Automotive Elastomers Market Size, Share, Growth, Trends, and Forecast 2032

Automotive Elastomers Market By Type (Natural Rubbers (NR), Butyl Elastomers (IIR), Butadiene (BR) (Polybutadiene) Elastomers, Ethylene-propylene (EPM/EPDM) Elastomers, Polyisoprene (IR) Elastomers, Nitrile (NBR) Elastomers, Silicones (Q), Polychloroprene (CR) (Neoprene) Elastomers , Acrylic (ACM) Elastomers, Fluoroelastomers, Styrene Block Copolymers (SBC), Thermoplastic Polyolefins, Thermoplastic Polyurethanes, Thermoplastic Vulcanizates, Thermoplastic Copolyesters, Thermoplastic Polyether Block Amides), By Application (Tire and Non-Tire), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles), and By Region - Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

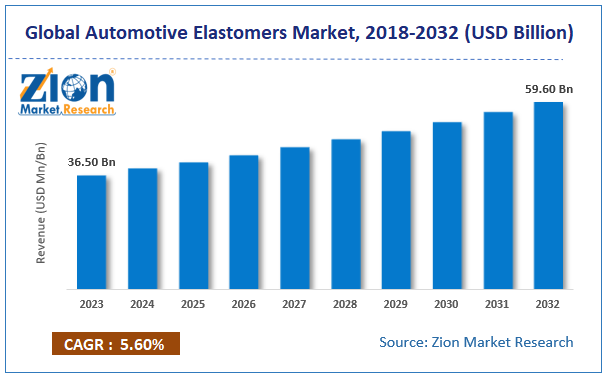

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 36.50 Billion | USD 59.60 Billion | 5.6% | 2023 |

Automotive Elastomers Market: Overview

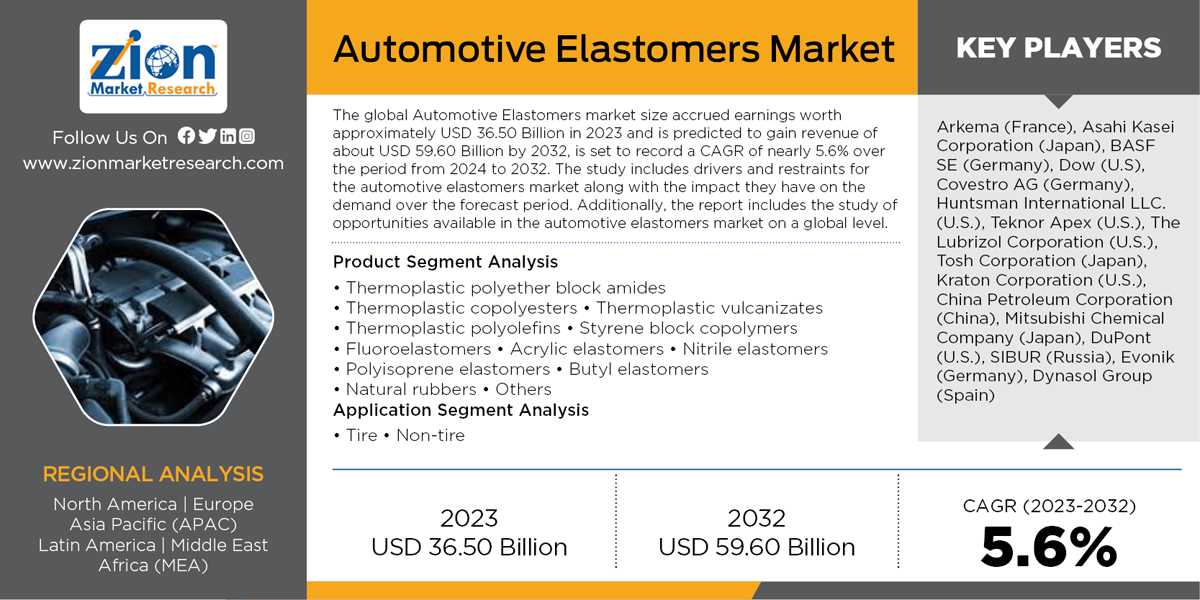

The global Automotive Elastomers market size accrued earnings worth approximately USD 36.50 Billion in 2023 and is predicted to gain revenue of about USD 59.60 Billion by 2032, is set to record a CAGR of nearly 5.6% over the period from 2024 to 2032. The study includes drivers and restraints for the automotive elastomers market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the automotive elastomers market on a global level.

The elastomer was derived from the name “elastic polymer”. These are composed of polymer materials, joined through chemical bonds and possess a slightly cross-linked structure. The compound is composed of five to ten components, wherein each one of them plays a specific role. The polymer is a crucial ingredient of the compound that regulates chemical and heat resistance along with the low-temperature performance of the substance. Elastomers include reinforcing filler to improve its strength and plasticizer for enhancing low-temperature properties. Other vital ingredients include an accelerator, curative, scorch retarder, release package and an anti-oxidant. Automotive elastomers are used in manufacturing various parts of vehicles.

Automotive Elastomers Market Growth Analysis

This report offers comprehensive analysis on the global automotive elastomers market along with, market trends, drivers, and restraints of the automotive elastomers market. This report includes a detailed competitive scenario and product portfolio of key vendors. To understand the competitive landscape in the market, an analysis of Porter’s five forces model for the market has also been included. The study encompasses a market attractiveness analysis, wherein all segments are benchmarked based on their market size, growth rate, and general attractiveness. This report is prepared using data sourced from in-house databases, and a secondary and primary research team of industry experts.

Rising demand for high-efficiency vehicles owing to stringent emission norms in automobile industry will primarily drive automotive elastomers market during the forecast period. Several international regulatory bodies are developing standards and restricting emissions of greenhouse gases. Usage of lightweight materials for better fuel efficiency in vehicle manufacturing is further supporting the product penetration. Further, superior properties of the substance as compared to its counterparts such as oil & gas resistance, chemical resistance, variety, aging resistance, durability, flexibility, ozone resistance, and heat resistance provides a traction to automotive elastomers market. However, fluctuating prices of crude oil results in oscillating manufacturing cost of the product. The further imbalance between elastomeric cost and its performance may hinder automotive elastomers market in near future. Extensive usage of thermoplastic polyolefin (TPO) for both interior and exterior applications of the vehicle as a replacement of traditional materials such as polycarbonate, ABS, and other metals is expected to give a positive outlook for automotive elastomers market. Development of environment-friendly elastomers is the latest trend in the automotive industry coupled with lightweight materials.

Automotive Elastomers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Elastomers Market |

| Market Size in 2023 | USD 36.50 Billion |

| Market Forecast in 2032 | USD 59.60 Billion |

| Growth Rate | CAGR of 5.6% |

| Number of Pages | 190 |

| Key Companies Covered |

Arkema (France), Asahi Kasei Corporation (Japan), BASF SE (Germany), Dow (U.S), Covestro AG (Germany), Huntsman International LLC. (U.S.), Teknor Apex (U.S.), The Lubrizol Corporation (U.S.), Tosh Corporation (Japan), Kraton Corporation (U.S.), China Petroleum Corporation (China), Mitsubishi Chemical Company (Japan), DuPont (U.S.), SIBUR (Russia), Evonik (Germany), Dynasol Group (Spain) |

| Segments Covered | By Product Type, By Flavor Type, By Category, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Elastomers Market Segmentation Analysis

The study provides a decisive view on the automotive elastomers market by segmenting the market based on product, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Automotive elastomers market is bifurcated on the basis of the product as thermoplastic polyether block amides, thermoplastic copolyesters, thermoplastic vulcanizates, thermoplastic polyolefins, styrene block copolymers, fluoroelastomers, acrylic elastomers, nitrile elastomers, polyisoprene elastomers, butyl elastomers and natural rubbers. Natural rubber is anticipated to dominate the product segment owing to its superior properties including high-temperature stability, resistance to fungi and bacteria, high physiological inertness, excellent compression set, and resistance to ozone and weathering.

Automotive elastomers market is segmented based on its application as tire and non-tire. Tire application is anticipated to dominate the market during the forecast period.

Automotive Elastomers Market Regional Analysis

The Asia Pacific will depict substantial growth rate in global automotive elastomers market till 2023. China is witnessing highest demand for the product in the region. Substantial economic growth, low manufacturing cost, and enhanced lifestyle of youth have increased vehicles demand in the Asia Pacific. Europe is estimated to maintain its share in the market between 2018 and 2023 due to its ever-increasing and well-established automobile industry.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East, and Africa. Each region has been further segmented into countries such as the U.S., the UK, France, Germany, China, India, Japan, and Brazil.

The report covers a detailed competitive outlook including the market share and company profiles of the key participants operating in the global automotive elastomers market such as

- Arkema (France)

- Asahi Kasei Corporation (Japan)

- BASF SE (Germany)

- Dow (U.S)

- Covestro AG (Germany)

- Huntsman International LLC. (U.S.)

- Teknor Apex (U.S.)

- The Lubrizol Corporation (U.S.)

- Tosh Corporation (Japan)

- Kraton Corporation (U.S.)

- China Petroleum Corporation (China)

- Mitsubishi Chemical Company (Japan)

- DuPont (U.S.)

- SIBUR (Russia)

- Evonik (Germany)

- Dynasol Group (Spain)

The report segments the global automotive elastomers market as follows:

Automotive Elastomers Market: Product Segment Analysis

- Thermoplastic polyether block amides

- Thermoplastic copolyesters

- Thermoplastic vulcanizates

- Thermoplastic polyolefins

- Styrene block copolymers

- Fluoroelastomers

- Acrylic elastomers

- Nitrile elastomers

- Polyisoprene elastomers

- Butyl elastomers

- Natural rubbers

- Others

Automotive Elastomers Market: Application Segment Analysis

- Tire

- Non-tire

Automotive Elastomers Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed