Biopolymer Coatings Market Size, Share, Trends and Outlook 2032

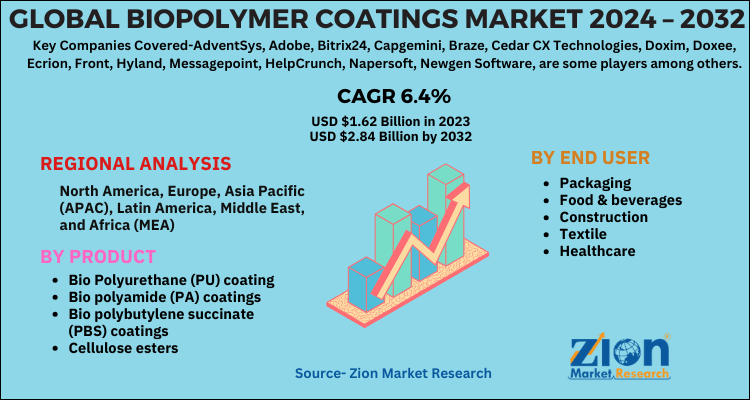

Biopolymer Coatings Market By Product (bio polyurethane (PU) coating, bio polyamide (PA) coatings, bio polybutylene succinate (PBS) coatings, cellulose esters and others), By End user (packaging, food & beverages, construction, textile, healthcare and others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

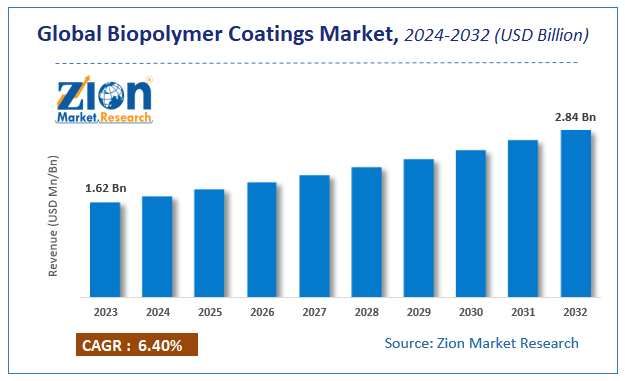

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.62 Billion | USD 2.84 Billion | 6.4% | 2023 |

Biopolymer Coatings Market Insights

According to Zion Market Research, the global Biopolymer Coatings Market was worth USD 1.62 Billion in 2023. The market is forecast to reach USD 2.84 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.4% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Biopolymer Coatings Market industry over the next decade.

Biopolymer Coatings Market: Overview

Biopolymers are polymeric biomolecules, used for making adhesives and coating. They're naturally renewable and might be used as block coatings on paper packaging materials. The biopolymer coating breaks unwanted moisture transfer in food products. These coatings are good oxygen and oil barriers, are biodegradable, and are capable of changing present synthetic paper and paperboard coatings. They're made by a mixture of antimicrobial agents in coatings to supply the active paper packaging material, which is a spectacular option for shielding food from microorganism development and spread.

Rising environmental anxieties regarding the pollution produced from certain synthetic packaging & coatings and therefore the demand from consumers for coatings that provide higher quality and longer periods are driving the biopolymer coatings market. It possesses a unique potential and thus, can help reduce Greenhouse Gas (GHG) emissions effectively. Additionally, the growing demand for cost-effective and environment-friendly materials for packaging is anticipated to fuel market growth within the forecast period. Also, the increased growth within the packaging industry and acceptance of biopolymer coatings by manufacturers are increasing demand.

Biopolymer Coatings Market: Growth Factors

Growing industrialization and standardization of the packaging procedures and high implementation of biopolymer coatings is driving the market. Preference towards eco-friendly materials in packaging industries also as textiles is that the driving factor of the biopolymer coatings market. Sustainable, recyclable, and non-toxic nature is that the key element boosting the buyer preference towards the biopolymer materials, thus boosting the expansion of the biopolymer coatings market.

Moreover, rising urbanization and lifestyle, health and environment awareness, and consumer preferences towards fresh and prepared meals in removing packaging with convenient packaging style are that the vital factor impacting the expansion of the biopolymer coatings market positively. Increasing investment for this packaging revolution is leading to the demand for biopolymer coatings within the market. High demand for biopolymers in cosmetics, food, and beverages also as constant efforts of the manufacturers to develop a good range of quality products and technologies are the main drivers of the biopolymer coatings market.

Biopolymer Coatings Market: Segment Analysis

The global biopolymer coatings market is segmented based on their material types as polysaccharides, proteins, and lipid compounds. These materials are further sub-segmented as for polysaccharides, cellulose, starches, chitosan acts as a protective film against oil, the protein includes collagen, gluten, cottonseed proteins, and zein. Lipid compounds comprise natural waxes, animal fat, and Bio polybutylene succinate (PBS) coatingsnt fat.

Based on the end-user, the global market is further classified as rigid packaging, textiles, food and beverages, flexible packaging, Textile, agriculture, Food & Beverages, and others. Packaging was the foremost application of the global Biopolymer Coatings market in 2020. It accounted for above 30% share of the total volume consumption of the market in 2020. The growing rigid and flexible packaging in the food & beverages, pharmaceutical & healthcare industries is expected to accelerate the market’s growth during the coming years.

Biopolymer Coatings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Biopolymer Coatings Market |

| Market Size in 2023 | USD 1.62 Billion |

| Market Forecast in 2032 | USD 2.84 Billion |

| Growth Rate | CAGR of 6.4% |

| Number of Pages | 110 |

| Key Companies Covered | AdventSys, Adobe, Bitrix24, Capgemini, Braze, Cedar CX Technologies, Doxim, Doxee, Ecrion, Front, Hyland, Messagepoint, HelpCrunch, Napersoft, Newgen Software, are some players among others |

| Segments Covered | By Offering, By Deployment Model, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Biopolymer Coatings Market: Regional Analysis

The US dominates the worldwide biopolymer coatings market due to the growing food and packaging industry, implementation of eco-friendly concepts, and rising industrialization and technology. Europe is predicted to grow at a rapid pace thanks to changing consumer preferences towards using reusable products and expanding the food industry within the coming years. The Asia Pacific may boost the expansion of the market due to the rising economy and rapid urbanization.

Biopolymer Coatings Market: Competitive Landscape

Key market Bio polybutylene succinate (PBS) coatingsyers in the global biopolymer coatings market include

- Ashland Inc.

- Dow Chemical

- Economy Polymers & Chemicals

- JM Huber

- Novamont

- Archer-Daniels-Midland (ADM)

- Bio polybutylene succinate (PBS) coatingsntic Technologies

- Cargill Inc

- Corbion NV

- ICC Industries Incorporated

- NovaMatrix

- Borregaard ASA

- Croda International

The global Biopolymer Coatings Market is segmented as follows:

By Products

- Bio Polyurethane (PU) coating

- Bio polyamide (PA) coatings

- Bio polybutylene succinate (PBS) coatings

- Cellulose esters

- Others

By End User

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed