Global Thermoplastic Polyolefin (TPO) Market Size, Share, Growth Analysis Report - Forecast 2034

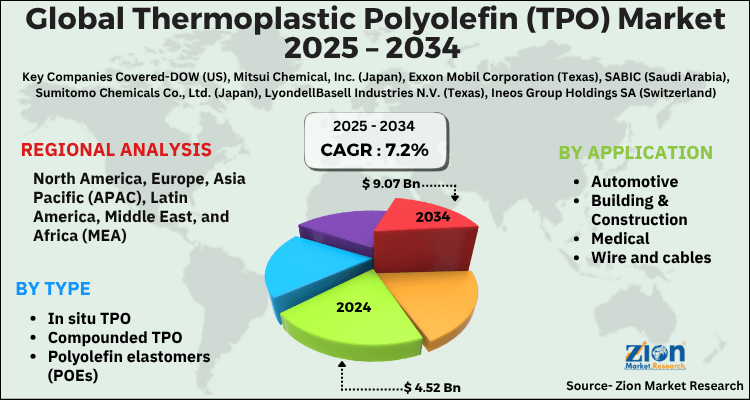

Thermoplastic Polyolefin (TPO) Market By Type (In situ TPO, Compounded TPO, Polyolefin elastomers (POEs)), By Application (Automotive, Building & Construction, Medical, Wire and cables, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

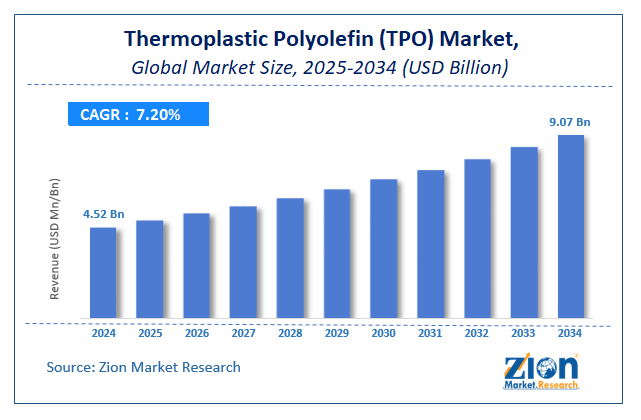

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.52 Billion | USD 9.07 Billion | 7.2% | 2024 |

Global Thermoplastic Polyolefin (TPO) Market: Industry Perspective

The global thermoplastic polyolefin (TPO) market size was worth around USD 4.52 Billion in 2024 and is predicted to grow to around USD 9.07 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.2% between 2025 and 2034. The report analyzes the global thermoplastic polyolefin (TPO) market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the thermoplastic polyolefin (TPO) industry.

Global Thermoplastic Polyolefin (TPO) Market: Overview

The shift in trend to exchange polyvinyl chloride due to growing environmental concerns in major end-use industries like automotive and construction around the world has been boosting the demand for thermoplastic polyolefins in the recent past. PVC contains phthalates, which are considered to be harmful to the environment. TPOs represent a member of an outsized group of thermoplastic elastomers (TPEs). TPOs a bit like other members of the TPE family including TPV, TPU, etc. have rubber-like properties but a process-like polymer which makes them highly suitable for top performance applications during a sort of end-use industries. Advancements in terms of functionalities like abrasion resistance, economical, durability, lightweight, antioxidants & UV light stabilizer to resist solar UV radiation and oxidation will make the merchandise highly preferable in regions of utmost weather.

Thermoplastic polyolefin (TPO) is the most widely used product in the thermoplastic elastomer family. TPO possesses properties of rubber as well as plastic and is used to handle applications which require functions of both thermoplastics and elastomers for better functioning. TPO has the lowest specific gravities as compared to other thermoplastic elastomers. It is widely used in the production of roofing membrane systems and in the building & construction industry for door panels. It is employed in instrument panels, automotive bumpers, and dashboard skins. TPO is also extensively used in various end-users like medical, footwear, home appliances, and rubber goods.

Increasing demand of TPO in construction and automobile industries is expected to drive thermoplastic polyolefins (TPO) market growth in coming period. The automobile industry is likely to observe a substantial growth over the forecast period due to excellent product properties of TPO like processing ease, thermal resistance, design flexibility, light weight and ability to be recycled, these properties, in turn, increase the use of TPO in automotive industry resulting into growth of the automotive industry in market. Moreover, increasing the choice of replacing polyvinyl chloride with TPO owing to the health issues related to PVC applications is likely to boost TPO market over the forecast period. However, fluctuating prices of raw materials and a risk from substitutes like thermoplastic polyurethane, thermoplastic vulcanizate and polyvinyl chloride to TPO are estimated to hamper the TPO market in coming years. Moreover, brand visibility and geographical expansion will be major growth strategies adopted by the market players over the coming time frame.

Growth Factors

High product demand across automotive and construction activities will steer the event of the thermoplastic polyolefin market within the years to return. Aside from this, a rise in the sales of tires also as rubber items will create lucrative profit for the thermoplastic polyolefin market within the foreseeable period. Technological challenges alongside oscillating staple costs, however, can impede the thermoplastic polyolefin market during the forecast timeline. Nevertheless, the wide applications of the merchandise will create new avenues for the global thermoplastic polyolefin market within the forthcoming years, thereby normalizing the impact of hindrances on the market, reports the study.

Key Insights

- As per the analysis shared by our research analyst, the global thermoplastic polyolefin (TPO) market is estimated to grow annually at a CAGR of around 7.2% over the forecast period (2025-2034).

- Regarding revenue, the global thermoplastic polyolefin (TPO) market size was valued at around USD 4.52 Billion in 2024 and is projected to reach USD 9.07 Billion by 2034.

- The thermoplastic polyolefin (TPO) market is projected to grow at a significant rate due to increasing demand for lightweight and durable materials in the automotive and construction industries, growing focus on sustainable and energy-efficient building practices, and rising adoption in packaging and medical applications due to TPO's beneficial properties.

- Based on Type, the In situ TPO segment is expected to lead the global market.

- On the basis of Application, the Automotive segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Global Thermoplastic Polyolefin (TPO) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Thermoplastic Polyolefin (TPO) Market |

| Market Size in 2024 | USD 4.52 Billion |

| Market Forecast in 2034 | USD 9.07 Billion |

| Growth Rate | CAGR of 7.2% |

| Number of Pages | 140 |

| Key Companies Covered | DOW (US), Mitsui Chemical, Inc. (Japan), Exxon Mobil Corporation (Texas), SABIC (Saudi Arabia), Sumitomo Chemicals Co., Ltd. (Japan), LyondellBasell Industries N.V. (Texas), Ineos Group Holdings SA (Switzerland), Borealis AG (Austria), Formosa Plastic Corporation (Taiwan), RTP Company (US), and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Thermoplastic Polyolefin (TPO) Market: Segmentation Analysis

The global thermoplastic polyolefin (TPO) market is segmented based on Type, Application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on Type, the global thermoplastic polyolefin (TPO) market is divided into In situ TPO, Compounded TPO, Polyolefin elastomers (POEs).

On the basis of Application, the global thermoplastic polyolefin (TPO) market is bifurcated into Automotive, Building & Construction, Medical, Wire and cables, Others.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Thermoplastic Polyolefin (TPO) Market: Regional Analysis

The Thermoplastic Polyolefin (TPO) market exhibits strong regional growth patterns driven by varying industrial applications and economic development. North America leads the market due to high demand from the automotive and construction sectors, particularly in the U.S., where TPO is widely used for roofing membranes and vehicle components. Europe follows closely, supported by environmental regulations encouraging the use of recyclable and lightweight materials in automotive manufacturing. The Asia-Pacific region is witnessing rapid growth, fueled by expanding construction activities, infrastructure development, and the booming automotive industry in countries like China, India, and Japan. Meanwhile, Latin America and the Middle East & Africa are emerging markets, with increasing investments in commercial construction and growing awareness of cost-effective, durable polymer materials like TPO.

Global Thermoplastic Polyolefin (TPO) Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the thermoplastic polyolefin (TPO) market on a global and regional basis.

The global thermoplastic polyolefin (TPO) market is dominated by players like:

- DOW (US)

- Mitsui Chemical Inc

- (Japan)

- Exxon Mobil Corporation (Texas)

- SABIC (Saudi Arabia)

- Sumitomo Chemicals Co. Ltd. (Japan)

- LyondellBasell Industries N.V. (Texas)

- Ineos Group Holdings SA (Switzerland)

- Borealis AG (Austria)

- Formosa Plastic Corporation (Taiwan)

- RTP Company (US)

Global Thermoplastic Polyolefin (TPO) Market: Segmentation Analysis

The global thermoplastic polyolefin (TPO) market is segmented as follows;

By Type

- In situ TPO

- Compounded TPO

- Polyolefin elastomers (POEs)

By Application

- Automotive

- Building & Construction

- Medical

- Wire and cables

- Others

Global Thermoplastic Polyolefin (TPO) Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The shift in trend to exchange polyvinyl chloride due to growing environmental concerns in major end-use industries like automotive and construction around the world has been boosting the demand for thermoplastic polyolefins in the recent past. PVC contains phthalates, which are considered to be harmful to the environment. TPOs represent a member of an outsized group of thermoplastic elastomers (TPEs). TPOs a bit like other members of the TPE family including TPV, TPU, etc. have rubber-like properties but a process-like polymer which makes them highly suitable for top performance applications during a sort of end-use industries. Advancements in terms of functionalities like abrasion resistance, economical, durability, lightweight, antioxidants & UV light stabilizer to resist solar UV radiation and oxidation will make the merchandise highly preferable in regions of utmost weather.

The global thermoplastic polyolefin (TPO) market is expected to grow due to growing demand in automotive, construction, and roofing applications due to its lightweight, recyclability, and cost-effectiveness, alongside stringent environmental regulations promoting sustainable materials.

According to a study, the global thermoplastic polyolefin (TPO) market size was worth around USD 4.52 Billion in 2024 and is expected to reach USD 9.07 Billion by 2034.

The global thermoplastic polyolefin (TPO) market is expected to grow at a CAGR of 7.2% during the forecast period.

North America is expected to dominate the thermoplastic polyolefin (TPO) market over the forecast period.

Leading players in the global thermoplastic polyolefin (TPO) market include DOW (US), Mitsui Chemical, Inc. (Japan), Exxon Mobil Corporation (Texas), SABIC (Saudi Arabia), Sumitomo Chemicals Co., Ltd. (Japan), LyondellBasell Industries N.V. (Texas), Ineos Group Holdings SA (Switzerland), Borealis AG (Austria), Formosa Plastic Corporation (Taiwan), RTP Company (US), among others.

The report explores crucial aspects of the thermoplastic polyolefin (TPO) market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed