Bio-Implants Market Size, Share, Trends, Growth 2032

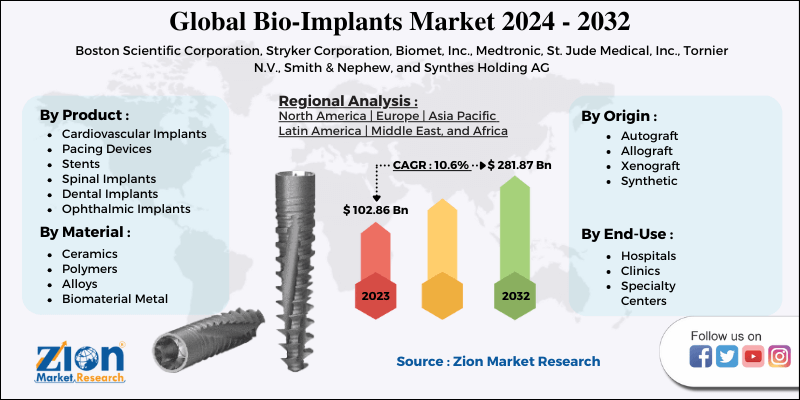

Bio-Implants Market By Material (Polymers, Ceramics, Alloys, And Biomaterial Metal), By Product (Cardiovascular, Dental, Spinal, Orthopedic, Ophthalmic, And Others), By End-Use (Hospitals, Specialty Centers, And Clinics), By Origin (Autograft, Xenograft, Allograft, And Synthetic), And By Region- Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

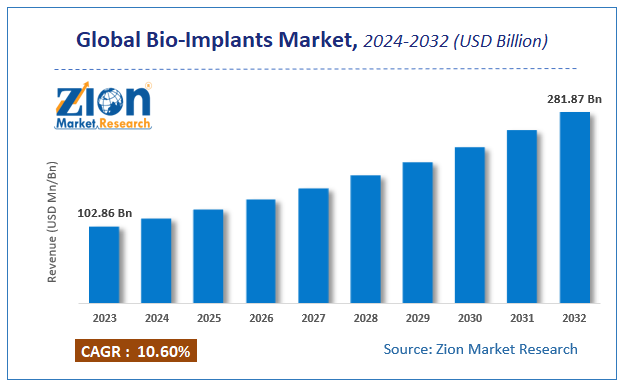

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 102.86 Billion | USD 281.87 Billion | 10.6% | 2023 |

Industry Perspective: Bio-Implants Market

The global Bio-Implants market, estimated at about 102.86 (USD Billion) in 2023 and predicted to accrue earnings worth 281.87(USD Billion) by 2032, is set to record a CAGR of nearly about 10.60% over 2024-2032. The report offers valuation and analysis of the Bio-Implants market on a global as well as regional level.The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on value (USD Billion).

Bio-Implants Market: An Overview

Bio-implants used for teeth are materials that provide living PDL connectivity to titanium implants. Furthermore, it comprises hydroxyapatite that is coated with the titanium screw and is sheathed into the sheets of cells produced from human periodontal cells. Apart from this, bio-implants are also used for treating skin burns and sores as well as cornea sores in the eye. Moreover, bio-implants help in rapid healing in comparison to other kinds of implants. Additionally, these products are made up of collagen, artificial skin, and animal tissues. Few of these bio-implants are made up of bio-polymers and polymers.

Apparently, the rise in the utilization of bio-implant methods has proved to be beneficial to individuals as compared to arthroscopy and this is anticipated to steer the bio-implant market trends. In addition to this, bio-implants have played a vital role in the treatment of heart disorders, neurological ailments, osteoarthritis, congenital problems, orthopedic problems, spinal disorders, and ophthalmic issues apart from dental surgeries. Bio-implants are also defined as prostheses that are utilized for regulating physiological activities and help in the fast recovery & reconstruction of damaged tissues of human body cavities & organs.

Bio-Implants Market Growth Drivers

Humungous use of bio-implants in organ transplants as well as tissue replacement will kindle the growth of the bio-implants industry over the projected timeframe. The massive use of bio-implants in various ENT fields and their ability to provide security from infection will steer the expansion of the bio-implants market over the anticipated timespan. The surge in the geriatric population prone to chronic disorders and lifestyle-related diseases will proliferate the market size over the years to come.

Furthermore, bio-implants assist in various drug delivery in musculoskeletal disorders and obesity. A rise in oral care issues and demand for minimally invasive products will contribute immensely toward the bio-implants market earnings during the forecast timespan. For instance,

in 2016, WHO projected that oral disorders affected nearly half of the population across the globe with nearly 3 billion persons suffering from tooth disorders & problems related to dental cavities.

Apart from this, the bio-implants such as spacers & beads with high concentrations of antibiotics are utilized for treating chronic osteomyelitis and deep soft-tissue infections. They also help in annihilating systemic side effects. All these aforementioned factors are anticipated to bolster business growth over the forecast timeline. Traumatic injuries caused as a result of road mishaps can also be effectively treated with bio-implants. Additionally, rise in the cosmetic surgeries due to changing fashion trends & lifestyle patterns and crave for looking beautiful among young as well as old people will not only complement the bio-implants market growth but will also assist the industry reach scaling peaks of growth in the years ahead.

Breakthroughs in bio-engineering technologies, 3D printing, nanotechnology, and laser systems will help the bio-implants market chart a profitable growth map in the forthcoming years. Favorable government healthcare policies and a large allocation of funds by organizations like WHO for improving the healthcare infrastructure of developing and underdeveloped nations will further enhance the popularity of bio-implants in the healthcare and medical sector. Apart from this, growing awareness about oral care among the people as well as physicians will create new horizons of growth for the bio-implants market in the near future.

Bio-Implants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bio-Implants Market |

| Market Size in 2023 | USD 102.86 Billion |

| Market Forecast in 2032 | USD 281.87 Billion |

| Growth Rate | CAGR of 10.6% |

| Number of Pages | 110 |

| Key Companies Covered | Boston Scientific Corporation, Stryker Corporation, Biomet, Inc., Medtronic, St. Jude Medical, Inc., Tornier N.V., Smith & Nephew, and Synthes Holding AG. |

| Segments Covered | By Product, By Material, By Origin, By End-Use and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America To Acquire Major Bio-Implants Market Share By 2032

The growth of the bio-implants market in the sub-continent can be contributed to large number of acquisitions made by key industry players in the countries such as the U.S. For instance, in January 2021, the U.S. based firm Stryker Corporation has acquired Orthosensor Inc., another U.S. based firm manufacturing sensor tools for musculoskeletal care & joint replacement. Such strategic moves are likely to play a major role in promoting innovation in bio-implants industry across the region with the smart sensor technologies facilitating the use of smart bio-implants and intraoperative sensors in the joint replacements. These moves will also help the bio-implants market reach new milestones & endeavors of success in the forthcoming years. All these aspects are likely to create lucrative growth avenues for the bio-implants industry in the region.

Furthermore, the need for quick recovery of the patients has become the top-most priority for most of the clinics in the U.S. and Canada. Additionally, requirement for reducing hospital stay and the cost of treatment will prop up the expansion of the bio-implants market in North America. Need for reducing the burden of hospital acquired infections is predicted to produce high demand for product innovations resulting in huge funding of research activities. This, in turn, will culminate into rapid expansion of the market space in the sub-continent.

Key Market Players & Competitive Landscape:

Key participants in the business include

- Boston Scientific Corporation

- Stryker Corporation

- Biomet, Inc

- Medtronic

- St. Jude Medical, Inc

- Tornier N.V

- Smith & Nephew

- Synthes Holding AG

The global bio-implants market is segmented as follows:

By Product

- Cardiovascular Implants

- Pacing Devices

- Pacemaker

- ICDs

- Stents

- Orthopedic Implants

- Orthobiologics

- Trauma Implants

- Hip Replacements

- Knee Replacements

- Spinal Implants

- Dental Implants

- Ophthalmic Implants

- Others

- Orthopedic Implants

By Material

- Ceramics

- Polymers

- Alloys

- Biomaterial Metal

By Origin

- Autograft

- Allograft

- Xenograft

- Synthetic

By End-Use

- Hospitals

- Clinics

- Specialty Centers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Medical tools or tissues called bio-implants are placed into the body to either replace, assist, or improve biological activities. These can be produced synthetic to resemble real tissues or from biological materials. Orthopaedics, cardiovascular therapy, and dental surgery are only a few of the several medical disciplines where they find great utility.

Demand for bio-implants to treat age-related disorders including osteoporosis, arthritis, and cardiovascular ailments rises as the global population ages. Joint replacements, pacemakers, and other implanted devices are increasingly likely needs of older persons.

The global Bio-Implants market, estimated at about 102.86 (USD Billion) in 2023 and predicted to accrue earnings worth 281.87(USD Billion) by 2032.

The global Bio-Implants market is set to record a CAGR of nearly about 10.60% over 2024-2032.

The growth of the bio-implants market in the sub-continent can be contributed to large number of acquisitions made by key industry players in the countries such as the U.S. For instance, in January 2021, the U.S. based firm Stryker Corporation has acquired Orthosensor Inc., another U.S. based firm manufacturing sensor tools for musculoskeletal care & joint replacement.

Boston Scientific Corporation, Stryker Corporation, Biomet, Inc., Medtronic, St. Jude Medical, Inc., Tornier N.V., Smith & Nephew, and Synthes Holding AG.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed