Automotive DC-DC Converter Market Size, Share, Trends, Growth 2034

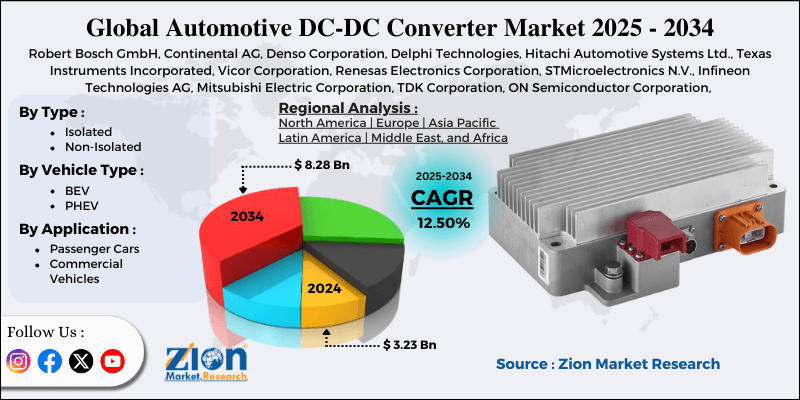

Automotive DC-DC Converter Market By Type (Isolated, Non-Isolated), By Vehicle Type (BEV, PHEV), By Application (Passenger Cars, Commercial Vehicles), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

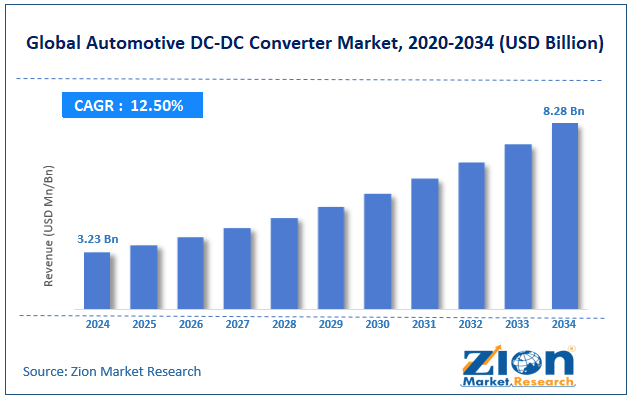

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.23 Billion | USD 8.28 Billion | 12.50% | 2024 |

Automotive DC-DC Converter Industry Perspective:

The global automotive DC-DC converter market size was approximately USD 3.23 billion in 2024 and is projected to reach around USD 8.28 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive DC-DC converter market is estimated to grow annually at a CAGR of around 12.50% over the forecast period (2025-2034)

- In terms of revenue, the global automotive DC-DC converter market size was valued at around USD 3.23 billion in 2024 and is projected to reach USD 8.28 billion by 2034.

- The automotive DC-DC converter market is projected to grow significantly owing to the surging demand for advanced driver-assistance systems (ADAS), government regulations promoting vehicle electrification, and rising demand for high-power applications in electric mobility.

- Based on type, the isolated segment is expected to lead the market, while the non-isolated segment is expected to grow considerably.

- Based on vehicle type, the BEV segment is the dominant segment, while the PHEV segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the passenger cars segment is expected to lead the market, followed by the commercial vehicles segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Automotive DC-DC Converter Market: Overview

The automotive DC-DC converter is a vital component in newer vehicles, especially hybrid and electric models, as it steps down high-voltage DC from the main battery pack to lower voltages required for various onboard systems, including control units, infotainment systems, and lighting. They enhance energy efficacy, enable integration of advanced electronics, and support electrification. The global automotive DC-DC converter market is projected to experience substantial growth, driven by the increasing demand for advanced vehicle electronics and advancements in power electronics. Modern vehicles feature improved infotainment systems, connectivity solutions, and ADAS that need stable low-voltage power. DC-DC converters assure unified power distribution, improving performance and safety. The growth of autonomous driving solutions further augments power requirements, impelling industry growth.

Moreover, advancements like gallium nitride (GaN) and silicon carbide (SiC) semiconductors are enhancing converter efficiency and reducing heat production. These improvements enable higher power density, increased converter efficiency, and reduced energy loss. This makes DC-DC converters more suitable and reliable for next-generation EV platforms.

Although drivers exist, the global market is challenged by factors such as integration challenges, complex design, and dependence on the semiconductor supply chain. Integrating DC-DC converters into EV platforms requires accurate thermal management and electromagnetic compatibility compliance. Design complexity raises cost for OEMs and development time. This creates obstacles for small manufacturers with restricted engineering resources.

Additionally, the automotive sector experiences semiconductor scarcity, which directly impacts DC-DC converter production. Varying prices of raw materials and the global chip shortage are delaying vehicle deliveries and increasing costs. This vulnerability may reduce industry growth in the near future. Even so, the global automotive DC-DC converter industry is well-positioned due to the growing demand for bidirectional DC-DC converters and the integration of solid-state batteries in EVs. Bidirectional converters allow vehicle-to-grid and vehicle-to-home applications, backing smart grid integration and energy storage.

With the rising interest in renewable energy, the domain offers a significant growth opportunity. OEMs investing in vehicle-to-grid (V2G) EV platforms will drive demand. Furthermore, future EVs with solid-state batteries will need highly efficient power management systems. DC-DC converters dedicated to solid-state technology will open fresh market opportunities. This move will support suppliers for next-generation energy storage systems.

Automotive DC-DC Converter Market: Growth Drivers

How is the global automotive DC-DC converter market spurred by improvements in Wide-Bandgap Technologies (SiC and GaN)?

The global automotive DC-DC converter market is experiencing speedy adoption of Gallium Nitride (GaN) and Silicon Carbide (SiC) devices in automotive power electronics. Leading companies, such as STMicroelectronics, Infineon, Wolfspeed, and onsemi, have pronounced multi-billion-dollar investments in GaN and SiC production capacity for 2023-2024. These solutions enhance power density, thermal performance, and efficiency, which are vital for EV platforms. Renesas acquired GaN specialist Transphorm in January 2024 to strengthen its automotive power solutions. Such developments reduce the cost of wide-bandgap devices, increasing their accessibility for DC-DC converter applications in electric vehicles.

How are stringent safety compliance and emission regulations fueling the automotive DC-DC converter market growth?

Governments worldwide are strengthening emission regulations and accelerating electrification through policies such as the U.S. EPA's 2027-2032 standards and the EU's 2030 CO2 targets. These regulations are driving the adoption of electric and hybrid vehicles, thereby increasing demand for DC-DC converters.

Cybersecurity rules, such as UNECE R155/R156, further require secure power frameworks in newer vehicles. This regulatory landscape is fueling OEMs to incorporate certified and more advanced DC-DC converter technologies to assure safety, compliance, and reliability.

Automotive DC-DC Converter Market: Restraints

Semiconductor shortages and supply chain disturbances negatively impact the market progress

Although the worldwide chip storage situation improved in 2023, the automotive semiconductor market still experienced lead times of 26-30 weeks for some power devices in 2024. The surge in demand for power MOSFETs, controllers in EV programs, and SiC modules outstrips capacity growth.

Leading companies, such as STMicroelectronics and onsemi, reported production backlogs for automotive-grade SiC parts during their fourth-quarter 2023 earnings calls. These supply chain issues lead to delayed vehicle production and hinder OEM efforts to establish EV manufacturing.

Automotive DC-DC Converter Market: Opportunities

How does growth in zonal architecture adoption and autonomous vehicles present favorable prospects for the automotive DC-DC converter market expansion?

The transition from distributed ECU frameworks to zonal architectures in next-generation vehicles surges the need for multiple localized DC-DC converters. Zonal designs enhance wiring efficiency and reduce weight, but require highly reliable, multi-output, and compact converters. Companies like Aptiv, Nvidia, and NXP are introducing domain controllers that rely on advanced DC-DC solutions. This trend presents fresh opportunities for suppliers offering software-configurable and smart converters for zonal systems, thereby fueling the automotive DC-DC converter industry.

Automotive DC-DC Converter Market: Challenges

Standardization gaps in EV power architecture limit the market growth

The automotive market lacks universal standards for electric vehicle voltage levels, connector specifications, and converter topologies, increasing platform-specificity of the design. For instance, some OEMs use 400 V platforms, while others are transitioning to 800 V, which increases complications in supply chains. This lack of coordination surges research and development costs and restricts economies of scale for DC-DC suppliers.

While initiatives for common EV frameworks are still under discussion, complete standardization will still need years. Until then, converters should be highly customizable, increasing complexity and cost.

Automotive DC-DC Converter Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive DC-DC Converter Market |

| Market Size in 2024 | USD 3.23 Billion |

| Market Forecast in 2034 | USD 8.28 Billion |

| Growth Rate | CAGR of 12.50% |

| Number of Pages | 213 |

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, Delphi Technologies, Hitachi Automotive Systems Ltd., Texas Instruments Incorporated, Vicor Corporation, Renesas Electronics Corporation, STMicroelectronics N.V., Infineon Technologies AG, Mitsubishi Electric Corporation, TDK Corporation, ON Semiconductor Corporation, Panasonic Corporation, Valeo SA., and others. |

| Segments Covered | By Type, By Vehicle Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive DC-DC Converter Market: Segmentation

The global automotive DC-DC converter market is segmented based on type, vehicle type, application, and region.

Based on type, the global automotive DC-DC converter industry is categorized into isolated and non-isolated types. The isolated DC-DC converters segment held a remarkable share of the market, as they offer galvanic isolation between low-voltage and high-voltage circuits, preventing electrical failures and ensuring safety. They are vital in hybrid and electric vehicles where power flows from traction batteries to low-voltage auxiliary systems. These converters are widely adopted in critical applications, such as propulsion systems and battery charging. Their prominence is anticipated to continue with the rising adoption of EVs and the growing trend towards high-voltage frameworks.

Based on vehicle type, the global automotive DC-DC converter market is segmented into BEV and PHEV. The BEVs segment has registered a substantial share of the worldwide market, as they are fully electric and require multiple high-power DC-DC converters to manage energy between low-voltage systems and the traction battery. With zero tailpipe emissions and government regulations and mandates encouraging electrification, BEVs are experiencing a massive adoption across the globe. The lack of internal combustion engines in BEVs makes efficient power conversion even critical. Their prominence is anticipated to grow as nations incline towards 100% EV adoption in the near future.

Based on application, the global market is segmented into passenger cars and commercial vehicles. The passenger car segment held leadership in the market due to the rapid adoption of hybrid and electric vehicles within the segment. Rising consumer preference for electric cars, advancements in battery technology, and government subsidies are driving demand for electric vehicles. Passenger cars require multiple DC-DC converters to power infotainment, comfort, and safety systems. Their large-scale production and growing integration of electronic components ensure they hold a dominant share in the market.

Automotive DC-DC Converter Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Automotive DC-DC Converter Market?

The Asia Pacific is likely to sustain its leadership in the automotive DC-DC converter market due to the region's high EV sales and production, strong government incentives and policies, and rising demand for passenger cars. The APAC region accounts for more than 60% of global EV sales, primarily driven by China, which sold 8.1 million electric vehicles in 2023. This significant EV penetration creates strong demand for these converters to manage power distribution in high-voltage systems. Furthermore, governments in Japan, China, and India offer tax incentives, subsidies, and mandates for zero-emission vehicles to promote the adoption of EVs.

For instance, China's NEV policy aims for a 50% share of EV sales by 2035, thereby strengthening industry growth in the region. The APAC region is the leading automotive industry, with India and China registering the highest rankings for passenger car sales. The growing preference for e-passenger cars with modernized infotainment and ADAS needs effective power conversion. Smart city projects and rapid urbanization initiatives also boost EV adoption, thereby driving demand for electric vehicle (EV) converters.

Europe continues to hold the second-highest share in the automotive DC-DC converter industry, driven by strong EV adoption, a strong presence of premium automakers, and expanding charging infrastructure. Europe holds a considerable share of the global EV market, with 3.2 million EVs sold in 2023, accounting for 25% of all vehicle sales in the region.

Economies such as France, Germany, and the United Kingdom are leading the way in electric vehicle adoption, necessitating the use of effective DC-DC converters for innovative power management. Europe is home to premium brands like Mercedes-Benz, Audi, Volkswagen, and BMW, which are introducing electric models with increasing rigor. These vehicles incorporate multiple DC-DC converters for infotainment, ADAS, and safety features. Premium EV frameworks also need high-efficiency converters to manage complex electronic systems.

Europe has also heavily invested in EV infrastructure, with more than 630,000 public charging points expected to be installed by 2024. This network supports speedy EV adoption, surging the need for onboard power conversion systems. The development of ultra-fast charging stations also fuels the need for high-performance DC-DC converters in cars.

Automotive DC-DC Converter Market: Competitive Analysis

The leading players in the global automotive DC-DC converter market are:

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Delphi Technologies

- Hitachi Automotive Systems Ltd.

- Texas Instruments Incorporated

- Vicor Corporation

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- TDK Corporation

- ON Semiconductor Corporation

- Panasonic Corporation

- Valeo SA.

Automotive DC-DC Converter Market: Key Market Trends

Transition to 800V EV architectures:

Premium EV models are transitioning from 400-800V systems, requiring more advanced DC-DC converters that can handle fast charging and high volume. This trend significantly reduces charging times and improves vehicle efficiency. Manufacturers such as Hyundai and Porsche are already leading the way with 800V platforms.

Integration of connected and smart features:

Smart DC-DC converters with predictive maintenance and real-time monitoring diagnostics are gaining popularity. These smart systems enhance power management and advance reliability in EVs. The trend enhances safety and supports connected car infrastructure in electric mobility.

The global automotive DC-DC converter market is segmented as follows:

By Type

- Isolated

- Non-Isolated

By Vehicle Type

- BEV

- PHEV

By Application

- Passenger Cars

- Commercial Vehicles

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The automotive DC-DC converter is a vital component in newer vehicles, especially hybrid and electric models, as it steps down high-voltage DC from the main battery pack to lower voltages required for various onboard systems, including control units, infotainment, and lighting. They enhance energy efficacy, enable integration of advanced electronics, and support electrification.

The global automotive DC-DC converter market is projected to grow due to the increasing adoption of EVs and hybrid vehicles, growing fuel efficiency and emission reduction requirements, and the growth of charging infrastructure for electric cars.

According to study, the global automotive DC-DC converter market size was worth around USD 3.23 billion in 2024 and is predicted to grow to around USD 8.28 billion by 2034.

The CAGR value of the automotive DC-DC converter market is expected to be approximately 12.50% from 2025 to 2034.

Applications such as autonomous driving systems, electric vehicles, 48V mild hybrids, advanced infotainment/ADAS, and vehicle-to-grid (V2G) integration will offer significant growth opportunities in the automotive DC-DC converter market.

Significant opportunities exist in strategic partnerships for SiC/GaN semiconductor development, investments in high-voltage DC-DC converter research and development, and charging infrastructure integration, as well as joint ventures for EV power electronics manufacturing.

Asia Pacific is expected to lead the global automotive DC-DC converter market during the forecast period.

China is a major contributor to the global automotive DC-DC converter market due to its strong battery supply chain, dominant EV production, and rapid charging infrastructure growth.

The key players profiled in the global automotive DC-DC converter market include Robert Bosch GmbH, Continental AG, Denso Corporation, Delphi Technologies, Hitachi Automotive Systems Ltd., Texas Instruments Incorporated, Vicor Corporation, Renesas Electronics Corporation, STMicroelectronics N.V., Infineon Technologies AG, Mitsubishi Electric Corporation, TDK Corporation, ON Semiconductor Corporation, Panasonic Corporation, and Valeo SA.

The report examines key aspects of the automotive DC-DC converter market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed