Automotive Electronics Market Size, Share, Growth, Trends, Demand 2032

Automotive Electronics Market By Application (ADAS, Body Electronics, Infotainment, Powertrain, and Safety Systems): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

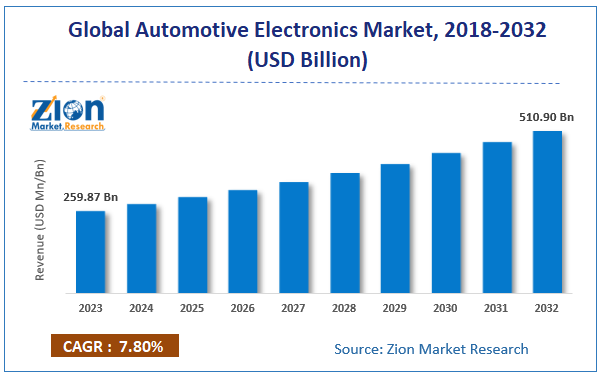

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 259.87 Billion | USD 510.90 Billion | 7.80% | 2023 |

Automotive Electronics Industry Perspective:

The global automotive electronics market size was worth around USD 259.87 billion in 2023 and is predicted to grow to around USD 510.90 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.80% between 2024 and 2032.

High penetration of electric and hybrid vehicles is predicted to become a major focus area for electronic system suppliers. Automotive electronics include electrically driven systems built into vehicles. Airbags, electronic fuel injection, infotainment, and ADAS are major areas where automobile electronic systems are used, to optimize the overall efficiency of the combined systems. Technological advancements, such as powertrains for EVs and electrical active suspensions in the automobile industry, are predicted to fuel the application space for power electronic systems in the automotive sector.

Market Definition

Automotive electronics refer to electronic systems and components used in vehicles, including:

-

Infotainment systems (e.g., touchscreens, navigation, audio systems)

-

Advanced Driver Assistance Systems (ADAS) (e.g., adaptive cruise control, lane-keeping assist)

-

Powertrain electronics (e.g., engine control units, transmission control)

-

Safety systems (e.g., airbags, anti-lock braking systems (ABS))

-

Body electronics (e.g., lighting, climate control, power windows)

-

Electric vehicle (EV) electronics (e.g., battery management systems, power inverters)

Automotive Electronics Market Growth Analysis

The global automotive electronics market is primarily driven by the growing demand for premium audio systems paired with advanced driver assistance systems. In addition, the introduction of new technologies, such as emergency call systems, increasing concerns for safety and security in vehicles, alcohol ignition interlocks, and accident recorder systems are likely to drive the growth of this global market during the estimated time period. The continuous use of various electronic components by automobile manufacturers has generated new business opportunities for the suppliers. The high purchasing power of consumers and changes in their lifestyles are expected to support the automotive electronics market in the near future. Contrarily, the lack of awareness about the benefits of safety systems in vehicles might limit the automotive electronics market expansion. Nonetheless, the growing trend of in-vehicle infotainment and technological advancements witnessed across the automobile sector are likely to create new growth horizons for the automotive electronics market in the near future.

The report gives transparent views of the automotive electronics market. We have included a detailed competitive situation and portfolio of leading vendors that are operating in the automotive electronics market. To understand the competitive state in the automotive electronics market, an analysis of Porter’s Five Forces model for the automotive electronics market has also been covered. The study also offers a market attractiveness analysis, in which application and regional segments are marked based on their growth rate, market size, and general attractiveness for the automotive electronics market.

Key Trends

-

Electrification of Vehicles: The rise of hybrid and electric vehicles is driving demand for power electronics and battery management systems.

-

Connected Cars: Integration of IoT and 5G technology is enabling vehicle-to-everything (V2X) communication.

-

Autonomous Driving: Increasing investments in autonomous vehicle technology are boosting the demand for sensors, cameras, and AI systems.

-

Sustainability: Focus on energy-efficient and eco-friendly electronic components.

-

Consolidation and Partnerships: Automakers are collaborating with tech companies to develop advanced electronics.

The report provides a company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, product, and expansion of major participants involved in the market on a regional basis.

By application, the automotive electronics market is segmented into ADAS, powertrain, safety systems, infotainment, and body electronics. In 2023, the safety system segment held the largest market share. Initiatives taken by regulatory boards of different countries to prevent accidents are projected to fuel this segment’s growth and simultaneously that of the automotive electronics market. The ADAS and infotainment segments are likely to emerge as the most attractive in the upcoming years.

In 2023, North America dominated the regional market for automotive electronics, followed by Europe. The Asia Pacific is likely to be the fastest-growing regional market and hold the largest share in the forecast time period. Schemes launched by the Government of China for safety assessments, the presence of significant manufacturers, and the rising need for minimizing production costs are some of the major growth drivers for the Asia Pacific region in the automotive electronics market. The Middle Eastern and African and Latin American markets are also predicted to grow significantly in the upcoming years, due to the shift in the production bases of the manufacturers to remote areas in these regions.

Automotive Electronics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Electronics Market |

| Market Size in 2023 | USD 259.87 Billion |

| Market Forecast in 2032 | USD 510.90 Billion |

| Growth Rate | CAGR of 7.80% |

| Number of Pages | 215 |

| Key Companies Covered | Yamaha Corporation, Sanyo Electric Co., Ltd., Philips N.V., Bosch, TRW, Johnson Controls, Denso Corporation, Sony Corporation, Continental AG, Delphi Automotive PLC, and others. |

| Segments Covered | By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The regional segmentation comprises the current and forecast demand for the Middle East and Africa, North America, Europe, Latin America, and the Asia Pacific with its further classification into the U.S., the UK, France, Germany, India, China, Japan, and Brazil for the automotive electronics market.

Automotive Electronics Market: Competitive Analysis

The competitive profiling of key players in the automotive electronics market includes the company and financial overviews, business strategies adopted by them and their recent developments, and products offered by them which can help in assessing competition in the market. The global automotive electronics market is dominated by players like:

- Yamaha Corporation

- Sanyo Electric Co., Ltd.

- Philips N.V.

- Bosch

- TRW

- Johnson Controls

- Denso Corporation

- Sony Corporation

- Continental AG

- Delphi Automotive PLC

This report segments the global automotive electronics market as follows:

Global Automotive Electronics Market: Application Segment Analysis

- ADAS

- Body Electronics

- Infotainment

- Powertrain

- Safety Systems

Global Automotive Electronics Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive electronics refer to electronic systems utilized in automobiles, such as engine management, ignition, radio, carputers, telematics, in-car entertainment systems, and more.

According to a study, the global automotive electronics market size was worth around USD 259.87 billion in 2023 and is expected to reach USD 510.90 billion by 2032.

The global automotive electronics market is expected to grow at a CAGR of 7.80% during the forecast period.

North America is expected to dominate the automotive electronics market over the forecast period.

Leading players in the global automotive electronics market include Yamaha Corporation, Sanyo Electric Co., Ltd., Philips N.V., Bosch, TRW, Johnson Controls, Denso Corporation, Sony Corporation, Continental AG, and Delphi Automotive PLC, among others.

The automotive electronics market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed