Automotive Tire Pressure Monitoring System Market Size, Share, Trends, 2034

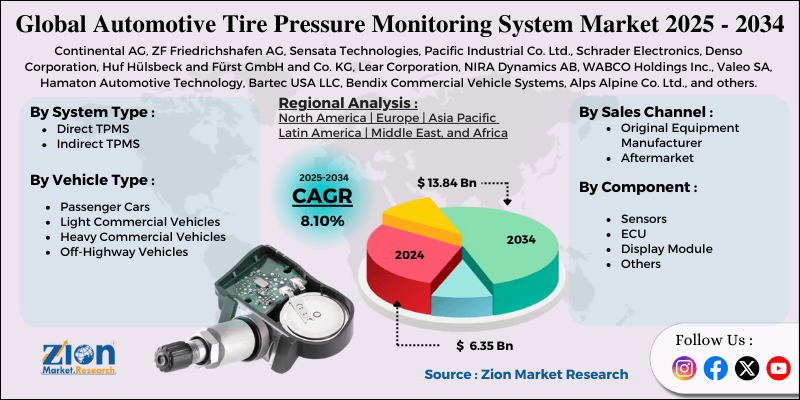

Automotive Tire Pressure Monitoring System Market By System Type (Direct TPMS and Indirect TPMS), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Off-Highway Vehicles), By Sales Channel (Original Equipment Manufacturer and Aftermarket), By Component (Sensors, ECU, Display Module, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

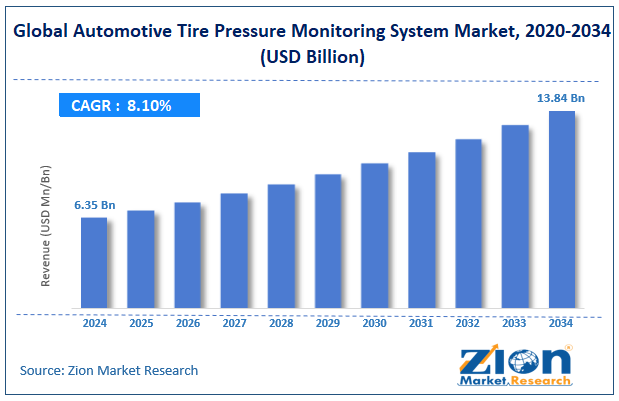

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.35 Billion | USD 13.84 Billion | 8.10% | 2024 |

Automotive Tire Pressure Monitoring System Industry Perspective:

The global automotive tire pressure monitoring system market was valued at approximately USD 6.35 billion in 2024 and is expected to reach around USD 13.84 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 8.10% between 2025 and 2034.

Automotive Tire Pressure Monitoring System Market: Overview

Automotive Tire Pressure Monitoring Systems (TPMS) are electronic systems that monitor the air pressure inside pneumatic vehicle tires and alert the driver to any significant pressure changes that could affect safety, fuel efficiency, and tire life. These systems prevent accidents caused by underinflated tires, improve fuel economy, reduce environmental impact through lower emissions, extend tire life, and reduce overall vehicle maintenance costs.

The automotive TPMS market serves passenger vehicles, commercial transport fleets, and industrial vehicles, with solutions ranging from simple pressure indicators to complex systems communicating with the vehicle's onboard computer and providing real-time monitoring.

The growth of the global automotive tire pressure monitoring system industry is driven by stringent safety regulations mandating TPMS installation in new vehicles, increasing consumer awareness of safety and maintenance benefits, technological advancements in sensor and wireless communication technologies, and the growing adoption of connected car features.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive tire pressure monitoring system market is estimated to grow annually at a CAGR of around 8.10% over the forecast period (2025-2034)

- In terms of revenue, the global automotive tire pressure monitoring system market size was valued at around USD 6.35 billion in 2024 and is projected to reach USD 13.84 billion by 2034.

- The automotive tire pressure monitoring system market is projected to grow significantly due to the expansion of electric and hybrid vehicle production, increasing fuel efficiency and tire longevity demand, and growing fleet management applications requiring real-time tire monitoring.

- Based on system type, direct TPMS leads the market and will continue to lead the global market.

- Based on vehicle type, passenger cars are expected to lead the market.

- Based on sales channel, original equipment manufacturers are anticipated to command the largest market share.

- Based on the component, sensors are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Automotive Tire Pressure Monitoring System Market: Growth Drivers

Regulatory mandates and safety awareness

The automotive tire pressure monitoring system market is growing due to increasing safety regulations globally. The government mandates the installation of TPMS in new vehicles in North America, Europe, China, and other major automotive markets.

Consumer awareness about the safety implications of proper tire inflation has risen significantly, and drivers know that underinflated tires can lead to accidents. Insurance companies offer incentives for vehicles with advanced safety features, including a tire pressure monitoring system. Commercial transportation has tire pressure management, which helps reduce fleet operational costs through better fuel efficiency and longer tire life.

Technological advancements and vehicle connectivity

The automotive tire pressure monitoring system industry is being transformed by technological evolution and integration with vehicle connectivity ecosystems. Next-generation tire pressure monitoring system sensors feature improved battery life, accuracy, reduced weight, and expanded temperature operating ranges.

Advanced systems now provide additional data points, including tire temperature, wear patterns, and load conditions beyond simple pressure readings. Integration with vehicle telematics systems enables remote monitoring of tire conditions, which is particularly valuable for fleet management applications.

Automotive Tire Pressure Monitoring System Market: Restraints

Cost sensitivity and technical limitations

Despite its growth trajectory, the automotive tire pressure monitoring system market faces challenges related to cost considerations and current technological constraints. System cost remains a significant factor, particularly in economy vehicle segments and price-sensitive markets, with a direct tire pressure monitoring system adding manufacturing costs.

Consumer resistance to replacement sensor costs following battery failure or damage creates aftermarket adoption barriers. Technical limitations persist; the sensor is exposed to harsh environmental conditions, road salts, and extreme temperatures, and has occasional reliability issues. Sensor battery life of 5-10 years needs replacement, which many consumers find inconvenient and expensive.

Automotive Tire Pressure Monitoring System Market: Opportunities

Electric vehicles and advanced monitoring capabilities

The automotive tire pressure monitoring system market is opening up with new vehicle technologies and increasing functionality. The rapid growth of electric vehicles is creating a new TPMS segment as these vehicles have unique tire pressure requirements due to higher vehicle weight and the critical link between tire pressure and battery range.

The commercial vehicle segment has growth potential as fleet operators are starting to realize the massive fuel savings and tire longevity benefits of proper pressure maintenance. Integration with predictive analytics and AI will allow for more advanced tire health checks beyond just pressure readings.

Automotive Tire Pressure Monitoring System Market: Challenges

System reliability and consumer education

The automotive tire pressure monitoring system industry faces challenges related to product performance consistency and market awareness limitations. Maintaining consistent sensor performance in harsh conditions is difficult, as exposure to road chemicals, temperature extremes, and physical impacts can reduce long-term durability. System accuracy is also vulnerable to external influences like sudden temperature shifts or driving at high altitudes, which may cause false alerts and reduce driver trust.

Many consumers lack sufficient understanding of how TPMS works, what warning lights mean, and how to maintain the system, which limits the system’s effectiveness.

Automotive Tire Pressure Monitoring System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Tire Pressure Monitoring System Market |

| Market Size in 2024 | USD 6.35 Billion |

| Market Forecast in 2034 | USD 13.84 Billion |

| Growth Rate | CAGR of 8.10% |

| Number of Pages | 211 |

| Key Companies Covered | Continental AG, ZF Friedrichshafen AG, Sensata Technologies, Pacific Industrial Co. Ltd., Schrader Electronics, Denso Corporation, Huf Hülsbeck and Fürst GmbH and Co. KG, Lear Corporation, NIRA Dynamics AB, WABCO Holdings Inc., Valeo SA, Hamaton Automotive Technology, Bartec USA LLC, Bendix Commercial Vehicle Systems, Alps Alpine Co. Ltd., and others. |

| Segments Covered | By System Type, By Vehicle Type, By Sales Channel, By Component, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Tire Pressure Monitoring System Market: Segmentation

The global automotive tire pressure monitoring system market is segmented into system type, vehicle type, sales channel, component, and region.

Based on system type, the market is segregated into direct TPMS and indirect TPMS. Direct TPMS leads the market due to its superior accuracy, real-time monitoring capabilities, individual tire readings, and compliance with stringent regulatory requirements in major automotive markets.

Based on vehicle type, the automotive tire pressure monitoring system industry is classified into passenger cars, light commercial vehicles, heavy commercial vehicles, and off-highway vehicles. Of these, passenger cars hold the largest market share due to widespread regulatory mandates in this segment, higher production volumes, and greater consumer awareness of safety technologies.

Based on the sales channel, the automotive tire pressure monitoring system market is divided into original equipment manufacturers and aftermarket. The original equipment manufacturer is expected to lead the market during the forecast period due to regulatory requirements for factory installation in new vehicles and consumer preference for fully integrated systems.

Based on the component, the market is segmented into sensors, ECU, display module, and others. Sensors lead the market share due to their critical function as primary data collection points in the system and their regular replacement requirements, creating consistent demand.

Automotive Tire Pressure Monitoring System Market: Regional Analysis

North America to lead the market

North America leads the global automotive tire pressure monitoring market due to the early adoption of regulations, high vehicle safety standards, and high consumer awareness about tire maintenance.

The region accounts for 38% of the global market share, with the U.S. being the largest, followed by Canada and Mexico. The TREAD Act in the U.S., which mandated TPMS in all new vehicles since 2007, has laid the foundation for growth and adoption. The region's premium and luxury vehicle segment has advanced TPMS as standard equipment.

North American consumers are willing to invest in vehicle safety systems and are becoming more aware of the fuel efficiency benefits of proper tire inflation. The region has a well-established aftermarket service network for replacing and upgrading TPMS components.

Asia Pacific is set to grow significantly.

Asia Pacific is the fastest-growing region in the automotive tire pressure monitoring system industry, driven by increasing vehicle production, growing safety awareness, and evolving regulations. China, Japan, South Korea, and India are seeing the fastest growth in TPMS adoption.

The region’s rapid growth in personal vehicle ownership presents tremendous market opportunities. Gradual implementation of safety regulations mandating TPMS in countries like China and India is driving market penetration.

Increasing consumer awareness of vehicle safety features is shifting purchasing decisions beyond price. The growing premium vehicle segment in developing Asian economies naturally includes advanced safety features like TPMS. Huge manufacturing cost advantage makes the region a key production hub for TPMS components serving global markets.

Recent Market Developments:

- In January 2025, Mak S.p.A. reported “extremely positive results” for the Mate – TPMS & Diagnostic brand, citing strong 2024 growth in pressure sensor and diagnostics segments driven by demand for advanced wheel system technologies.

Automotive Tire Pressure Monitoring System Market: Competitive Analysis

The global automotive tire pressure monitoring system market includes diverse manufacturers ranging from large automotive component suppliers to specialized sensor technology companies. Leading players include:

- Continental AG

- ZF Friedrichshafen AG

- Sensata Technologies

- Pacific Industrial Co. Ltd.

- Schrader Electronics

- Denso Corporation

- Huf Hülsbeck and Fürst GmbH and Co. KG

- Lear Corporation

- NIRA Dynamics AB

- WABCO Holdings Inc.

- Valeo SA

- Hamaton Automotive Technology

- Bartec USA LLC

- Bendix Commercial Vehicle Systems

- Alps Alpine Co. Ltd.

The global automotive tire pressure monitoring system market is segmented as follows:

By System Type

- Direct TPMS

- Indirect TPMS

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Off-Highway Vehicles

By Sales Channel

- Original Equipment Manufacturer

- Aftermarket

By Component

- Sensors

- ECU

- Display Module

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive Tire Pressure Monitoring Systems (TPMS) are electronic systems that monitor the air pressure inside pneumatic vehicle tires and alert the driver to any significant pressure changes that could affect safety, fuel efficiency, and tire life.

The automotive tire pressure monitoring system market is expected to be driven by mandatory safety regulations in major automotive markets, increasing consumer awareness about vehicle safety, technological advancements in sensor technology, integration with connected car ecosystems, and growing adoption of electric vehicles requiring specialized tire monitoring.

According to our study, the global automotive tire pressure monitoring system market was worth around USD 6.35 billion in 2024 and is predicted to grow to around USD 13.84 billion by 2034.

The CAGR value of the automotive tire pressure monitoring system market is expected to be around 8.10% during 2025-2034.

The global automotive tire pressure monitoring system market will register the highest growth in North America during the forecast period.

Key players in the automotive tire pressure monitoring system market include Continental AG, ZF Friedrichshafen AG, Sensata Technologies, Pacific Industrial Co., Ltd., Schrader Electronics, Denso Corporation, Huf Hülsbeck and Fürst GmbH and Co. KG, Lear Corporation, NIRA Dynamics AB, WABCO Holdings Inc., Valeo SA, Hamaton Automotive Technology, Bartec USA LLC, Bendix Commercial Vehicle Systems, and Alps Alpine Co., Ltd.

The report comprehensively analyzes the automotive tire pressure monitoring system market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, regulatory impacts, and the evolving vehicle safety landscape shaping the automotive industry.

List of Contents

Automotive Tire Pressure Monitoring SystemIndustry Perspective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisRecent Market Developments:Competitive AnalysisThe global automotive tire pressure monitoring system market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed