for BWCs among sports professionals is expected to further drive market revenue during the forecast period.

Growing threats against national security to propel military applications of BWCs

Countries worldwide are reporting growing threats against national security. Economies are registering increasing terror events across the globe in the form of the rising number of militants, gunmen, and other antisocial elements such as terrorists. It has led to a heightened need to seek novel measures to improve the safety of military professionals stationed across borders and other soft targets. The increase in military expenditure worldwide can open new avenues for growth among BWC providers.

Body-worn Cameras Market: Challenges

Concerns over privacy invasion caused by BWC to challenge market expansion

The global body-worn cameras market is expected to be challenged by the rising concerns over privacy invasion due to the use of BWCs. For instance, body-worn cameras are known to start recording without the consent of individuals. Furthermore, the cameras may capture confidential or sensitive scenarios, thus affecting the industry adoption rate across domains.

Body-Worn Cameras Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Body-Worn Cameras Market |

| Market Size in 2024 | USD 1.65 Billion |

| Market Forecast in 2034 | USD 4.25 Billion |

| Growth Rate | CAGR of 9.90% |

| Number of Pages | 219 |

| Key Companies Covered | WatchGuard Video, Axon Enterprise Inc., Panasonic Corporation, Reveal Media, GoPro Inc., COBAN Technologies Inc., Wolfcom Enterprises, Wireless CCTV LLC, VIEVU LLC, Motorola Solutions Inc., Edesix Ltd., Pro-Vision Video Systems, Utility Inc. (BodyWorn), Sony Corporation, Digital Ally Inc., and others. |

| Segments Covered | By Operation, By Camera Resolution, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Body-worn Cameras Market: Segmentation

The global body-worn cameras market is segmented based on operation, camera resolution, end-user, and region.

Based on the operation, the global market segments are recording and live streaming. In 2024, the highest growth was listed in the recording segment. Body-worn cameras are regularly used by law enforcement agencies to record conversations and situations encountered by their agents. According to official reports, in recent times, more than 78.9% of police officers in the US were working in departments with BWC programs.

Based on camera resolution, the global body worn camera industry is divided into high-definition (HD), ultra-high definition, 4K, and others.

Based on the end-user, the global market divisions are sports & leisure, transportation, military, law enforcement, and others. In 2024, the highest revenue-generating segment was law enforcement. According to industry experts, BWCs can assist law enforcement officers in reducing criminal behavior or interactions since the cameras are always recording and storing the interaction. Moreover, BWCs are useful in building public trust, helping officers perform their duties seamlessly. The average cost of a BWC designed for law enforcement use can range from USD 210 to USD 450.

Body-worn Cameras Market: Regional Analysis

North America to take the lead during the forecast period

The global body-worn cameras market is projected to be led by North America during the forecast period. The US is expected to take the lead in the regional market, driven by increased use of BWCs among federal and regional police officials across the country. The US is home to some of the most stringent and transparent policies governing the use of body-worn cameras by safety officers.

In January 2024, the U.S. Immigration and Customs Enforcement (ICE) announced that it had updated guidance for its law enforcement personnel concerning the use of BWCs. The policy now requires that body-worn cameras be used during all events involving ICE enforcement, except for investigative activities. The growing adoption of advanced technologies among US law enforcement entities is helping fuel regional revenue.

In March 2025, the Ohio Office of Criminal Justice Services announced that around 131 law enforcement agencies would receive grant awards. 21 agencies will use the fund to create comprehensive body-worn camera programs, while the rest will use the money to expand existing infrastructure.

Body-worn Cameras Market: Competitive Analysis

The global body-worn cameras market is led by players like:

- WatchGuard Video

- Axon Enterprise Inc.

- Panasonic Corporation

- Reveal Media

- GoPro Inc.

- COBAN Technologies Inc.

- Wolfcom Enterprises

- Wireless CCTV LLC

- VIEVU LLC

- Motorola Solutions Inc.

- Edesix Ltd.

- Pro-Vision Video Systems

- Utility Inc. (BodyWorn)

- Sony Corporation

- Digital Ally Inc.

The global body-worn cameras market is segmented as follows:

By Operation

- Recording

- Live Streaming

By Camera Resolution

- High-Definition (HD)

- Ultra-High Definition

- 4K

- Others

By End-User

- Sports & Leisure

- Transportation

- Military

- Law Enforcement

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Body-worn cameras are compact audio and video recording devices. These gadgets are primarily used by law enforcement officers or military personnel for safety purposes.

The global body-worn cameras market is expected to be driven by the rising use of recording devices among law enforcement personnel.

According to study, the global body-worn cameras market size was worth around USD 1.65 billion in 2024 and is predicted to grow to around USD 4.25 billion by 2034.

The CAGR value of the body-worn cameras market is expected to be around 9.90% during 2025-2034.

The global body-worn cameras market is projected to be led by North America during the forecast period.

The global body-worn cameras market is led by players like WatchGuard Video, Axon Enterprise, Inc., Panasonic Corporation, Reveal Media, GoPro, Inc., COBAN Technologies, Inc., Wolfcom Enterprises, Wireless CCTV LLC, VIEVU LLC, Motorola Solutions, Inc., Edesix Ltd., Pro-Vision Video Systems, Utility, Inc. (BodyWorn), Sony Corporation, and Digital Ally, Inc.

The report explores crucial aspects of the body-worn cameras market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

List of Contents

Body-Worn CamerasIndustry Perspective:OverviewKey Insights:Body-worn Cameras Growth DriversBody-worn Cameras RestraintsBody-worn Cameras OpportunitiesBody-worn Cameras ChallengesReport ScopeBody-worn Cameras SegmentationBody-worn Cameras Regional AnalysisBody-worn Cameras Competitive AnalysisThe global body-worn cameras market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed