Baby food Market Size, Share, Growth Report 2032

Baby food Market Size, Share, By Product Type (Bottled Baby Food, Baby Food Cereals, Baby Food Snacks, Baby Food Cereals and Frozen Baby Food): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

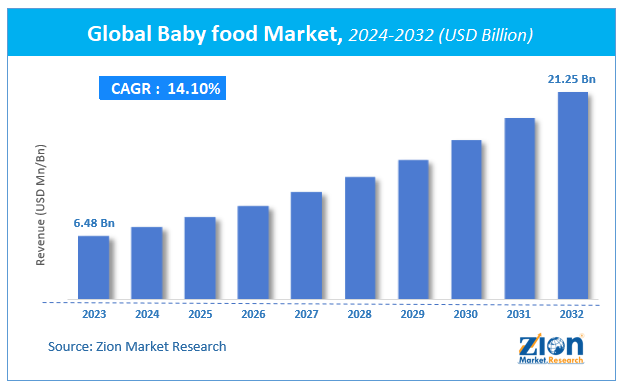

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.48 Billion | USD 21.25 Billion | 14.1% | 2023 |

Baby food Market Insights

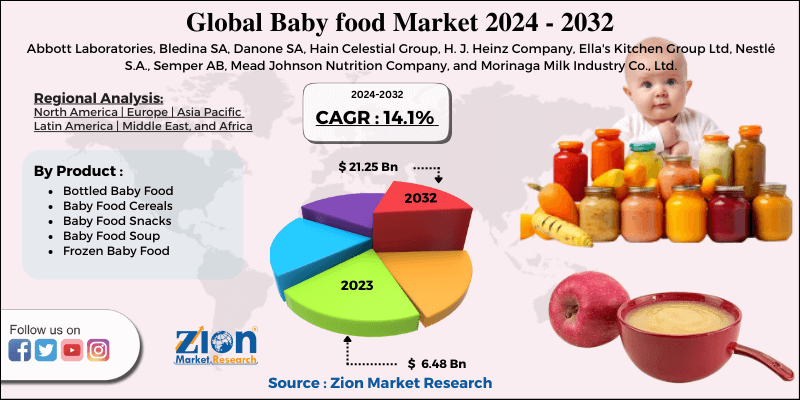

According to Zion Market Research, the global Baby food Market was worth USD 6.48 Billion in 2023. The market is forecast to reach USD 21.25 Billion by 2032, growing at a compound annual growth rate (CAGR) of 14.1% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Baby food Market industry over the next decade.

Global Baby food Market Size: Overview

Consumers nowadays prefer superfood flavors for their babies, such as beetroot, and blueberry-flavored food products, as these contain additional antioxidants and higher levels of nutrition. Moreover, while opting for baby food, consumers are also focused on examining the nutritional value of the food and aim to choose food products that are free from additives. The rising population of working women globally is expected to boost the overall growth of the baby food market during the forecast period. For instance, in the year 2020, the employment rate of women in Europe will account for 67%, which is a major factor contributing to the growth of the global baby food market.

Major manufacturers in the baby food market are focusing on various strategies, such as new product launches, and mergers and acquisitions, to strengthen their position in the market. For instance, in January 2021, Timios, an India based health snacks brand, entered the baby food market by launching a new "Made to Order" porridge range for infants and toddlers. The new product was designed keeping in mind the nutritional requirements of babies between the ages of 6 and 18 months and is available in 12 variants. Additionally, in February 2020, Happy Family Organics, one of the leading baby food markets in the U.S., launched a new product line of baby food. Happy Baby Organics Regenerative and Organic Baby Food is recommended for babies aged 6 months and up.

Baby food is a soft, easily consumed food, other than breastmilk or infant formula that is made specifically for babies, roughly between the ages of four to six months and two years. Baby food is available in multiple varieties, tastes, and forms. It includes table food that has been mashed or readily available and purchased from the retail shop. As a result of the increase in a number of working women and increase in parental concerns for nutrition, the global baby food market has been growing faster pace. The baby food is made by the professional way which helps working women to manage their feeding time. Professionally made baby food is considered as one of the best solutions for breastfeeding problems. Due to the fulfillment of nutrition requirements of babies, it also helps to prevent under nutrition problem in babies.

Baby food Market: Growth Factors

New and improved packaging adopted by major manufacturers is boosting the growth of the market. For instance, recently, Nestle launched first of its kind single-material pouch packaging for its baby food products. The new, designed-to-be-recyclable pouch is made from polypropylene (PP). With the launch of new packaging, the company aims to manufacture 100% of its packaging that is recyclable or reusable by 2025. Additionally, to attract retail customers, key manufacturers are launching new and improved products in the market, which in turn is driving the growth of the global baby food market. For instance, in April 2021, Heinz launched three new plant-based baby food products on the market. The new products include saucy pasta stars with beans and carrots, risotto with chickpeas and pumpkin, and potato bake with green beans and sweet garden peas.

Vegetables and other green plant proteins are key ingredients in baby foods that are low in sugar and high in nutrition. Therefore, rising demand for vegetable content in baby food is expected to bolster the growth of the baby food market during the forecast period. Additionally, growing concerns about added chemicals and increasing health awareness are contributing to increased demand for natural and organic food products among consumers.

The increase in disposable income and adoption of the modern lifestyle in developing economies demand for baby food has increased. Moreover, increasing global urbanization is expected to be a major opportunity for the manufacturers of baby food. New product development is likely to attract more consumers. Furthermore, declining birth rates and milk intolerance in babies are expected to be a big challenge for the baby food market.

Baby food Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Baby food Market |

| Market Size in 2023 | USD 6.48 Billion |

| Market Forecast in 2032 | USD 21.25 Billion |

| Growth Rate | CAGR of 14.1% |

| Number of Pages | 140 |

| Key Companies Covered | Abbott Laboratories, Bledina SA, Danone SA, Hain Celestial Group, H. J. Heinz Company, Ella's Kitchen Group Ltd, Nestlé S.A., Semper AB, Mead Johnson Nutrition Company, and Morinaga Milk Industry Co., Ltd. |

| Segments Covered | By Product Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Baby food Market: Segmentation

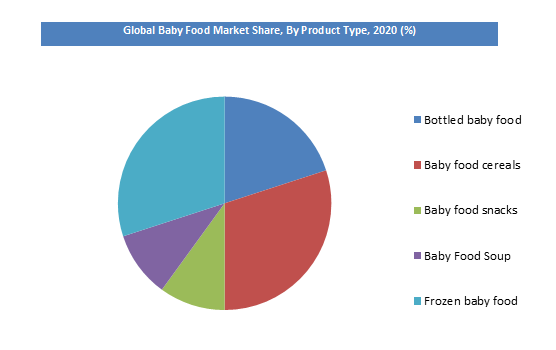

Baby food product includes frozen baby foods, baby snacks, soups, bottled baby foods and baby cereals. In 2015, bottled baby food held the dominant share of the global market followed by baby cereals. Due to easy availability and ease of handling of bottled baby food, consumers tend to prefer bottled baby food. However, frozen baby food is expected to have the highest growth potential within the forecast period. Baby food market can further be segmented by the health benefits derived from it and the basic ingredients used in baby food preparation. However, the product range is the more attractive segment by the consumer.

The frozen baby food segment is expected to grow at a noteworthy rate during the forecast period owing to an increase in the trend of on-the-go food due to rapid urbanization and an increase in the disposable market. Frozen baby foods are considered a healthier option as compared to other packed food products, which is supported by the ease of accessibility of frozen baby foods owing to the increase in the number of large format retail stores.

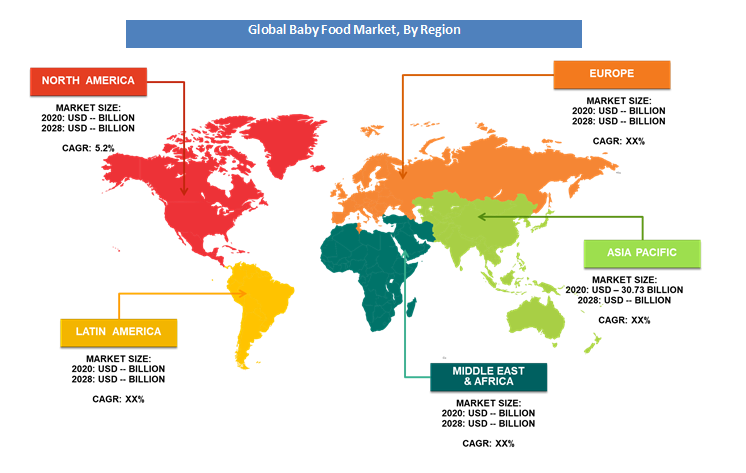

Baby food Market: Regional Analysis

The Asia Pacific region held a dominant share in the overall baby food market owing to increasing birth rates in the region. For instance, in 2019, around 14.65 million babies were born in China alone. Moreover, rising per capita income in the region is one of the key factors contributing to the growth of the market.

Further, the baby food market in India has experienced prominent growth over the past few years due to growing concerns regarding the proper nutrition in baby food and a changing consumer mindset. The North American region is projected to grow at a significant rate over the forecast period.

Global Baby food Market: Key Players And Competitive Landscape

Some of the key players in the baby food market are:

- Abbott Laboratories

- Bledina SA

- Danone SA

- Hain Celestial Group

- H. J. Heinz Company

- Ella's Kitchen Group Ltd,

- Nestlé S.A.

- Semper AB

- Mead Johnson Nutrition Company

- Morinaga Milk Industry Co., Ltd.

The Global Baby Food Market is segmented as follows:

By Product Type

- Bottled Baby Food

- Baby Food Cereals

- Baby Food Snacks

- Baby Food Soup

- Frozen Baby Food

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global Baby Food Market size was valued at $ 6.48 Billion in 2023.

The Global Baby Food Market size is expected to reach $ 21.25 Billion by 2032, with CAGR of around 14.1% from 2024 to 2032.

Some of the key factors driving the Global Baby Food Market growth are, rising birth rates along with rising working women population.

Asia Pacific region held a substantial share of the baby food market in 2023. This is attributable to the presence of top companies such Nestle, Heinz Company and among others.

Some of key players in baby food market are Abbott Laboratories, Bledina SA, Danone SA, Hain Celestial Group, H. J. Heinz Company, Ella's Kitchen Group Ltd, Nestlé S.A., Semper AB, Mead Johnson Nutrition Company and Morinaga Milk Industry Co., Ltd.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed