Dental Surgical Instruments Market Size, Share, Analysis, Trends, Growth, 2032

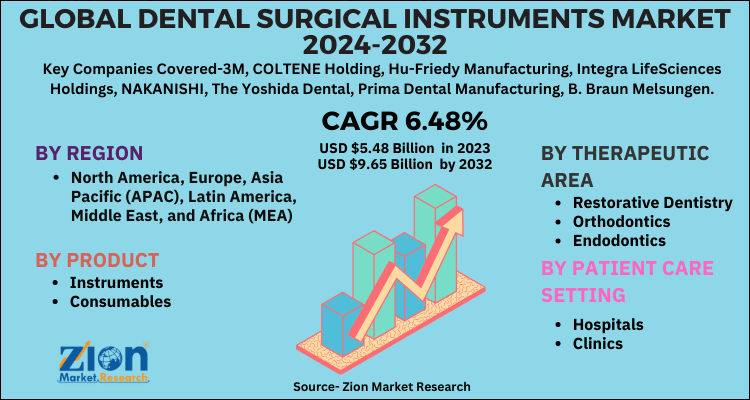

Dental Surgical Instruments Market by Product (Instruments and Consumables), by Therapeutic Area (Restorative Dentistry, Orthodontics, Endodontics, and Others), and by Patient Care Setting (Clinics and Hospitals): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

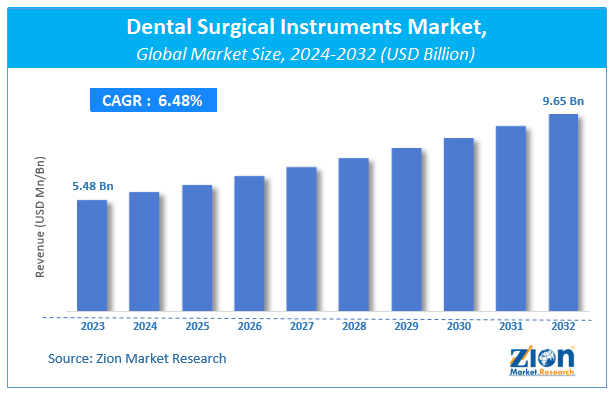

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.48 Billion | USD 9.65 Billion | 6.48% | 2023 |

Dental Surgical Instruments Industry Perspective:

The dental surgical instruments market size was worth around USD 5.48 Billion in 2023 and is predicted to grow to around USD 9.65 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.48% between 2024 and 2032.

The report covers a forecast and an analysis of the dental surgical instruments market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints of the dental surgical instruments market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the dental surgical instruments market on a global level.

In order to give the users of this report a comprehensive view of the dental surgical instruments market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Dental Surgical Instruments Market: Overview

Dental diagnosis deals with the evaluation and treatment of the diseases related to the oral cavity. Dental surgical equipment is used for the treatment and diagnosis of dental diseases and dental infections. In recent years, there has been an increase in the population suffering from dental problems. People are now opting for invasive, painless surgeries for dental problems, which is driving the demand for dental surgical equipment.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launch, agreements, partnerships, collaborations & joint ventures, research and development, and regional expansion of major participants involved in the market on a global and regional basis.

Dental Surgical Instruments Market: Growth Factors

Growing concerns related to oral hygiene and increasing life expectancy are contributing to the increasing number of dental visits globally. Moreover, aging population base is also boosting the dental surgical instruments market. The cosmetics influence in improving one’s smile and overall appearance along with rising aesthetic dental care sense are likely to further fuel the dental surgical instruments market. Additionally, medical tourism is providing cost-effective treatment with assured quality standards. Subsequent economic surge, rapid globalization, and flourishing dental tourism in emerging economies are creating lucrative opportunities for the global dental surgical instruments market. Dental grafting, lesser invasive procedures, advancements in technology, desired outcome delivery, and provision of reliable solutions have generated patient’s trust in opting for dental surgeries.

Dental Surgical Instruments Market: Segmentation

The study provides a decisive view of the dental surgical instruments market by segmenting it based on product, therapeutic area, patient care setting, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

The product segment of the market includes instruments and consumables.

The instruments segment, is further divided into handheld instruments, lasers (soft-tissue lasers and all-tissue lasers), handpieces (air-driven, hybrid, and electric), electrosurgical systems, and ultrasonic instruments. Consumables include aspiration tips, intraoral tips, impression trays, accessories, sutures, retractors, syringes, mouth props and gags, elastics, needles, and bite blocks.

Based on therapeutic area, the market includes endodontics, orthodontics, restorative dentistry, and others.

The patient care setting segment is categorized into hospitals and clinics.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Dental Surgical Instruments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dental Surgical Instruments Market |

| Market Size in 2023 | USD 5.48 Billion |

| Market Forecast in 2032 | USD 9.65 Billion |

| Growth Rate | CAGR of 6.48% |

| Number of Pages | 110 |

| Key Companies Covered | 3M, COLTENE Holding, Hu-Friedy Manufacturing, Integra LifeSciences Holdings, NAKANISHI, The Yoshida Dental, Prima Dental Manufacturing, B. Braun Melsungen, AMD Lasers, Danaher Corporation, and DENTSPLY Sirona |

| Segments Covered | By product, By therapeutic area, By patient care setting and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dental Surgical Instruments Market: Regional Insights

North America and Europe are anticipated to dominate the global dental surgical instruments market in the future and will together account for nearly 61 percent market share globally by 2032. This can be attributed to the presence of major producers like DENTSPLY Sirona and Straumann in Europe, which leads to enhanced competition in the dental surgical instruments market. According to Europa statistics, by 2020, more than 26 percent of the European population is expected to be geriatric. This is anticipated to provide a high-profit market for dental surgical instruments along with a high unrestricted revenue group in the region. Germany is a major dental surgical instruments market, owing to it's high per capita revenue for dental treatments.

Dental Surgical Instruments Market: Competitive Space

Some key players in the global dental surgical instruments market are

- 3M

- COLTENE Holding

- Hu-Friedy Manufacturing

- Integra LifeSciences Holdings

- NAKANISHI

- The Yoshida Dental

- Prima Dental Manufacturing

- B. Braun Melsungen

- AMD Lasers

- Danaher Corporation

- DENTSPLY Sirona.

- Among Others

This report segments the global dental surgical instruments market into:

Global Dental Surgical Instruments Market: Product Analysis

- Instruments

- Handheld Instruments

- Handpieces

- Air-Driven Handpieces

- Electric Handpieces

- Hybrid Handpieces

- Lasers

- Soft-Tissue Lasers

- All-Tissue Lasers

- Electrosurgical Systems

- Ultrasonic Instruments

- Consumables

Global Dental Surgical Instruments Market: Therapeutic Area Analysis

- Restorative Dentistry

- Orthodontics

- Endodontics

- Others

Global Dental Surgical Instruments Market: Patient Care Setting Analysis

- Hospitals

- Clinics

Global Dental Surgical Instruments Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Dental diagnosis deals with the evaluation and treatment of the diseases related to the oral cavity. Dental surgical equipment is used for the treatment and diagnosis of dental diseases and dental infections.

Growing concerns related to oral hygiene and increasing life expectancy are contributing to the increasing number of dental visits globally.

According to a study, the global dental surgical instruments Industry size was $5.48 Billion in 2023 and is projected to reach $9.65 Billion by the end of 2032.

The global dental surgical instruments market is expected to grow at a CAGR of 6.48% during the forecast period.

North America and Europe are anticipated to dominate the global dental surgical instruments market in the future and will together account for nearly 61 percent market share globally by 2032.

Some key players in the global dental surgical instruments market are 3M, COLTENE Holding, Hu-Friedy Manufacturing, Integra LifeSciences Holdings, NAKANISHI, The Yoshida Dental, Prima Dental Manufacturing, B. Braun Melsungen, AMD Lasers, Danaher Corporation, and DENTSPLY Sirona.

The global dental surgical instruments market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed