Automotive Active Seat Headrests Market Size & Forecast 2034

Automotive Active Seat Headrests Market By Vehicle Type (Passenger Cars, SUVs and Crossovers, Trucks and Vans), By Material (Leather, Fabric, Synthetic Materials), By Technology (Automatic Adjustment, Crash-Responsive, Smart Headrests), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

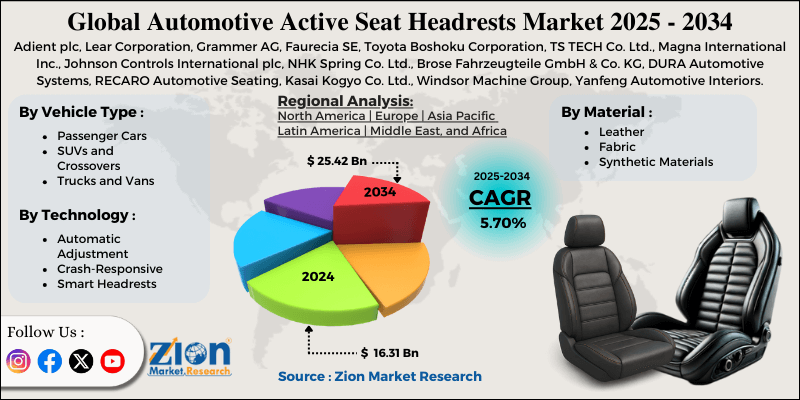

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.31 Billion | USD 25.42 Billion | 5.7% | 2024 |

Automotive Active Seat Headrests Industry Perspective:

What will be the size of the automatic active seat headrest market during the forecast period?

The global automotive active seat headrests market size was around USD 16.31 billion in 2024 and is projected to reach USD 25.42 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive active seat headrests market is estimated to grow annually at a CAGR of around 5.70% over the forecast period (2025-2034)

- In terms of revenue, the global automotive active seat headrests market was valued at approximately USD 16.31 billion in 2024 and is projected to reach USD 25.42 billion by 2034.

- The automotive active seat headrests market is projected to grow significantly owing to increasing adoption of advanced driver-assistance systems (ADAS), growing consumer preference for premium and luxury vehicle features, and technological innovations in sensor and actuator systems.

- Based on vehicle type, the passenger cars segment is expected to lead the market, while the SUVs and crossovers segment is expected to grow considerably.

- Based on material, the synthetic materials segment is the dominating segment, while the fabric segment is projected to witness sizeable revenue over the forecast period.

- Based on technology, the crash-responsive segment is expected to lead the market, followed by the smart headrests segment.

- By region, Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Automotive Active Seat Headrests Market: Overview

Automotive active seat headrests are safety devices designed to reduce the risk of injury in rear-end collisions. They work by automatically raising and tilting the headrest when a crash is detected, supporting the occupant’s neck and head more quickly than a fixed headrest. The global automotive active seat headrests market is poised for notable growth, driven by stringent safety regulations, rising consumer safety awareness, and integration with advanced safety systems. Safety agencies and governments worldwide are enforcing strict vehicle safety standards. Automobile manufacturers are adopting active headrests to meet crash protection requirements. Compliance helps enhance vehicle safety ratings and industry acceptance.

Moreover, buyers increasingly prioritize safety features when purchasing vehicles. Awareness of injury-prevention technologies increases interest in active headrests. Automakers use these features to strengthen brand trust. Furthermore, active headrests work in conjunction with seatbelt pretensioners and airbags. The integrated approach enhances overall occupant protection. Automakers choose systems that improve coordinated crash response.

Nevertheless, the global market faces limitations due to factors such as high system costs, design and integration challenges, and maintenance and repair concerns. Active headrests increase integration and manufacturing costs. This restricts adoption in low-cost vehicle segments, thus raising challenges for price-conscious markets. The systems should support seat structure and vehicle development time for manufacturers. Likewise, active mechanisms add complexity after collisions. Repairs can be more expensive than passive systems, thus discouraging budget buyers and fleet managers.

Still, the global automotive active seat headrests industry benefits from several favorable factors, including future safety regulations, aftermarket and retrofit potential, and supplier collaboration and innovation. Upcoming safety mandates may need improved occupant protection. Active headrests may become standard equipment. This may remarkably increase industry demand. Older vehicles lack modernized safety features. Retrofit solutions may address this gap. Additionally, associations fuel innovation and cost reduction. Advanced materials and AI sensing enhance performance, while collaboration augments the development of next-generation systems.

Automotive Active Seat Headrests Market: Dynamics

Growth Drivers

How are technological innovation and integration with connected vehicle systems driving the automotive active seat headrests market?

Technological improvements have transformed active headrests into sensor-driven, smart components that connect with other comfort and safety systems. Modern systems use occupant detection sensors and AI algorithms to forecast crash severity and deploy headrest movement proactively. Integration with vehicle connectivity platforms allows personalized adjustments depending on driver profiles and seat settings. These improvements enhance response accuracy and functionality while aligning with wider trends in vehicle intelligence. As technology becomes more cost-efficient, even entry-level models are beginning to benefit from these improved headrest capabilities.

How does the automotive active seat headrests market benefit from automotive production growth in emerging regions?

The rapid growth of automotive manufacturing in Latin America, the Asia Pacific, and the Middle East is driving local demand for advanced safety components. As vehicle sales grow in these regions, regional and global OEMs are adopting active headrests to meet rising safety expectations. Surging consumer demand is steadily educating consumers about safety technologies and making them willing to pay for improved protection. Regulatory alignment and local assembly investments encourage broader adoption of headrests. This geographic diversification of demand and production helps sustain long-term growth in the automotive active seat headrests market across multiple continents.

Restraints

Weight and packaging constraints unfavorably impact the market progress

Active headrest mechanisms add weight and need additional space within the seat assembly, impacting vehicle mass targets and interior packaging flexibility. In EVs, where weight management is important for range optimization, this offers a harder engineering challenge. Designers should balance the advantages of active headrests with overall vehicle design priorities, such as cabin space, comfort, and performance. Additional weight may also impact fuel efficiency in older vehicles. These limitations necessitate careful trade-offs during vehicle design.

Opportunities

How are customization and premium feature add-ons presenting favorable prospects for the expansion of the automotive active seat headrests market?

There is mounting consumer interest in comfort-enhancing and personalized features, even in mid-tier vehicles. Active headrests that offer adjustable ergonomic support, memory settings, or integration with seat massage and climate systems may be promoted as part of premium interior packages. This offers opportunities for Tier-1 and OEM suppliers to differentiate their offerings and produce better margins. Technologies such as occupant monitoring and adaptive responses may further elevate perceived value, thereby accelerating growth in the automotive active seat headrest industry. Customization options also attract fleet buyers who prefer differentiated comfort for passengers and drivers.

Challenges

Supply chain disruptions and component shortages restrict the market growth

Like several automotive components, active headrests rely on a complex supply chain for sensors, electronics, and mechanical components. Disturbances due to raw material shortages, geopolitical stresses, or logistical barriers may increase costs and delay production. Small Tier-3 and Tier-2 suppliers are especially important in the face of shocks, which may ripple up to OEM assembly lines. Ensuring resilient supply networks requires investment in forecasting and redundancy, which adds to operational complexity.

Automotive Active Seat Headrests Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Active Seat Headrests Market |

| Market Size in 2024 | USD 16.31 Billion |

| Market Forecast in 2034 | USD 25.42 Billion |

| Growth Rate | CAGR of 5.70% |

| Number of Pages | 216 |

| Key Companies Covered | Adient plc, Lear Corporation, Grammer AG, Faurecia SE, Toyota Boshoku Corporation, TS TECH Co. Ltd., Magna International Inc., Johnson Controls International plc, NHK Spring Co. Ltd., Brose Fahrzeugteile GmbH & Co. KG, DURA Automotive Systems, RECARO Automotive Seating, Kasai Kogyo Co. Ltd., Windsor Machine Group, Yanfeng Automotive Interiors, and others. |

| Segments Covered | By Vehicle Type, By Material, By Technology, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Active Seat Headrests Market: Segmentation

The global automotive active seat headrests market is segmented by vehicle type, material, technology, and region.

Based on vehicle type, the global automotive active seat headrests industry is divided into passenger cars, SUVs and crossovers, and trucks and vans. The passenger cars segment registers a 55-65% market share due to high production volumes and the broader adoption of advanced safety systems across hatchbacks, sedans, and similar models. This dominance is fueled by regulatory mandates and consumer demand for improved safety features in personal cars.

However, the SUVs and crossovers segment holds 25-30% market share. These vehicles are increasingly preferred due to comfort and safety features, including active headrests. These features are majorly offered as optional or standard equipment in these popular vehicle classes.

Based on material, the global automotive active seat headrests market is segmented into leather, fabric, and synthetic materials. The synthetic materials segment holds a 45% market share due to their strong balance of durability, cost-efficiency, ability to mimic leather, and lightweight properties, while supporting integration across several vehicle models and ease of maintenance. This makes synthetic materials majorly popular in mid-range vehicles and the mass market, where affordable performance is crucial.

Conversely, the fabric segment registers nearly 30-35% market share, broadly used for its breathability, comfort, and low cost, making it a common choice in several mainstream and entry-level vehicles before premium options like leather.

Based on technology, the global market is segmented into automatic adjustment, crash-responsive, and smart headrests. The crash-responsive segment captures a dominant 55-65% market share and accounts for the leading revenue share. This is supported by its primary safety function of detecting impacts and rapidly moving the headrest to reduce whiplash injuries.

Nonetheless, the smart headrest segment accounts for 20-30% of the market share. The segment is gaining prominence, particularly in luxury and premium vehicles, by combining safety with features like integrated sensors and customization options. This is anticipated to grow substantially.

Automotive Active Seat Headrests Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Automotive Active Seat Headrests Market?

Asia Pacific is projected to maintain its dominant position in the global automotive active seat headrests market, driven by a massive automotive production base, urbanization, rapid vehicle sales growth, and surging safety awareness and regulations. Asia Pacific holds leadership due to its massive automotive manufacturing hubs in Japan, India, South Korea, and China, which produce a major share of the world's vehicles annually. In 2024, the APAC market was estimated at nearly USD 1.1 billion, underscoring its scale than other regions.

Moreover, growing urbanization and an expanding middle-class population are fueling vehicle ownership in the Asia Pacific, especially in India and China, where consumer demand for more feature-rich and safer vehicles is growing. The region is anticipated to achieve higher adoption rates of safety technologies, such as active headrests, driven by the expanding consumer base. Governments in major APAC nations are tightening vehicle safety norms and promoting advanced occupant protection technologies. This regulatory push boosts OEMs to install active headrests more frequently to meet safety standards.

North America maintains its position as the second-largest region in the global automotive active seat headrests industry, driven by a well-developed automotive industry, strict safety regulations, and consumer awareness. North America has a well-established automotive industry, with significant annual vehicle production and sales. This sophisticated ecosystem promises a constant demand for advanced safety systems, comprising active seat headrests. The region’s large-scale production of SUVs and passenger cars offers a strong groundwork for industry growth.

Moreover, strict safety regulations in the region, such as crash-test standards, force automakers to adopt improved occupant protection systems. Simultaneously, consumers prioritize vehicles with enhanced safety features, such as active headrests, creating a dual push for adoption. This assimilation of regulatory pressure and informed buyers boosts industry penetration. Additionally, North American consumers often purchase mid- to high-end and luxury cars, which often include active headrests as standard or optional features. These vehicles carry higher per-unit safety content, driving regional market revenue. The growth of connected and electric cars further encourages manufacturers to integrate advanced headrest technologies.

Automotive Active Seat Headrests Market: Competitive Analysis

The leading players in the global automotive active seat headrests market are:

- Adient plc

- Lear Corporation

- Grammer AG

- Faurecia SE

- Toyota Boshoku Corporation

- TS TECH Co. Ltd.

- Magna International Inc.

- Johnson Controls International plc

- NHK Spring Co. Ltd.

- Brose Fahrzeugteile GmbH & Co. KG

- DURA Automotive Systems

- RECARO Automotive Seating

- Kasai Kogyo Co. Ltd.

- Windsor Machine Group

- Yanfeng Automotive Interiors

Automotive Active Seat Headrests Market: Key Market Trends

Growth in premium and smart headrest features:

Smart headrests now offer occupant detection, infotainment connectivity, seat memory, and crash responsiveness. These features are prominent in luxury and premium vehicles, improving safety and comfort. Innovation in smart headrests is becoming a major USP for automakers.

Focus on lightweight and cost-efficient designs:

Manufacturers are developing more affordable and lighter active headrests to reduce production costs and vehicle weight. Advanced materials and efficient actuator systems maintain performance while reducing expenses. This trend makes active headrests accessible in entry-level and mid-range vehicles.

The global automotive active seat headrests market is segmented as follows:

By Vehicle Type

- Passenger Cars

- SUVs and Crossovers

- Trucks and Vans

By Material

- Leather

- Fabric

- Synthetic Materials

By Technology

- Automatic Adjustment

- Crash-Responsive

- Smart Headrests

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed