Automotive Rubber-Molded Components Market Size Report 2034

Automotive Rubber-Molded Components Market By Material Type (Ethylene Propylene Diene Monomer (EPDM), Natural Rubber (NR), Styrene-butadiene Rubber (SBR), and Others), By Component Type (Gaskets, Seals, Hoses, Weather-Strips, O-Rings, and Others), By Vehicle Type (Commercial Vehicle and Passenger Vehicle), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

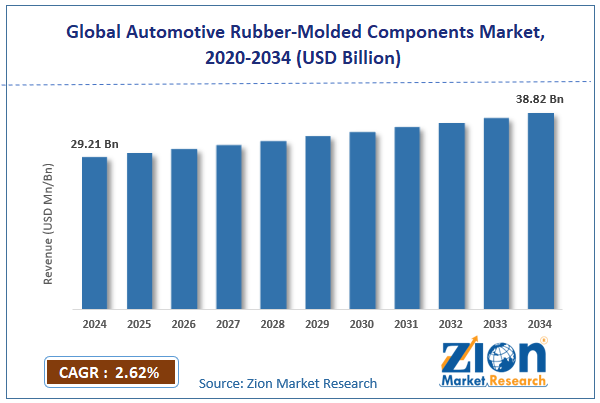

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 29.21 Billion | USD 38.82 Billion | 2.62% | 2024 |

Automotive Rubber-Molded Components Industry Perspective:

What will be the global automotive rubber-molded components market size during the forecast period?

The global automotive rubber-molded components market size was worth around USD 29.21 billion in 2024 and is predicted to grow to around USD 38.82 billion by 2034, with a compound annual growth rate (CAGR) of roughly 2.62% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive rubber-molded components market is estimated to grow annually at a CAGR of around 2.62% over the forecast period (2025-2034)

- In terms of revenue, the global automotive rubber-molded components market size was valued at around USD 29.21 billion in 2024 and is projected to reach USD 38.82 billion by 2034.

- The automotive rubber-molded components market is projected to grow at a significant rate due to the rising production volume of automobiles

- Based on material type, the ethylene propylene diene monomer (EPDM) segment is growing at a high rate and will continue to dominate the global market, as per industry projections

- Based on vehicle type, the passenger vehicles segment is anticipated to command the largest market share

- Based on region, the Asia-Pacific is projected to dominate the global market during the forecast period

Automotive Rubber-Molded Components Market: Overview

Automotive rubber-molded components are essential aspects of the modern automotive industry. They are primarily used in vehicles as sealing solutions to ensure safety and optimize performance. Some of the most common applications of rubber-molded components in the automotive sector include bushings & mounts, seals & gaskets, O-rings, hoses, weatherstripping, grommets, and anti-slip pads, among others. Automotive rubber-molded components offer several performance-enhancing advantages. For instance, they are highly beneficial in stopping gas or oil leakage.

Additionally, they assist in damping noise & vibrations, along with providing insulation against electrical damage. The demand for automotive rubber-molded components is expected to continue growing during the projection period due to the rising production volumes of new vehicles. Moreover, increasing demand for vehicles with longer lifetimes and the emerging after-market services segment will promote industry revenue. A major drawback for market participants is the disruption to raw material supply chains and price volatility.

Automotive Rubber-Molded Components Market: Dynamics

Growth Drivers

How will increasing automobile production volume influence the automotive rubber-molded components market growth?

The global automotive rubber-molded components market is expected to be dominated by the rising production volume of automobiles. The growing global demand for vehicles, including passenger cars and commercial automobiles, has influenced the surge in production volumes. According to industry analysis, more than 92 million units of passenger cars were produced in 2024. Similar statistics are reported for commercial counterparts. The emergence of new regional policies favoring the expansion of the automotive sector has proved beneficial for industry players.

For instance, in November 2025, Great Wall Motor, a leading automaker in China, announced plans to increase its European production capacity to 300,000 vehicles by 2029. The company is currently seeking locations to develop its first car manufacturing plant in the region. Automotive rubber-molded components are critical elements of all modern vehicles. The surge in automobile production rate will subsequently impact demand for rubber-molded components in the coming years.

Expansion of commercial-grade fleet solutions to accelerate the industry growth rate during the forecast period

A major growth propeller for automotive rubber-molded components is the rising expansion of commercial-grade fleet solutions. The accelerated growth in the e-commerce, logistics, and transportation industries has created demand for fuel-efficient commercial vehicles. Additionally, growing demand for car rentals and leasing services has further fueled investments in the extension of fleet vehicle volume.

In July 2025, STO Express, a leading Chinese courier service, announced it had signed a new strategic agreement with Cainiao. The latter is the logistics wing of Alibaba. The collaboration is aimed at accelerating the adoption of autonomous vehicles in the last-mile delivery segment. The global automotive rubber-molded components market will continue to benefit from the rapid proliferation of fleet automobiles.

Restraints

What will be the impact of supply chain disruptions on the automotive rubber-molded components market growth?

The global automotive rubber-molded components industry is expected to be constrained by the increasing frequency of supply chain disruptions. These inconsistencies include raw material shortage and disruptions in the supply chain. For instance, an uninterrupted supply of rubber depends heavily on the volume of natural rubber production. Climate conditions can severely impact the final volume of rubber produced worldwide. Additionally, geopolitical risks further add to the prominent reasons for supply chain disruptions reported in the market.

Opportunities

Advancements in molding processes to create new growth opportunities for the industry players

The global automotive rubber-molded components market is expected to experience growth opportunities due to advances in molding processes. For instance, in May 2024, YIZUMI, a Chinese industrial technology company, announced the official launch of a novel rubber injection molding machine.

The recently launched A3 series rubber injection molding machines have been optimized to deliver reliable molding performance while also ensuring optimal cost and maintenance. The increasing adoption of precision manufacturing solutions in rubber-molded components will create new growth opportunities for industry leaders.

How will accelerating demand in the aftermarket services segment propel the automotive rubber-molded components industry revenue?

The aftermarket services segment is growing steadily. These service providers offer cost-efficient access to automotive parts. In addition, aftermarket companies cater to the customization needs of end-customers. The rapidly ageing vehicle fleet worldwide will further accelerate demand for rubber-molded components in the aftermarket.

Challenges

High cost of initial investment to challenge market expansion during the projection period

The global automotive rubber-molded components industry is expected to be challenged by the high cost of initial investment associated with the market. The industry players are required to invest in robust tooling and molding technologies that are generally cost-intensive to apply. Additionally, evolving end-consumer demands and increased research & development efforts may further increase costs, creating growth barriers for market players.

Automotive Rubber-Molded Components Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Rubber-Molded Components Market |

| Market Size in 2024 | USD 29.21 Billion |

| Market Forecast in 2034 | USD 38.82 Billion |

| Growth Rate | CAGR of 2.62% |

| Number of Pages | 216 |

| Key Companies Covered | Sumitomo Riko Co. Ltd., Continental AG, Trelleborg AB, Federal‑Mogul Corporation, ElringKlinger AG, Saint‑Gobain Performance Plastics, NOK Corporation, AB SKF, Toyoda Gosei Co. Ltd., Henniges Automotive Holdings Inc., Freudenberg Group, Cooper‑Standard Automotive Inc., Parker Hannifin Corporation, Hutchinson SA, Dana Incorporated, and others. |

| Segments Covered | By Material Type, By Component Type, By Vehicle Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Rubber-Molded Components Market: Segmentation

The global automotive rubber-molded components market is segmented based on material type, component type, vehicle type, and region.

What will help the ethylene propylene diene monomer segment lead the automotive rubber-molded components market?

Based on material type, the global market segments are ethylene propylene diene monomer (EPDM), natural rubber (NR), styrene-butadiene rubber (SBR), and others. In 2024, the highest growth was listed in the ethylene propylene diene monomer (EPDM) segment due to higher applications of the material in the production of hoses, gaskets, and seals. EPDM offers excellent performance compared to other counterparts and has a longer service life.

Based on component type, the global automotive rubber-molded components industry is segmented into gaskets, seals, hoses, weather-strips, O-rings, and others.

Why will the passenger vehicles segment dominate the automotive rubber-molded components industry?

Based on vehicle type, the global market is divided into commercial and passenger vehicles. In 2024, the passenger vehicles segment emerged as the leading revenue generator. The increasing production of passenger vehicles, rising focus on automotive safety, and increased sales of electric & hybrid vehicles are expected to fuel segmental demand in the coming years.

Automotive Rubber-Molded Components Market: Regional Analysis

Which factors will enable the Asia-Pacific to dominate growth in the automotive rubber-molded components market?

The global automotive rubber-molded components market is expected to be led by Asia-Pacific during the forecast period. The region is anticipated to record a CAGR of 20.05% in the coming years, driven by countries such as China, India, and Japan. The regional market prominence will be facilitated by increasing production volumes of passenger and commercial vehicles. China, for instance, is the current world leader in terms of electric vehicle (EV) production.

Additionally, favorable government policies that encourage the expansion of the regional automotive industry, along with the presence of several key players, will further facilitate revenue growth in the Asia-Pacific.

What revenue share will North America hold in the automotive rubber-molded components industry?

North America is expected to become the second-largest revenue generator, with a 7% CAGR over the forecast period. North America enjoys the benefits of a mature market. Countries such as the US and Canada have high automotive demand.

In addition, the rising expansion of the region’s EV sector will facilitate demand for improved rubber-molded components. The ongoing innovations in the production methods for rubber-molded elements for automotive applications will further influence regional market expansion in the long term.

Automotive Rubber-Molded Components Market: Competitive Analysis

The global automotive rubber-molded components market is led by players like:

- Sumitomo Riko Co. Ltd.

- Continental AG

- Trelleborg AB

- Federal‑Mogul Corporation

- ElringKlinger AG

- Saint‑Gobain Performance Plastics

- NOK Corporation

- AB SKF

- Toyoda Gosei Co. Ltd.

- Henniges Automotive Holdings Inc.

- Freudenberg Group

- Cooper‑Standard Automotive Inc.

- Parker Hannifin Corporation

- Hutchinson SA

- Dana Incorporated

What are the key trends in the Automotive Rubber-Molded Components Market?

Lightweight materials

A promising trend in the automotive rubber-molded components industry is the increasing demand for lightweight elements. These components are known to affect a vehicle's fuel efficiency and to enhance performance. Introduction of lightweight materials for rubber-molded component production will work in favor of the industry players

Advanced production techniques

The increasing integration of smart technologies, such as robotics & automation and the Internet of Things (IoT), will help market players achieve precision manufacturing. These technologies can also assist in optimizing production methods and reducing overall waste generated during rubber-molded component production.

The global automotive rubber-molded components market is segmented as follows:

By Material Type

- Ethylene Propylene Diene Monomer (EPDM)

- Natural Rubber (NR)

- Styrene-butadiene Rubber (SBR)

- Others

By Component Type

- Gaskets

- Seals

- Hoses

- Weather-Strips

- O-Rings

- Others

By Vehicle Type

- Commercial Vehicle

- Passenger Vehicle

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed