Blockchain in Insurance Market Size, Share, Growth, Forecast 2032

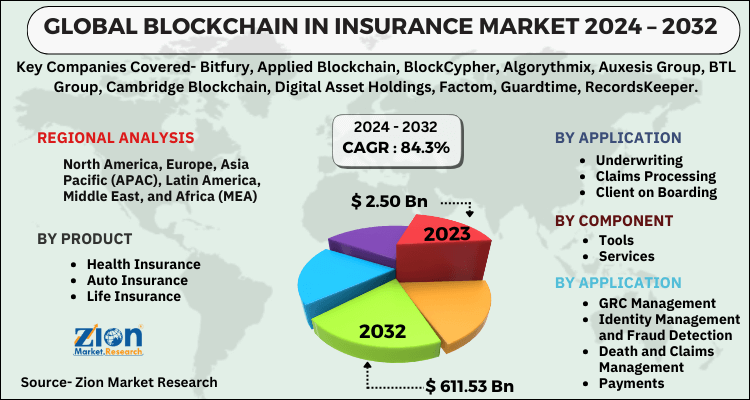

Blockchain in Insurance Market: by Product (Health Insurance, Auto Insurance and Life Insurance), by Application Area (Underwriting, Claims Processing and Client on Boarding), by Components (Tools and Services) for GRC management, Identity Management and Fraud Detection, Death and Claims Management, Payments and Others Among Other Applications and By Region- Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032.

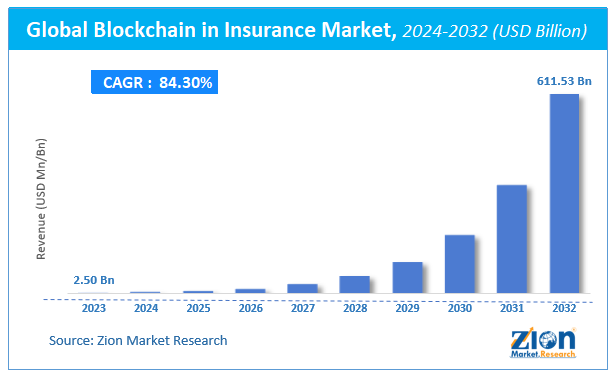

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.50 Billion | USD 611.53 Billion | 84.3% | 2023 |

Blockchain in Insurance Market Insights

According to Zion Market Research, the global Blockchain in Insurance Market was worth USD 2.50 Billion in 2023. The market is forecast to reach USD 611.53 Billion by 2032, growing at a compound annual growth rate (CAGR) of 84.3% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Blockchain in Insurance Market industry over the next decade.

The report analyzes the global blockchain in insurance market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the blockchain in insurance industry.

Blockchain in Insurance Market: Overview

Block-chain is basically an encrypted protocol designed to secure digitalized data. It is basically formed of encrypted list of database that is considered as block. Currently block-chain plays vital role in insurance industry. Basically in insurance sector block-chain is implied for fraud detection, claims management, payment modeling, and reinsurance management.

Currently number of false insurance claims is tremendously increasing. Fraud risk management is one of the prime areas of concern for an insurer. Such frauds are driving up the cost of both insurer and policy holder. Handling such frauds is burdensome task. Therefore to prevent or handle such sharp practices block-chain is widely used by numerous insurance companies. The boosting need of handling such frauds is significantly driving the market growth. Blockchain handles such fraud claims with viable proofs. It basically develops a highly secured system that verifies any insurance claim quickly. However, constant need of energy sources to run the blockchain software for encryption and decryption is restraining the market growth to some extent. Transparency and trust is one of the prime matters of concern for insurance industry that is significantly offered by blockchain technology. The constant need of enhancing the efficiency and claims processing is expected to create enormous opportunities in future.

Blockchain in Insurance Market: Segmentation

The blockchain in insurance market is bifurcated on the basis of product, application area, component, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By product segment analysis includes health insurance, auto insurance, life insurance.

By application area segment analysis includes underwriting, claims processing, client on boarding.

By component segment analysis includes tools and services.

By application segment analysis includes grc management, identity management and fraud detection, death and claims management, payments and others (content storage management and customer communication).

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Blockchain in Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Blockchain in Insurance Market |

| Market Size in 2023 | USD 2.50 Billion |

| Market Forecast in 2032 | USD 611.53 Billion |

| Growth Rate | CAGR of 84.3% |

| Number of Pages | 189 |

| Key Companies Covered | Bitfury, Applied Blockchain, BlockCypher, Algorythmix, Auxesis Group, BTL Group, Cambridge Blockchain, Digital Asset Holdings, Factom, Guardtime, RecordsKeeper, Microsoft, IBM, Earthport, iXLedger, SAP , Symbiont and SafeShare |

| Segments Covered | By Product, By Application Area, By Component, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

By component the market is classified into tools and services. Services segment is anticipated to hold massive share in the upcoming years due to boosting rate of consulting services of insurance industry. Blockchain is used in diversified applications of insurance industry including smart contracts, GRC management, identity management and fraud detection, death and claims management, payments and others. Rising insurance fraud claims rate is immensely accelerate the growth of identity management and fraud detection segment.

Blockchain in Insurance Market: Competitive Analysis

At present adoption of blockchain technology is rapid pace; key players of the market are highly focused on enhancing the security level offered. Globally renowned key players of blockchain in insurance Bitfury, Applied Blockchain, BlockCypher, Algorythmix, Auxesis Group, BTL Group, Cambridge Blockchain, Digital Asset Holdings, Factom, Guardtime, RecordsKeeper, Microsoft, IBM, Earthport, iXLedger, SAP , Symbiont and SafeShare Global.

Blockchain in Insurance Market: Regional Analysis

Geographically the market is classified into five regions North America, Europe, Asia Pacific, Latin America, and MEA. Due to high rate of adoption of blockchain, North America is observed to significantly dominate the market.

The report segments global blockchain in insurance market as follows:

Global Blockchain in Insurance Market: Product Segment Analysis

- Health Insurance

- Auto Insurance

- Life Insurance

Global Blockchain in Insurance Market: Application Area Segment Analysis

- Underwriting

- Claims Processing

- Client on Boarding

Global Blockchain in Insurance Market: Component Segment Analysis

- Tools

- Services

Global Blockchain in Insurance Market: Application Segment Analysis

- GRC Management

- Identity Management and Fraud Detection

- Death and Claims Management

- Payments

- Others (content storage management and customer communication)

Global Blockchain in Insurance Market: Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Blockchain in insurance refers to the application of blockchain technology within the insurance industry to improve various processes, enhance transparency, reduce fraud, and streamline operations. Blockchain is a distributed and decentralized digital ledger technology that enables secure, transparent, and tamper-proof recording and sharing of data across multiple parties. It provides a single source of truth that is updated and validated through consensus among participants.

Blockchain's decentralized and cryptographic nature enhances data security and privacy, addressing concerns in the insurance industry. As data breaches and cyber threats increase, the adoption of blockchain for secure data management can drive market growth.

The global blockchain in insurance market size was worth around $ xx Million in 20223and is predicted to grow to around $ xx Million by 2032.

a compound annual growth rate (CAGR) of roughly xx% between 2024 and 2032.

Geographically the market is classified into five regions North America, Europe, Asia Pacific, Latin America, and MEA. Due to high rate of adoption of blockchain, North America is observed to significantly dominate the market.

At present adoption of blockchain technology is rapid pace; key players of the market are highly focused on enhancing the security level offered. Globally renowned key players of blockchain in insurance Bitfury, Applied Blockchain, BlockCypher, Algorythmix, Auxesis Group, BTL Group, Cambridge Blockchain, Digital Asset Holdings, Factom, Guardtime, RecordsKeeper, Microsoft, IBM, Earthport, iXLedger, SAP , Symbiont and SafeShare Global.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed