Automation And Instrumentation Market Size, Share, Growth Report 2032

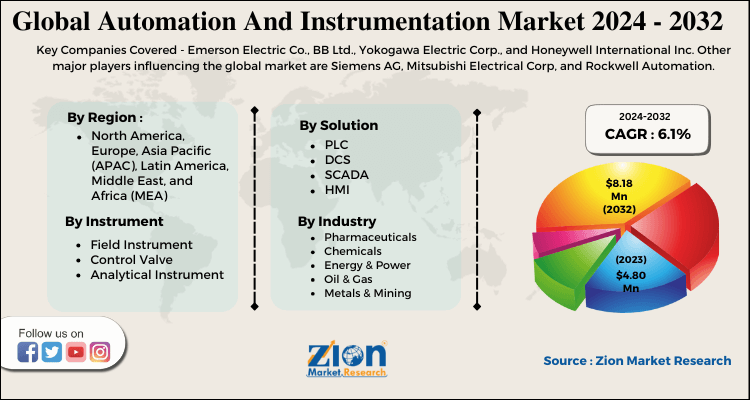

Automation And Instrumentation Market by Instrument (Field Instrument, Control Valve, Analytical Instrument), Solution (APC, DCS, HMI, MES, PLC, Functional Safety, SCADA): Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.80 Billion | USD 8.18 Billion | 6.1% | 2023 |

Automation And Instrumentation Market Insights

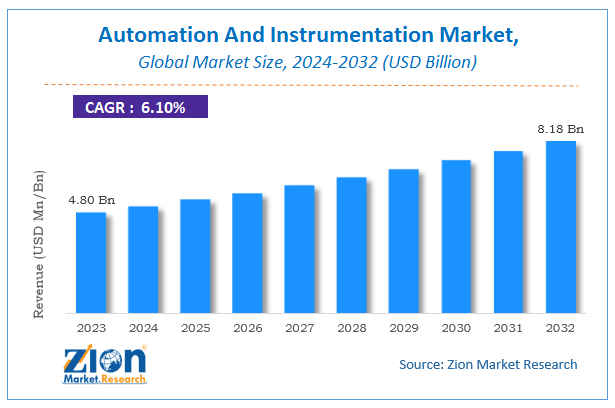

Zion Market Research has published a report on the global Automation And Instrumentation Market, estimating its value at USD 4.80 Billion in 2023, with projections indicating that it will reach USD 8.18 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.1% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Automation And Instrumentation Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Automation is that the use of varied control systems for operating any equipment with negligible or no human interference. The use of automation has improved the standard, accuracy, and precision. The advantage of using automation is that it saves energy, labor, and materials. Instrumentation is often defined because of the art of control and therefore the measurement of the method variables within a production or manufacturing area. Instrumentation and automation go hand in hand. Different instruments are required within the automation process for measuring and analyzing the extent of the product's performance.

Automation and instrumentation complement one another as the automation process requires the assistance of various instruments. The necessity to extend productivity has prompted organizations to adopt automation to realize a competitive advantage over their rivals. Increasing labor costs have encouraged companies to implement automation to streamline their production procedures and reduce their dependency on expensive human labor. The labor scarcity in established regions is supposed to play a key role in determining the market within the near future. Industry participants that aim to scale back the general production time, decrease manufacturing cost, and increase manufacturing flexibility are expected to adopt such practices and are anticipated to play a lead role in influencing the market. Growing industrial safety concerns are projected to play a key role in complementing the worldwide market within the near future.

The process industries are having an excellent demand for automation which is one of the main factors boosting the expansion of the automation instrumentation market. Lack of effective product differentiation may hamper the expansion of the market; for instance, various automation instrument retailers face augmented competition from regional and native vendors thanks to a lack of effective product differentiation. As an answer to the present problem and to satisfy the requirements of the clients, retailers have begun to use customized automation solutions. Another benefit is that this stuff is offered to them at a competitive price. Hence, different industries like oil, gas, and petrochemical are moving to use automation instruments to enhance their operational efficiency.

Automation And Instrumentation Market: Growth Factors

The growth of this market is propelled by factors like the growing importance of energy efficiency and price reduction, emphasis on digitalized technologies like IIoT, increasing adoption of commercial automation, and optimum utilization of resources. Furthermore, the labor shortage in developed regions is presumed to play a key role in shaping the market shortly. Industry participants that aim to scale back the general production time, decrease manufacturing cost, and increase manufacturing flexibility are expected to adopt such practices and are anticipated to play a lead role in influencing the market. Growing industrial safety concerns are projected to play a key role in complementing the worldwide automation instrumentation market over the forecast period.

Automation And Instrumentation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automation And Instrumentation Market |

| Market Size in 2023 | USD 4.80 Billion |

| Market Forecast in 2032 | USD 8.18 Billion |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 134 |

| Key Companies Covered | Emerson Electric Co., BB Ltd., Yokogawa Electric Corp., and Honeywell International Inc. Other major players influencing the global market are Siemens AG, Mitsubishi Electrical Corp, and Rockwell Automation |

| Segments Covered | By Instrument, By Solution, By Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 - 2024 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

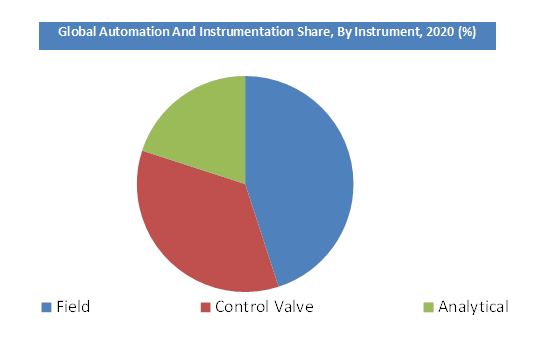

Instrument Segment Analysis Preview

Field instruments play an important role in process control by measuring the key elements like pressure, temperature, flow, and level in process industries like pharmaceuticals, chemicals, mining, oil & gas. These instruments are often controlled or automated from an impact room. Field instruments mainly contain transmitters that mainly measure and track pressure, flow, level, temperature, and humidity of liquid and gases and also contain a vibration level switch, which is employed for level detection of solids and liquids. The measurement of key elements—temperature, pressure, flow, and level—in process control is important to realize optimum productivity. It's imperative to get information quickly, smoothly, securely, and accurately from field instruments altogether process industries.

Solution Segment Analysis Preview

HMI is present during a computer that communicates with a specialized computer that's placed within the plant. It allows plant operators in procuring usable and actionable information from the plant equipment. It collects data from other integrated systems, processes the info, and provides a visible presence to the operator on a display board. It reduces human involvement within the production processes and enhances productivity and operator safety. HMI is that the single point of contact for operators to urge a whole view of production processes on the plant floor, leading to speed and accuracy within the decision-making process. The demand for HMI systems is growing owing to their increased applications in process industries.

Industry Segment Analysis Preview

Increasing competition within the industry and legislations associated with this industry; the growing importance of providing precision measuring equipment to supply accurate dosage of medicine; and the rising need for process automation solutions to varied processes like testing, manufacturing, drug development, packaging, and distribution are among the factors that are likely to propel the expansion within the pharmaceutical industry in automation and instrumentation market. Moreover, thanks to the involvement of complex manufacturing processes like milling, granulation, coating, and tablet pressing in pharmaceutical companies, there's a growing need for process automation solutions, which, in turn, is probably going to drive the demand for process automation and instrumentation market.

Automation And Instrumentation Market: Regional Analysis Preview

The Asia Pacific is anticipated to witness considerable growth due to upstream end-use industries in countries like China, India Brazil, and Russia. Moreover, high demand from these countries also impacts the expansion of the market in an appositive way.

Request Free Sample

Request Free Sample

Request Free Sample

Automation And Instrumentation Market: Key Players & Competitive Landscape

Major market players of Automation And Instrumentation market:

- comprise Emerson Electric Co.

- BB Ltd.

- Yokogawa Electric Corp.

- Honeywell International Inc.

Other major players influencing the global market are:

- Siemens AG

- Mitsubishi Electrical Corp

- Rockwell Automation.

The global Automation And Instrumentation Market is segmented as follows:

By Instrument

- Field Instrument

- Control Valve

- Analytical Instrument

By Solution

- PLC

- DCS

- SCADA

- HMI

- Functional Safety

- APC

- MES

By Industry

- Pharmaceuticals

- Chemicals

- Energy & Power

- Oil & Gas

- Metals & Mining

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global Automation And Instrumentation Market was valued at US$ 4.80 Billion in 2023.

The Global Automation And Instrumentation Market is expected to reach US$ 8.18 Billion by 2032 at a CAGR of about 6.1% from 2024 to 2032.

Some of the key factors driving the Global Automation And Instrumentation Market growth are the rising focus on industrial automation & best utilization of resources, increase in the adoption of new technologies, and the proliferation of IoT.

Asia Pacific region is expected to grow at the highest CAGR during the forecast period. This is attributable to the increasing needs of a huge population and rapid industrialization along with favorable government policies.

Some of the major companies operating in Automation And Instrumentation Market are Emerson Electric Co., BB Ltd., Yokogawa Electric Corp., and Honeywell International Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed