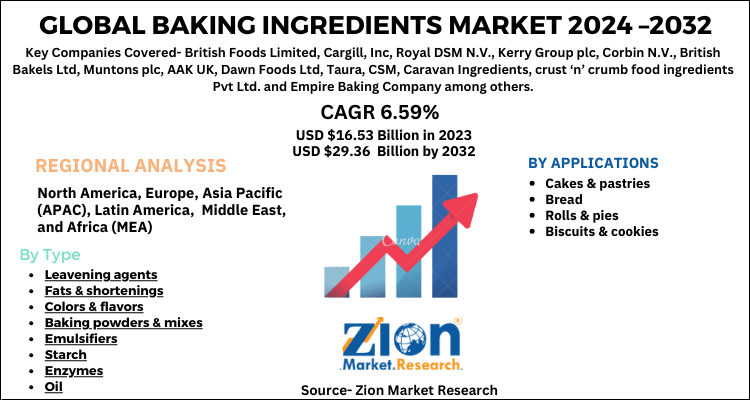

Baking Ingredients Market Size, Share, Growth and Forecast 2032

Baking Ingredients Market By Type (Leavening Agents, Fats & Shortenings, Colors & Flavors, Baking Powders & Mixes, Emulsifiers, Starch, Enzymes, Oil and Other Types) for Cakes & Pastries, Bread, Rolls & Pies, Biscuits & Cookies and Other Application: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.53 Billion | USD 29.36 Billion | 6.59% | 2023 |

Baking Ingredients Market Insights

According to a report from Zion Market Research, the global Baking Ingredients Market was valued at USD 16.53 Billion in 2023 and is projected to hit USD 29.36 Billion by 2032, with a compound annual growth rate (CAGR) of 6.59% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Baking Ingredients Market industry over the next decade.

Global Baking Ingredients Market: Overview

Increasing demand for packaged and baked goods is propelling the baking ingredients market. Furthermore, as the world's population grows, so does food demand. The growth of this demand is fueled by a changing lifestyle along with rising dual and discretionary income. Furthermore, the baking ingredients market size is being driven by the rapidly rising food chain industry. The rising demand for frozen and baked goods is driving the baking ingredients market. The growth of this industry is fueled by changing lifestyles and rising dual and discretionary income.

Moreover, key manufacturers in the market are focusing on strategies such as new product launches. For instance, in June 2020, Ingredion, Inc. launched a new clean-label emulsifier in the United States and Canadian markets. It offers wide applications such as being suitable for egg replacement in low- and high-fat vegan, spreadable, spoonable, and pourable dressings, white cooking sauces, and ready-meal applications. Likewise in February 2021, American Key Food Products introduced an organic starch in the market. The new starch is gluten-free and paleo- and vegan-friendly.

Baking Ingredients Market Size: Growth Factors

The baking ingredients market size is expected to rise in response to the rising demand for ready-to-eat foods. In developing markets, the transition from traditional home-cooked food to convenience foods has raised the demand for these baking products. Thereby, providing various growth opportunities in the market. Moreover, the adoption of a westernized lifestyle, dual-income households, a focus on healthy lifestyles, increased wellness awareness, and a rise in disposable income are the main factors driving the baked foods industry's expansion, which will fuel demand for baking ingredient manufacturers.

Type Segment Analysis Preview

Based on type, the Global Baking Ingredients Market is segmented into Leavening agents, fats & shortenings, colors & spices, baking powders & blends, emulsifiers, flour, enzymes, and oil, and others

Due to the high demand and active use of starch in the baking process, the segment dominated the market in the year 2020. The growth of the starch segment is supported by various benefits offered by it such as starch helping in improving texture and aims to increase the shelf life of baked products. Moreover, the rising consumption of bread across the globe is expected to boost the growth of the market as starch is the key ingredient in bread production. For instance, it is estimated that the total bread consumption accounted for 129,000 tonnes in 2016 as compared to 122,000 tonnes in 2007.

Emulsifiers help in maintaining the freshness and quality of baked food by improving the mixing capacity of immiscible liquids such as oil and water. Emulsifiers used in baking help you to improve batter stability, cake volume and texture, prolonged shelf life, and cost reductions. Thereby, the segment is expected to grow at a significant rate during the forecast period.

Baking Ingredients Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Baking Ingredients Market |

| Market Size in 2023 | USD 16.53 Billion |

| Market Forecast in 2032 | USD 29.36 Billion |

| Growth Rate | CAGR of 6.59% |

| Number of Pages | 140 |

| Key Companies Covered | British Foods Limited, Cargill, Inc, Royal DSM N.V., Kerry Group plc, Corbin N.V., British Bakels Ltd, Muntons plc, AAK UK, Dawn Foods Ltd, Taura, CSM, Caravan Ingredients, crust ‘n’ crumb food ingredients Pvt Ltd. and Empire Baking Company among others |

| Segments Covered | By Type, By Applications and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

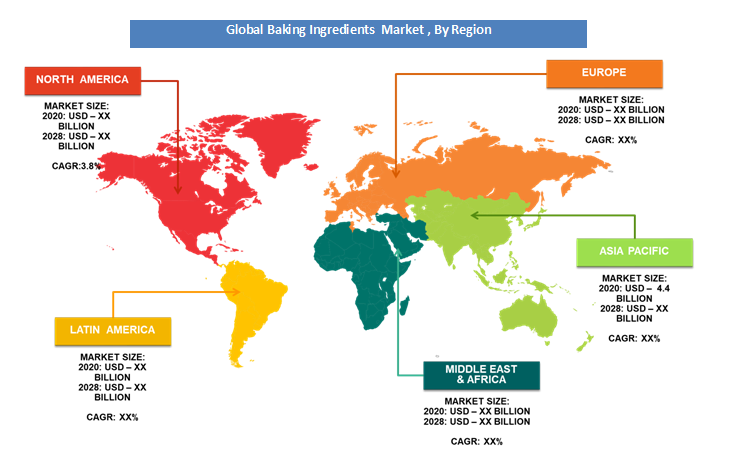

Baking Ingredients Market: Regional Analysis Preview

North America dominated the overall baking ingredients market in 2020 and is expected to continue its dominance over the forecast period. The baking industry contributes significantly to the US economy, raising more than $30 billion in sales in 2013. In the United States, there are 2,800 private bakeries and 6,000 retail bakeries. This graphic depicts the industry's scale and size. Despite the fact that there are many bakeries in the United States, the top four producers account for 35% of industry sales and commercial producers account for 91% of the total revenue. Moreover, various strategies adopted by the major player also support the growth of the market. For instance, recently, Grupo Bimbo acquired Sara Lee and Weston Bread Unit, making it the largest baked 6 goods company in the US. The aforesaid reasons are some of the key factors contributing to the growth of the market.

Asia Pacific region is expected to grow at the fastest rate during the forecast period. For instance, the bakery industry in India is the largest segment of the food processing industry and has enormous growth potential. More than 2,000 organized or semi-organized bakeries produce 1.3 million tonnes of bakery products in India, while 1,000,000 unorganized small-scale bakeries produce 1.7 million tonnes.

Baking Ingredients Market: Key Players & Competitive Landscape

Some of the key players in the Baking Ingredients Market are

- British Foods Limited

- Cargill, Inc

- Royal DSM N.V.

- Kerry Group plc

- Corbin N.V

- British Bakels Ltd

- Muntons plc

- AAK UK

- Dawn Foods Ltd

- Taura

- CSM

- Caravan Ingredients

- crust ‘n’ crumb food ingredients Pvt Ltd

- Empire Baking Company

The Global Baking Ingredients Market is segmented as follows:

By Type

- Leavening agents

- Fats & shortenings

- Colors & flavors

- Baking powders & mixes

- Emulsifiers

- Starch

- Enzymes

- Oil

- Other

By Applications

- Cakes & pastries

- Bread

- Rolls & pies

- Biscuits & cookies

- Other

Baking Ingredients Market Size By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global Baking Ingredients Market was valued at USD 16.53 Billion in 2023 and is projected to hit USD 29.36 Billion by 2032.

According to a report from Zion Market Research, the global Baking Ingredients Market a compound annual growth rate (CAGR) of 6.59% during the forecast period 2024-2032.

Some of the key factors driving growth of the Global Baking Ingredients Market is rising consumption of bread worldwide

NorthAmerica region held a substantial share of the Baking Ingredients Market in 2020. This is attributable to the increased per capita income of people.

Some of the major companies operating in Baking Ingredients Market are are British Foods Limited, Cargill, Inc, Royal DSM N.V., Kerry Group plc, Corbian N.V., British Bakels Ltd, Muntons plc, AAK UK, Dawn Foods Ltd, Taura, CSM, Caravan Ingredients, crust ‘n’ crumb food ingredients Pvt Ltd. and Empire Baking Company among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed