Automotive After-Sales Service Market Size & Growth Report 2034

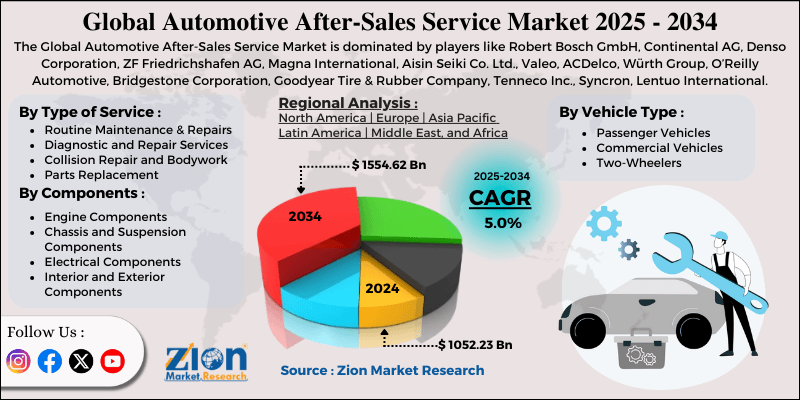

Automotive After-Sales Service Market By Type of Service (Routine Maintenance and Repairs, Diagnostic and Repair Services, Collision Repair and Bodywork, Parts Replacement), By Components (Engine Components, Chassis and Suspension Components, Electrical Components, Interior and Exterior Components), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two-Wheelers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

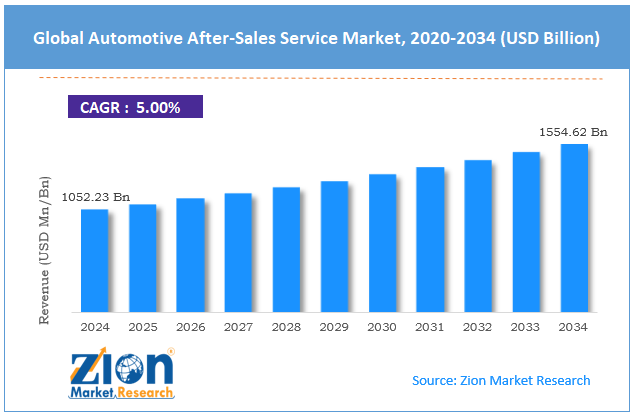

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1052.23 Billion | USD 1554.62 Billion | 5.0% | 2024 |

Automotive After-Sales Service Industry Perspective:

What will be the size of the global automotive after-sales service market during the forecast period?

The global automotive after-sales service market size was around USD 1052.23 billion in 2024 and is projected to reach USD 1554.62 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive after-sales service market is estimated to grow annually at a CAGR of around 5% over the forecast period (2025-2034)

- In terms of revenue, the global automotive after-sales service market size was valued at around USD 1052.23 billion in 2024 and is projected to reach USD 1554.62 billion by 2034.

- The automotive after-sales service market is projected to grow significantly owing to the rising demand for scheduled maintenance, expansion of digital service platforms, and rising consumer preference for genuine spare parts.

- Based on service type, the routine maintenance and repairs segment is expected to lead the market, while the parts replacement segment is expected to grow significantly.

- Based on components, the engine components segment is the dominating segment, while the chassis and suspension components segment is projected to witness sizeable revenue over the forecast period.

- Based on vehicle type, the passenger vehicles segment is expected to lead the market, followed by the commercial vehicles segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by the Asia Pacific.

Automotive After-Sales Service Market: Overview

Automotive after-sales service comprises the support and services provided to customers after they purchase an automobile, including assurances of safety, optimal performance, and longevity. It comprises maintenance, spare parts supply, repairs, customer assistance, value-added offerings, and warranty services. The global automotive after-sales service market is likely to expand rapidly, fueled by the growing global vehicle parc, technological improvements in vehicles, and the growth of connected vehicles. The growing number of vehicles on the road directly augments the demand for maintenance, spare parts, and repairs. As vehicles age, servicing becomes crucial to ensure safety and performance. This growth in the vehicle base continues to expand the after-sales market.

Moreover, modern cars feature improved electronics, software systems, and sensors that need professional servicing. These technologies make maintenance more precise and specialized. Subsequently, this increases the demand for after-sales services. Furthermore, connected vehicles provide real-time data on performance and potential issues. This allows proactive service scheduling and predictive maintenance. It enhances efficiency while encouraging owners to depend on authorized service centers.

Despite the growth, the global market is impeded by factors such as the high cost of advanced repairs and the scarcity of skilled technicians. Modern vehicles need expensive diagnostic tools and trained technicians. Repair costs for ADAS and electronic systems are high. This can discourage frequent servicing among price-sensitive customers. The market experiences a scarcity of trained technicians for connected vehicles and EVs. Specialized skills are important to handle complex repairs and diagnostics. This restricts service efficiency and capacity.

Nonetheless, the global automotive after-sales service industry stands to gain from several key opportunities, including digital after-sales platforms, mobile and on-demand services, and predictive maintenance. Online service platforms enhance booking, customer communication, and tracking. Digital solutions enable scalable, customer-friendly operations. Mobile service vans and on-site repairs meet customer demand for convenience. Routine maintenance can be performed at work or at home. This model is largely prominent in urban areas. Vehicle data and telematics allow service providers to predict failures before they occur. This enhances customer satisfaction and reduces downtime. Predictive maintenance strengthens retention and loyalty.

Automotive After-Sales Service Market: Dynamics

Growth Drivers

How is the growing emphasis on customer experience and service quality fueling the automotive after-sales service market?

Customer experience has become a major differentiator in the automotive after-sales service market, impacting repeat business and loyalty. Service centers are prioritizing faster turnaround times, enhanced communication, and transparent pricing to meet the growing customer expectations. Recent satisfaction surveys show higher service ratings due to digital service tracking and personalized support. Comfortable service environments and mobile servicing options are gaining prominence among urban consumers. This heightened focus on service quality is driving competitive advantage and long-term industry growth.

How is the automotive after-sales service market driven by OEMs' focus on branded after-sales service networks?

Original Equipment Manufacturers (OEMs) are expanding their authorized service networks to hold a larger share of post-purchase vehicle servicing revenue. OEMs are leveraging genuine parts, standardized service quality, and certified technicians to appeal to customers away from independent workshops. Recent industry trends indicate that manufacturers are increasing their investments in service infrastructure and customer loyalty programs. extended warranties and service packages are strengthening long-term customer retention and recurring revenue. This strategic focus on after-sales services is changing OEMs into lifecycle mobility service providers.

Restraints

Price sensitivity and preference for unorganized workshops adversely impact the industry's progress

In several emerging markets, consumers remain highly price-sensitive and prefer low-cost, unorganized service providers. Independent garages usually undercut authorized service centers by using informal labor and non-genuine parts. This pricing pressure restricts revenue growth for organized after-sales players. Customers may prioritize affordability over quality, thereby affecting the adoption of standardized services. This behavior continues to restrain industry penetration of premium after-sales services.

Opportunities

How is the growth of digital service platforms and online booking creating promising avenues for the automotive after-sales service industry?

Digital transformation is creating opportunities in the automotive after-sales service industry through online service booking, remote diagnostics, and mobile applications. Customers steadily prefer engagement for scheduling and service tracking. Service providers can improve efficiency and customer retention using data-driven insights. Predictive maintenance platforms are gaining traction in private vehicles and fleets. These digital solutions enable customer-centric, scalable service models.

Challenges

Environmental regulations and compliance requirements restrict the market growth

Stringent waste management and environmental regulations affect after-sales service operations. Workshops should comply with the rules governing the disposal of batteries, hazardous waste, and emissions-related components. Compliance raises operational costs and administrative pressure; EV battery recycling adds further complexity. Adapting to changing regulatory frameworks offers an ongoing challenge.

Automotive After-Sales Service Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive After-Sales Service Market |

| Market Size in 2024 | USD 1052.23 Billion |

| Market Forecast in 2034 | USD 1554.62 Billion |

| Growth Rate | CAGR of 5.0% |

| Number of Pages | 215 |

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, Magna International, Aisin Seiki Co. Ltd., Valeo, ACDelco, Würth Group, O’Reilly Automotive, Bridgestone Corporation, Goodyear Tire & Rubber Company, Tenneco Inc., Syncron, Lentuo International, and others. |

| Segments Covered | By Type of Service, By Components, By Vehicle Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive After-Sales Service Market: Segmentation

The global automotive after-sales service market is segmented by service type, components, vehicle type, and region.

Based on service type, the global automotive after-sales service industry is divided into routine maintenance and repairs, diagnostic and repair services, collision repair and bodywork, and parts replacement. The routine maintenance and repairs segment accounts for 45% of the market. It encompasses regular services such as brake checks, oil changes, minor repairs, and tire rotations that all vehicles need regularly.

On the other hand, the parts replacement segment captures 30% of the market share because vehicles require periodic replacement of consumables and wear-and-tear parts, such as filters, batteries, tires, and brake pads.

Based on components, the global automotive after-sales service market is segmented into engine components, chassis and suspension components, electrical components, and interior and exterior components. The engine components segment registers 40% of the market. This is because engines are crucial, experience wear over time, and require frequent servicing, repairs, and replacement of components such as pistons, fuel systems, and gaskets.

Conversely, chassis and suspension components account for 25% of the market, as they are crucial to vehicle safety and performance and include components such as struts, shock absorbers, steering systems, and axles that require replacement or maintenance over the vehicle’s life.

Based on vehicle type, the global market is segmented into passenger vehicles, commercial vehicles, and two-wheelers. The passenger vehicle segment accounts for 60% of the market. They account for a leading share of the worldwide vehicle parc and require regular maintenance, parts replacement, and repairs.

However, the commercial vehicles segment leads with 30% market share, comprising vans, trucks, and buses that undergo heavy use and frequent servicing to ensure operational reliability.

Automotive After-Sales Service Market: Regional Analysis

Why is North America outperforming other regions in the global Automotive After-Sales Service Market?

North America is anticipated to retain its leading role with a 5% CAGR in the global automotive after-sales service market, driven by a large vehicle parc, high market share, aging vehicle fleets, and extensive service infrastructure. North America has the world's largest vehicle fleet, with millions of registered vehicles. A larger vehicle base naturally creates higher demand for maintenance, parts replacement, and repairs. This scale offers the region a leading share of the worldwide after-sales market.

Moreover, the average age of vehicles in North America surpasses 12 years, raising the frequency of repairs and servicing. Older vehicles require more frequent routine maintenance, replacement of worn parts, and diagnostic testing. This promises consistent and steady demand for after-sales services.

Furthermore, the region holds a well-developed network of authorized dealerships, parts distributors, and independent repair shops. The broader infrastructure assures convenience and accessibility for vehicle owners in rural and urban areas. It boosts service coverage and industry efficiency.

Asia Pacific ranks as the second-largest region in the global automotive after-sales service industry, with an 8% CAGR, driven by rapid vehicle ownership growth, an expanding middle class, rising spending power, and a growing independent service and parts market. Asia Pacific is experiencing explosive growth in vehicle ownership, particularly in Southeast Asian nations, China, and India. A speedily expanding vehicle parc results in increasing demand for routine servicing, parts replacement, and repairs. This growth trajectory is driving the region’s share of the worldwide after-sales market. Growing incomes and urbanization have made vehicle ownership more affordable for millions of consumers in the region.

As owners invest in improved vehicle maintenance, demand for both value-added and basic after-sales services increases. This trend backs higher service uptake and aftermarket spending. Asia Pacific houses a large network of independent service providers and spare parts dealers beyond authorized dealerships. These players make after-sales services more affordable and accessible in rural and urban areas. Their scale significantly contributed to the industry's overall reach and volume.

Automotive After-Sales Service Market: Competitive Analysis

The leading players in the global automotive after-sales service market are:

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Magna International

- Aisin Seiki Co. Ltd.

- Valeo

- ACDelco

- Würth Group

- O’Reilly Automotive

- Bridgestone Corporation

- Goodyear Tire & Rubber Company

- Tenneco Inc.

- Syncron

- Lentuo International

Automotive After-Sales Service Market: Key Market Trends

Digital and mobile service solutions:

Automotive after-sales is shifting toward digital platforms that allow online booking, automated reminders, and service tracking. Customers increasingly prefer mobile or on-site servicing for convenience, such as maintenance at work or home. This trend augments customer satisfaction and reduces service center congestion.

Predictive and connected vehicle maintenance:

Connected vehicles generate real-time data that service providers use to forecast maintenance needs prior failures happen. Predictive analytics and telematics help schedule timely interventions, lower long-term repair costs, and minimize downtime. This data-driven approach strengthens customer loyalty and optimizes service operations.

The global automotive after-sales service market is segmented as follows:

By Type of Service

- Routine Maintenance and Repairs

- Diagnostic and Repair Services

- Collision Repair and Bodywork

- Parts Replacement

By Components

- Engine Components

- Chassis and Suspension Components

- Electrical Components

- Interior and Exterior Components

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed