Global Polyamide 12 (PA 12/Nylon 12) Market Size, Share, Growth Analysis Report - Forecast 2034

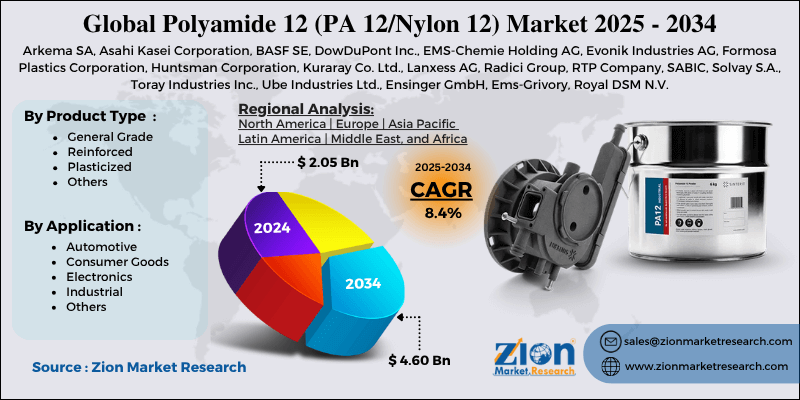

Polyamide 12 (PA 12/Nylon 12) Market By Product Type (General Grade, Reinforced, Plasticized, Others), By Application (Automotive, Consumer Goods, Electronics, Industrial, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.05 Billion | USD 4.60 Billion | 8.4% | 2024 |

Polyamide 12 (PA 12/Nylon 12) Market: Industry Perspective

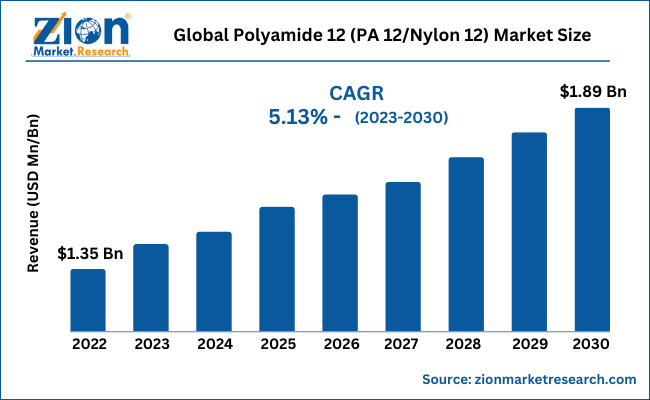

The global polyamide 12 (PA 12/nylon 12) market size was worth around USD 2.05 Billion in 2024 and is predicted to grow to around USD 4.60 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.4% between 2025 and 2034. The report analyzes the global polyamide 12 (PA 12/nylon 12) market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the polyamide 12 (PA 12/nylon 12) industry.

The market report offers remarkable insights into the essential drivers, opportunities, constraints, and challenges impacting the global polyamide 12 (PA 12/Nylon 12) industry.

Polyamide 12 (PA 12/Nylon 12) Market: Overview

Polyamide 12 (PA 12) is a common class of plastics with large additive applications, it is also known for its tensile strength, toughness, ability to bend without fracture, and impact strength. Due to these mechanical properties, it has long been used by injection molders. PA 12 is also referred to as Nylon 12. And more recently, in additive manufacturing processes for making usable parts and prototypes, PA 12 has been adopted as a standard material.

Key Insights

- As per the analysis shared by our research analyst, the global polyamide 12 (PA 12/nylon 12) market is estimated to grow annually at a CAGR of around 8.4% over the forecast period (2025-2034).

- Regarding revenue, the global polyamide 12 (PA 12/nylon 12) market size was valued at around USD 2.05 Billion in 2024 and is projected to reach USD 4.60 Billion by 2034.

- The polyamide 12 (PA 12/nylon 12) market is projected to grow at a significant rate due to rising demand in automotive and 3D printing applications, superior material properties, and increasing adoption in fuel-resistant and flexible components.

- Based on Product Type, the General Grade segment is expected to lead the global market.

- On the basis of Application, the Automotive segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Polyamide 12 (PA 12/Nylon 12) Market: Dynamics

Key Growth Drivers:

The Polyamide 12 (PA 12/Nylon 12) market is primarily driven by its superior mechanical properties, such as high strength, flexibility, and chemical resistance, which make it suitable for a wide range of applications in automotive, aerospace, electronics, and medical industries. Growing demand for lightweight materials to improve fuel efficiency and reduce carbon emissions in the automotive sector is significantly boosting PA 12 consumption. Additionally, the rising adoption of additive manufacturing (3D printing) and advanced manufacturing technologies is fueling market growth, as PA 12 is widely used for producing high-precision prototypes and functional parts. Increasing industrial automation and the need for durable and corrosion-resistant materials further support the expansion of the PA 12 market.

Restraints:

The high production cost of Polyamide 12 compared to other polymers is a major restraint for market growth, limiting its adoption in cost-sensitive applications. Complex manufacturing processes and the dependence on specialty raw materials also add to the expense, reducing competitiveness in some sectors. Limited availability of PA 12 in certain regions due to supply chain constraints can hinder market expansion. Moreover, competition from alternative engineering polymers and composites with similar performance but lower costs poses a challenge for PA 12 manufacturers, particularly in industries where price sensitivity is high.

Opportunities:

Expanding applications of PA 12 in emerging sectors such as medical devices, oil and gas pipelines, and electrical components present significant opportunities for market growth. The increasing use of PA 12 in additive manufacturing for producing complex and custom parts offers substantial potential for innovation. Growing investments in infrastructure and industrial automation across developing economies create new demand for high-performance polymers like PA 12. Furthermore, advancements in sustainable and bio-based PA 12 production methods offer opportunities for manufacturers to address environmental concerns while meeting rising demand for eco-friendly materials.

Challenges:

The Polyamide 12 market faces challenges including volatility in raw material prices, which can impact production costs and pricing stability. The polymer’s sensitivity to moisture absorption can limit its performance in certain environments, restricting its application scope. Stringent environmental regulations regarding polymer manufacturing and disposal create compliance challenges for manufacturers. Additionally, competition from low-cost alternatives and emerging polymer technologies may slow PA 12 adoption in price-sensitive industries, requiring continuous innovation and cost optimization to sustain growth.

Polyamide 12 (PA 12/Nylon 12) Market: Segmentation

The global polyamide 12 market is segmented based on product type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on product type, the global market is segmented into General Grade, Reinforced, Plasticized, and others. The reinforced segment held the dominating market share in 2022 and is further projected to grow rapidly during the forecast period. The reinforced segment of the polyamide 12 market has experienced steady growth in recent years.

This can be attributed to the increasing demand from industries such as automotive, electrical, and industrial, which require materials with high strength, stiffness, and durability. Reinforced polyamide 12 offers improved mechanical properties compared to general-grade polyamide 12, making it a popular choice in applications such as engine components, gear parts, and electrical connectors. Additionally, advancements in reinforcement technologies, such as glass and carbon fiber reinforcements, have further increased the performance of reinforced polyamide 12, expanding its application scope.

The reinforced segment is expected to continue its growth trajectory in the coming years as end-use industries continue to demand high-performance materials that can withstand harsh operating conditions and offer long-term durability.

Based on application, the polyamide 12 industry is segmented into Automotive, Consumer Goods, Electronics, Industrial, and others. The automotive segment held the largest market share in 2022 and is further predicted to surge exponentially during the forecast period. The automotive segment is one of the key drivers of the polyamide 12 market, as polyamide 12 offers excellent mechanical properties and thermal stability, making it ideal for use in various automotive applications.

The demand for lightweight materials in the automotive industry has been on the rise, as automakers seek to reduce the weight of vehicles to improve fuel efficiency and reduce emissions. Polyamide 12 offers a lightweight alternative to traditional materials such as metal and glass, while still maintaining high-performance standards. Additionally, the growing adoption of electric vehicles is expected to further drive the demand for polyamide 12, as it offers excellent insulation properties and can help reduce the weight of battery components.

Polyamide 12 (PA 12/Nylon 12) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polyamide 12 (PA 12/Nylon 12) Market |

| Market Size in 2024 | USD 2.05 Billion |

| Market Forecast in 2034 | USD 4.60 Billion |

| Growth Rate | CAGR of 8.4% |

| Number of Pages | 242 |

| Key Companies Covered | Arkema SA, Asahi Kasei Corporation, BASF SE, DowDuPont Inc., EMS-Chemie Holding AG, Evonik Industries AG, Formosa Plastics Corporation, Huntsman Corporation, Kuraray Co. Ltd., Lanxess AG, Radici Group, RTP Company, SABIC, Solvay S.A., Toray Industries Inc., Ube Industries Ltd., Ensinger GmbH, Ems-Grivory, Royal DSM N.V., Mitsubishi Chemical Holdings Corporation, and others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polyamide 12 (PA 12/Nylon 12) Market: Regional Analysis

Asia-Pacific leads the Polyamide 12 (PA 12/Nylon 12) market driven by rapid industrialization, a large automotive and electronics manufacturing base, and growing adoption in additive manufacturing, while North America remains a strong market due to advanced applications in aerospace, medical devices, and high-value industrial uses supported by technological innovation; Europe shows steady demand fueled by automotive and electronics industries and a growing emphasis on sustainable and bio-based materials, and the Middle East & Africa and Latin America are emerging regions where infrastructure development, oil & gas inspection needs, and expanding industrial activity are gradually increasing PA 12 consumption, resulting in a global market with Asia-Pacific as the primary growth engine and other regions contributing through specialized end-use applications.

Polyamide 12 (PA 12/Nylon 12) Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the polyamide 12 (PA 12/nylon 12) market on a global and regional basis.

The global polyamide 12 (PA 12/nylon 12) market is dominated by players like:

- Arkema SA

- Asahi Kasei Corporation

- BASF SE

- DowDuPont Inc.

- EMS-Chemie Holding AG

- Evonik Industries AG

- Formosa Plastics Corporation

- Huntsman Corporation

- Kuraray Co. Ltd.

- Lanxess AG

- Radici Group

- RTP Company

- SABIC

- Solvay S.A.

- Toray Industries Inc.

- Ube Industries Ltd.

- Ensinger GmbH

- Ems-Grivory

- Royal DSM N.V.

- Mitsubishi Chemical Holdings Corporation.

The global Polyamide 12 (PA 12/Nylon 12) Market is segmented as follows:

By Product Type

- General Grade

- Reinforced

- Plasticized

- Others

By Application

- Automotive

- Consumer Goods

- Electronics

- Industrial

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polyamide 12 (PA 12) is a common class of plastics with large additive applications, it is also known for its tensile strength, toughness, ability to bend without fracture, and impact strength. Due to these mechanical properties, it has long been used by injection molders. PA 12 is also referred to as Nylon 12. And more recently, in additive manufacturing processes for making usable parts and prototypes, PA 12 has been adopted as a standard material.

The global polyamide 12 (PA 12/nylon 12) market is expected to grow due to increasing demand for lightweight, high-performance materials in the automotive (especially electric vehicles) and electronics industries, coupled with the growing adoption of 3D printing/additive manufacturing technologies and a rising focus on sustainable and bio-based polymer solutions.

According to a study, the global polyamide 12 (PA 12/nylon 12) market size was worth around USD 2.05 Billion in 2024 and is expected to reach USD 4.60 Billion by 2034.

The global polyamide 12 (PA 12/nylon 12) market is expected to grow at a CAGR of 8.4% during the forecast period.

North America is expected to dominate the polyamide 12 (PA 12/nylon 12) market over the forecast period.

Leading players in the global polyamide 12 (PA 12/nylon 12) market include Arkema SA, Asahi Kasei Corporation, BASF SE, DowDuPont Inc., EMS-Chemie Holding AG, Evonik Industries AG, Formosa Plastics Corporation, Huntsman Corporation, Kuraray Co. Ltd., Lanxess AG, Radici Group, RTP Company, SABIC, Solvay S.A., Toray Industries Inc., Ube Industries Ltd., Ensinger GmbH, Ems-Grivory, Royal DSM N.V., Mitsubishi Chemical Holdings Corporation, among others.

The report explores crucial aspects of the polyamide 12 (PA 12/nylon 12) market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed